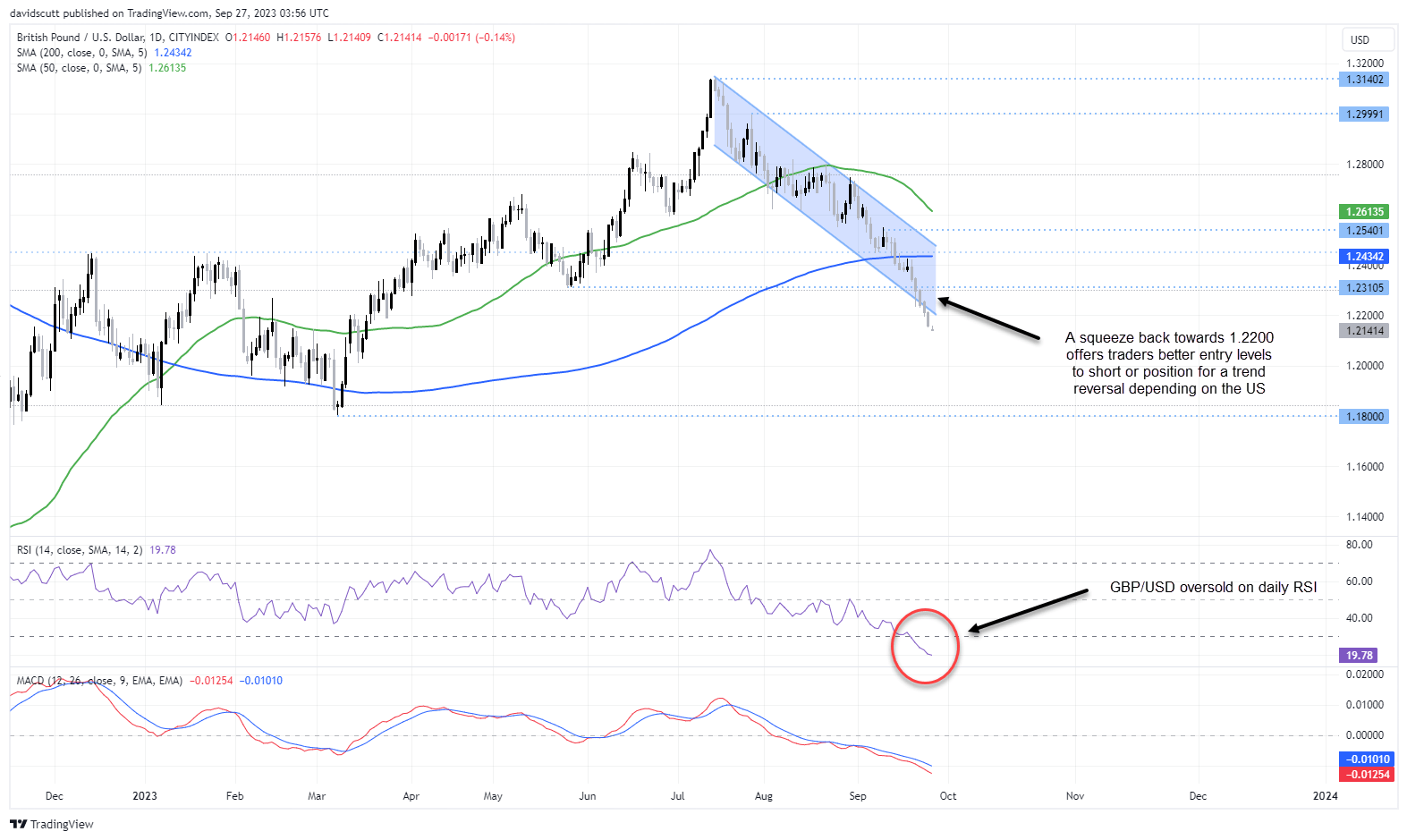

GBP/USD doesn’t have much going for it in the wake of the Bank of England’s surprise decision to hold interest rates steady last week. The daily chart looks ugly, resembling a waterfall cascading out of an already a steep downtrend. It’s unloved, oversold, has weakening fundamentals and has no visible technical support for at least a few big figures. It comes across as a screaming short, even after the substantial decline we’ve seen since July.

But with sentiment so poor and major US economic data arriving later this week, conditions look ideal for a countertrend squeeze over the coming days, providing a potential opportunity for those looking to establish short positions in GBP/USD at better levels or a buying opportunity for those brave enough to go against the prevailing bearish trend.

US data must impress to support further USD gains

Having made the argument for interest rates needing to stay higher for longer to suffocate inflation, it’s now up to the data to prosecute the Fed’s case. And that may be difficult given how much hawkish expectation has been priced in, as demonstrated by the relentless US dollar index rally that’s now entered it’s eleventh consecutive week.

While many traders will be eyeing off Thursday’s initial jobless claims report given it’s the closest thing we have to a real-time snapshot of what’s happening in the US labour market, the data is too volatile on a weekly basis to provide a reliable guide, especially at a time of increased industrial disputes. Instead, Friday’s personal consumption and incomes report for August, including the Fed’s closely watched core services inflation ex-housing inflation measure, looms as the release that could make or break the argument for higher for longer.

I’m not going to try to predict what the report will contain. A whole array of specialists across various realms of economics attempt that every month, often to no avail. But the risk of incomes, expenditure or inflation undershooting expectations centered around rates remaining elevated is obvious, hence there’s a decent chance some USD longs may not be willing to run positions into the release, leading to short covering in other pairs such as the British pound.

GBP/USD squeeze provides two-way optionality post PCE

For those looking to position for a squeeze, you’d want to see some evidence of stability in the pair before entering a long, with a tight stop below entry to protect against a continuation of the trend. There’s likely to be light resistance around 1.2200, making that a potential upside target.

When the data is released, it will provide far greater clarity for traders to assess whether the bearish trend is likely to continue. Another strong report may provide better levels to sell GBP/USD, with a stop above 1.2300 for protection. There’s very little visible support found until you get to 1.1800, making that an obvious target. Should the data whiff, a break of 1.2300 would open the door to a further retracement towards 1.2460.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade