When is the Autumn Budget?

On Wednesday 27th October the Chancellor of the Exchequer, Rishi Sunak, will lay out the government's latest tax and spending plans. It usually starts around 12:30 UK time.

This will be the second budget of the year after one in March. It also comes at the end of the spending review. Here we break down what to watch:

Health of the economy

The Office of Budget Responsibility (OBR) will update on GDP expectations for the year. The OBR is expected release forecasts that show a faster rebound than the 4% predicted for this year in the March budget.

The forecast for unemployment is also expected to be lowered following the success of the furlough scheme. This would follow an improved outlook for the labour market at the BoE as well..

However, the economic recovery is already slowing as a direct result of supply chain issues, labour shortages and surging inflation. At the latest BoE meeting the central bank cuts its GDP forecast for Q3 by 1% to 2%. Weaker economic growth automatically reduces tax revenue. Any sense of disappointment from the OBR could drag on GBP.

New fiscal rules

The government spent significantly across the pandemic, racking up debts in the once in a lifetime crisis. Not only were measures such as the furlough scheme expensive but the government also collected less tax during the pandemic.

The government had to borrow in order to plug the gap between spending and revenue. The government borrowed £320 billion by year end April 2021, the highest level in peace time. Expectations are for borrowing to remain elevated this year at around £180 billion. This figure will be under the spotlight, particularly as the economic recovery starts to slow and inflation surges. Higher inflation adds to debt servicing costs. Given that the national debt is almost 100% of GDP at its highest level since 1963 public finances are very sensitive to changes in borrowing costs.

The Chancellor will announce new fiscal rules in an attempt to bring borrowing back under control and the debt down. How strictly these are set will provide clues as to how much wiggle room the Chancellor gives himself for extra spending or further tax cuts.

Personal taxes

Rishi Sunak has already announced the largest rise in personal taxes in twenty years, lifting NI for employers, employees and the self-employed plus a rise in dividend tax. Will this be enough to balance the books? Unlikely. There is a good chance Rishi Sunak will need more revenue to meet spending pressure. However, the economy is still far from firing on all cylinders and the coming months are already looking challenging for many households. Inflation is surging, energy costs are rising, furlough is winding down, other pandemic support measures such as the universal credit top up are also coming to an end.

Rishi Sunak has a fine line to walk down. Should taxes be considered too harsh and he could stifle the economic recovery. Too low and concerns over huge borrowing costs and mounting debt could rise and Pound traders could worry over huge borrowing

Rishi Sunak could look to cut VAT on household energy bills. There have also been calls to raise inheritance tax and capital gains tax. With COP26 next month pressure could be high to tackle climate change. Therefore we could see an outline for a plan as to how the government intends to encourage households to do this.

Where next for the Pound?

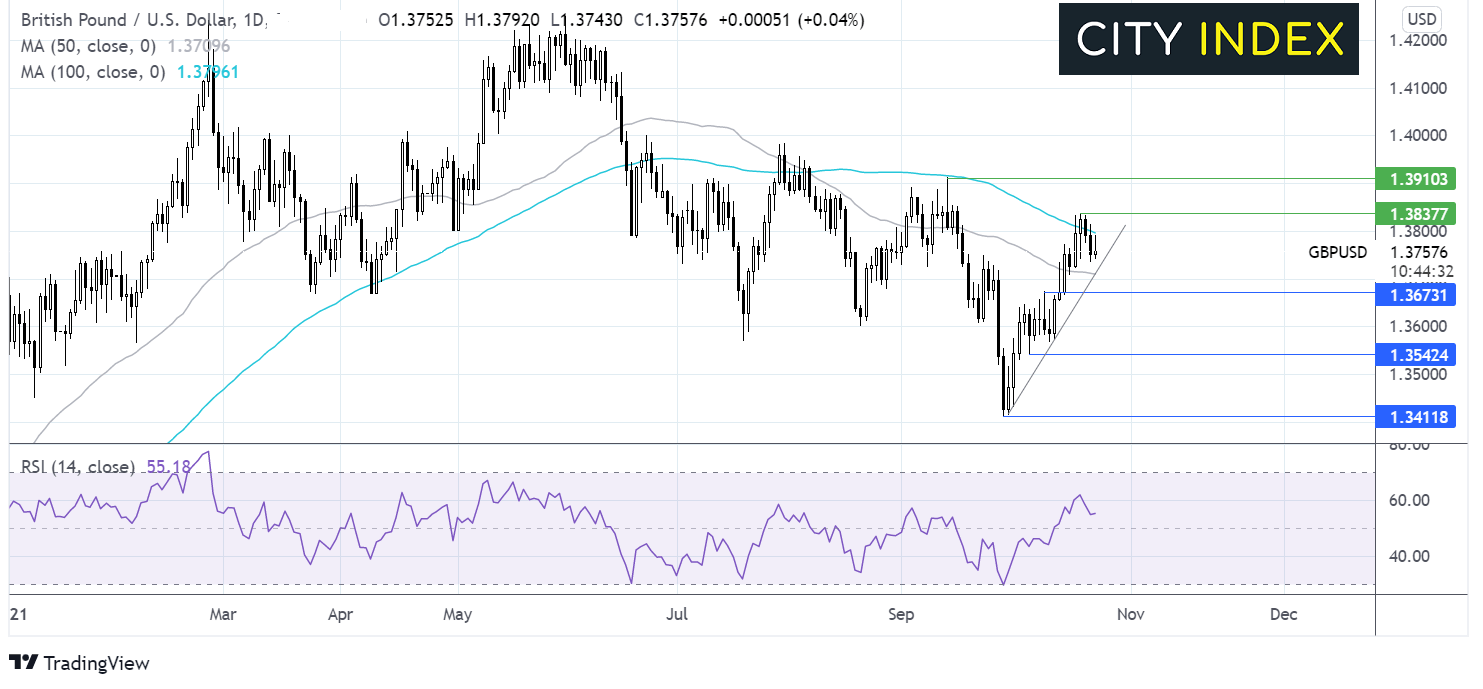

GBP/USD rebounded from 1.3412 retaking the 50 & 100 sma. The pair ran into resistance at 1.3835 and has since eased lower to current levels of 1.3750.

GBP/USD trades caught between the 50 & 100 sma but still holds above the steep rising trendline from the start of the month. The RSI suggests that there is still more upside to be had.

Buyers could look for a move over the 50 sma to retest last week’s high of 1.3835 and look towards 1.39 the September high.

Meanwhile a break below the trendline and 50 sma at 1.3715 could open the door to 1.3670 and see the bears gain momentum.

UK Autumn Budget: stocks and sectors to watch

UK businesses are still in recovery mode but their ability to bounce back is being threatened by a variety of headwinds – from rising material costs and a shortage of workers to spiralling energy costs the supply crunch. The need for support is high, but the government is also limited in what it can spend considering national debt is at its highest level since the 1960s. This means major giveaways are likely to be off the table this week, but there are some stocks and sectors that could be impacted by the budget.

Banks

The UK has already pencilled in plans to raise corporation tax to 25% from 19% in April 2023, but is concerned that this could make the banking industry and financial services – one of the country’s key exports – uncompetitive against foreign rivals, particularly as competition has intensified since Brexit.

There are expectations that the chancellor will follow through with plans to cut the bank corporation tax surcharge to 3% from the current rate of 8% in April next year as a result. That would ultimately mean banks would be charged less on their profits, providing a boost the industry, possibly at a time when higher interest rates could improve the industry’s profitability over the coming years.

Stocks to watch: Lloyds Banking Group, NatWest, Barclays, Metro Bank

Hospitality

The hospitality industry has only just started to get back on its feet after being decimated by the pandemic. One lever the government pulled to support the likes of restaurants and pubs was the introduction of a temporarily lower rate of VAT. This was initially cut to just 5% but recently increased to 12.5%, with the current plan set for VAT to return to its pre-pandemic rate of 20% from April next year.

However, the industry has been calling for the 12.5% rate to be made permanent in order to help aide the industry’s recovery, especially as a rise in VAT will only exacerbate inflationary problems amid rising costs, which are being passed on to customers.

There could also be some changes to alcohol duty. Pubs are struggling with everything from higher C02 prices to labour shortages and an industry body warned last week that 20,000 pubs could close if beer duty rises. Reports suggest the chancellor could overhaul alcohol duties with expectations that some taxes could be cut to help them stay competitive as costs and prices rise.

There are also reports that the National Living Wage for over 23s could be raised by around 5.7%, which would weigh on sectors like hospitality more than most.

Stocks to watch: Wetherspoons, Mitchells & Butlers, Marston’s, Whitbread, Restaurant Group

High street

A recurring theme in any UK budget are the calls for business rates to be reformed – a statement that most politicians agree with but rarely act upon due to the complex and costly nature of the topic.

However, the argument for reforming business rates – one of the biggest outgoings for bricks-and-mortar retailers – has never been stronger. The high street was deserted during the pandemic, forcing consumers to use online rivals that are not subject to property-based business rates, leaving physical retailers at a severe disadvantage.

The chancellor launched a review of business rates and the findings are expected to be presented this autumn after being postponed due to the pandemic. A reduction in business rates or an overhaul of the system would be welcomed by retailers and other businesses on the high street.

Still, expectations that the review will lead to major change are low, even though the argument for an overhaul have never been stronger. Given an overhaul of business rates could drastically hit the public purse, the chancellor may instead focus on taxing online rivals more to level the playing field.

Retailers would also be among the biggest affected by any increases to the National Living Wage.

Stocks to watch: AB Foods (Primark), Next, JD Sports, Dunelm, Frasers Group, B&M, Pets at Home, Card Factory

Transport

The chancellor has already revealed that he wants to help build back public transport outside of London, with around £6.9 billion in funding earmarked to upgrade train stations, expand the tram network, and improve bus services. However, reports suggest only around £1.5 billion of that is set to be new funding unveiled this week.

Bus and train services have been propped up by the government since the pandemic started and news of more investment underpins the government’s view that public transport will be key to achieving its climate goals.

Stocks to watch: Stagecoach, National Express, Go-Ahead and Firstgroup

Airlines

There are also reports that the chancellor could raise air passenger duty for long-haul flights in order to crackdown the environmental damage caused by travelling to far-flung destinations like Australia or Japan.

Reports suggest the levy will be tied to the length of the flight, resulting in pricier levies for longer flights. Air passenger duty is paid by airlines but this is almost always reflected in the fares paid by passengers, and the industry is expected to pass on higher taxes to consumers. Currently, air passenger duty is split into two bands: flights over 2,000 miles and flights under 2,000 miles. Reports suggest this could evolve into three bands of flights upto 2,000 miles, flights between 2,000 to 5,500 miles, and 5,500 miles plus. This implies any change will predominantly hit airlines focused on longer-haul flights compared to those that mostly conduct short haul flights.

Stocks to watch: IAG, Ryanair, easyJet, Wizz Air

Housebuilders

Housebuilders will also be on the radar of investors this week on news that the chancellor has set aside almost £2 billion to help accelerate the number of houses being built on derelict or unused land.

The funds are expected to be funnelled into building 160,000 greener homes on brownfield land. It is anticipated this could help regenerate certain parts of England that have fallen behind, support 50,000 new jobs and help it achieve its goal of becoming net-zero by 2050. The burden of building the new houses the country needs fall solely on the private housebuilding sector, but the government can provide funding to help steer them in the right direction or encourage them to step-up activity.

There is also likely to be some developments on cladding as the government looks for ways to address skyrocketing insurance bills for leaseholders, which could add headwinds for certain housebuilders.

Stocks to watch: Barratt Developments, Berkeley Group, Persimmon, Bellway, Redrow, Taylor Wimpey, Countryside Properties, Crest Nicholson

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.