Market Summary:

- US manufacturing, services and composite PMIs rose in tandem, with manufacturing squeaking in its first expansion in nine months and at its fastest pace in 15.

- Wall Street once again gapped higher and pushed to new record highs before pulling back. But there's clearly no immediate appetite to short.

- Fed fund futures mow imply a 58.4% chance of a hold in March, with first cut tipped in May at 53.7% and another in June with a 52.7% probability. Will the Fed really cut twice in H1 with data like this? I'm not convinced myself, but we'll see...

- European PMIs

- BOC interest held their interest rate at 5%, although BOC governor pushed back on any loosening by saying it was “premature to discuss rate cuts” and the focus of the meeting was “very much on holding rates steady”. The statement highlighted a concern for the rate of underlying inflation.

- PMI data for the UK came in broadly better than expected, with services expanding faster and manufacturing contracting at a slower pace. The report cited “signs of renewed momentum” and business optimism for the economy over the next year. And with input costs rising, its adds to the case for the BOE holding rates higher for longer.

- Japan’s exports rose by an impressive 9.8% y/y in December to show global demand for their goods is on the rise. Exports to their largest trade partner, the US, rose 20.4% although imports from Australia sank by -31.4% y/y

- China’s equity markets leapt from their lows on news that the PBOC will slash reserve requirement ratio (RRR) 0.5% to free up liquidity

- Price action across forex majors remained choppy for some, with EUR/USD now trapped between the 100 and 50-day EMAs and a large upper wick, AUD/USD formed a second consecutive shooting star day and GBP/USD handed back half of its earlier gains to also form a potential shooting star.

Events in focus (AEDT):

- 10:50 – Japan’s foreigner bond and stock investments

- 18:00 – German Ifo business sentiment

- 12:15 – ECB interest rate decision

- 12:30 – Canadian average earnings

- 12:30 – US GDP, jobless claims, durable goods orders, Chicago Fed national activity index

- 12:45 – ECB press conference

- 02:15 – ECB President Lagarde speaks

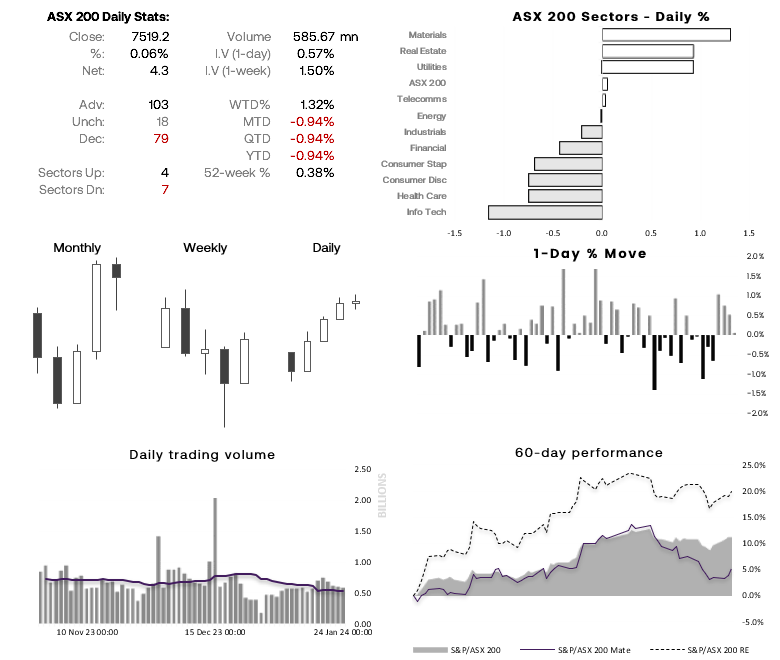

ASX 200 at a glance:

- The ASX 200 rose for a fourth day and left a small spinning top doji on the cash market, yet SPI futures markets continued higher overnight and Wall Street hit new record highs which points to a positive open today

- The day ahead of Australia Day has averaged negative returns of -0.04%, although the median return has been 0.9%. The win rate has been 51.6%, so it seems T-1 relative to Australia day is on the random side.

- Therefore, be prepared for a tighter range and perhaps a retracement lower from the open.

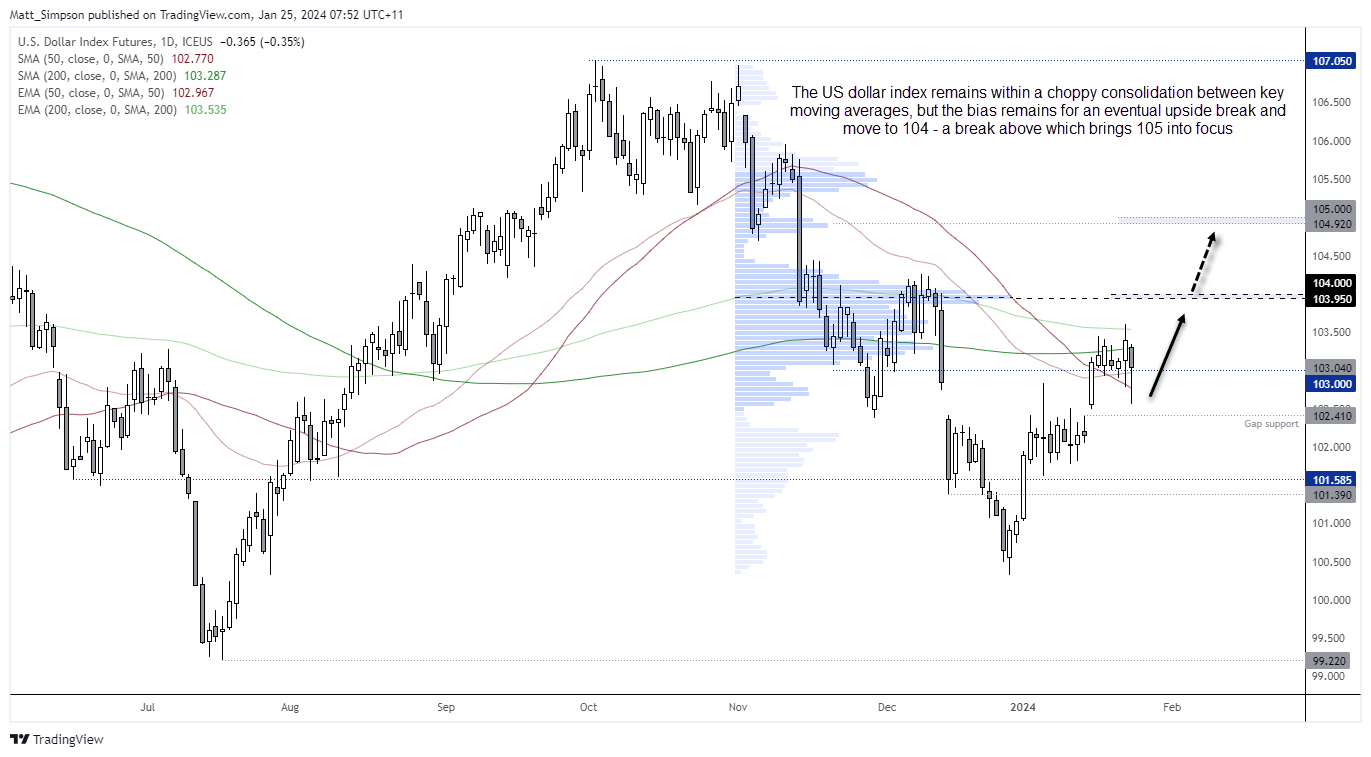

US dollar technical analysis (daily chart):

The US dollar index closed back beneath the 200-day average yet above its 50-day average and EMA. Ultimately it remains within a choppy consolidation, but I continue to suspect its next leg will be higher. GDP data could set the tone for tomorrow’s PCE inflation report if growth (and prices) surpass expectations. The bias for the US dollar remains bullish whilst prices hold above gap support and for a move to 104 – a break above which brings 105 into focus.

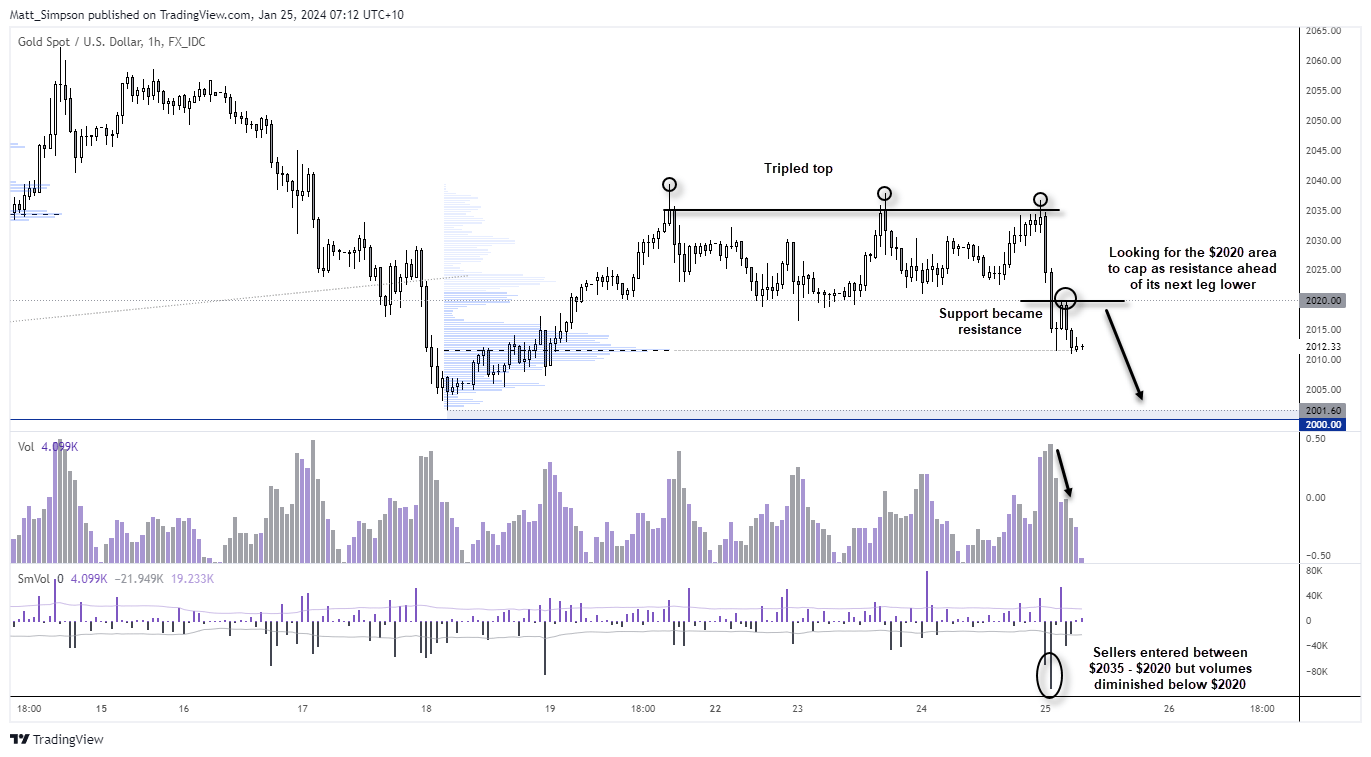

Gold technical analysis (1-hour chart):

A bearish engulfing day formed on gold and prices are back beneath $2020, a level gold has flirted with but mostly respected as support or resistance on a daily-close basis. The 1-hour chart also shows a bearish break, retest and swing high around that level with a bearish engulfing candle.

We saw some heavy selling above $2020 which was accompanied with negative delta volume – this means bears loaded up at the beginning of the move. Yet volumes diminished when prices fell below $2020, and the daily low fond support at a prior high-volume node to suggest a pullback.

My theory is that bears may want to fade into move up to but below $2020 and a stop above, for an anticipated move to the $2000 - $2005 area. A break above $2020 (allows some wriggle room) invalidates the bearish bias on this timeframe.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade