DXY Driving US Dollar Pairs

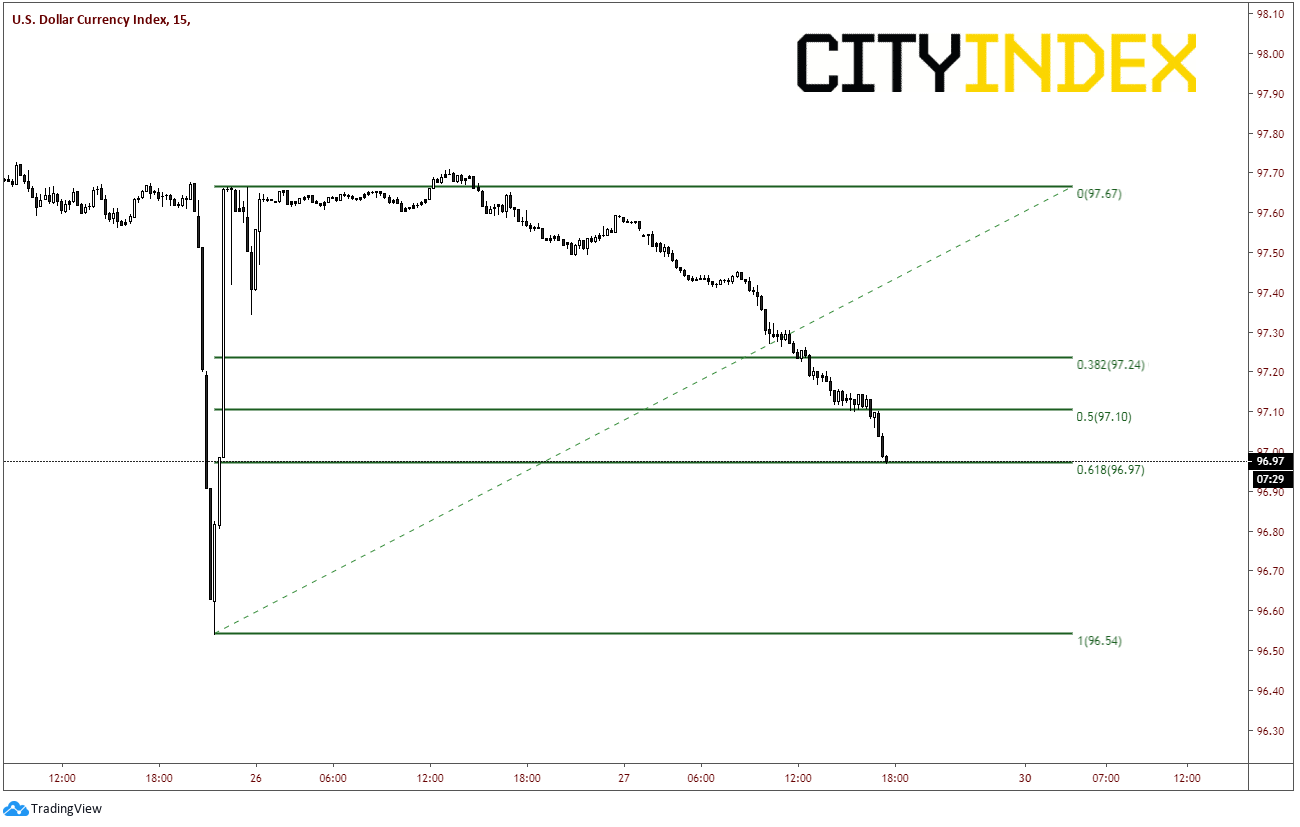

Yesterday we wrote about how the DXY had a nasty move on December 25th/26th during quiet trading, which was exacerbated by the holiday with many markets closed. Price spiked lower by over 100 pips and bounced back to unchanged within 2 hours! Looks like there may be some real money behind that move as the US Dollar Index continues to move lower today. The move on the 25th had the looks of a Central Bank all over it (ie..no idea how to trade, just get it done). Whoever is selling US Dollars today seems to have learned from that move. Instead of dumping the US Dollar position all at once in a thin market, someone may have realized its smarter to piece meal the trade. (This is total speculation on my part).

Price so far today has retraced 61.8% of the spike lower to 96.97. If the US Dollar breaks below, price can easily run down to the spike low at 96.59. And as we have discussed before, if someone needs to get something done heading into year end, price and technical won’t matter.

Source: Tradingview, City Index

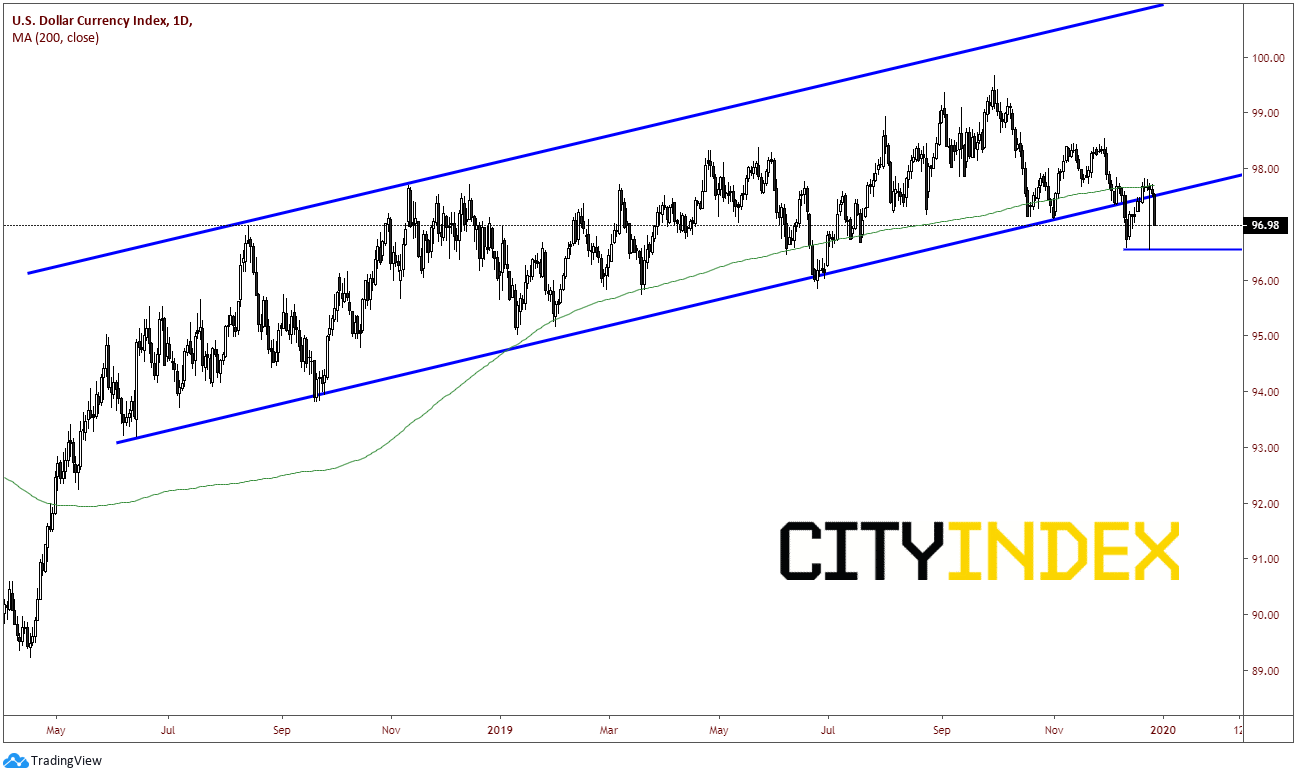

On a daily timeframe, the US Dollar broke lower on December 13th out of the upward sloping channel where price has been since mid-2018. Price then bounced and retested the bottom trendline of the channel and the 200-day moving average near 97.70. With the spike lower to the lows of December 13th, it opened the door for another move lower to the 96.59 level as possible a decisive move lower away from the channel!

Source: Tradingview, City Index

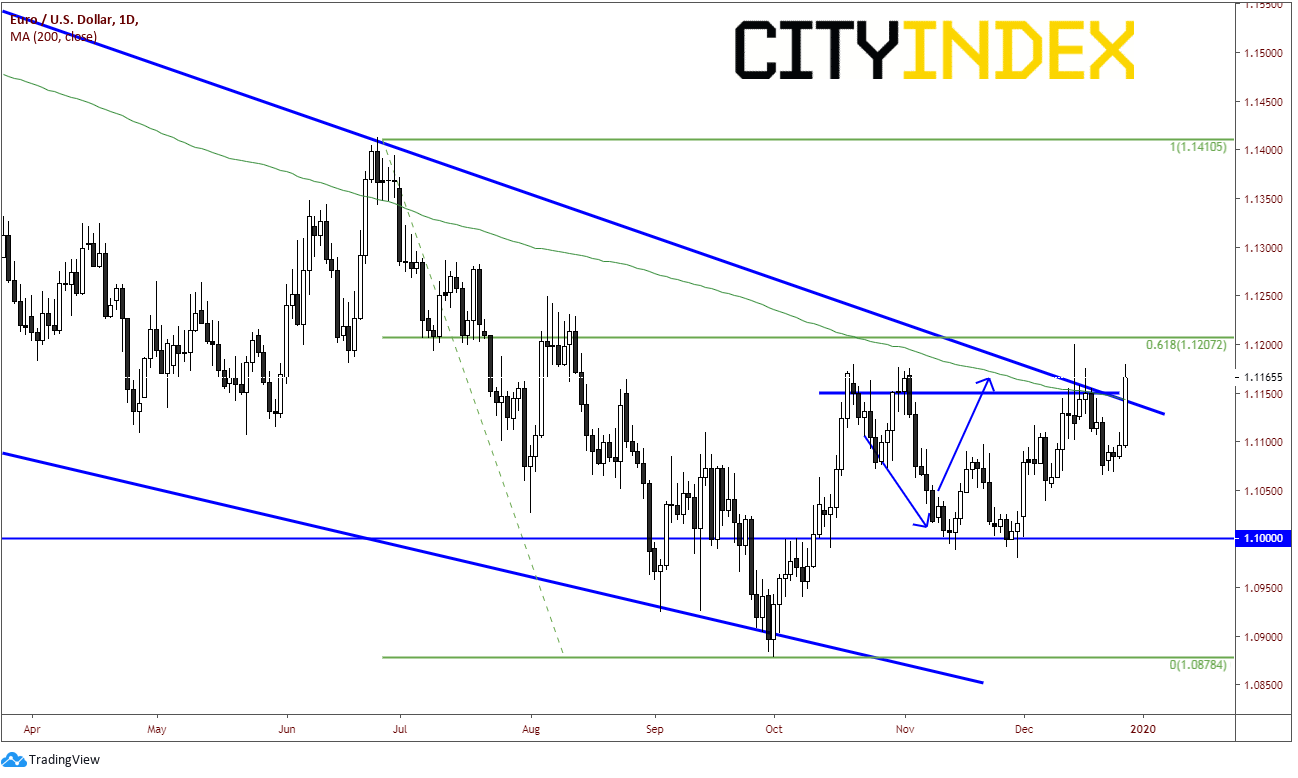

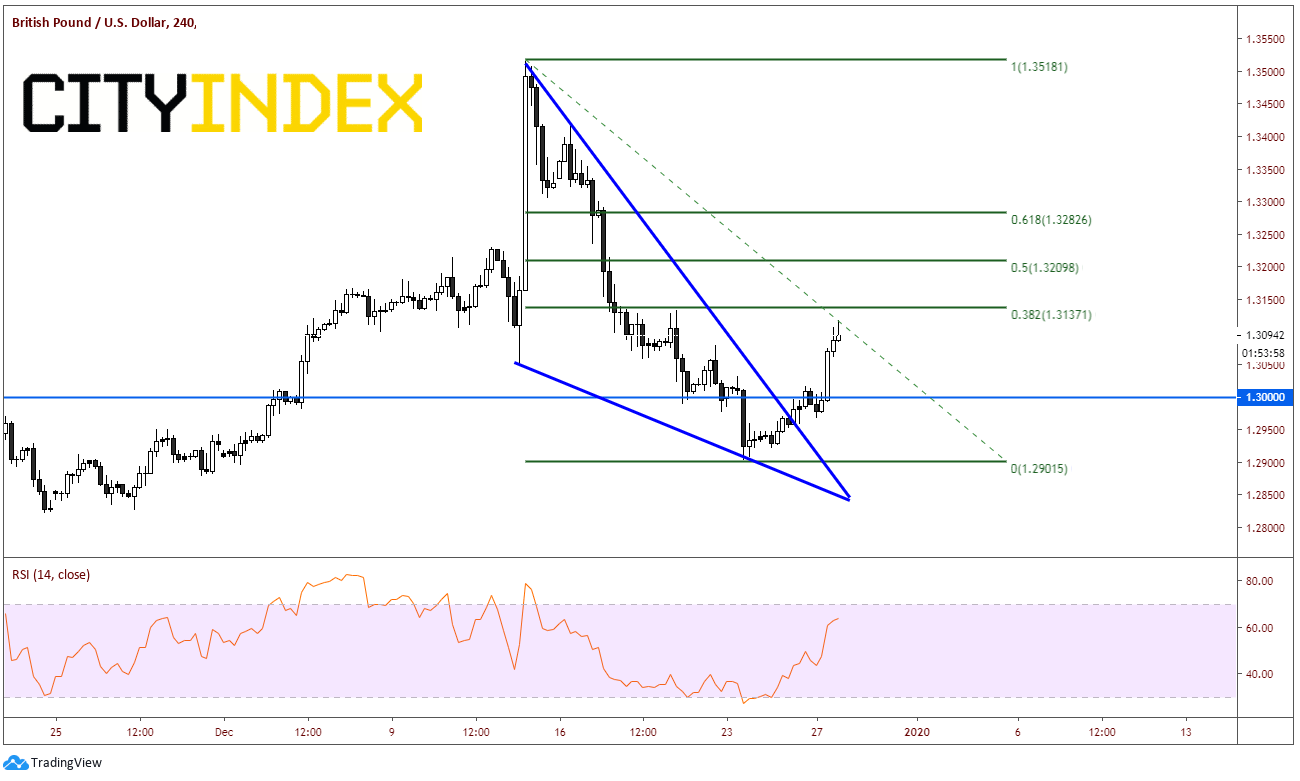

As a result of the US Dollar move, related pairs such as EUR/USD and GBP/USD are also having a big day.

EUR/USD is up 75 pips near 1.1170 and looking to retest the highs from December 13th and the 61.8% Fibonacci retracement level from the June 25th highs to the October 1st lows near 1.1207.

Source: Tradingview, City Index

GBP/USD is up over 100 pips near 1.3090 and looking to test the 38.2% Fibonacci retracement level from the spike higher on December 12th after the election to the low on December 23rd at 1.3137. Resistance above isn’t until 1.3210, which is the 50% retracement level.

Source: Tradingview, City Index

Watch for these trends continue into year end early next week!