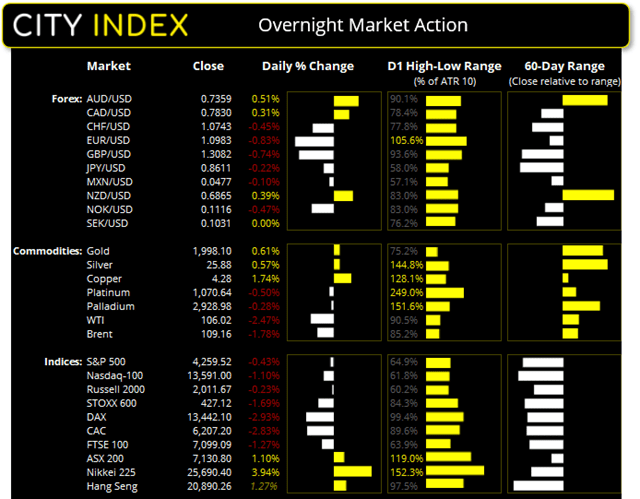

Thursday US cash market close:

- The Dow Jones Industrial fell -112.18 points (-0.34%) to close at 33,174.07

- The S&P 500 index rose -18.36 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index fell -151.204 points (-1.1%) to close at 13,591.00

Asian futures:

- Australia's ASX 200 futures are down -38 points (-0.53%), the cash market is currently estimated to open at 7,092.80

- Japan's Nikkei 225 futures are down -440 points (-1.73%), the cash market is currently estimated to open at 25,250.40

- Hong Kong's Hang Seng futures are down -434 points (-2.09%), the cash market is currently estimated to open at 20,456.26

- China's A50 Index futures are down -101 points (-0.73%), the cash market is currently estimated to open at 13,728.96

US Inflation continues to heat up

US inflation rose to 7.9% y/y a 40-year high of 7.9%, up from 7.5%, and rose 0.8% m/m, up from 0.5% in January. Core CPI rose to a 39-year high of 6.4%. That we’ve seen commodity prices rip higher and this inflation report largely ignores those rises, then we could expect CPI to be even hotter at the next report. The Fed Fund futures are pricing a 94.9% chance of a hike to the 25-50 bps band at the FOMC meeting next week.

Third round of Ukraine-Russia talks ended without resolve

There had been a risk-on rally for European markets ahead of these talks after Ukraine said they’re open to retaining ‘neutrality’, which was a key demand from Russia. Yet the firt high-level talks ended without a ceasefire and no progress had been made.

Walt Disney stated they will ‘pause’ business in Russia. But more interestingly, Goldman Sachs became the first Wall Street bank to cut ties with Russia, with JP Morgan saying they will follow suit shortly after.

Wall Street hands back some of Wednesday’s rally

US equity markets were lower on the back of hot inflation and disappointment over the Ukraine-Russia talks. The Nasdaq was down -1.1%, the S&P -4.3% and Dow Jones -0.47% - but compared to recent levels of volatility is not too bad.

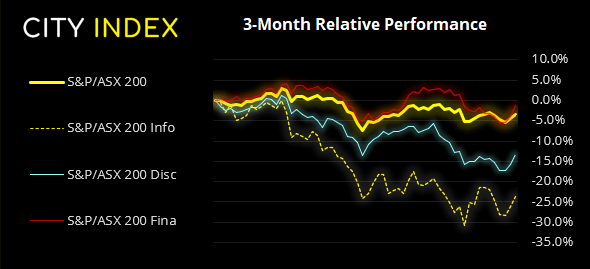

ASX 200:

The ASX rallied for a second consecutive day, eight of its 11 sectors rallied (led by technology and financial sectors) with 76% of its stocks advancing. It reached the upper target of 7150 but met resistance at its 100-hour eMA to close around 7145. Today’s intraday support levels are 7100/08 and 7072, with 7200 being the immediate upside target – a close above which is constructive for the bull case entering next week.

ASX 200: 7130.8 (1.10%), 10 March 2022

- Information Technology (3.29%) was the strongest sector and Energy (-2.48%) was the weakest

- 8 out of the 11 sectors closed higher

- 3 out of the 11 sectors closed lower

- 6 out of the 11 sectors outperformed the index

- 152 (76.00%) stocks advanced, 40 (20.00%) stocks declined

Outperformers:

- +11.04% - Paladin Energy Ltd (PDN.AX)

- +6.69% - GQG Partners Inc (CQG.AX)

- +6.61% - Flight Centre Travel Group Ltd (FLT.AX)

Underperformers:

- -13.17% - Nickel Mines Ltd (NIC.AX)

- -8.25% - Summerset Group Holdings Ltd (SNZ.AX)

- -7.73% - Rio Tinto Ltd (RIO.AX)

Euro lower after ECB and US CPI

The euro was given a little boost after their meeting more hawkish than expected. There had been expectation they would hold back given the situation in Ukraine, but instead the core focus was on hot inflation and announced a faster increase of their asset purchases, and PEPP will end this month as originally planned.

But it was not enough to see the euro as the weakest currency overnight. A considerably more hawkish Fed alongside the Ukraine crisis saw EUR/USD revert back to its bearish trend and the DAX hand back some of Wednesday’s rally. EUR/GBP failed to hold onto its break above the December trendline and effectively closed flat with a wide legged Doji.

Commodity currencies remained firm with commodity prices and AUD was the strongest major on the day. AUD/JPY reached out 85.50 target after a textbook pullback to 84.60 support.

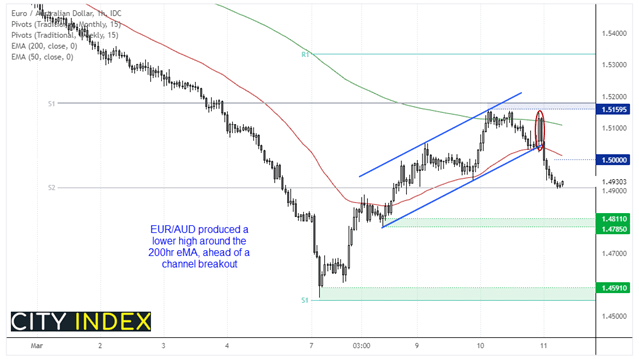

EUR/AUD reverts to trend

The pair broke a 2-day pullback and formed a bearish engulfing candle o the daily chart. It was also the weakest of the 28 pairs we track. The hourly chart shows a lower high formed around the 200-hour eMA, ahead of a trendline break. Prices have since fallen to the monthly S2 pivot point, so we’re looking for a break of yesterday’s low to assume bearish trend continuation. We would also consider fading into low volatility rallies whilst prices remain below 1.5000.

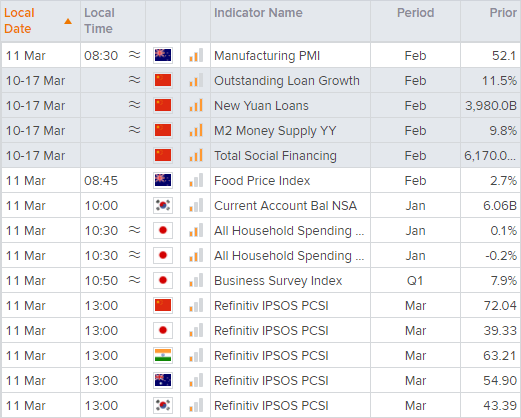

Up Next (Times in AEDT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade