- FOMC member Bostic said on Thursday that a rate cut is not likely until the end of the year. This makes sense given the strength of US data with elevated interest rates, and likely lands conveniently after the election that the Fed do not want to be seen interfering with by changing policy a couple of months before it.

- Backing up the sentiment, Kashkari said that “once inflation is heading back to 2%, we can cut rates”.

- The ECB continued to prime markets for a June cut, with Kazaks saying “the path for rates in down” and “the probability of a June rate cut is quite high”.

- Just in case someone out there may be expecting any monetary policy excitement from the BOJ this year, Noguchi said “it’s short-term policy rate adjustment is likely to be slow”.

- The US, Japan and Korea released their first trilateral dialogue on Wednesday and agreed to consult closely on FX markets following the rapid depreciation of the Japanese yen and Korean won.

- Australia’s unemployment rose to 3.8% and 28.5k jobs were added in March, which likely changes nothing in regards to the RBA likely retaining their cash rate at 4.35% over the foreseeable future

- Morgan Stanley are retaining their call that the Bank of England (BOE) could begin cutting rates in May, which is against the consensus of September among other banks.

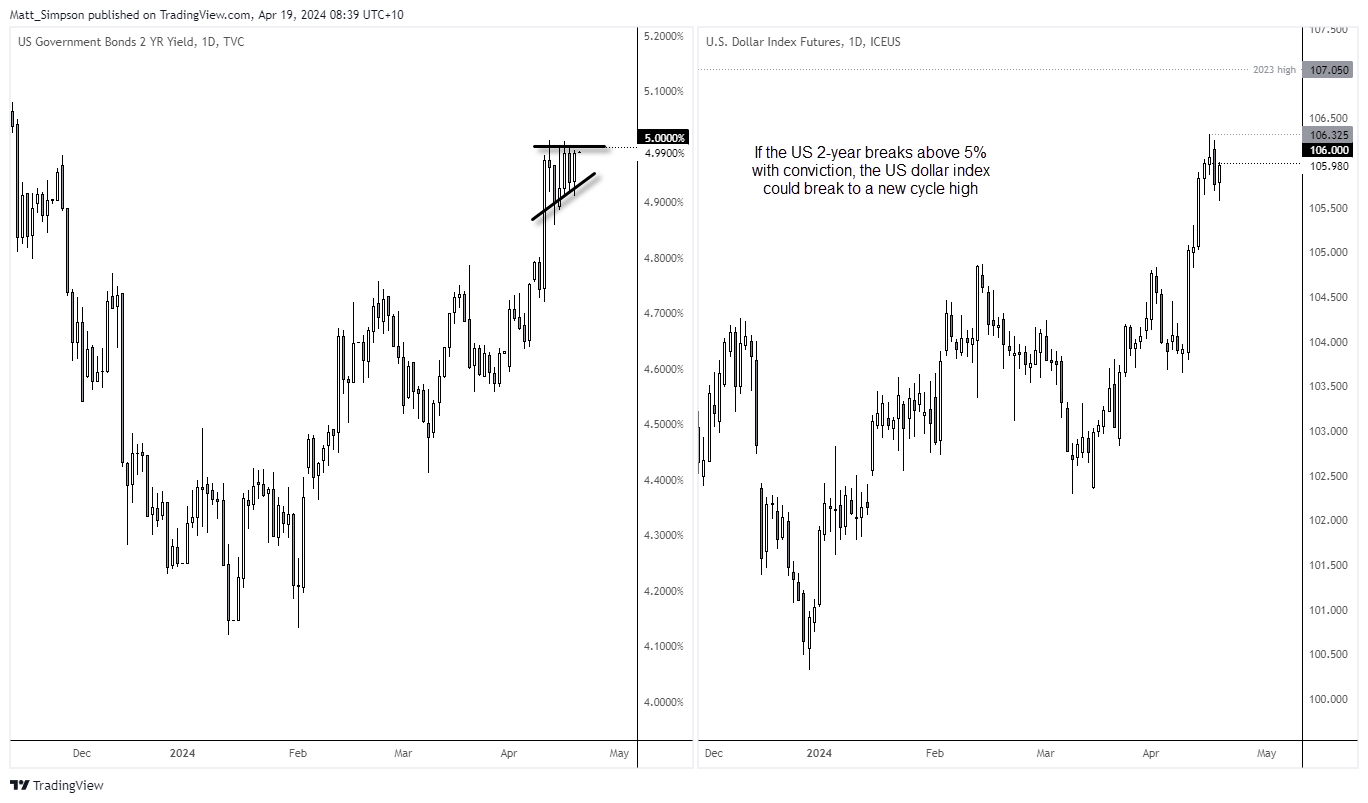

- US yields were higher on Thursday, sending the US 2-year just below 5% within a potential bullish pennant pattern

- Higher yields allowed the US dollar to recoup some of Wednesday’s ‘bearish engulfing day’ losses and retrace to 106, a key level for bulls and bears to scrap over today.

- I noted in yesterday’s report that US bonds are nearing support levels on the weekly chart which could cap yields in the coming weeks, but that still allows for some bullish wriggle room over the near term.

Economic events (times in AEST)

- 09:30 – Japan’s inflation report

- 16:00 – UK retail sales

- 16:00 – German PPI

- 19:00 – IMF meetings

- 00:15 – BOE Breeden speaks, MOC member Ramsden speaks

- 00:30 – Fed member Goolsbee speaks

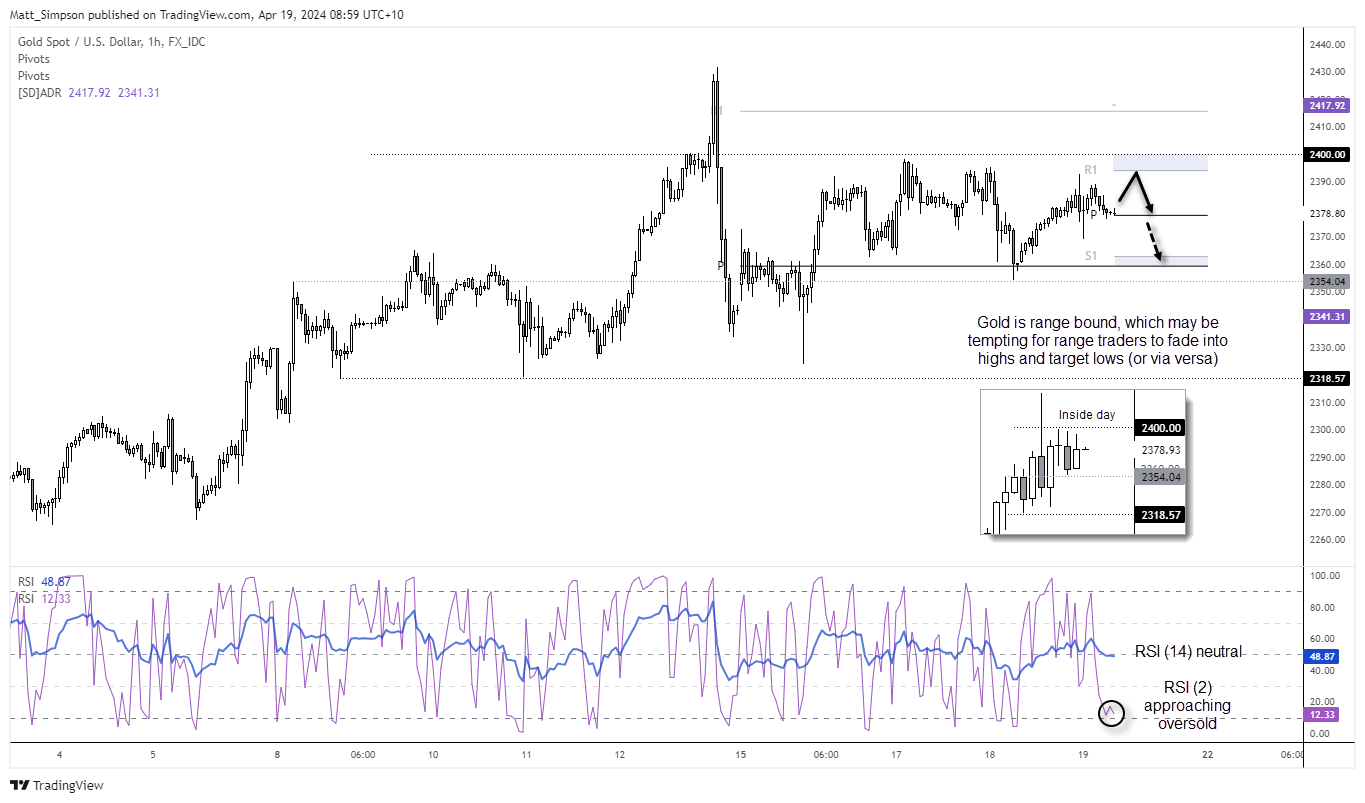

Gold technical analysis:

Gold is currently on track for a fifth consecutive bullish week, and at current level it would close at a record high on the weekly chart (even though it trades beneath last week’s high). However, it is also on track for an inside week, which shows a loss of momentum from the bull camp. A bullish inside day also formed on Thursday, further suggesting gold remains rangebound between 2355 – 2400 with diminishing volatility. And looking at the calendar there is a reasonable chance gold could remain rangebound today.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM