- NZD/USD tumbled sharply on Monday on the back of no major news

- The pair closed at the lowest level in a month, breaking uptrend support in the process

- As a high beta play on the global economy, the Kiwi may be signaling downside risks are growing in other cyclical assets

NZD/USD has closed at the lowest level in a month, breaking the uptrend it’s been in since the Federal Reserve meeting in November where it signalled an end to interest rate increases for this cycle. With most cyclical assets remaining at elevated levels, does the Kiwi’s breakdown signal that soft landing hopes are now entirely priced in, only leaving room for disappointment? As a high beta play on the global economy, it’s a pair to keep on the radar, especially if you like to dabble in emerging market names or the Australian dollar.

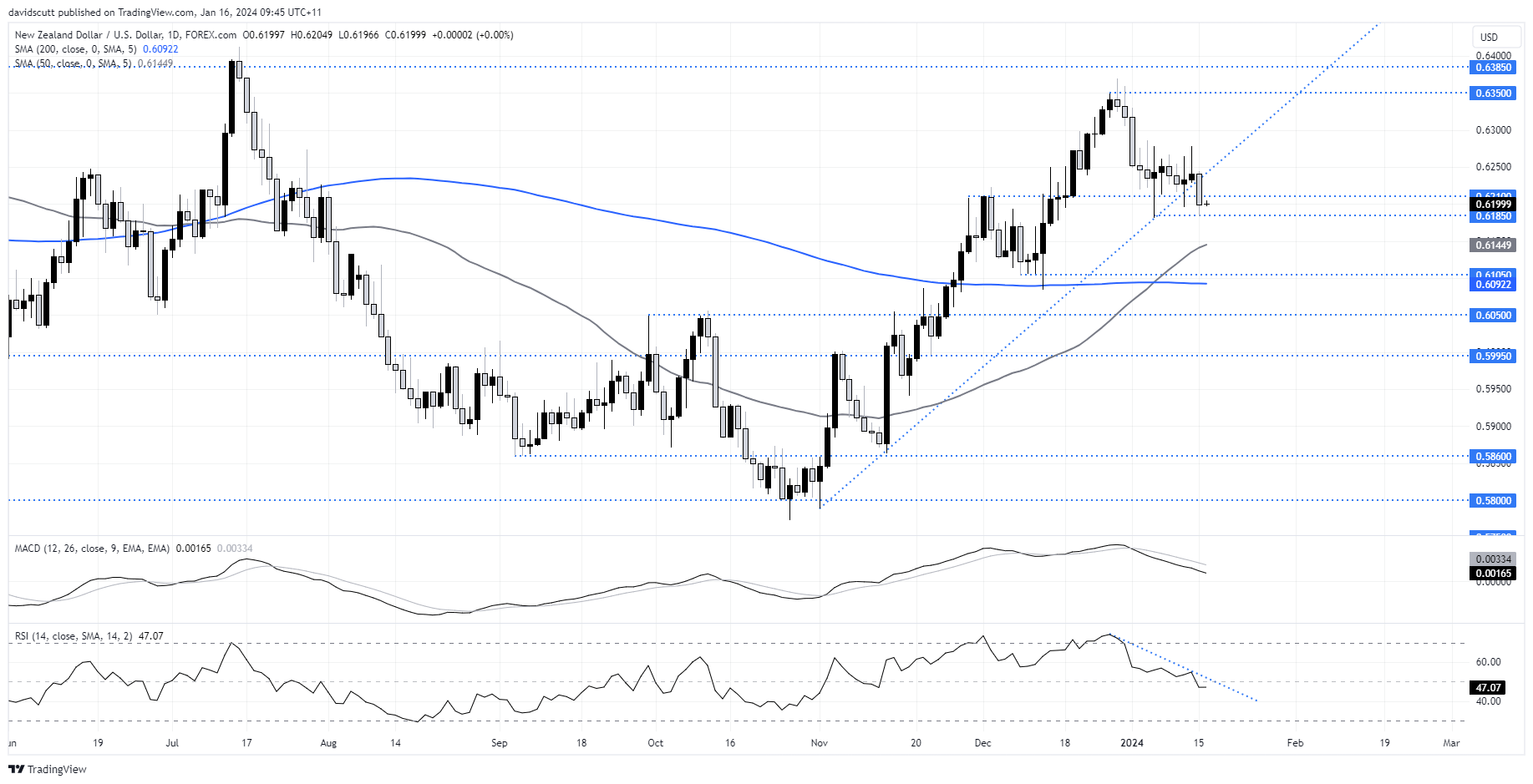

NZD/USD slices through uptrend from November

The breakdown in NZD/USD on Monday can be seen on the daily chart below, sliding more than 0.7% in what was an otherwise quiet session to close at lows not seen since before the Fed policy pivot announced at the December FOMC meeting. Some commentators cited disappointment over the decision from the People’s Bank of China (PBoC) who refrained from lowering its medium-term lending facility (MLF) rate for one year wholesale money on Monday, disappointing expectations for a 10bps drop relative to a month earlier.

A sign soft landing trades are becoming exhausted?

Perhaps it was the catalyst – AUD/USD fell, albeit by a lesser margin – but you have to question what impact it would have had on China’s overall economic trajectory? The MLF was already cut in August and there have been numerous other stimulus measures announced since, yet China’s economy isn’t exactly shooting the lights out. China’s data dump released on Wednesday, including not only monthly information on retail sales, industrial output, fixed asset investment and unemployment but also China’s 2023 GDP growth rate will likely underline that point.

Rather, I wonder if the Kiwi’s breakdown is a sign the soft landing narrative that has powered risk assets higher since mid-October may have run its course, needing reality to now deliver on those lofty expectations.

The NZD/USD move certainly doesn’t come across as domestically driven with traders barely batting an eyelid on Tuesday to data showing a significant improvement in business confidence in the fourth quarter, according to the NZIER survey. Net confidence among respondents surged from -52% to -2% with reported capacity utilisation lifting nearly four percentage points to 91.4%. Those numbers don’t scream the New Zealand economy is falling off a cliff. It says the Kiwi move was almost certainly offshore driven.

NZD/USD carrying downside momentum

While some traders will be willing to sell the uptrend break, it may pay to see whether NZD/USD can break .6185, a level it has now bounced off on a couple of occasions, including on Monday. Other than the 50-day moving average, there’s not a lot of visible support below .6185 until you get to .6105, a level the price tagged on four consecutive days during December. A stop above .6185 or .6210 would provide protection for those considering shorts, depending on your entry level. From a momentum perspective, both RSI and MACD suggest downside is in the ascendency.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade