US dollar and NFP takeaways

- The Fed has repeatedly indicated that it wants to pause rate hikes, but strong US economic data may force their hand.

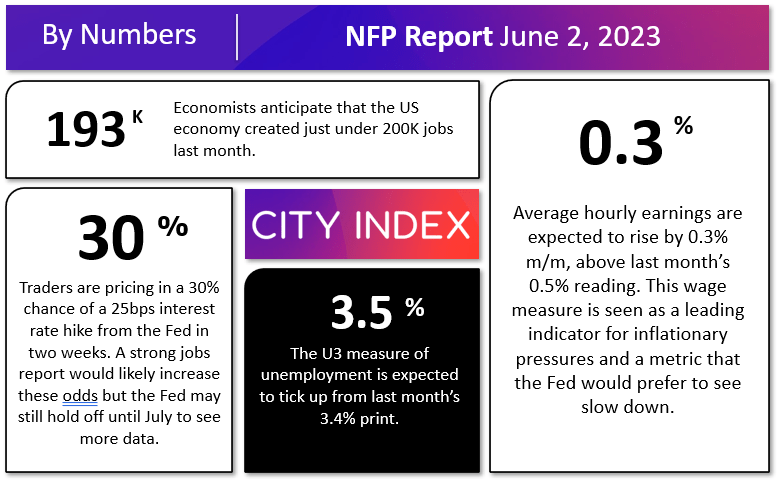

- The NFP report is expected to show 193K net new jobs and average hourly earnings rising at 0.3% m/m.

- The risks to the US dollar are tilted to the downside after a big rally in May, with potential setups on AUD/USD and EUR/USD.

NFP overview

It’s not often that an entity as powerful as a central bank doesn’t get what it wants.

Fed Chairman Jerome Powell and company clearly expected to pause rate hikes after last month’s 25bps increase, but US economic data has remained resilient, despite concerns about the debt ceiling and the highest interest rates we’ve seen since the start of the century. Earlier this week, Fed Vice Chair nominee Jefferson came out in favor of “skipping” a rate hike at the June meeting, though continued strong economic data may force the Fed’s hand.

The next major hurdle for the US economy will be Friday’s NFP reading, which is expected to show nearly 200K net new jobs and wages to rise at 0.3% m/m:

Source: StoneX

Are these expectations justified? We dive into the key leading indicators for Friday’s critical jobs report below!

NFP forecast

By now most regular readers know that we focus on four historically reliable leading indicators to help handicap each month’s NFP report, but due to the vagaries of the calendar this month, we won’t get the ISM Services PMI report until after the NFP report, leaving just three key data points to watch:

-

The ISM Manufacturing PMI Employment component printed at 51.4, up a point from last month’s 50.2 print.

-

The ADP Employment report came in at 278K net new jobs, above expectations and in-line with last month’s downwardly-revised 291K reading.

-

Finally, the 4-week moving average of initial unemployment claims fell slightly to 230K, down from 239K last month.

Weighing the data and our internal models, the leading indicators point to a slightly above expectation reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 200K-250K range.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which rose 0.5% m/m last month, will likely be just as important as the headline figure itself.

US dollar impact from NFP

|

|

Wages < 0.2% m/m |

Wages 0.2-0.4% m/m |

Wages > 0.4% m/m |

|

< 150K jobs |

Strongly Bearish USD |

Bearish USD |

Slightly Bearish USD |

|

150K – 250K jobs |

Bearish USD |

Slightly Bearish USD |

Neutral USD |

|

> 250K jobs |

Slightly Bearish USD |

Neutral USD |

Bullish USD |

The US dollar index surged over 300 pips over the last month before stalling in the lower 1.04s over the last week. With core Fed members talking down the potential for a June rate hike, it will likely take a strong NFP report to drive the greenback to new highs from here, tilting the odds in favor of a post-NFP pullback.

If we see a strong reading on the US labor market, readers may want to consider sell opportunities on AUD/USD, which is testing the top of a near-term bearish channel as we go to press. As long as the pair remains below last week’s breakdown area in the upper-0.6500s, the path of least resistance remains to the downside.

Meanwhile, a soft jobs report could present buying opportunities in EUR/USD. The world’s most widely-traded currency pair is testing previous support in the 1.0700 area and showing a potential bullish divergence on the 14-day RSI indicator. Any excuse for the Fed to pause will emphasize the monetary policy divergence between the ECB and the Federal Reserve, potentially boosting EUR/USD.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX