Despite Fed members pushing back on imminent rate cuts, markets are taking much greater notice of softer economic data form the US to keep prospects of a June cut alive. The US dollar delivered its second worst day of the year following Wednesday’s soft ISM services report, which expanded at its slowest pace in three months, new orders were lower, employment contracted further and prices paid expanding at their slowest pace since March 2020.

If this is to be coupled with a refreshingly weak NFP report on Friday, all bets are likely on for the Fed to cut by 25bp in June. And if the Fed cut, it paves the way for other central banks to ease – which could prompt another round of risk on trade.

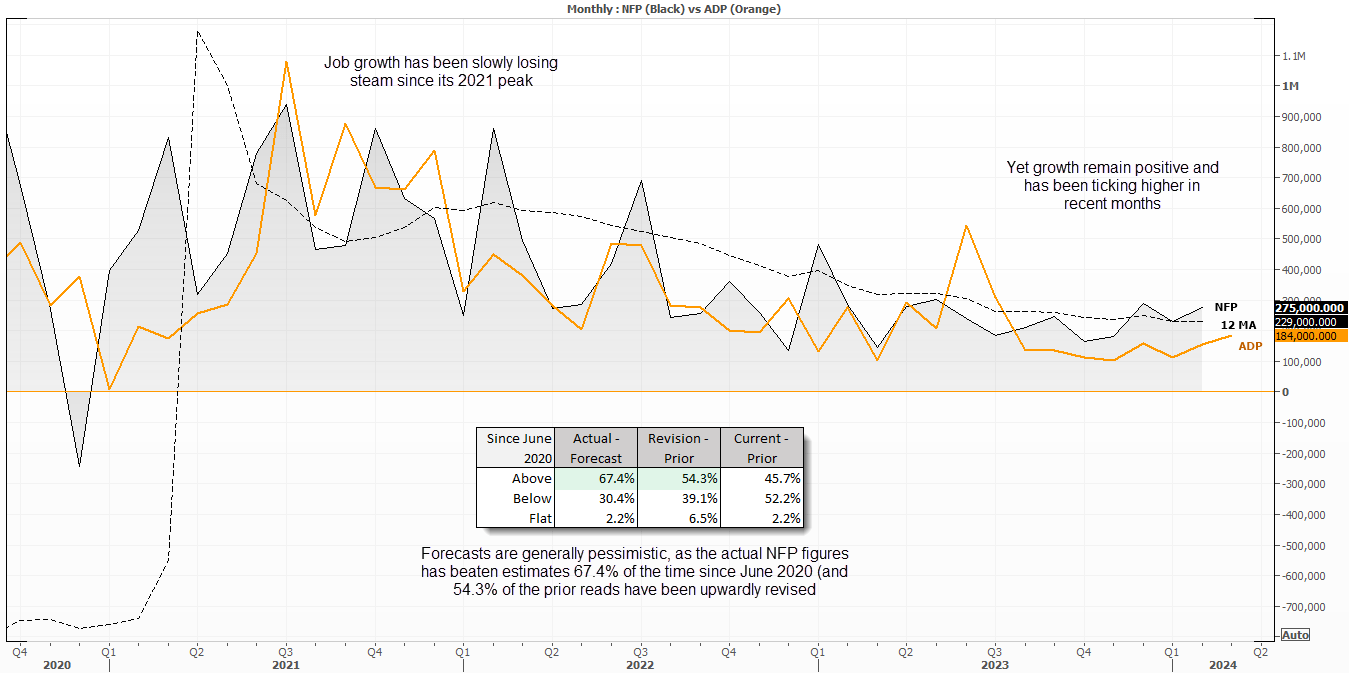

However, looking at NFP job growth figures since the pandemic reveals that estimates tend to be on the pessimistic side.

The chart shows that NFP job growth figures remain positive but have been steadily trending lower since the 2021 peak as the cycle loses steam. The prospect of a slower economy certainly excites dovish market participants who want to see the Fed cut rates, yet it should be remembered that the Fed only tend to cut when something breaks – and like it or not, job growth is still expansive. In fact, we could say that the softening of job growth plateaued in 2023, so it is interesting to note that job growth is picking up again in recent months.

Furthermore, NFP job growth tens to bear estimates more often than not looking at recent data:

Nonfarm job growth since June 2020:

- NFP jobs has exceeded estimates 67.4% of the time

- The previous NFP figure has been upwardly revised 54.3% of the time

- Yet despite this, the current NFP figure has only beaten the prior print 45.7% of the time (which makes sense, as job growth has been trending lower)

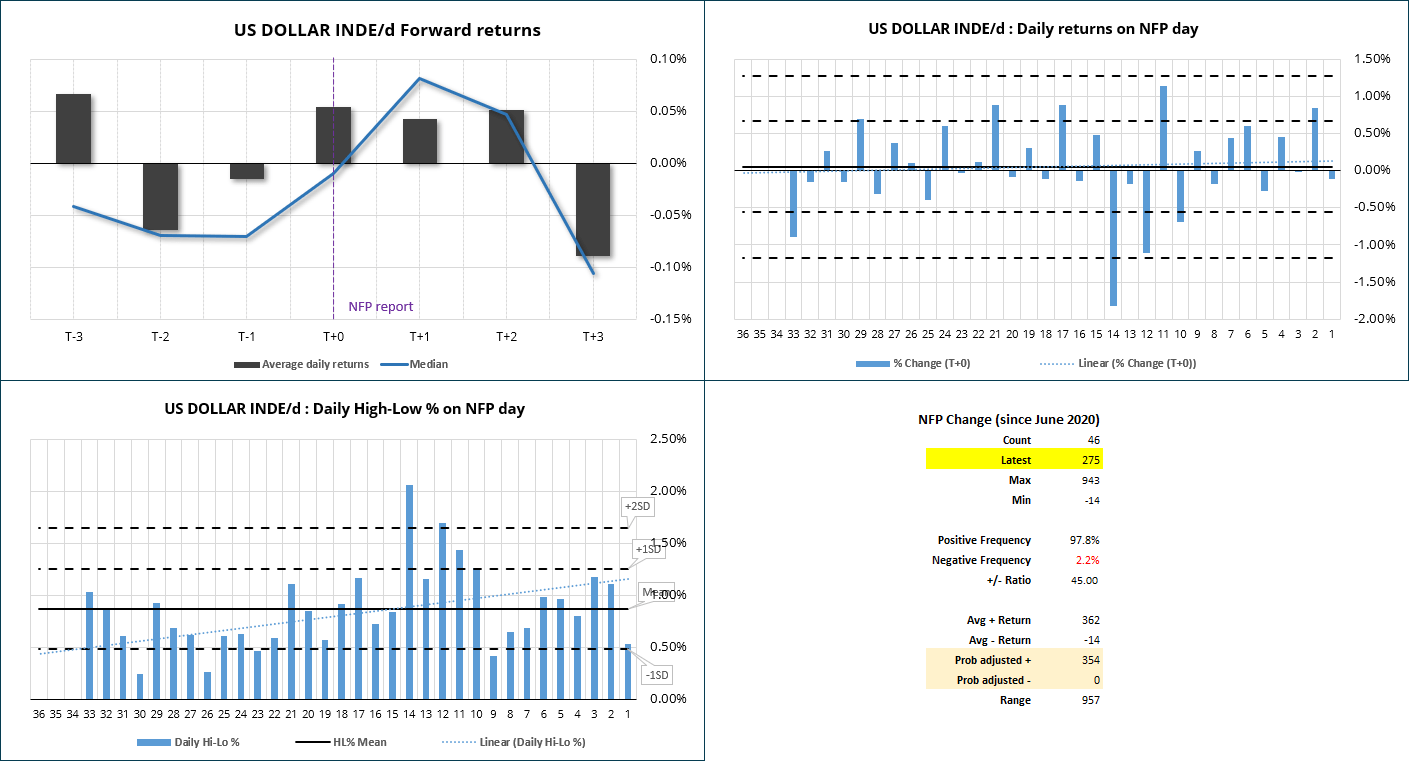

How the US dollar index has performed around Nonfarm payrolls (NFP):

The charts above look at the performance of the US dollar index on the day of NFP, and the three days either side of it. As NFP is always released on a Friday (T+0) it becomes easy to match patterns to days of the week.

- Wednesday and Thursday prior to NFP have generated negative returns (average and median)

- NFP day (Friday), and the following Monday and Tuesday have seen positive returns (average and negative

- The following Wednesday tends to produce average and median negative returns

- High-to-low range on the day is 0.87%, and its trend is pointing higher

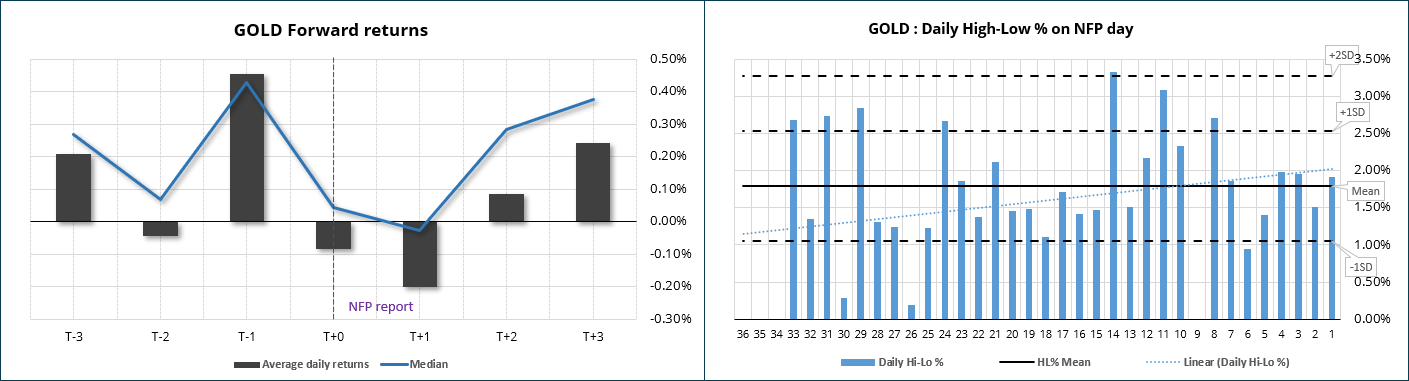

How gold has performed around Nonfarm payrolls (NFP):

- Gold has performed well on the Thursday ahead of NFP

- Yet it has averaged negative returns on NFP day and the following Monday

- Interestingly, median returns for gold have been positive for all days except the following Tuesday, since June 2020

- The daily high-low % average is 1.79%

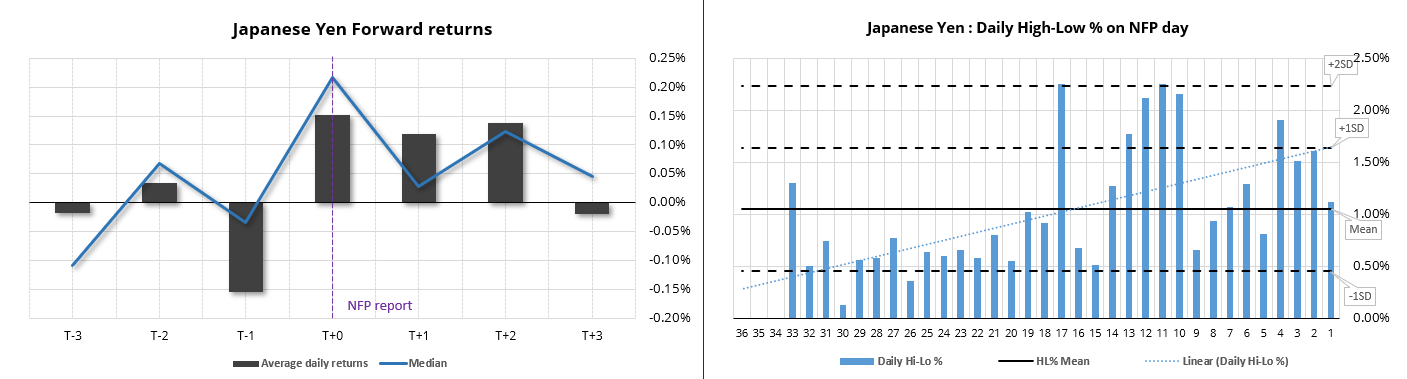

How USD/JPY performed around Nonfarm payrolls (NFP):

- The performance on USD/JPY has essentially tracked the US dollar index around NFP, making it an ideal market for traders without access to DXY

- NFP day has provided the strongest average and median returns

- USD/JPY ha also provided positive average returns the following Monday and Tuesday (median returns are also positive for the following Wednesday)

- The daily high-low average is 1.05%, and its trend is pointing higher to denote increasing volatility around the event

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade