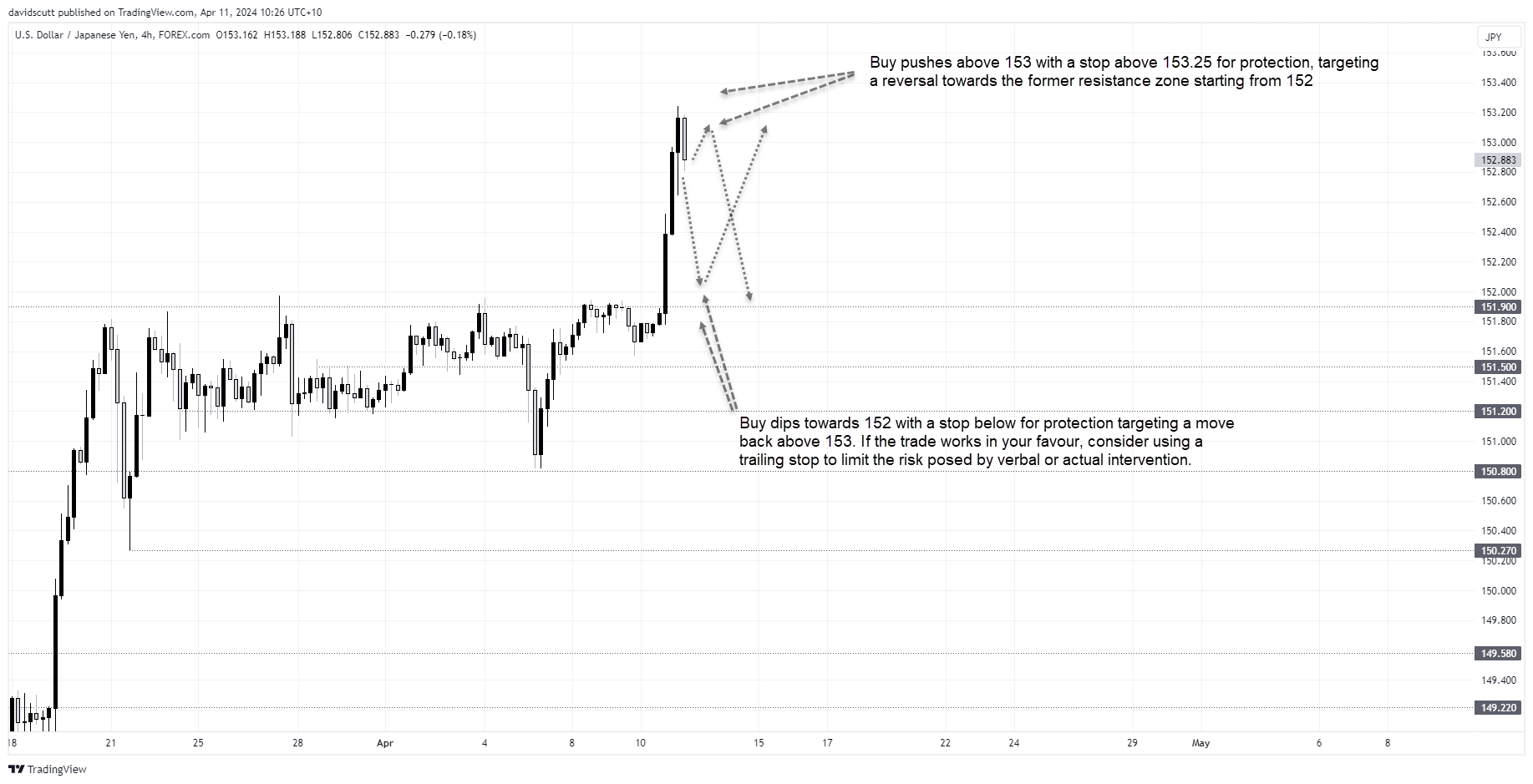

- USD/JPY has broken resistance at 152, pointing to the potential for a sizeable move higher

- Higher US bond yields are helping to boost the appeal of the US dollar relative to the Japanese yen

- Japanese officials may attempt to jawbone USD/JPY lower by implicitly warning of intervention from the Bank of Japan

The overview

Whether you look at fundamentals or technicals, the case for USD/JPY upside is compelling. But the threat of BOJ intervention to support the yen has not gone away, making for a tricky environment for traders to navigate. However, the volatility it generates provides multiple trade setups depending on your timeframe.

The background

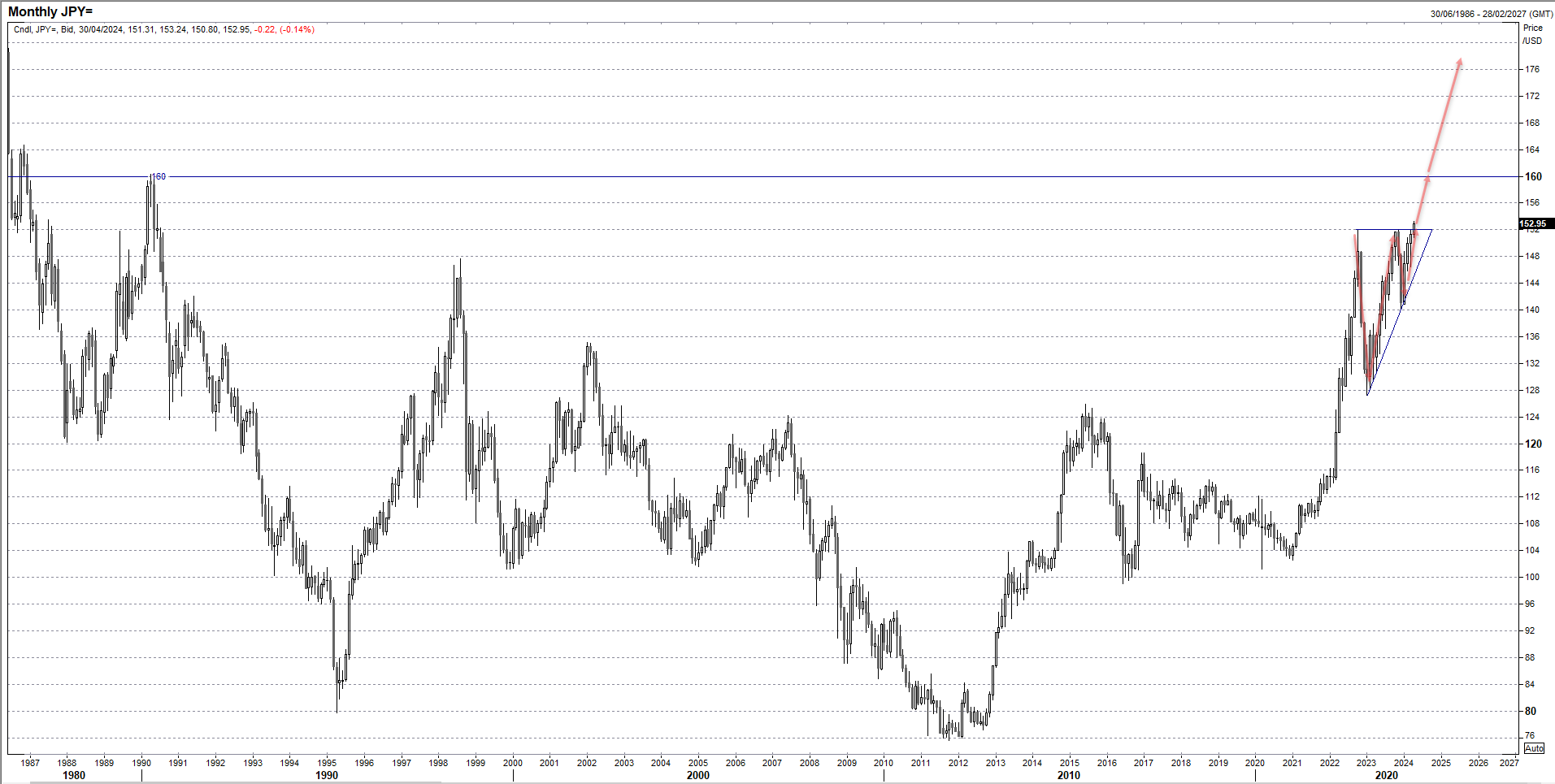

USD/JPY breakout points to rally risk

If you exclude everything else and focus solely on technicals, we just saw a textbook topside break from a long-running ascending triangle pattern in USD/JPY. Based on when the triangle was formed, an extension points to a significant move higher, potential to around 180.

Source: Refinitiv

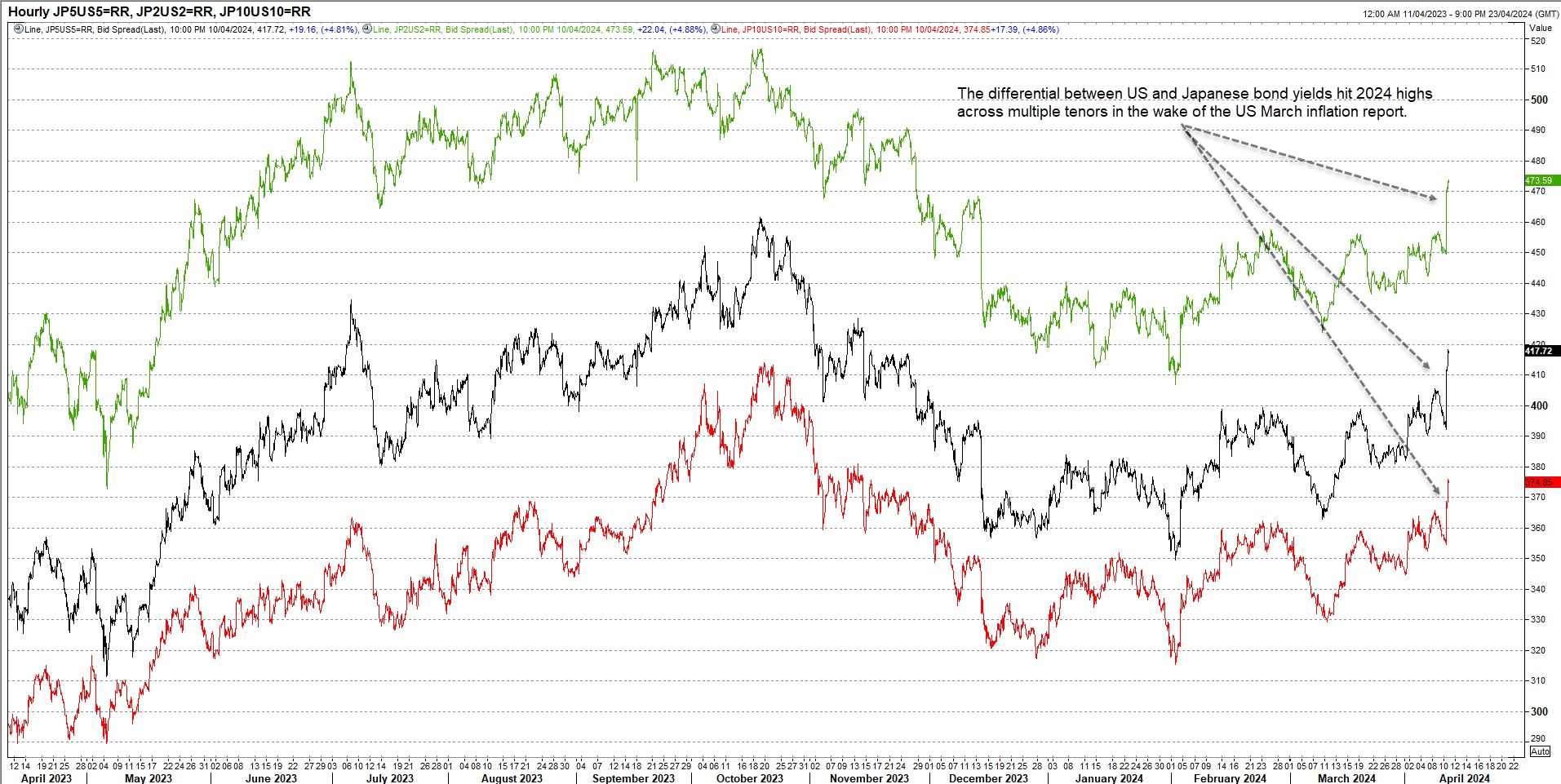

Fundamentals fueling upside

Fundamentals also point to USD/JPY upside with yield differentials between US and Japanese bonds ballooning to year-to-date highs across multiple tenors following the hot inflation report form the States on Wednesday, boosting the appeal of the dollar relative to the yen.

Source: Refinitiv

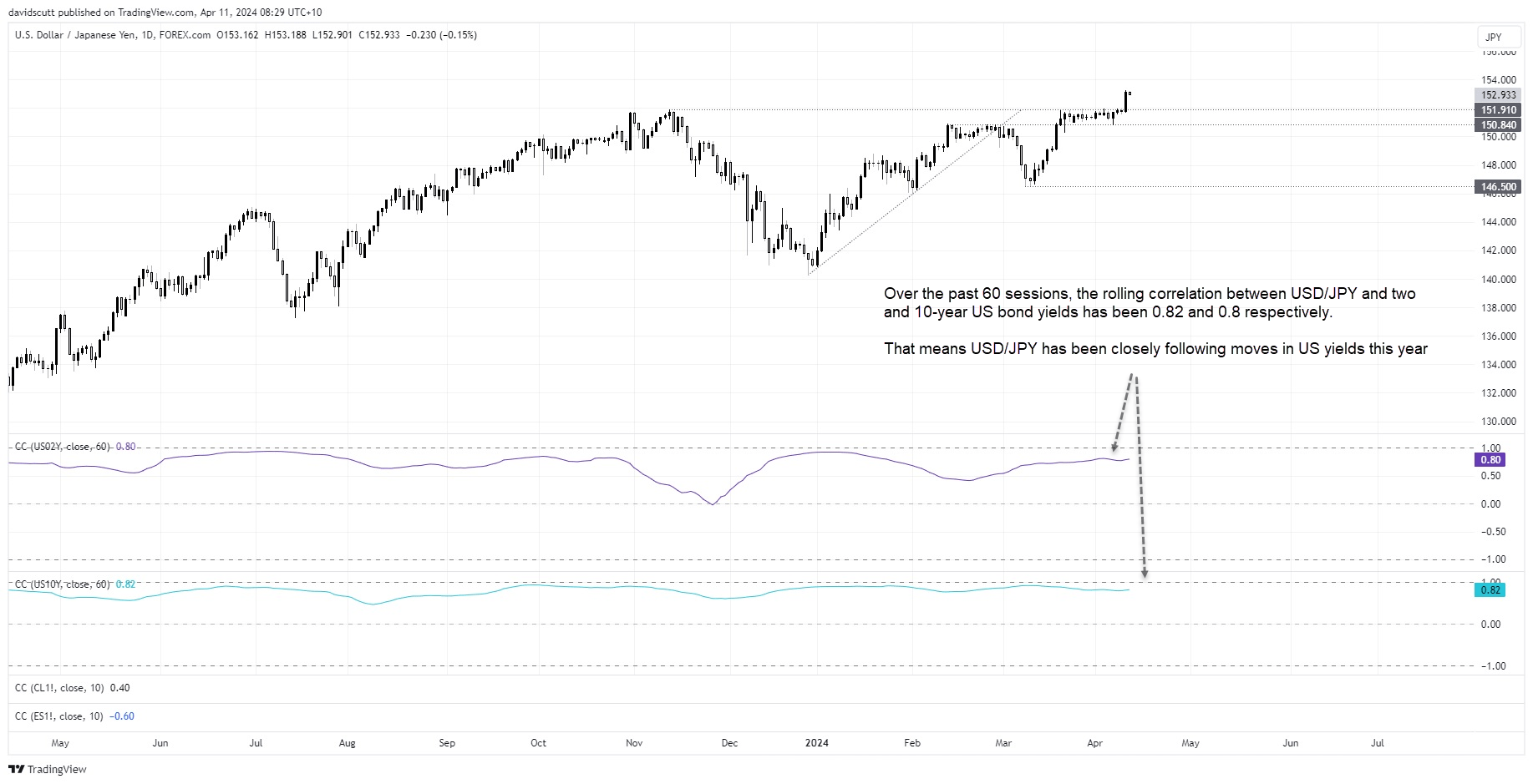

With a rolling daily correlation in the past three months of 0.82 and 0.8 with US two and 10-year yields, it comes as no surprise that USD/JPY traded to fresh 34-year highs following the inflation report.

With technicals and fundamentals working in tandem, USD/JPY upside is compelling.

But BOJ threat creates artificial USD/JPY cap

Any trader who has been looking at USD/JPY recently would know about the threat of the Bank of Japan (BOJ) intervening on behalf of the Japanese government to support the yen, artificially capping USD/JPY prior to Wednesday’s breakout. That hasn’t gone away.

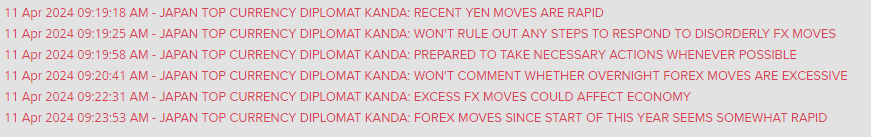

It's likely we'll hear plenty of moaning from Japanese officials about the USD/JPY on Thursday, claiming it’s undesirable and driven by speculative activity rather than fundamentals. That’s simply not correct.

Japan continues to run extremely loose monetary policy while the outlook for rates in the US is quickly swinging towards no cuts in 2024 rather than the seven that were being priced in January when USD/JPY traded in the low 140s. To claim the yen should be stronger in such an environment is ridiculous, yet that probably won’t stop Japanese policymakers from implying it.

It makes for a tricky backdrop for traders; the case for upside is strong but you have one rather large market participant that could send USD/JPY tumbling hundred of pips within seconds.

The trade idea

There are a few ways traders could play the unique environment, depending in their preferred timeframe.

Over the short-term, traders are likely to be ultra-sensitive to remarks from Japanese officials expressing displease of recent moves, allowing for pushes towards the overnight high of 153.25 to be faded given the likelihood it will prompt verbal intervention. A stop at or just above entry would keep potential risk to minimal levels,

Japan’s top currency diplomat Masato Kanda has already been on the wires Thursday morning, resulting in USD/JPY sliding around 0.2%. Should other officials join in it may amplify downside, especially if accompanied by increasingly agitated commentary which might be the last warning before an intervention episode.

Source: Refinitiv

For those with more patience, pullbacks towards 152 provide an opportunity to enter longs should the prevailing fundamental backdrop remain relatively the same, allowing for stops to be placed below the former resistance zone for protection. A potential target could be the high of 153.25 or a little lower. Those looking at this setup may want to consider a trailing stop given the threat of intervention near-term.

The wildcards

While the early evidence suggests it’s unlikely, there is a risk Japanese officials may recognise the futility of intervening against such strong fundamentals. If the BOJ were to pull the trigger it will offer traders an opportunity to buy the US dollar at artificially low levels. A sudden dearth of verbal intervention is something to watch out for, or even public remarks implying comfort regarding the current level of the yen.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade