USD/JPY Key Points

- A series of leaks late last week suggested that the BOJ is already arranging an end to its negative interest rate policy (NIRP) at its meeting this week.

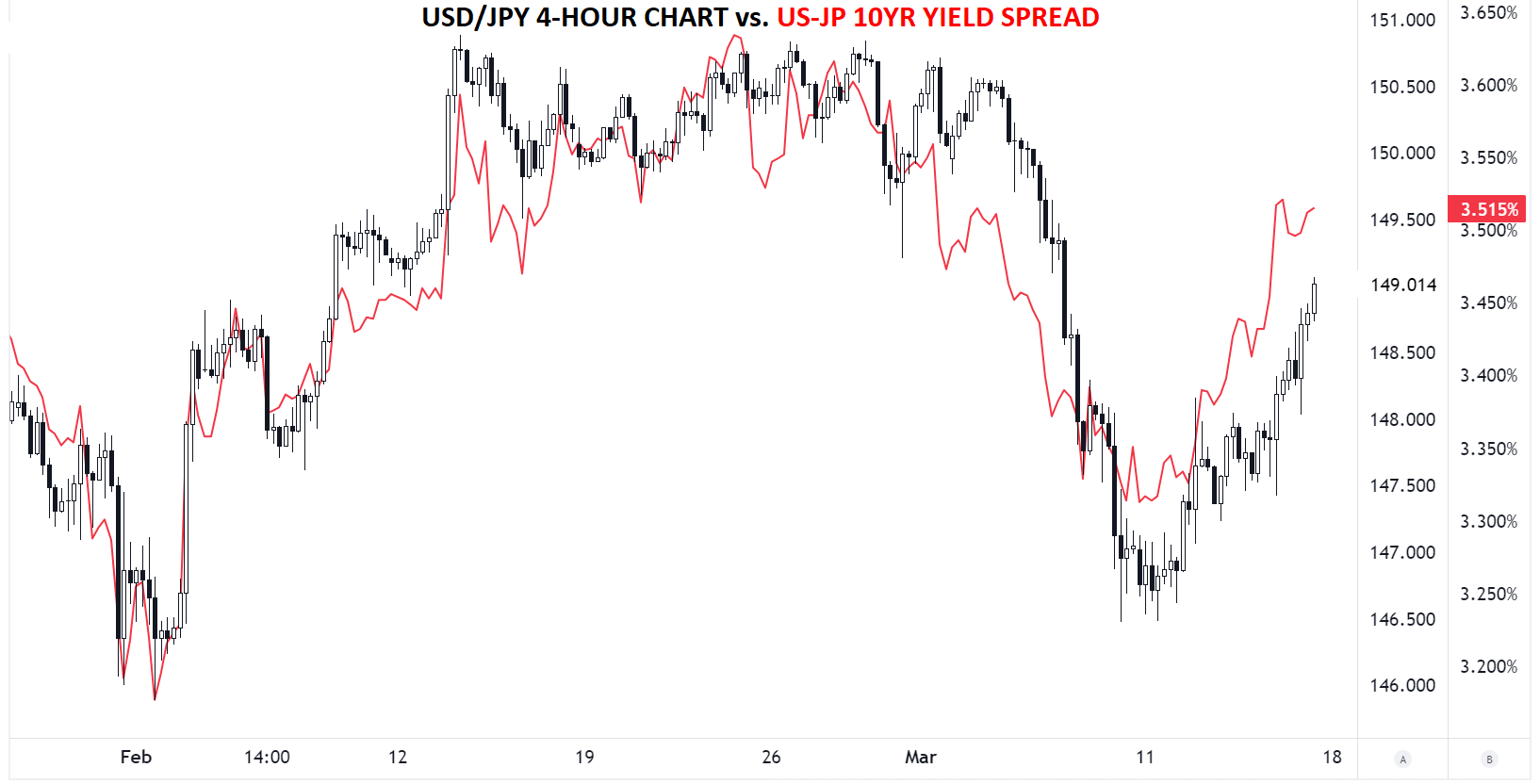

- A surge in the 10yr bond yield spread between the US and Japan drove USD/JPY’s rally last week

- Key technical levels to watch in the coming days include possible resistance at 149.70 and 151.00, with support down at 148.70 and 145.85.

USD/JPY: Will the BOJ Exit NIRP?

As we noted earlier this week, the long-awaited results from the Japan’s spring wage negotiations were generally in line with what the BOJ wanted to see to exit its ultra-accommodative monetary policy.

Japanese companies agreed to the biggest pay raises in over 30 years, with an average increase of 5.3% at Rengō, Japan’s largest trade union, surpassing last year's 3.8% increase. This is significant because smaller companies, which employ the majority Japanese workers, usually give smaller raises.

The key question for the yen this week is whether these wage increases will push the Bank of Japan (BOJ) to exit its negative interest rate policy, especially if higher wages help achieve sustainable inflation closer to the 2% target. A series of leaks late last week suggested that the BOJ is already arranging an end to its negative interest rate policy (NIRP) at its meeting this week.

Rather than take that move as gospel, readers should note that many past hawkish “leaks” from the BOJ have ultimately led to disappointment. That said, the central bank has been highlighting the importance of wage discussions for months now, so it seems logical that we’ll finally see a shift from BOJ Governor Ueda and company.

USD/JPY: Japanese Economic Data to Watch

Monday

- No major releases of note

Tuesday

- Bank of Japan Monetary Policy Meeting and Press Conference

- JP Capacity Utilization (Jan)

- JP Industrial Production (Jan)

Wednesday

- No major releases of note

Thursday

- Tankan Index (Mar)

- JP Trade Balance (Feb)

- Flash Manufacturing and Services PMIs (March)

Friday

- JP Inflation and Core Inflation (Feb)

- Weekly Foreign Bond and Stock Investments

USD/JPY: Bond Yields Remain the Dominant Driver

Source: TradingView, StoneX

For the countless traders (including myself to some extent!) who were puzzled by the yen’s big drop last week, despite the aforementioned strong wage growth and hawkish BOJ reports, it’s worth looking at one of the most basic drivers of currency valuation: interest rates. As the 4-hour chart above shows, the spread between the US and Japanese 10yr bond yields bounced back strongly in favor of the US last week, pulling the currency pair higher along with it.

In other words, while developments out of Japan pointed to the potential for higher interest rates last week, that same dynamic was even stronger for the US.

With both central banks announcing their latest interest rate decisions and economic forecasts this week, USD/JPY traders should keep a close eye on how this interest rate spread evolves.

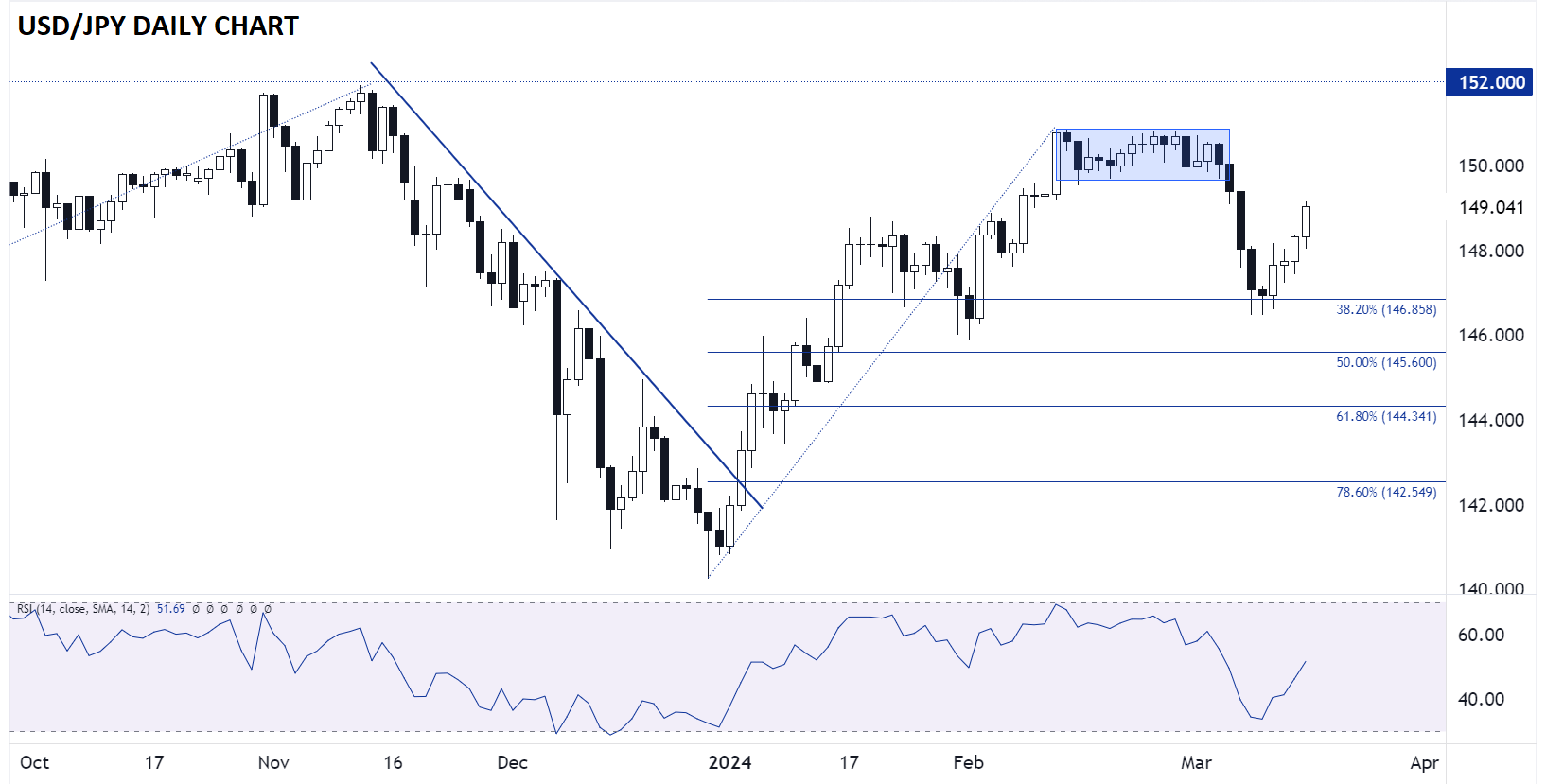

Japanese Yen Technical Analysis – USD/JPY Daily Chart

Source: TradingView, StoneX

As you can see, last week’s impressive rally in USD/JPY came off the 38.2% Fibonacci retracement of the January-February rally at 146.85. After tacking on more than 200 pips last week, USD/JPY could see a short-term dip heading into the BOJ meeting in Tuesday’s Asian session, but once the central banks start lobbing grenades, all bets are off. Key levels to watch in the coming days include possible resistance at 149.70 and 151.00, with support down at 148.70 and 145.85.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX