Barclays Q3 earnings beat expectations

Barclays revealed net operating income rose to £5.5 billion in the third quarter from £4.6 billion last year while pretax profit jumped to £2.0 billion from £1.1 billion. That came in ahead of the £5.1 billion in income and £1.6 profit forecast by analysts. EPS of 8.5p increased from 3.5p last year and also came in ahead of the 6.2p expected by analysts.

Barclays shares struggled to find higher ground this morning despite the strong performance, but have already surged over 37% since the start of 2021 and over 12% in the last month alone as investor confidence steadily improves in-line with improving economic conditions.

Barclays delivers record profits

Barclays said the strong performance in the third quarter built on top of the solid first half, allowing it to deliver a record pretax profit of £6.9 billion in the first nine months of 2021, up from just £2.4 billion last year.

Earnings were partly boosted by the net release of £600 million worth of provisions set aside for potentially bad loans during the pandemic due to the improvement in the economic outlook over the last nine months.

‘We continue to support our customers and clients through the COVID-19 pandemic, have achieved a double-digit RoTE in every quarter year to date, and expect to deliver a full year RoTE above 10%,’ said Barclays CEO James Staley.

Global M&A deal making frenzy drives record performance

The Corporate and Investment Bank also delivered its best nine-month performance ever, driven by investment banking fees and equities income, with the unit delivering a return on tangible equity of 16.4% in the period compared to just 10.5% the year before.

The investment banking division put in a particularly strong performance as Barclays capitalised on the boom in global deal making within the M&A space. Investment banking fees rose to £971 million in the third quarter from just £610 million the year before, marking its best performance in years. Notably, Barclays is the only British bank that still competes for investment banking business in the US, allowing it to reap similar rewards to that seen by the likes of Goldman Sachs and Morgan Stanley last week as M&A activity hit new highs.

‘While the Corporate and Investment Bank performance continues to be an area of strength for the group, we are also seeing evidence of a consumer recovery and the early signs of a more favourable rate environment. Against that backdrop, we are focused on balancing cost efficiencies with further investment into high-returning growth opportunities,’ said Staley.

Barclays ‘well positioned for a rising rate environment’

Barclays said it is well-positioned for a rising rate environment, with some in the markets preparing for a rate hike as early as next month. It said UK mortgage and deposit volumes remain ‘strong’ and that consumer spending in both the UK and the US has followed positive trends as lockdown restrictions ease – although said this is yet to translate to meaningful unsecured balance growth.

Barclays UK saw pretax profit rise to £1.96 billion in the first three quarters of 2021 from just £264 million last year, with RoTE rising to 17.9% from 2.2%, reflecting the significant reduction in credit impairment charges. Personal banking income jumped 10% thanks to strong growth in mortgages, margins, deposit growth and lower Covid-19 support costs. Consumer income was down 23% as appetite for loans remains subdued, although income from Business Banking rose 12% as it took more deposits and lent out more funds.

Barclays International saw pretax profit almost double to £5.5 billion with RoTE improving to 16.4% from 7.5%. It said Global Markets income was down 14% as a strong performance in equities, posting its best performance on record over the nine-month period with income up 28%, was more than offset by the sharp 33% fall in income from fixed-income and currency trading.

Barclays reported a CET1 ratio – which measures the bank’s solvency - of 15.4%, well above the 13% to 14% target and better than the 14.9% forecast by analysts. It said this will allow it to maintain its progressive dividend policy and dish-out additional cash returns through buybacks.

Barclays upgrades economic outlook

Barclays said its economic outlook was refreshed in the third quarter and is now more optimistic than it was earlier this year. It said UK GDP is set to return to pre-pandemic levels by ‘early 2022’ and that unemployment will peak at 5.4% in the first quarter of 2022.

However, it warned that its downside scenario still sees the potential for the recovery to take longer in both the UK and the US if new virus variants emerge, especially if they prove immune to existing vaccines, and prompt governments to plunge nations back into lockdown.

‘Although the macroeconomic outlook has improved, the level of uncertainty is relatively high. Unemployment remains at elevated levels, with a significant number of jobs at risk of redundancy as measures of support are tapered down in the UK, US and Germany between the end of Q321 and Q122 respectively. To date, limited defaults have been observed in response to the COVID-19 pandemic, but credit deterioration may occur as support is withdrawn,’ Barclays said.

‘This uncertainty continues to be captured in two distinct ways: firstly, the identification of specific customers and clients who may be more vulnerable to the withdrawal of relief and secondly, macroeconomic and risk parameter uncertainties which are applied at a portfolio level,’ the bank added.

Where next for the Barclays share price?

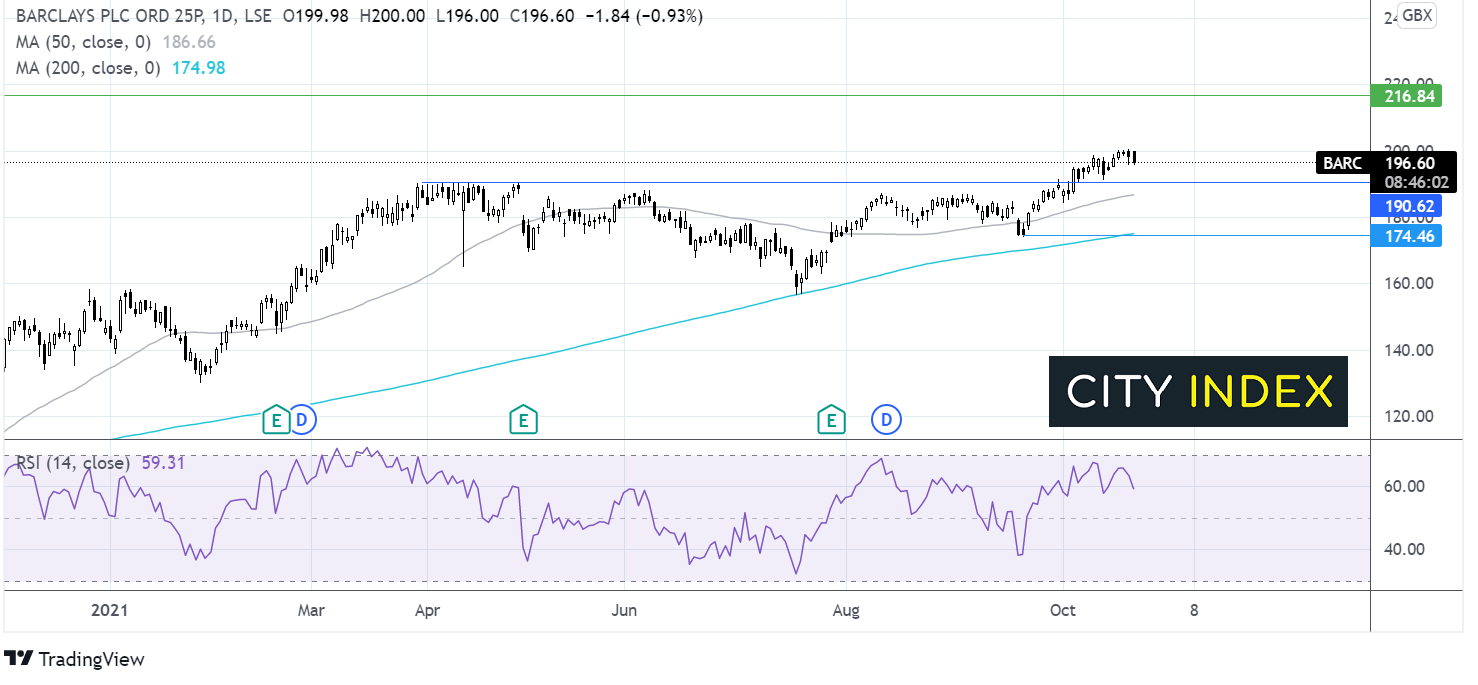

Barclays share price has been steadily grinding higher across the year. It rebounded off the 200 sma in md July. The 50 sma offered support in September. The price broke out above 190p the April high in early October hitting a fresh 3 year high of 200p.

The price is slipping lower today. The RSI is pointing lower but still in bullish territory suggesting that this is a corrective move. It would take a fall below 190p to negate the near term bullish run.

Meanwhile buyers will look for a move above 210p to bring 216p the May 2018 top into play. Between 200p and 216p there isn’t much in the way of resistance.

When do HSBC, Lloyds and NatWest report Q3 results?

Barclays is the first UK-listed bank to report third quarter earnings, with its peers to follow next week. HSBC will release quarterly earnings on Monday October 25, Lloyds Banking Group will follow on Thursday October 28, and NatWest will round-off the week when it reports on Friday October 29.

How to trade Barclays shares

You can trade Barclays shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Barclays’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade