US futures

Dow futures -0.03% at 33854

S&P futures -0.07% at 4090

Nasdaq futures -0.22% at 12467

In Europe

FTSE +0.26% at 7908

Dax +0.05% at 153270

Learn more about trading indices

US inflation misses forecasts

US stocks are pointing to weaker open after posting gains in the previous session, as investors digest the latest US inflation figures.

The January CPI report showed that inflation remained elevated at the start of the year, cooling by less than expected to 6.5% YoY, down from 6.4%. Consensus estimates had pointed to a fall to 6.2% annually. Meanwhile, core inflation was also stronger than forecast at 5.6% YoY, down from 5.7% and above the 5.5% forecast.

The hotter-than-expected inflation print adds pressure on the Federal Reserve to keep raising interest rates in the coming meetings. The market is now as good as fully in pricing in a 25 basis point hike in March and a 70% chance of a 25 basis point hike in May.

The initial reaction has seen US futures pare earlier gains fall into the red ahead of the open as the data supports the more hawkish narrative from the Fed and plays down the prospects of a rate cut this year.

Meanwhile, the USD remains in the red, suggesting that forex traders were focusing on the fact that inflation slowed again in January for a seventh straight month rather than the fact it missed estimates. However, the USD has pared earlier gains so this could just be a slow moving reaction.

Corporate news

Coca-Cola rises after reporting strong revenue in Q4 and forecast 2023 profits ahead of analysts’ estimates thanks to strong demand even as prices increased.

Palantir jumped 17% after the data analytics firm posted its first-ever quarterly profit, in addition to beating forecasts for both revenue and earnings.

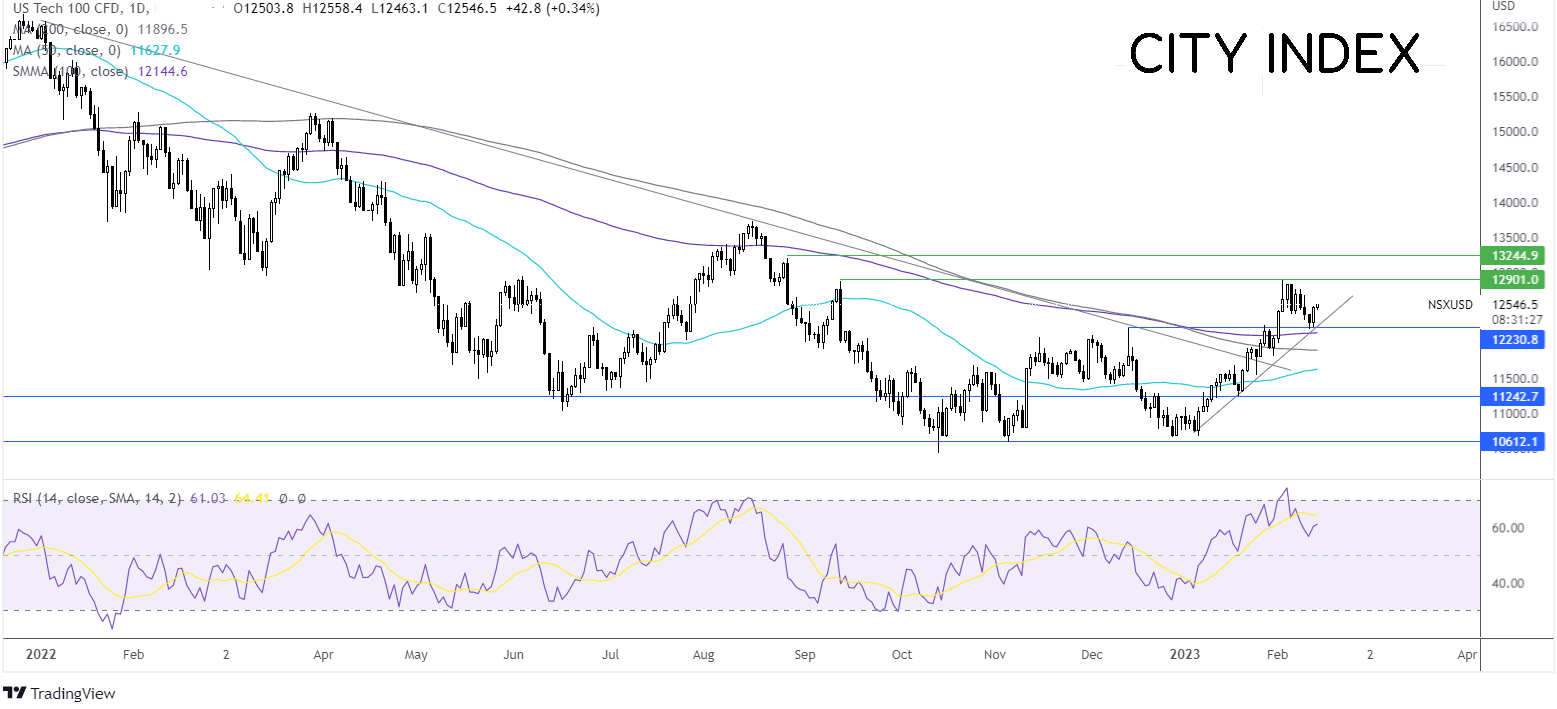

Where next for the Nasdaq?

The Nasdaq rebounded off 12200 the 100 sma and December high, and is grinding higher, above its multi-week rising trendline. This combined with the RSI above 50 keeps buyers hopeful of further upside. Buyers could look for a rise above 12900, the 2023 high, to extend the bullish rally. Sellers will be watching for a break below the 100 sma at 12200 to open the door to the 200 sma at 11900 and 11600 the 50 sma.

FX markets – USD falls, GBP rises

The USD is falling after US inflation data fell for a seventh consecutive month, albeit by less than expected. The data adds pressure to the Fed to keep hiking rates over the coming meetings.

EUR/USD is rising after eurozone GDP data confirmed that the bloc’s economy grew in the final three months of last year. Q4 GDP was confirmed at 0.1% in line with the preliminary reading. The data comes after the European Commission yesterday said that expects the eurozone to avoid a recession in 2023 upwardly revising growth forecasts to 0.9%.

GBP/USD is rising off day UK jobs data showed that the unemployment rate held steady at 3.7% but as wage growth rose BY more than expected 6.7% in the three months to December, this was up from 6.5% and raises concerns that inflation could prove stickier then initially failed. The solid jobs data means that the BoE could be raising interest rates for longer.

GBP/USD +0.6% at 1.2213

EUR/USD +0.15% at 1.0765

Oil falls after gains last week

Oil prices are falling after the US government announced that it would release more crude oil from its strategic petroleum reserves. the move comes after the Boynton administration release a record 180 million barrels from the reserve last year. Since then, supply concerns have eased, raising questions over whether more reserves would be released this year.

Attention will now turn to the API crude inventory report which is due to be released later today.

WTI crude trades -0.8% at $79.26

Brent trades at -1% at $85.87

Learn more about trading oil here.

Looking ahead

21:30 API stockpile data