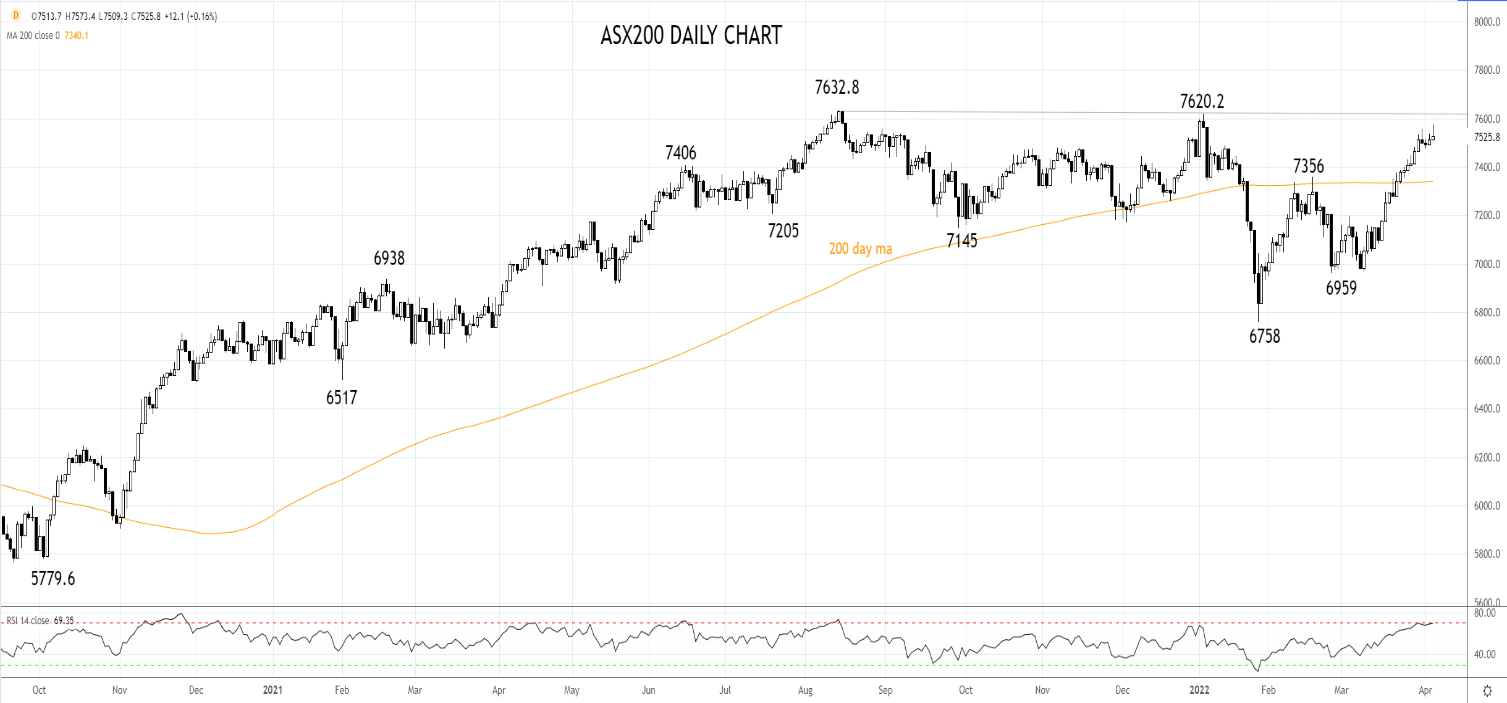

The ASX200 added 14 points today to 7528 after the RBA removed its dovish forward guidance at its monthly Board Meeting this afternoon.

The removal of the word “patient” and acknowledgement that inflation has picked up and a further increase is expected, will see the RBA begin lifting interest rates in June after the Federal Election.

While most commentators feel the RBA cash rate will end the year at around 1%, the Australian interest rate is pricing that rates will be closer to 2% by year-end.

Despite the prospect of higher rates, local IT stocks have surged, taking their lead from the tech-heavy Nasdaq index, which outperformance overnight following news that Elon Musk acquired a 9.2% stake in Twitter.

Afterpay owner Block (SQ2) added 6.22% to $191.44, Xero (XRO) added 4.49% to $108.00, Life 360 (360) added 2.65% to $5.80. Appen (APX) added 2.03% to $7.02 while Megaport (MP1) added 0.50% to $14.09.

The big banks mostly closed higher enjoying the prospect of higher rates. Westpac (WBC) added 0.59% to $24.05. Commonwealth Bank (CBA) added 0.62% to $104.36, National Australia Bank (NAB) added 0.34% to $32.18. ANZ closed lower at $27.04, while Macquarie Bank (MQG) added 0.47% to $207.06..

It's a sad truth that the worse the geopolitical disaster in Europe becomes, the better it is for the ASX200.

Evidence of Russian war crimes in Ukraine has raised the likelihood oftighter Westernsanctions on Russian gas and oil, spurring the price of crude oil back above $104.00 and the local Energy sector higher.

Origin Energy added 3.11% to $6.63, Woodside Petroleum (WPL) added 2.76% to $33.93. Santos (STO) added 2.27% to $8.10, while Beach Energy (BPT) added 1.60% to $1.59.

A mixed day for the materials sector. Mineral Resources (MIN) added 5.69% to $59.67 after announcing plans to increase production in 2 WA spodumene mines in response to surging global lithium demand. Fortescue Metals (FMG) added 0.09% to $21.72. While BHP Group (BHP) fell by 0.97% to $51.95, and Rio Tinto (Rio) fell by 0.35% to $120.24.

Healthcare names are trading lower after a good run higher in recent days. Cochlear fell by 0.49% to $224.33. Resmed (RMD) fell by 1.1% to $32.40. Ramsay Health Care (RHC) lost 0.23% to $64.20.

Lithium miners Liontown Resources (LTR) has given back a good chunk of yesterday’s 9% gains to close 6.13% lower at $1.99. Avz Minerals (AVZ) closed 7.89% lower at $1.23 while Vulcan Energy (VUL) lost 4.15% to $10.17.

The AUDUSD is trading at 9-month highs at .7630 after breaking above the .7555 high of October 2021 following the hawkish RBA shift and a lift in the commodity complex overnight.

Source Tradingview. The figures stated are as of April 5th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade