Asian Indices:

- Australia's ASX 200 index fell by -79.1 points (-1.16%) and currently trades at 6,721.00

- Japan's Nikkei 225 index has risen by 258.14 points (0.95%) and currently trades at 26,999.24

- Hong Kong's Hang Seng index has fallen by -400.3 points (-2.42%) and currently trades at 16,110.98

- China's A50 Index has fallen by -120.83 points (-0.97%) and currently trades at 12,375.60

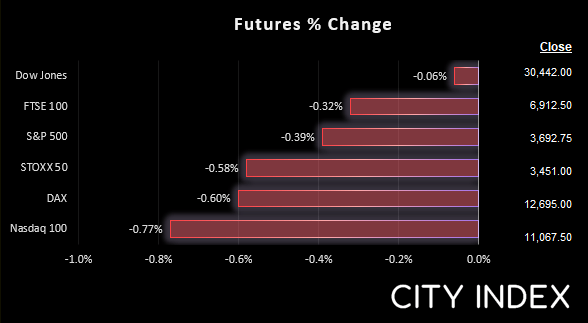

UK and Europe:

- UK's FTSE 100 futures are currently down -24.5 points (-0.35%), the cash market is currently estimated to open at 6,900.49

- Euro STOXX 50 futures are currently down -19 points (-0.55%), the cash market is currently estimated to open at 3,452.24

- Germany's DAX futures are currently down -72 points (-0.56%), the cash market is currently estimated to open at 12,669.41

US Futures:

- DJI futures are currently down -23 points (-0.08%)

- S&P 500 futures are currently down -85.75 points (-0.77%)

- Nasdaq 100 futures are currently down -14.25 points (-0.38%)

BOJ support the bond market (again)

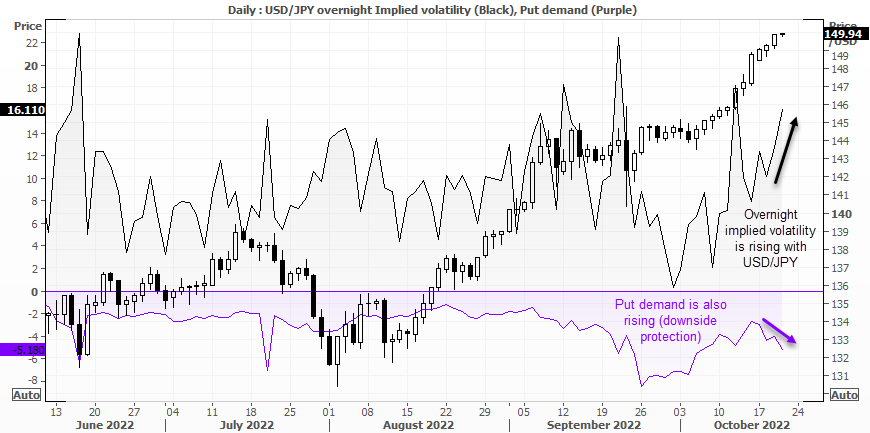

The BOJ announced emergency bond-buying operations after the yield on their 10-year government bond traded above 0.25% for a second consecutive day and USD/JPY came close to breaking above ¥150. It seems almost inevitable that USD/JPY will break, but the question is what will happen when it does. Not only could it entice further stern ‘words’ from MOF or BOJ officials, but it could also invoke volatility as options at 150 get defended and traders either try to fade the move or book a quick profit.

Perhaps not surprisingly, put demand for USD/JPY overnight options (downside protection) has risen to a 2-week high and implied volatility is now at a 1-week high.

Gold

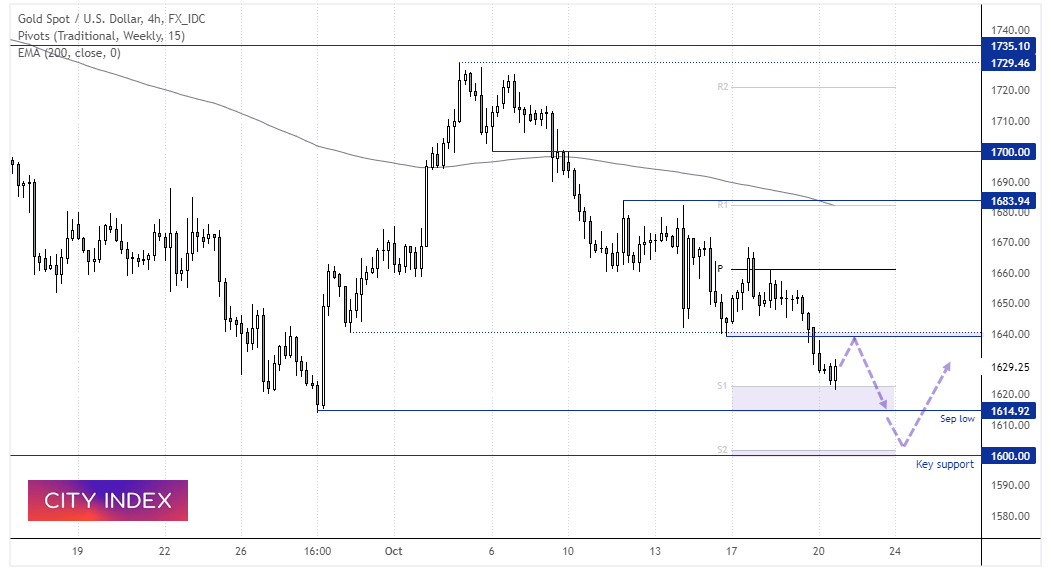

It’s been another tough week for gold bulls, but we’re fast approaching key lows which I’d expect to provide some relief – at least initially - such as the September low at 1614.92 and of course that big round 1600 level. That still leaves the potential for some downside to appease the bears, although reward to risk also needs to be considered depending on the timeframe chosen.

But we’ve also seen managed funds and large speculators reduce short exposure these past two weeks, so they’re obviously getting a bit nervous at these lows despite the rising yields and the dollar – market don’t move in a straight line, after all. A break below 1600 could see them return to the table.

Support has been found at the weekly S1 pivot and the H4 candle is on track for a bullish engulfing candle, If prices bounce, we’d look for evidence of a swing high below 1640, with the next support level for bears to target likely being around the September low. A break beneath which brings 1600 into focus, which would come as a surprise if prices didn’t bounce from that level due to its significance.

DAX performance:

FTSE 350 – Market Internals:

FTSE 350: 3814.32 (-0.17%) 19 October 2022

- 67 (19.14%) stocks advanced and 276 (78.86%) declined

- 1 stocks rose to a new 52-week high, 4 fell to new lows

- 13.71% of stocks closed above their 200-day average

- 20.86% of stocks closed above their 50-day average

- 14.57% of stocks closed above their 20-day average

Outperformers:

- +12.3% - ASOS PLC (ASOS.L)

- +5.56% - RHI Magnesita NV (RHIM.L)

- +2.48% - ITV PLC (ITV.L)

Underperformers:

- -15.39% - Moneysupermarket.Com Group PLC (MONY.L)

- -6.56% - Quilter PLC (QLT.L)

- -6.34% - Trainline PLC (TRNT.L)

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade