- The corrective EUR/USD rebound faces a big test with a packed events calendar arriving over the next few days

- Fed speeches, Fed minutes and bond auctions will be in focus

- Markets are extinguishing the risk of Fed rate hikes this year, taking the wind out of the US dollar rally

Event risk arrives thick-and-fast

To say the next couple of days are likely to be important for markets is an understatement.

On the data docket, US producer price inflation (PPI) data arrives on Wednesday as a tantalising scene-setter for the main event, US consumer price inflation (CPI) on Thursday. Markets will be scouring PPI final demand numbers, especially for services, for clues as to what may be found in the latter. For CPI, both the headline and core readings are tipped to lift 0.3% for September.

The Fed speaking circuit continues unabated with Bowman, Waller, Bostic and Collins scheduled Wednesday alongside the release of the FOMC September meeting minutes. Thursday is equally busy with Bostic and Collins speaking after the CPI report is released. A raft of ECB members, including Lagarde, Panetta, Knot and Villeroy de Galhau, are also set to shake things up.

Throw in 10 and 30-year US Treasury auctions on Wednesday and Friday respectively and we have plenty of ingredients to make things interesting for EUR/USD traders.

Make-or-break for EUR/USD rebound?

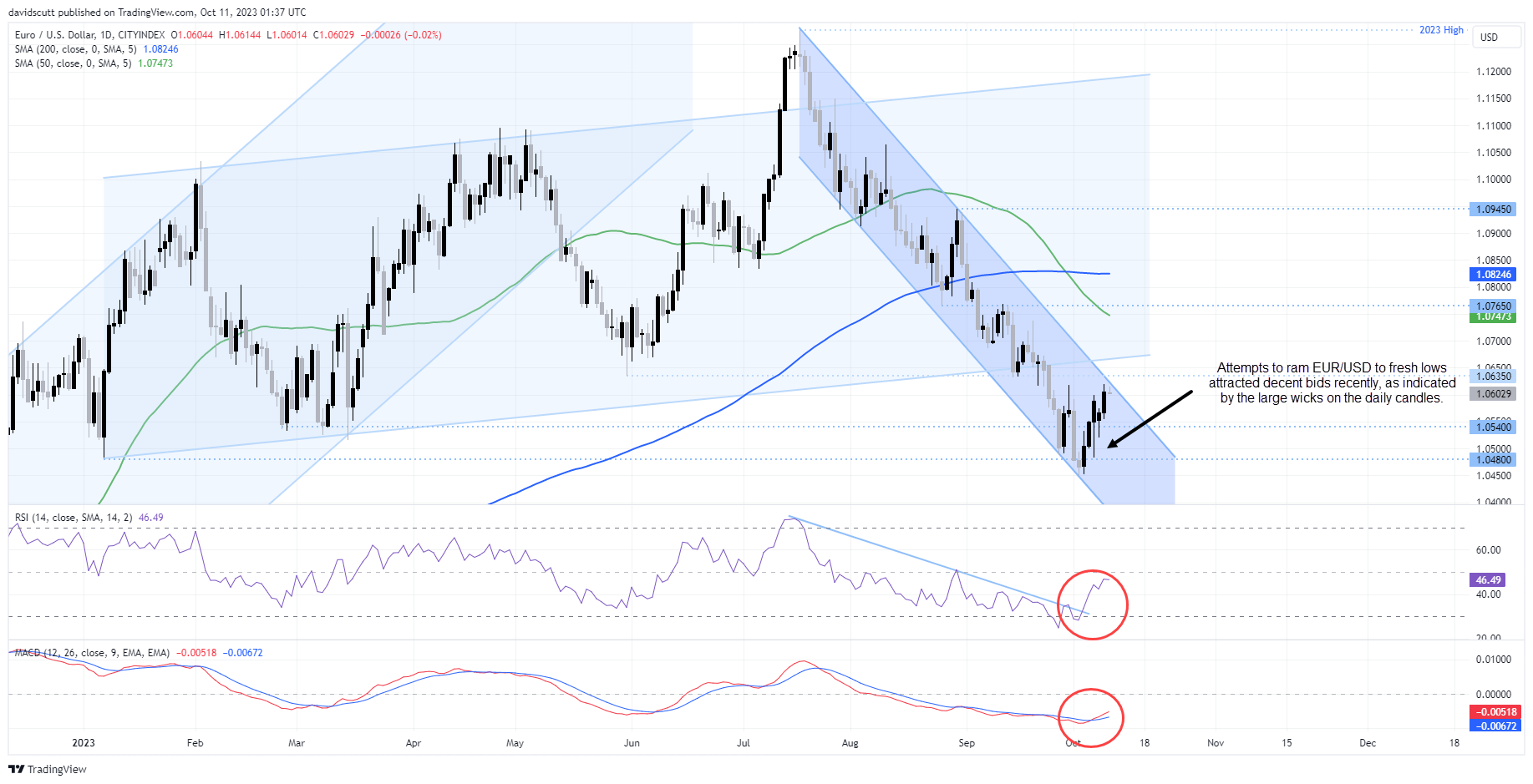

Looking at EUR/USD on the daily, price action has turned far more positively recently with the pair rebounding from channel support and horizontal support dating back to earlier this year. EUR/USD now finds itself back at the top of its downtrend channel, just below likely resistance found at 1.0635. RSI is indicating a potential trend change as is the MCD crossover.

But with such a packed calendar, at a time when markets are questioning the willingness for the Fed to maintain a hawkish rates bias, fundamentals will likely determine whether the EUR/USD bounce will be a dead cat version or longer lasting.

In the near-term, 1.0635, 50-day MA and 1.0765 are the topside levels to watch. On the downside, dips below 1.0540 have attracted decent bids of late.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade