The cost of living in the UK, as measured by the CPI remained elevated in September and well above the BoE’s 2% target for a second straight month.

- CPI rose to 3.1% YoY, this was down a touch from August’s 3.2% and also just shy of the 3.2% forecast.

- On a monthly basis CPI came in at 0.3%, down from 0.7% in August and also below the 0.4% forecast.

- Meanwhile, core CPI rose 2.9% down from 3.1% and short of the 3% forecast.

What does this mean for the BoE?

This is the last inflation reading ahead of the BoE’s November monetary policy meeting. Whilst the data is slightly below forecasts, it’s not expected to stay there with the BoE forecasting inflation will reach 4% by the end of the year.

The rise in prices have stemmed from the economy re-opening post pandemic. Supply chain disruptions and labour shortages have pushed prices higher. The BoE, until recently was insistent that the rise in inflation was transitory.

However, more recently the BoE has adopted a more hawkish tone prompting speculation that the BoE could raise interest rates as soon as November or December. BoE Governor has hinted towards taking measures to rein in inflation.

The change in bias at the central bank comes amid a surge in energy prices and as business are increasingly talking up price rises. The BoE fears that the rising cost of living could hamper the UK’s economic recovery from the pandemic, requiring a rate hike to tame inflation.

According to the CME Group BoE watch tool there is a 70% probability of a BoE rate hike in December priced into the market.

Banks would benefit from higher interest rates.

Q3 earnings for UK banks kick off tomorrow.

Retail sales in focus

Attention will now turn to retail sales due for release on Friday for any signs that consumers are tightening their purse strings as prices rise.

Using BRC retail sales numbers as a cue, expectations are low. The BRC retail sales index grow at the slowest pace since January. Furthermore, empty petrol stations will impact the data further. However, with rising concerns over empty shelves and supply chain issues we could see a pull forward for Christmas shopping. Although September does seem a bit early!

A strong reading could calm concerns over consumers ability to absorb higher prices. That said, a weak reading is unlikely to push the BoE off its more hawkish path given that inflationary pressure look set to stay.

Retail sales are expected to rise 0.5 MoM and decline -0.4% YoY.

Where next for GBP/USD?

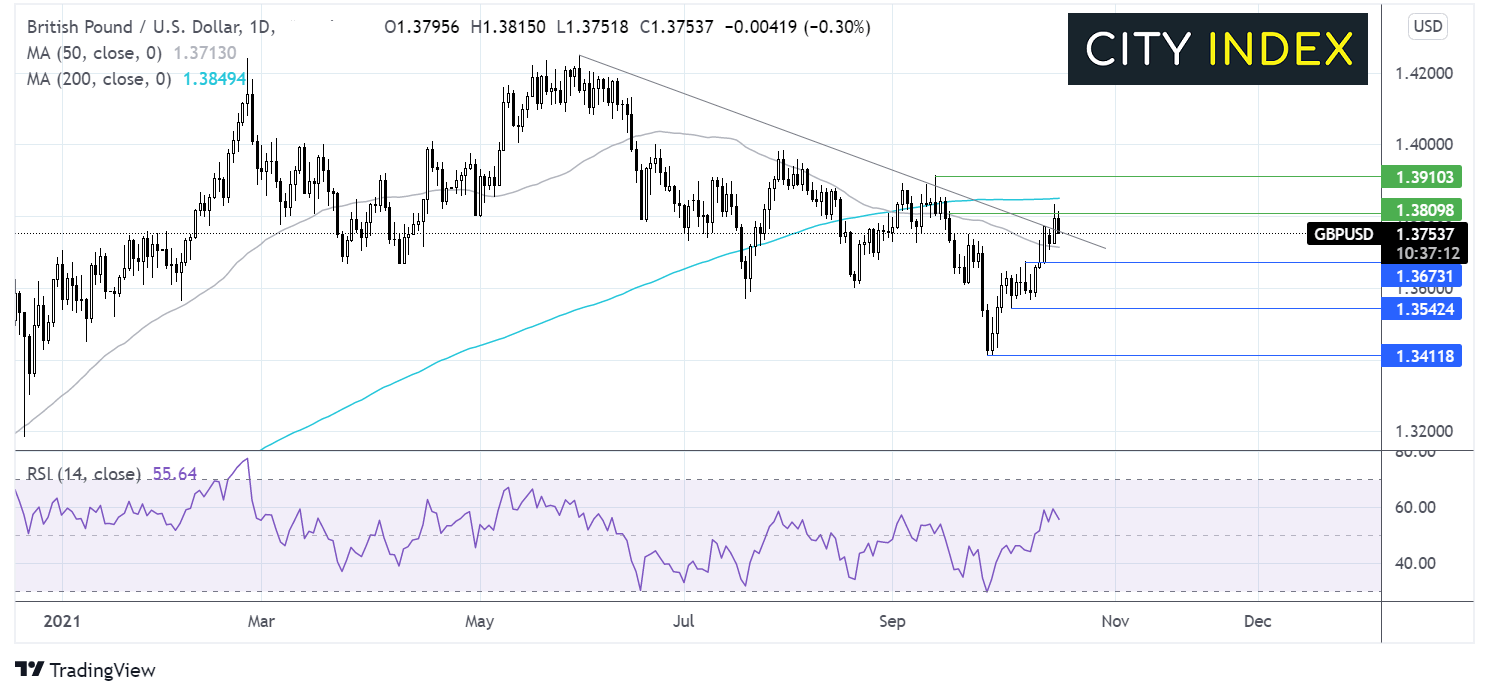

GBP/USD has been extending its rebound from 1.3415 the October low before running into resistance just shy of the 200 sma at 1.3835.

Today’s move lower has taken the paor back below the key psychological level of 1.38. However it appears to be find support on the multi-month falling trendline at 1.3755.

The RSI is pointing lower but remains firmly in bullish territory suggesting that this could be a corrective move lower.

Sellers will be looking for a move below the support line and the 50 sma at 1.3710 to negate the near term up trend. A move below 1.3670 could see sellers gain traction.

Meanwhile, buyers will be looking for a move over 1.38 to expose the 200 sma. Above here buyers are likely to gain momentum towards 1.39.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.