WTI, Brent Crude Oil Key Points

- Despite Israel-Gaza tensions, crude oil is falling to 8-week lows this week.

- Rising inventories and a recovery in the US dollar are driving the latest bout of weakness in oil prices.

- WTI and Brent both sliced through key support levels, opening the door for more downside as long as prices remain below them.

“Geopolitical tensions in the Middle East drive oil prices higher.”

It’s one of the first maxims that oil traders learn, but over the last couple of weeks, that platitude has not played out as expected.

Despite the ongoing conflict between Israel and Gaza (highlighted by Israeli forces recently moving into Rafah, a key city on the Gaza strip), oil prices have been in retreat since early April. In essence, markets are relatively sanguine about the risk of supply disruptions at the moment because high-level diplomatic negotiations, including with top US officials, continue to make progress, raising hopes that the situation could stabilize in the near future.

…So why are oil prices falling?

WTI and Brent Crude Oil are Falling for Two Key Reasons this Week

WTI and Brent crude oil prices are in retreat for two primary reasons: Increasing US stockpiles and a stronger US dollar.

Firstly, yesterday’s API report showed a 500K barrel build-up of crude oil inventories at Cushing, Oklahoma, a key US storage hub; traders and economists had expected a decline of -1.4M barrels. While the just-released EIA version of the report showed a slightly larger-than-expected drawdown in inventories, that comes on the back of last week’s massive surge of 7.26M barrels (vs. an expected decline of -1.1M barrels in storage). This buildup in inventories bolsters bearish sentiment toward oil because it suggests that supply is outstripping demand at the start of the key US “driving season.”

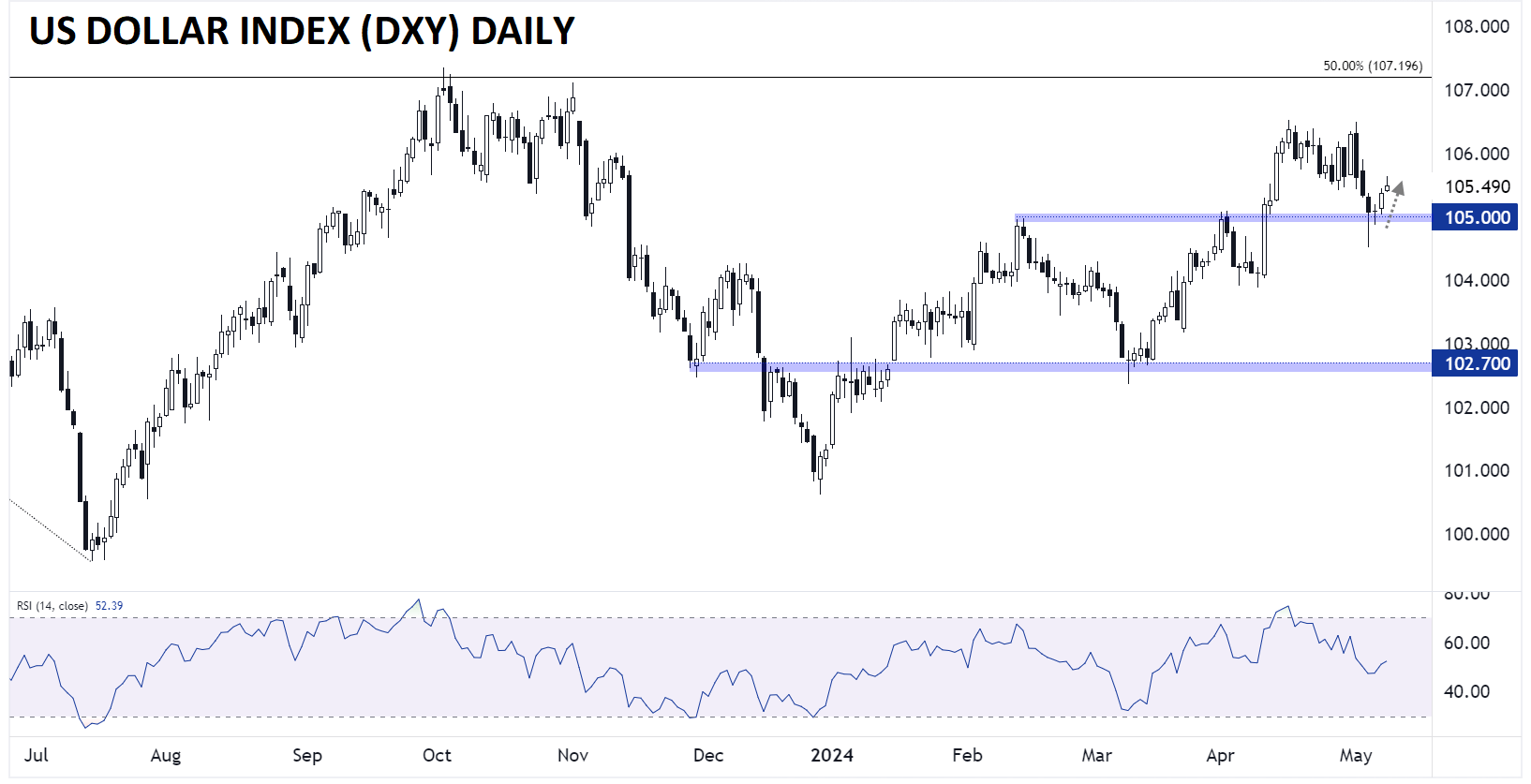

In addition to the oil inventory data, the US dollar has also been broadly recovering after last week’s swoon. As the chart below shows, the US dollar index found support at previous resistance near 105.00 and is back within 1% of the 2024 high in the mid-1.06 area:

Source: TradingView, StoneX

Oil, like all global commodities, is denominated in US dollars, so all else equal, a stronger greenback means it takes fewer US dollars to buy a barrel of oil.

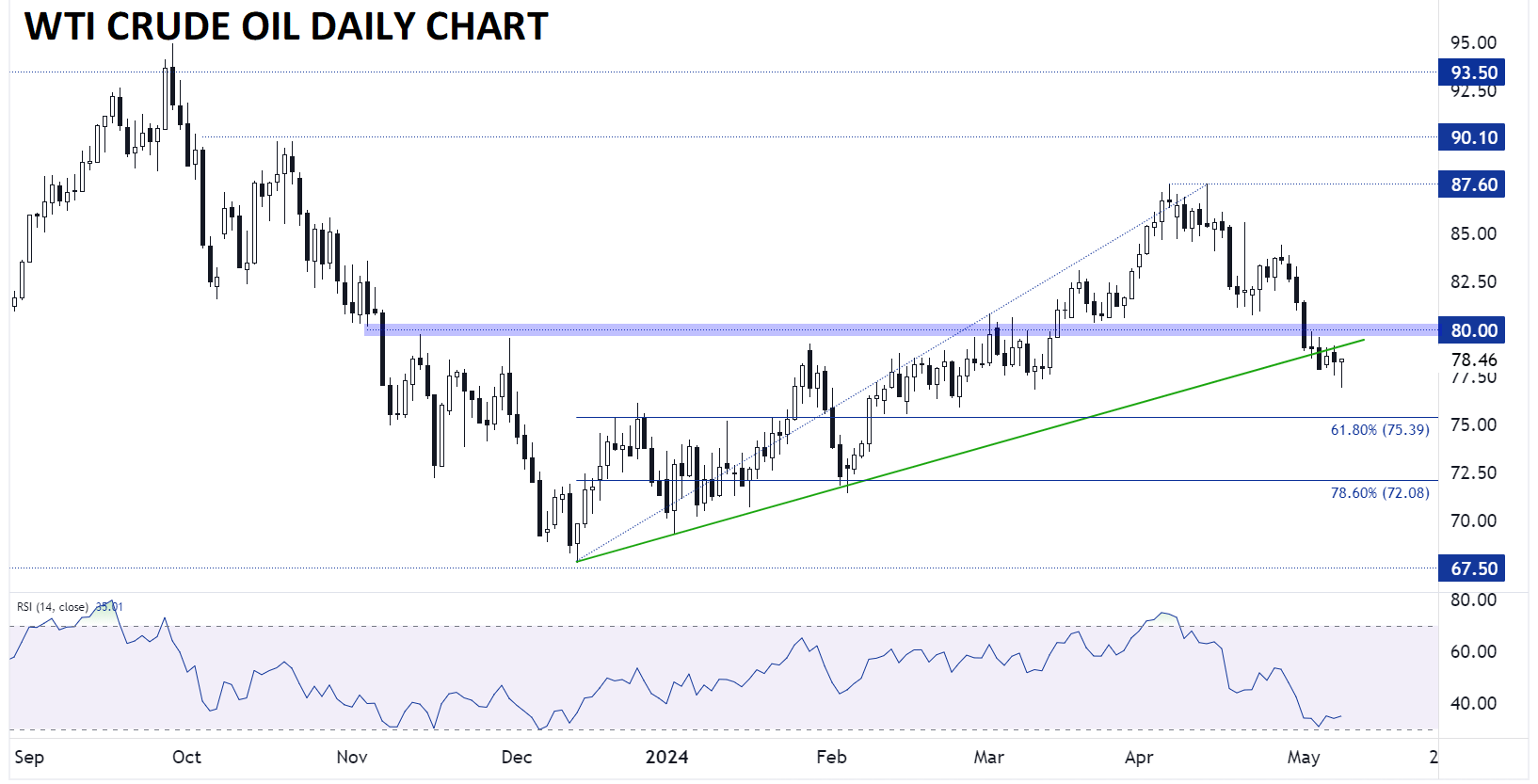

Crude Oil Technical Analysis – WTI Crude Oil Daily Chart

Source: TradingView, StoneX

Turning our attention to the charts, WTI crude oil broke below a key support level at $80 last week and has continued to drop in the first half of this week. As we go to press, the commodity is trading just below its rising bullish trend line for the 4th consecutive day, signaling that the selloff could accelerate toward the 61.8% Fibonacci retracement near $75.00 if the above bearish factors remain in place. At this point, only a break back above the key $80 level would flip the short-term bias back in favor of the bulls.

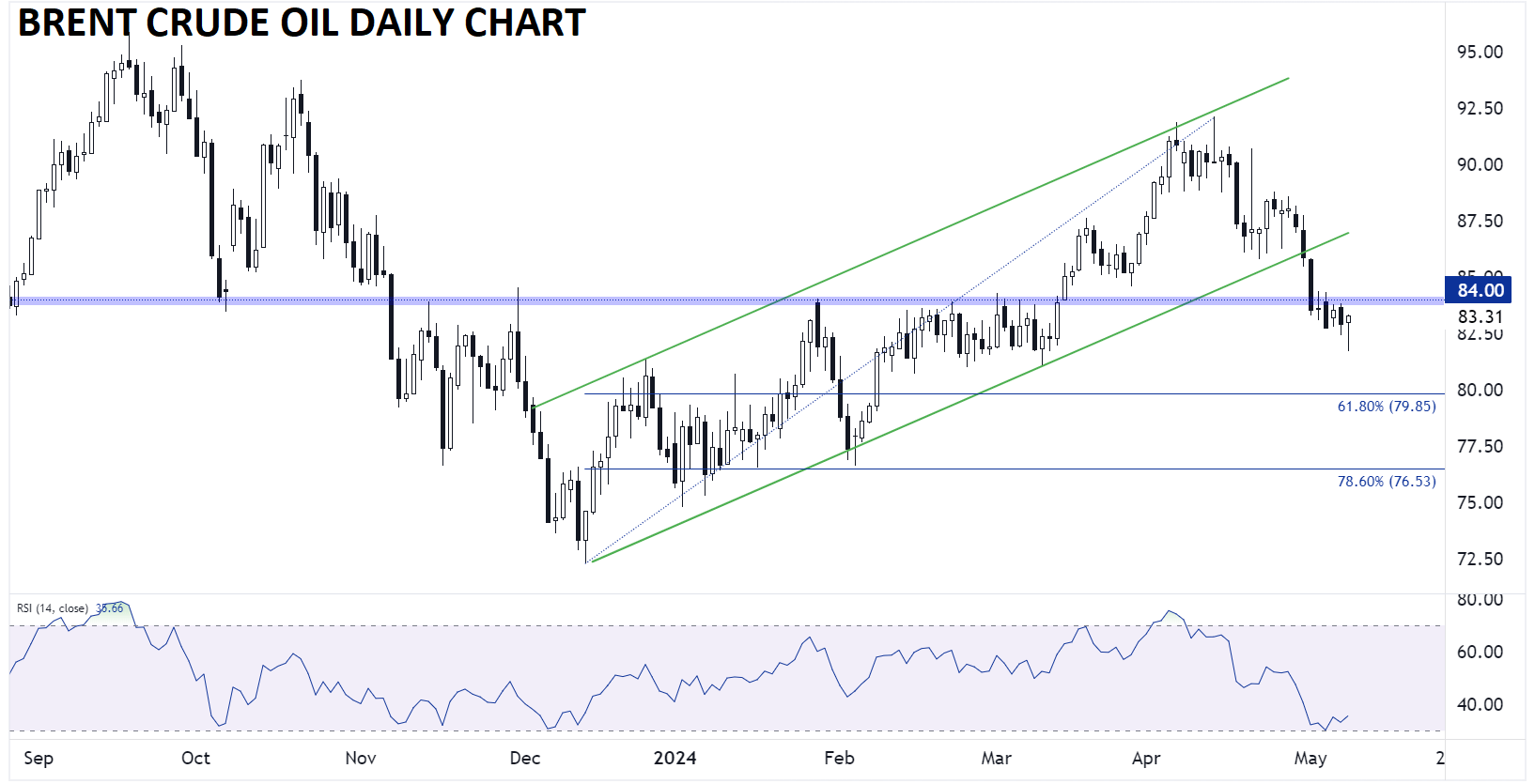

Crude Oil Technical Analysis – Brent Crude Oil Daily Chart

Source: TradingView, StoneX

Brent crude oil, the most widely-traded oil benchmark, is showing a similar technical setup. Brent sliced through the bottom of its rising channel last week and has spent most of this week consolidating below key previous-resistance-turned-support at $84.00. Similar to the $80.00 level in WTI, the technical bias favors more downside as long as Brent stays below $84.00, with potential for a move down toward the 61.8% Fibonacci retracement at $80.00 as long as that’s the case.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX