The UK economy contracted over 9% in 2020 owing to the pandemic, which was one of the largest economic contractions in the developed world. After solid growth in 2021, the UK economy is finally larger than it was at the start of the pandemic.

The economy grew 0.9% MoM in November, ahead of the 0.4% forecast. On a rolling 3-month basis, GDP grew 1.1% the 3 months to November ahead of the 0.8% forecast.

The surge in economic growth in November has been attributed to a combination of factors, including a faster pace of growth in construction as global supply chains eased and raw materials were easier to get hold of. Secondly. The fact that retailers had a strong November suggests that shoppers were out doing Christmas shopping early.

Whilst November’s data is encouraging, it is worth pointing out that surging Omicron infections in December could still knock growth in the final month of Q4. Particularly given the high rates of staff absences. That said, the impact from Omicron is widely expected to be short lived, with cases already falling consistently.

As such Omicron shouldn’t prevent the BoE from pressing ahead to hike interest rates in February. Currently the BoE forecasts that the UK economy will return to its pre-COVID size in Q1 2022.

There are still challenged ahead for the UK economy, such as 3-decade high inflation, rising energy prices and ongoing supply chain issues.

Client positioning

Our clients are net short EUR/GBP. 58% of those trading EURGBP across the Stone-X retail brands expect GBP to strengthen against the euro.

Where next for EUR/GBP?

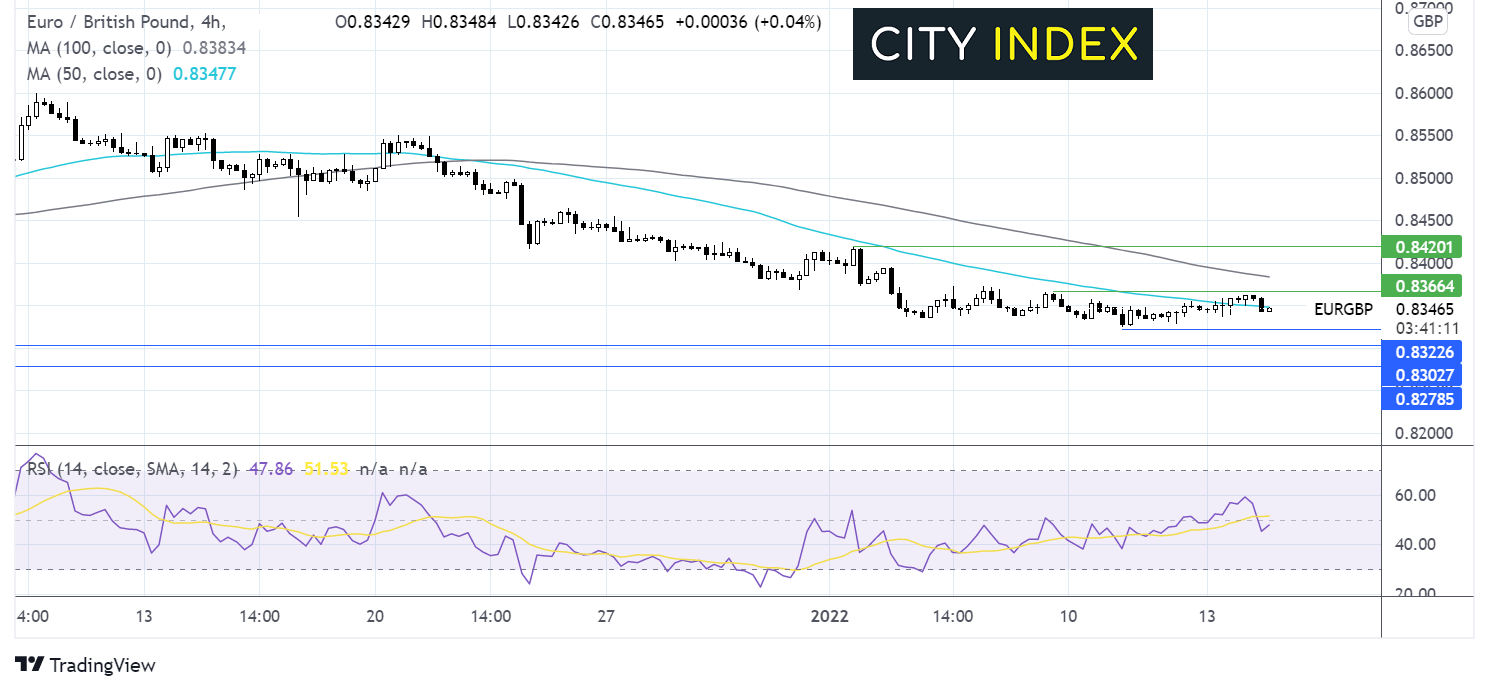

EUR/GBP trades lower following the data. The pair trades below its 50 & 100 sma on the 4 hour chart, the 50 crossed below the 100 in a bearish signal.

After hitting a 23 month low of 0.8323 the pair has been in consolidation mode, capped on the upside by 0.8365 the weekly high and 0.8323 the yearly low.

Traders might look for a breakout trade from here. Buyers are looking for a move over 0.8365 to test 0.8380 the 100 sma and 0.8420 the 2022 high.

Sellers could look for a move bellow 0.8323 to test 0.83 round number and 0.8280 a key level from 2020.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.