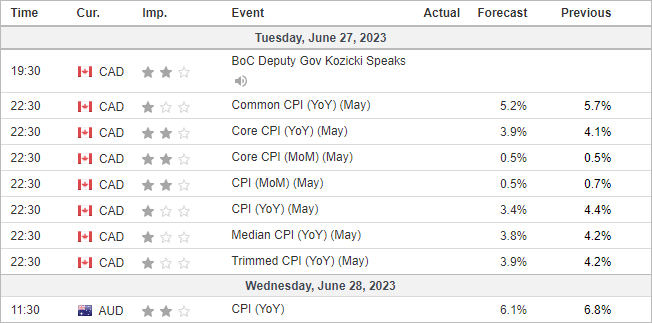

Both the RBA (Reserve Bank of Australia) and the BOC (Bank of Canada) hiked by 25bp at their last meeting, which came as a surprise to the consensus estimates for a pause. And that was before the Fed delivered a hawkish pause, the ECB and SNB hiked by 25bp as expected and the BOE surprised with a 50bp hike. It has served as harsh reminder that we cannot be complacent when central banks and hikes are concerned. And it is also worth remembering that both the RBA and BOC left room for further hikes – which makes inflation reports for Canada and Australia over the 24hrs all the more important.

The BOC’s statement was arguably more hawkish compared with the RBA’s as their statement flagged concerns that “CPI could get stuck materially above the 2% target” and that “excess demand in the economy looks to be more persistent than anticipated”. Furthermore, Canadian retail sales came in defiantly strong then, if coupled with a hot inflation report today, a hike in July 12 seems a given.

A Reuters poll of economists currently favours one more 25bp hike form the BOC to take rates to 5%. The 1-month OIS suggests a 24% chance of a 25bp hike, the 3-month is pricing in a 68% chance of a 5% rate – which has been fully priced in by the 6-month OIS. SO it appears that money markets and economists are on board with one final hike, but not on its timing. Of course, a hot inflation print today could quickly seem them aligned for a hike in July.

As for the RBA, I suspect another hike is due thanks to strong employment – unless tomorrow’s inflation comes in below 6% (3.1% consensus, 6.8% previous). There is also a case to be made that RBA governor may want to hike in case this is his last meeting, with the Treasury expected to announce who will lead the central bank later in July. Assistant governor Bullock has been tipped to take the post should Lowe not be renewed. With that said, markets are pricing in a low probability of a hike at just 21% (but then they were pricing in a pause for the past two hikes as well, so…). Ultimately, the RBA are as data dependant as ever and a hotter-than-expected inflation print seems likely to leave the RBA little choice but to hike again, given levels of inflation and hawkishness of central banks elsewhere.

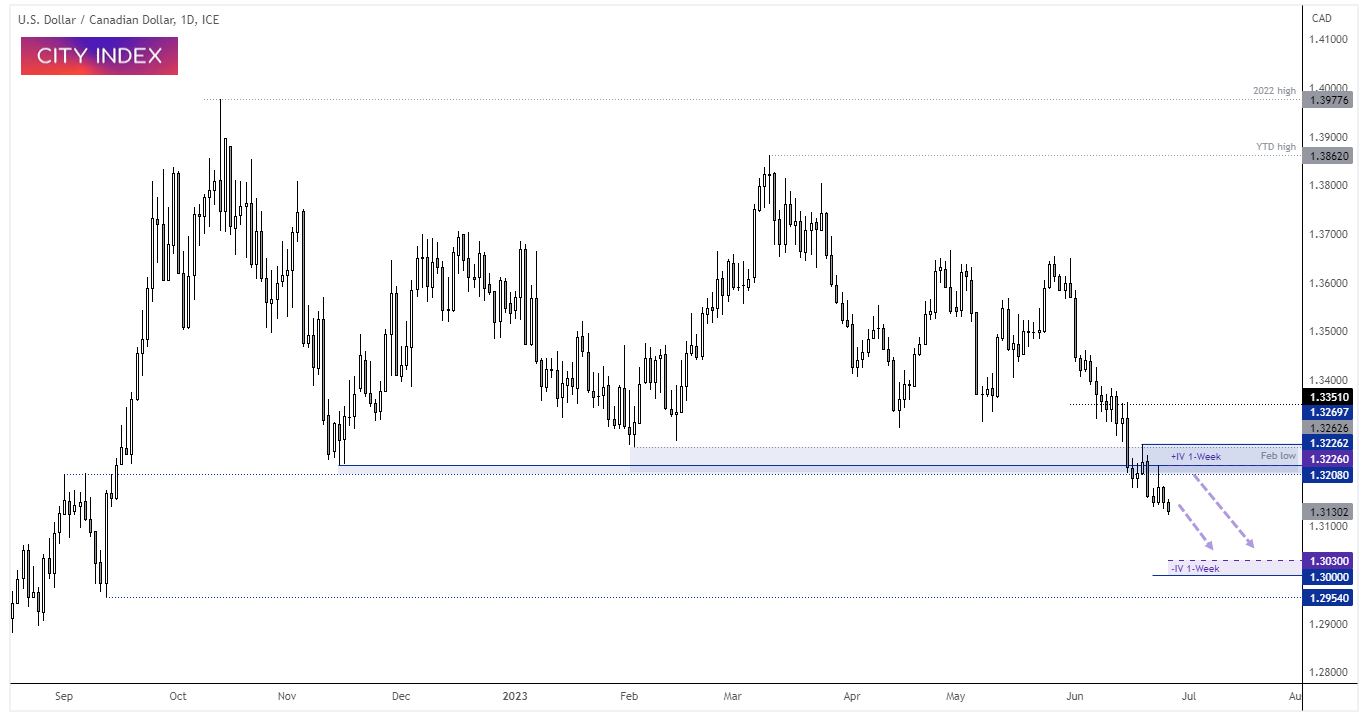

USD/CAD daily chart:

It’s not been a great month for USD/CAD bulls, with the pair trading at the lows of its 9-month low and on track for its worst month since January 2019. Just over a week ago USD/CAD broke out of its multi-month range which potentially brings support around 1.3000 into focus. It has also seen two spikes higher form lower highs, and the pair is now holding just above 1.3100 ahead of today’s Canadian inflation report.

A threat to the downside bias would be if Canada’s CPI came in softer than expected and US PCE data on Friday comes I hotter. But unless we see a large divergence between the two data sets, we would reconsider fading into moves beneath the November or February lows.

Take note that the upper and lower 1-week implied volatility bands sit around 1.0300 support and between the November and February highs.

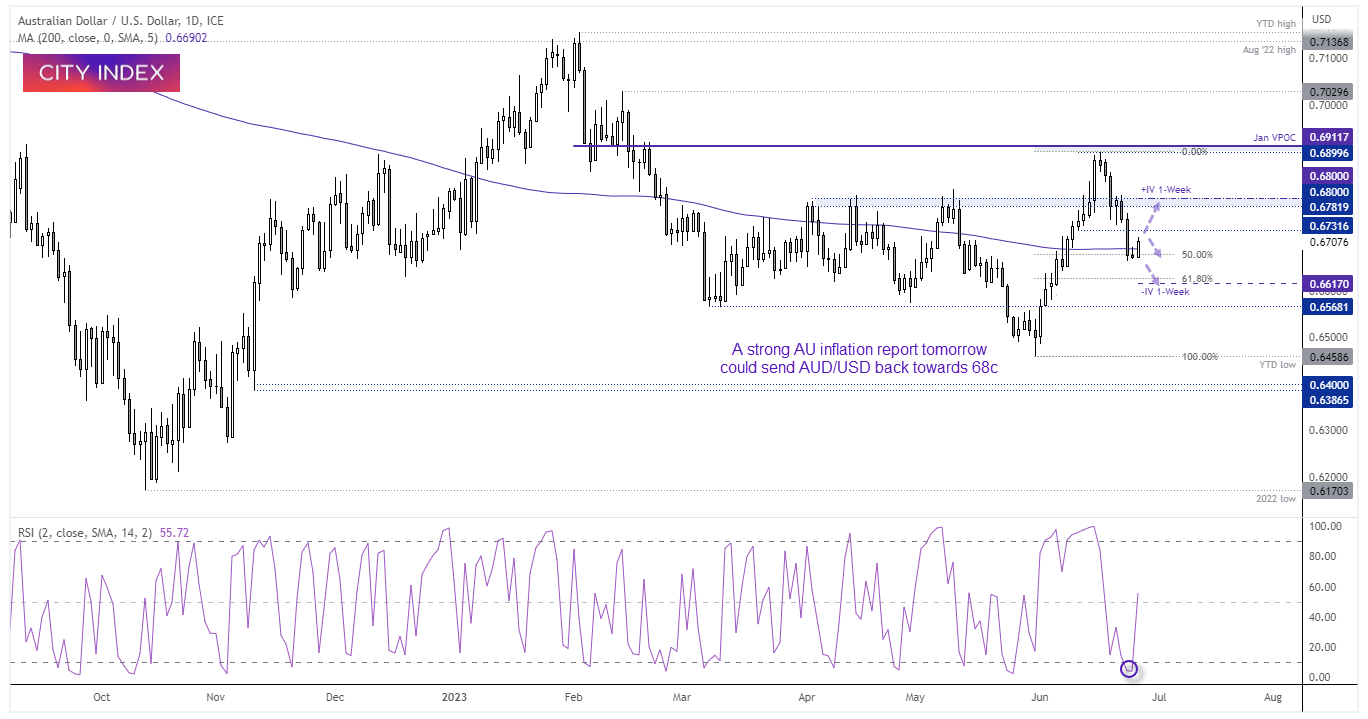

AUD/USD daily chart:

Whilst AUD/USD posted a strong rally at the beginning of the month which effectively rose within a straight line, momentum petered out just beneath the January VPOC (volume point of control) and fell ~3.5%. Yet support was found around the 50% retracement level and prices have broken back above the 200-day MA. Given indices appear oversold over the near-term and RSI (2) on AUD/USD reached oversold yesterday, the Aussie could potentially retest the 0.6800 handle should tomorrow’s inflation report come in strong enough. Yet if we’re treated to a relatively low number (ideally below 6%) then perhaps AUD/USD could print a swing high and break to fresh cycle lows, with bears eyeing up a move towards 0.6600.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade