US futures

Dow futures -0.52% at 33355

S&P futures -0.53% at 3875

Nasdaq futures -0.72% at 11026

In Europe

FTSE -0.26% at 7702

Dax -0.44% at 14750

Learn more about trading indices

Hawkish Fed worries weigh on sentiment

US stocks pointing to mildly lower open on Tuesday, in cautious trade, ahead of a hotly anticipated keynote speech by Federal Reserve chair Jeremy Powell. His comments will be scrutinized for clues about where the Fed sees the rate hikes going in the coming meetings.

Indices had finished in a mixed fashion on Monday after San Francisco Fed president Mary Daly said she expects the Fed to raise rates over 5%, and Atlanta Fed president Raphael Bostic agreed that interest rates should be above 5% thank you to and held there for some time. The slightly hawkish tone appears to have caught the market off guard and raises the likelihood of a slightly more hawkish tone from Powell.

Broadly speaking the stock markets have had a positive start to 2023 amid expectations that EU S central bank could slow the pace of rate hikes at the coming meetings. the market is now pricing in a 77% probability of a 25-basis point rate hike in February and just a 23% probability of A50 basis point rate hike. This comes after a 50-basis point hike in December and 75 basis point hikes in the previous meetings.

Aside from Powell, there is no major U.S. economic data due to be released today. Investors will look ahead to Thursday's inflation print which could be key to setting the tone for trade ahead of the Federal Reserve policy meeting at the end of the month.

Corporate news

Boeing falls pre-market, dropping 2.9% from a 10-month high amid broker reports that it is approaching fair value.

Alibaba ADR extends its rally, rising 1.3% pre-market, putting it on course to open at a 6-month high.

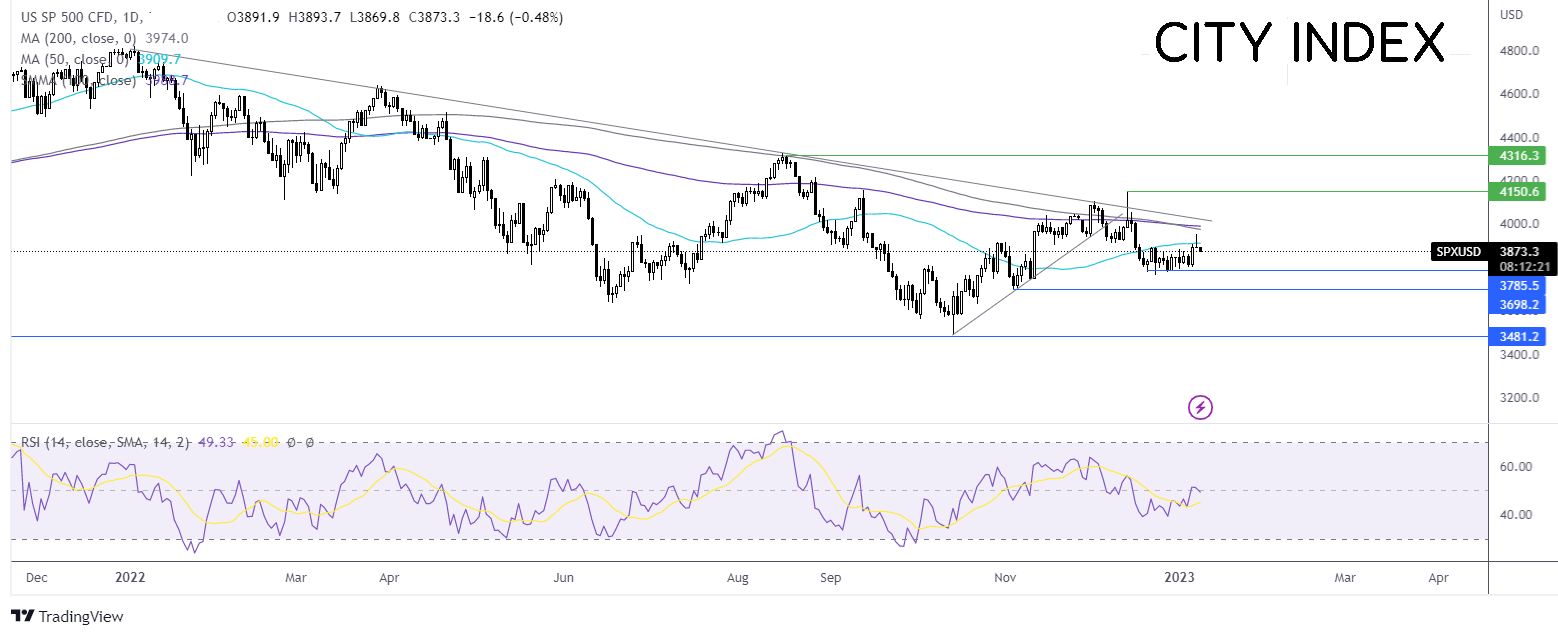

Where next for the S&P500?

The S&P500 continues to trade range-bound, capped on the upside by the 50 sma at 3910 and on the lower side by 3780 the weekly low. The RSI is neutral, giving away few clues. A breakout trade could see buyers looking for a rise above 3910 towards 3985, the 100 & 200 sma ahead of the 4150 the December high. Sellers could look for a move below 3780 to bring 3695, the November low, into play.

FX markets – USD rises, GBP falls

The USD is rising, recouping losses from the previous session as investors await a keynote speech from Federal Reserve chair Jerome Powell. This comes after 2 Federal Reserve officials sounded more hawkish yesterday.

EUR/USD is falling after two straight days of gains way down by the risk-adverse environment and as the USD rises. Falling natural gas prices could mean that inflation in the eurozone starts to fall at a quicker pace. Goldman Sacks has said that they no longer expect a recession in the eurozone, citing falling gas prices.

GBP/USD is falling amid a bleak economic outlook. Rising recession expectations mean that the BoE could be nearing the end of the current hiking cycle. Separately the UK government has said that it will slash business energy support from April, which could see many businesses struggle to pay energy bills.

GBP/USD -0.4% at 1.2135

EUR/USD -0.1% at 1.0710

Oil rises after losses last week

Oil prices are holding steady on Tuesday as the market waited cautiously for a speech from Fed Chair Powell, who could provide further clues over the central bank’s plans for interest rate hikes, which would, in turn, impact the economy and the oil demand outlook.

Meanwhile, the ongoing reopening in China continues to support the price of oil. Both Brent and WTI rose over 1% on Monday after China, the world's largest oil importer, reopened its borders for the first time in three years.

US API stockpile data is due later and is expected to show that inventory levels fell last week.

WTI crude trades +0.3% at $75.13

Brent trades at +0.3% at $79.90

Learn more about trading oil here.

Looking ahead

14:00 Fed Chair Powell speech

21:30 API crude oil stockpiles