- Risk assets have been rallying on hopes the Fed is done hiking

- Several Fed officials have flagged higher bond yields are doing the work for them

- Bond yields have been falling in response, creating a dilemma

- Fed minutes, US CPI, US bond auctions and the conflict in Israel make this a potentially big week for the higher for longer narrative

Talk of higher yields has risk rallying on hopes for a Fed pause, but yields are falling

Want to know something ironic? Risk assets have been rallying on hopes higher yields will prompt a Fed pause, as promoted by notable policy hawk Lorie Logan of the Dallas Fed on Monday.

But here’s the thing: yields have moved lower on her and other similar remarks from Fed officials, with financial conditions loosening as a result. It makes you wonder how long policymakers can run with the view that market-based forces are making the job easier to lower inflation when the exact opposite outcome is occurring?

Will the Fed push back against looser financial conditions?

Know one knows the exact answer, but I suspect we’ll find out soon enough with five FOMC members scheduled to speak on Tuesday, followed by numerous others later this week. The minutes of the Fed’s September FOMC meeting – the one that spooked the markets and ruptured the entire US yield curve higher – are like the cherry on top when they arrive on Wednesday, as will fresh 10 and 30-year US Treasury auctions to close out the week.

Perhaps the Fed are willing to tolerate a loosening in financial conditions? Perhaps risk aversion takes hold given the events in Israel? Perhaps we get a big undershoot on US core CPI, acting to promote a further bid in bonds? A lot of ifs and buts, for sure, but if there’s one thing we’ve learnt this cycle, it’s the Fed seems intent on seeing the inflation challenge through. It means we could easily see another coordinated hawkish tilt to re-tighten financial conditions to *actually* make its job easier.

That’s the risk this week, bringing into focus anything sensitive to shifts in bond yields.

Yield sensitive assets on the radar

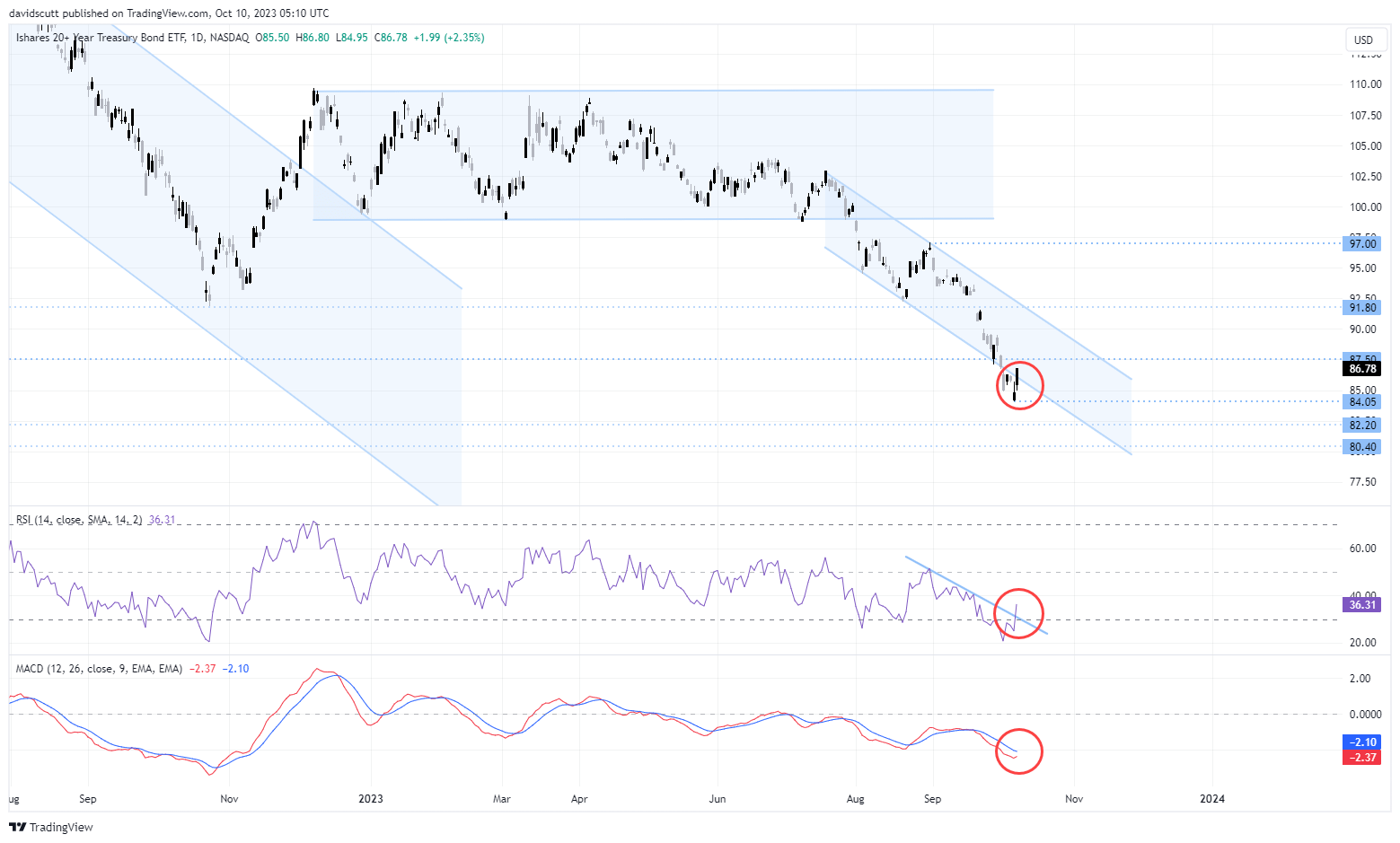

TLT – iShares’ 20-year plus Treasury Bond ETF – is an obvious candidate, especially with the challenge posed by two chunky longer-dated Treasury auctions. It bounced from just above $84.05 following the latest payrolls report, adding to gains on Monday. With RSI breaking its downtrend, MACD threatening to crossover from below, and the price forcing its way back through prior downtrend support, a few traders may be thinking the bottom is in. But a lot have though that recently, only to be runover by another wave of relentless selling. That’s why this week seems important.

There’s not a lot of technical support left for TLT with only $84.05, $82.20 and $80.40 evident on the data available. On the upside, $87.50 and $91.50 are the first resistance levels to watch.

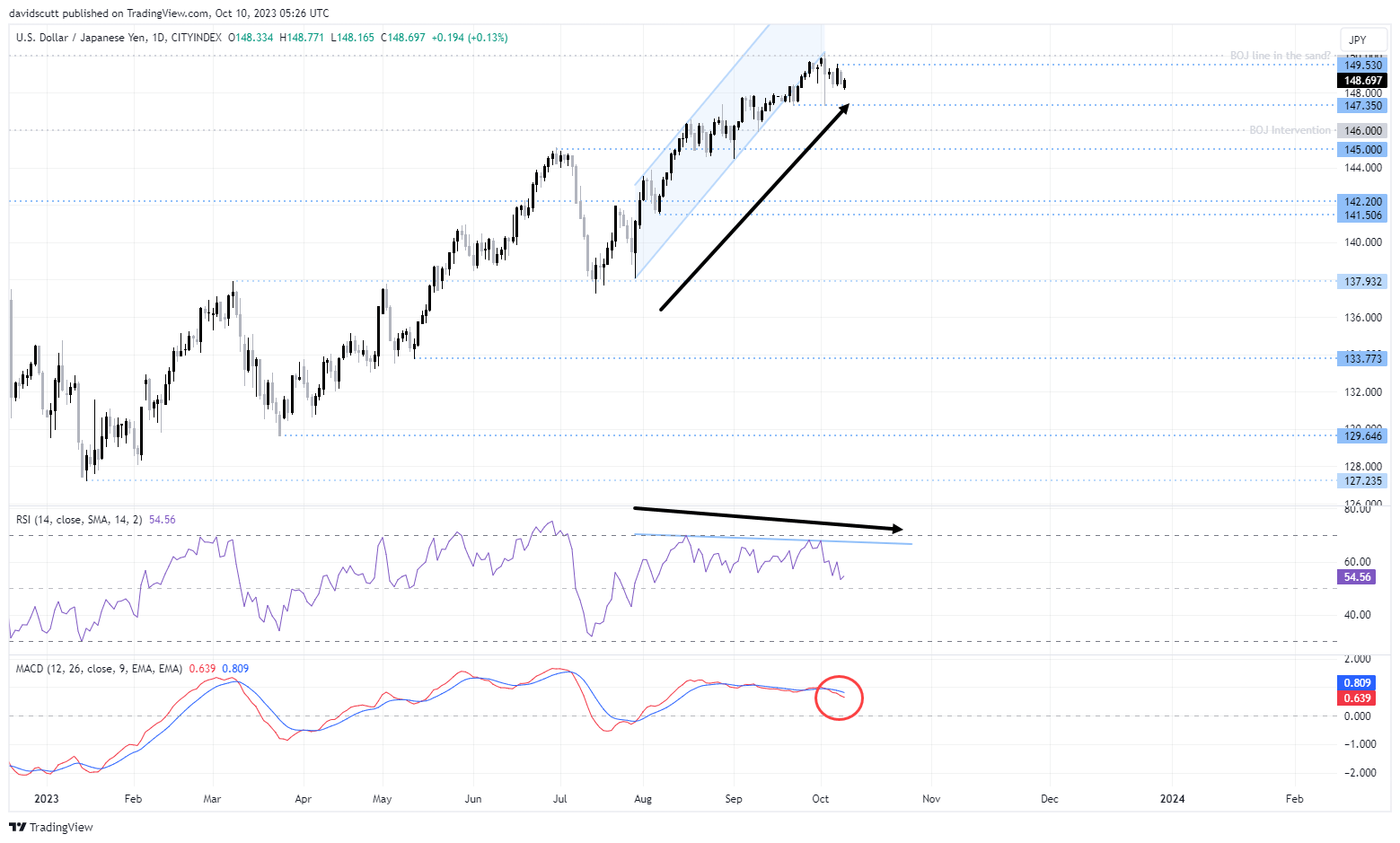

Outside long bond ETFs, USD/JPY is standout yield play in the FX universe that may also be at or nearing a turning point. The abrupt slide triggered on the brief probe above 150 has likely scared a lot of bulls off already. Throw in warning momentum on RSI even as the price pushed to fresh highs and some may be thinking the path of least resistance is lower. But a change in direction in US yields will play a major role, you’d think, making rhetoric from Fed officials in response to the loosening in financial conditions all the more important.

For USD/JPY, traders pushed the pair just above 149.50 last week before having second thoughts on making another attempt on 150. On the downside, 147.35 and 145.00 are the big levels to watch.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade