- GBP/USD forecast: All eyes on BoE policy decision

- UoM data in focus before attention turns to CPI next week

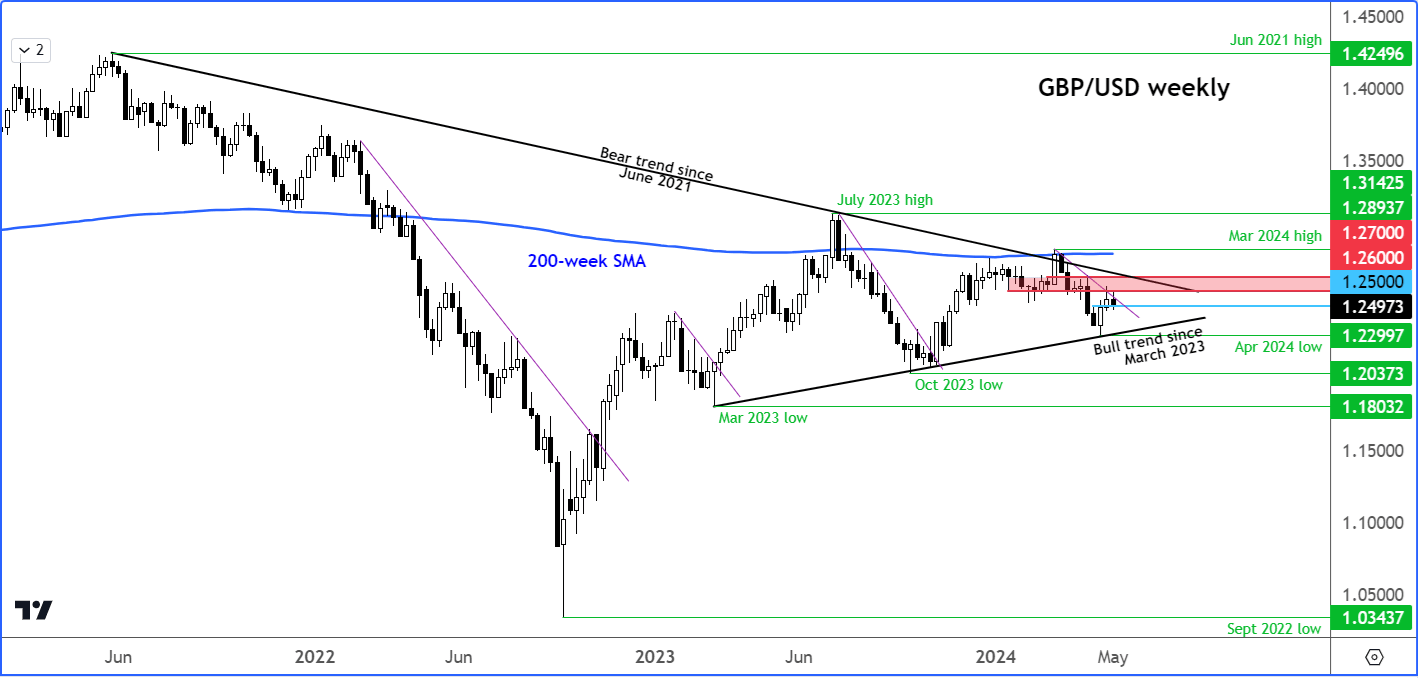

- GBP/USD technical analysis

The FX markets have been a little quieter so far this week, largely due to a quiet US data calendar. But as we approach the business end of the week, we should see pockets of elevated volatility and some independent moves in the likes of the British pound. The Bank of England is meeting on Thursday, and we have some important consumer sentiment and inflation expectations data from the US on Friday, before attention turns to CPI the following week. Ahead of these events, could we see the return of the US dollar weakness following last week’s softer jobs data? After all, the pricing of the Fed easing cycle in 2024 has again risen, with 45 basis points of cuts now expected compared to around 25bps at the start of last week. For now, though, the GBP/USD was edging below the 1.25 handle amid the renewed strength in US dollar this week. Our GBP/USD forecast is neutral to slightly bullish.

GBP/USD forecast: All eyes on BoE policy decision

The Bank of England’s policy decision is due on Thursday, at 12:00 BST with Governor Bailey’s press conference staring 30 mins later at 12:30 BST. No changes are expected, but the pound could move sharply depending on how hawkish or otherwise the central bank, or its Governor, is going to be relative to expectations.

The BoE has kept its policy rate unchanged for the last five meetings. The last change was a 25-basis point hike to the current 5.25% in August. Since then, there has been a lot of uncertainty about the direction of policy, which has been underscored by a rather split MPC. Repeated calls for further hikes by the hawks for the remainder of 2023 were voted down by a small majority. In more recent meetings this year, the split has narrowed. In the last meeting on March 21, the hawks finally threw in the towel – there was zero votes for an increase compared 2 in the Feb meeting, plus one vote for a cut. This was a dovish move and points to a potential cut in the summer. Will get any hints about the possible time of that at this meeting?

We also have a UK data dump on Friday including monthly and quarterly GDP estimates, industrial production, and a few other data releases to keep an eye on.

So, it is going to be a busier end of the week for the pound compared to other major currencies, especially for the GBP/USD which will face additional tests from the USD side of the equation with some important US data to come on Friday. Speaking of which…

UoM data in focus before attention turns to CPI next week

It has not been a massive week for US data, not after we have just had the Fed’s policy decision, NFP and various other economic indicators in the week before. This week’s only key US data is not due until Friday at 15:00 BST, when the result of the University of Michigan’s consumer sentiment and inflation expectations surveys are released.

Following the Fed’s meeting last week, investors were left scratching their heads. Powell quashed expectations of a rate hike this year, but the Fed Chair also indicated that the central bank was in no rush to start cutting interest rates – something that was widely expected anyway. However, despite the recent weakness in several survey-based data, ongoing concerns about persistent inflationary pressures that have been reflected in various economic indicators remain.

Those concerns could intensify if the University of Michigan’s Inflation Expectations survey shows a further increase. It has been climbing steadily in recent months from 2.9% in January to 3.2% in April. This is the percentage that surveyed consumers (about 500) expect the price of goods and services to change during the next 12 months, which is a leading indictor of inflation. However, with economic data starting to weaken recently, perhaps inflation expectations could start to fall back.

Don’t forget that the UoM will also release the latest consumer sentiment data at the same time too. This could overshow the inflation expectations survey in the event of a big surprise. This gauge of consumer sentiment has disappointed expectations in the last couple of months. Will we see a hattrick of disappoint on Friday? It is expected to print 76.3 compared to 77.2 previously.

GBP/USD forecast: technical levels and factors to watch

Source: TradingView.com

Sometimes it helps to zoom out and look at the longer-term picture, and in the case of the GBP/USD, you can see on this weekly chart that rates have been basically consolidating inside converging trend lines for a few years now.

A bearish trend that goes back to the high of June 2021 has kept the upside limited in the last year and a bit, while the downside has been supported by a shorter term trendline that has been in place since March 2023. In the interim, we've seen several higher highs and lower highs, as well as lower lows and lower highs, and breaks of short-term resistance levels and short term trend lines and whatnot.

Essentially, though, there's no clear long-term trend on the pound against the dollar. This trend is unlikely to change in the aftermath of the Bank of England's rate decision. However, as the trend lines get closer together, we will eventually see a break from this long term consolidation pattern in one or the other direction.

For what it is worth, I think the risks are skewed to the upside because of the potential for the Fed to cut rates starting at the end of the summer, which could see the US dollar go down across the board. It was these expectations that had led to the recent up move in the cable until renewed strength in US inflation figures caused investors to reprice their US rates expectations.

The GBP/USD topped in March at just below the 1.29 handle, where the 200-week moving average provided stiff resistance and the brief break above the long-term bearish trend couldn't hold. But in recent weeks, we've seen renewed weakness in US data, and if that trend continues, then the market is likely to bring forward its US rate cut expectations again, which could potentially lead to a drop in the dollar, causing the GBP/USD to rise.

At the time of writing, the cable was testing support at 1.2500, which was the high from a couple of weeks ago, before it was engulfed by a bullish candle in the second last week of April and start of May. The cable edged a little bit further higher last week until reaching resistance in the lower end of the 1.26 to 1.27 resistance area, leading to a weaker start to this week's trading.

But if the cable has indeed formed at least an interim low in April, then around these levels is, I would expect it to start trending higher again from, and a potentially hawkish Bank of England could be the catalyst for another move towards 1.26 to 1.27 area on Thursday.

However, if the Bank of England appears to be more dovish and point to a sooner than expected rate cut, then that could lead to a renewed drop below 1.23 handle, where the cable had formed a low in April.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade