Asian Indices:

- Australia's ASX 200 index fell by 0.2 points (0%) and currently trades at 7,410.80

- Japan's Nikkei 225 index has fallen by -15.72 points (-0.06%) and currently trades at 24,635.86

- Hong Kong's Hang Seng index has fallen by -15.72 points (-0.06%) and currently trades at 24,635.86

- China's A50 Index has risen by 27.34 points (0.17%) and currently trades at 15,676.94

UK and Europe:

- UK's FTSE 100 futures are currently down -9.5 points (-0.13%), the cash market is currently estimated to open at 7,257.19

- Euro STOXX 50 futures are currently down -2 points (-0.05%), the cash market is currently estimated to open at 4,281.82

- Germany's DAX futures are currently down -14 points (-0.09%), the cash market is currently estimated to open at 15,923.00

US Futures:

- DJI futures are currently up 194.55 points (0.55%)

- S&P 500 futures are currently down -37.25 points (-0.23%)

- Nasdaq 100 futures are currently down -11.5 points (-0.25%)

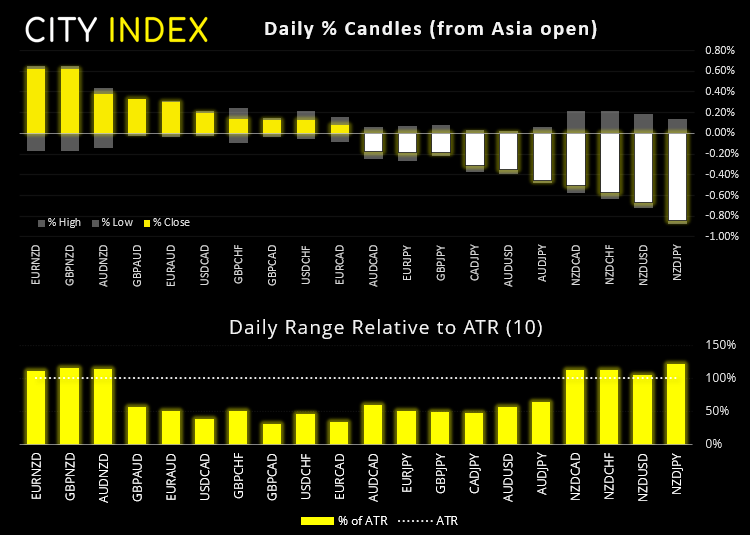

Hawkish hike from RBNZ, although pace is yet to be determined

The 25 bps point hike was expected, and whilst it was a ‘hawkish hike’ as they have upped their OCR target, RBNZ hinted that future hikes will be on a per-meeting basis. As an export economy they don’t want a high exchange rate yet must also raise rates to fend hot inflation. Therefore, whilst their approach signals their hawkish intent over the longer-term, it helps keep a bit of a lid on NZD prices as speculators aren’t sure if another hike is imminent. Not bad really.

The Turkish Lira is falling off a cliff (faster than Turkeys from Thanksgiving shelves)

Just when you think the Lira has had enough of a beating, its volatility rising volatility unleashes further downside. The Lira hit new lows yesterday after President Erdogan doubled down on his fight against (but inadvertently actually with) inflation, and reports that he’s called for a meeting with the central bank heads sent their currency into another tailspin. USD/TRY rallied nearly 13% yesterday, and we cannot say the damage is yet complete.

That said, the last time USD/TRY rallied over 10% in a single day marked the top in 2018. But unless Erdogan swiftly changes his ways (which we doubt he will) then it’s hard to say the Lira will actually hit rock bottom today.

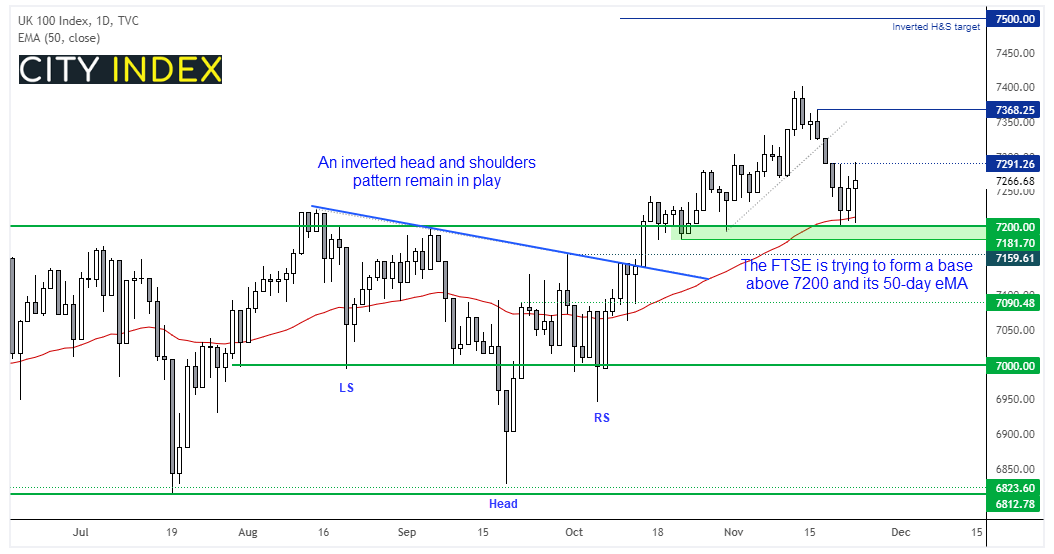

7200 – 7300 is the key range for the FTSE 100

After falling -2.6% from last week’s high the FTSE 100 has found stability above 7200 and its 50-day eMA. A bullish inside day and subsequent bullish outside day have reaffirmed support around 7200, and a break above 7300 is now required to confirm a swing low is in place. Remembering that an inverted head and shoulder remains in play, which projects a target around 7500, we are seeking fresh opportunities for longs whilst prices hold above the 7180 – 7200 support zone.

Virgin Money UK PLC (VMUK) release earnings today at 18:00.

FTSE 350: 4153.16 (-0.45%) 19 November 2021

- 130 (37.04%) stocks advanced and 206 (58.69%) declined

- 22 stocks rose to a new 52-week high, 12 fell to new lows

- 100% of stocks closed above their 200-day average

- 56.41% of stocks closed above their 50-day average

- 28.77% of stocks closed above their 20-day average

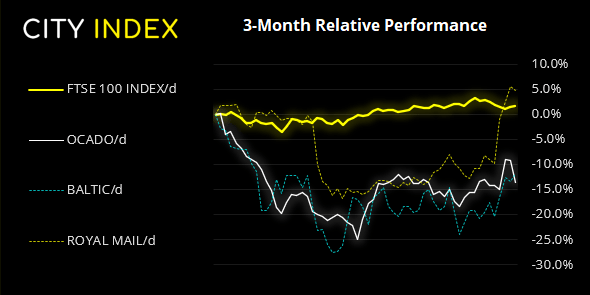

Outperformers:

- + 6.84%-Ocado Group PLC(OCDO.L)

- + 4.70%-Baltic Classifieds Group PLC(BCG.L)

- + 3.70%-Royal Mail PLC (RMG.L)

Underperformers:

- -8.00%-Mitie Group PLC(MTO.L)

- -5.22%-Compass Group PLC(CPG.L)

- -4.64%-Wizz Air Holdings PLC(WIZZ.L)

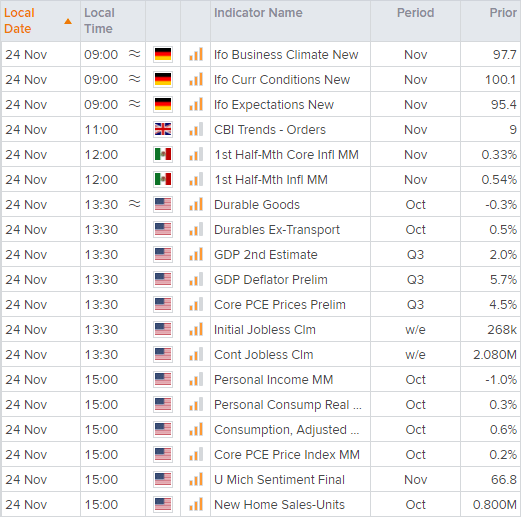

Eyes on consumer sentiment and GDP for the US

The University of Michigan also release their final read for consumer sentiment. We took an in-depth look at the initial release which revealed some interesting patterns, so we’re keen to see if any numbers have been significantly revised. Whilst consumer sentiment is not usually an immediate market mover, it is an indicator which can fine tune macro views and could become more significant for our outlook for 2022 if the negativity persists.The US also release their second estimate for GDP today. Headline growth undershot expectations in preliminary release, rising just 2% to make it the slowest rate of growth since lockdowns. It’s a backwards looking indicator at the best of times, so unless we see a significantly revised number to the upside today then it likely won’t excite markets. However, buried in the numbers were signs of softer inflation with PCE and core PCE prices moving lower in Q3. Should these numbers remain lower than Q2 then it is something that Fed doves could be quick to pounce on as part of their ‘transitory’ inflation case.

But first, Germany release their IFO business sentiment report. And given the bounce on euro pairs yesterday after higher PMI data then a decent ZEW print today could provide further support. Yet it should also be remembered that with parts of Europe (and Germany) potentially facing news lockdowns then upside could be limited from here for the euro.

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade