The GBP/USD forecast has not been materially impacted by the Bank of England’s expected decision to raise interest rates by 25 basis points to 4.5% today. The pound initially bounced back to trim its earlier losses as traders realised the BoE was actually more hawkish than expected and that more rate increases might be on the way. Yet, the GBP/USD struggled to get back above 1.26 handle, as the US dollar remained bid against most other currencies in a mild risk-off trade, despite a sharper-than-expected increase in weekly unemployment claims and following the release of weaker-than-expected US inflation data. Still, the longer-term GBP/USD forecast remains bullish, and it will probably head towards 1.30s once the impact of short-term dollar correction dissipates. But in the short-term, a drop back to 1.25 cannot be ruled out.

Hawkish BoE hike supports bullish GBP/USD forecast

The pound’s immediate positive reaction tells us the market was not expecting the BoE to be so hawkish. The UK central bank sees the need for more rate hikes should there be evidence of more persistent inflation. What’s more, policymakers no longer expect to see a recession and have therefore upgraded their GDP forecasts by the biggest amount ever. A tight labour market means wages could rise further, putting more force in the wage-price spiral.

So, the BoE thinks that the risks to inflation forecasts are skewed “significantly” to the upside. Yet, despite acknowledging that inflation is a massive problem, they just can’t get a unanimous vote. Once again, Dhingra and Tenreyro voted to keep rates unchanged. Yet, the hawkish language from the statement point to at least another 25 – possibly 50 – basis points hike by August.

All told, the BoE was more hawkish and hinted at more hikes, although that would be data dependent. Markets see rates topping at just below 5%, and the BoE is not pushing back too forcefully on those expectations.

This hike marks the 12th straight one, taking interest rates to their highest level since 2008.

But the decision to tighten policy was hardly surprising.

For one thing, inflation has been in double digits for 7 straight months now. Only once in 9 months did it fall below 10%, and that was in August when it printed…wait for it… 9.9%! In other words, CPI has been stuck around 10% for 3 quarters.

For another, the BoE would have further damaged its credibility had it not acted, given that UK CPI is way higher than it is in the eurozone (7%) and the US (4.9%). The key driver is food inflation, which is an international issue but one that has impacted the UK more significantly than many other developed economies. That said, the UK economy has proved to be more resilient than expected, with the labour market remaining very tight.

Therefore, the central bank no longer sees a recession and has accordingly revised upwards its growth and inflation outlook.

GBP/USD forecast: What does it all mean for the pound?

A hawkish-sounding BoE means that in the short-term, the pound is likely to find continued support on the back of any noticeable dips. However, concerns that the past rate hikes are going to negatively impact the economic outlook, this could limit the pound’s upside potential and weigh on the longer-term GBP/USD forecast. Indeed, a vast number of UK mortgages are fixed. As the fixed terms end, more and more households will find it difficult to make higher monthly payments on their debts. This could lead to vast defaults if inflation does not come back down fast enough to allow the BoE to cut rates soon enough.

Why is the dollar showing signs of life?

The drop in US CPI to 4.9% should have held the dollar back – and it has against the likes of the Japanese yen. But we have seen commodity dollars falling back against the greenback, while the euro has also struggled.

The laggards, including the AUD, are due partly to weakness in Chinese yuan and metals prices, with both copper (-3%) and silver (-2%) dropping noticeably today after benign Chinese CPI and PPI data overnight. The weakness in Chinese inflation data has intensified concerns about demand from the world’s second largest economy, where the recovery appears to be fading alarmingly. This was highlighted by a surprise 7.9% drop in imports on Tuesday, adding to the sluggish factory activity figures released last week.

The US dollar has also found some haven flows. Concerns over the US debt ceiling are rising, and credit is tightening. The latest talks between President Biden and top congressional leaders over the debt ceiling impasse saw no progress. The US could default on its debt obligations if no resolution is found within the next 3 weeks or so. That would be unthinkable. So, a bit of adverse market movement may be required to push lawmakers into making a decision.

Meanwhile, the latest data out of the US released today were not great, as jobless claims came in at 264K instead of 245K expected – a big miss. But PPI rose 0.2% month-over-month, weaker than 0.3% expected, providing more signs that inflation has peaked.

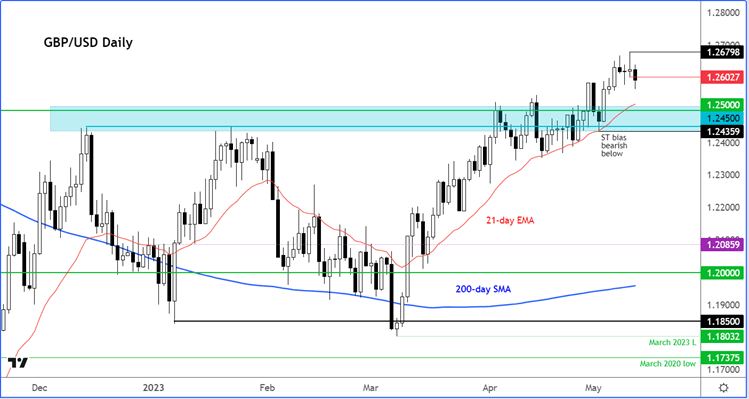

GBP/USD technical analysis

While the GBP/USD has struggled to get back above 1.26 handle, the trend remains positive. The higher highs on the cable’s chart means the trend is still bullish, until proven otherwise. In addition, you have the 21-day exponential providing consistent support on the dips, while the 200-day average has started to point upwards again.

Given these technical factors alone, I would only concentrate on the long side and look to fade the dips back to support, until the chart tells us otherwise.

The most important area of support for the bulls to defend is around 1.2500, which had been strong resistance in the past.

On the upside, the next bullish objective is just above this week’s range at 1.2680, where trapped sellers’ stops are likely to be resting. So, the cable could pop to 1.27ish next. Above that level, there are no further obvious targets to watch, so price could climb to 1.28, 1.29 and eventually all the way to 1.30 in the days/weeks to come without any fundamental trigger to reverse the trend.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade