Source: Tradingview, Stone X

The markets seem to be willing to look past the bout of Covid raging through China at the moment. As a result, traders see an opportunity to buy stocks, hoping the pandemic will be over sooner rather than later. If they are right, the China A50 will have to pass through strong near-term resistance. Be on the lookout for more positive headlines out of China.

Bulls were out in force in China as the country announced that it will gradually reopen the border between Hong Kong and mainland China on January 8th. The border had been closed for roughly three years due to China’s “zero-Covid” policy. In addition, China will re-open to the world as it will no longer require inbound travelers to quarantine upon entering the country. This comes after headlines yesterday that China will be setting up measures to help its ailing property market by creating a fund for “too big to fail” developers. Also, China said that it will consider a partial easing to the ban on imports of Australian coal, beginning April 1st.

Since early November 2022, the China A50 has been moving higher. Does this mean that the Covid pandemic raging through China is over? Hardly. However, it does mean that traders are looking past the pandemic to the reopening of the Chinese economy with hopes that the PBoC will be there to save any failing sectors or industries.

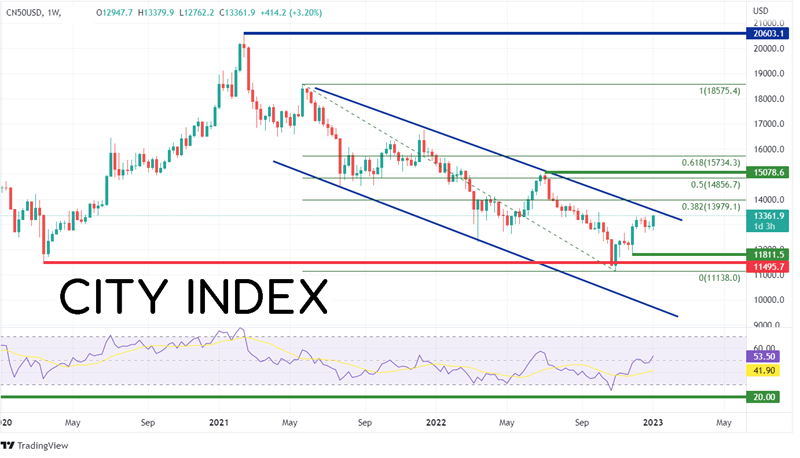

Prior to November 2022, the China A50 had been moving lower after making a high on February 18th, 2021, at 20603.1. However, once it became apparent that China’s “zero-Covid” policy wasn’t the best way to control the pandemic, Chinese stocks began to move lower in an orderly downward sloping channel. Growth slowed as important manufacturing cities throughout China we periodically closed and reopened due to the virus. The China A50 reached its lowest level since early 2019 on October 31st, 2022, when it traded down to 11138. However, the RSI was in oversold territory at the time and the index bounced. It is currently trading near the top trendline of the channel at its highest level since October 6th, 2022, at 13362.

Source: Tradingview, Stone X

Trade the China A50 now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

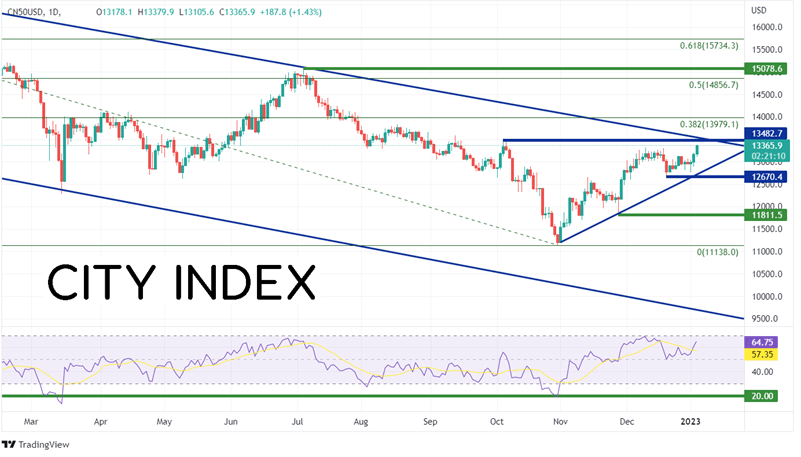

On a daily timeframe, the China A50 has been moving in a rising triangle since bouncing off the lows and is currently nearing the apex. First resistance is at a confluence of the horizontal, top line of the triangle and the top, downward sloping trendline of the long-term channel near 13482/13530. If price breaks above there, the next level of resistance is at the 38.2% Fibonacci retracement and then the 50% retracement from the highs of May 27th, 2021, to the lows of October 31st, 2022, at 13979 and 14856, respectively. However, if the resistance holds and the Chinese stock index moves lower, support is at the bottom trendline of the triangle near 12670, which is also the low from December 20th, 2022. Below there, price can fall to the spike lows from November 28th, 2022, at 11811.5, then the October 31st lows at 11138.

Source: Tradingview, Stone X

The markets seem to be willing to look past the bout of Covid raging through China at the moment. As a result, traders see an opportunity to buy stocks, hoping the pandemic will be over sooner rather than later. If they are right, the China A50 will have to pass through strong near-term resistance. Be on the lookout for more positive headlines out of China.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade