Asian Indices:

- Australia's ASX 200 index fell by -34.5 points (-0.47%) and currently trades at 7,301.80

- Japan's Nikkei 225 index has risen by -344.87 points (1.26%) and currently trades at 27,128.23

- Hong Kong's Hang Seng index has risen by 5.33 points (0.03%) and currently trades at 20,534.82

- China's A50 Index has fallen by -89.01 points (-0.65%) and currently trades at 13,624.56

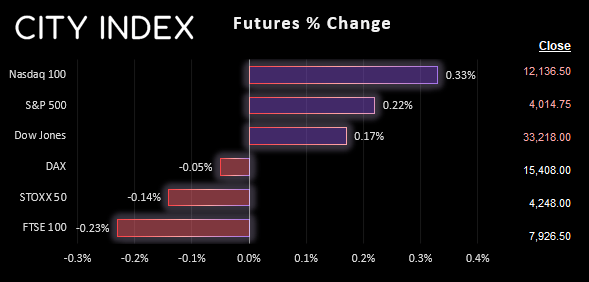

UK and Europe:

- UK's FTSE 100 futures are currently down -18 points (-0.23%), the cash market is currently estimated to open at 7,959.75

- Euro STOXX 50 futures are currently down -6 points (-0.14%), the cash market is currently estimated to open at 4,244.40

- Germany's DAX futures are currently down -8 points (-0.05%), the cash market is currently estimated to open at 15,389.62

US Futures:

- DJI futures are currently up 56 points (0.17%)

- S&P 500 futures are currently up 39.75 points (0.33%)

- Nasdaq 100 futures are currently up 9 points (0.22%)

- Geopolitical tensions are on the rise with Putin suspending Russia’s involvement in a nuclear pact, whilst Biden touts his unwavered support for Ukraine (whilst in Ukraine)

- Asian equities were mostly lower as fear of hawkish central banks (in general) weighed on sentiment, following a weak lead from Wall Street

- Also not helping was the weak earnings and profit warning from Wallmart – the world’s largest retailer – based on expectations of lower consumer spending

- NZD was the strongest major after the RBNZ’s (slightly) hawkish hike – where more hikes are coming, but 75bp increments are likely a thing of the past

- AU wage data was softer than the RBA’s and economists forecasts, which likely tames the hawks, keeps the RBA on track for a 25bp hike in March and May (but not soft enough to warrant a pause)

- Economic data across the Euro Area and UK has surprised to the upside recently, with yesterday’s PMI reports showing surprise expansions in places and sparking talks of ‘green shoots’ for the economy

- And there’s the potential to build upon that sentiment today, should German inflation at 07:00 comes in softer than forecast and business sentiment at 09:00 become another beat

- But the main event for today is actually the release of the FOMC minutes tonight at 19:00 GMT – for which we have gold in focus

The FOMC minutes have become increasingly important this week

The rise of US yields and increased expectations of a 50bp March hike mean the minutes have become of greater importance. As traders had assumed a 25bp February hike was practically a given, it could come as a surprise if we learn that the Fed were closer to opting for a 50bp hike than previously assumed – and that would likely increase bets of a 50bp hike in March, given the slew of strong US economic data we’ve seen of late.

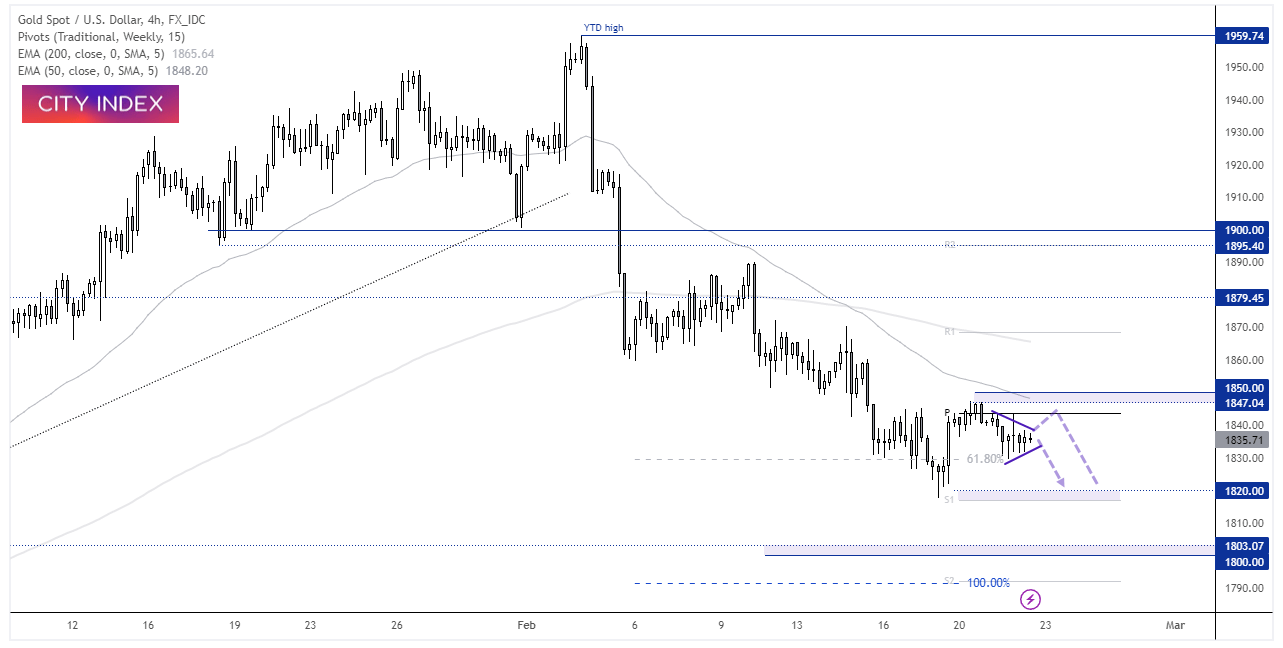

Gold 4-hour chart

Gold remains within a downtrend on the 4-hour chart and consolidating near its lows. You could say its leaning on the ropes, but also doing quite well considering how strong US yields performed yesterday. On the assumption that markets are sensitive to perceived hawkish FOMC minutes, I suspect gold will trey to push lower and test the lows around $1820. We may seen an initial move higher (given Friday’s bullish hammer on the daily chart), but the weekly pivot point and $1850 handle loom above – which I suspect will cap upside potential for now.

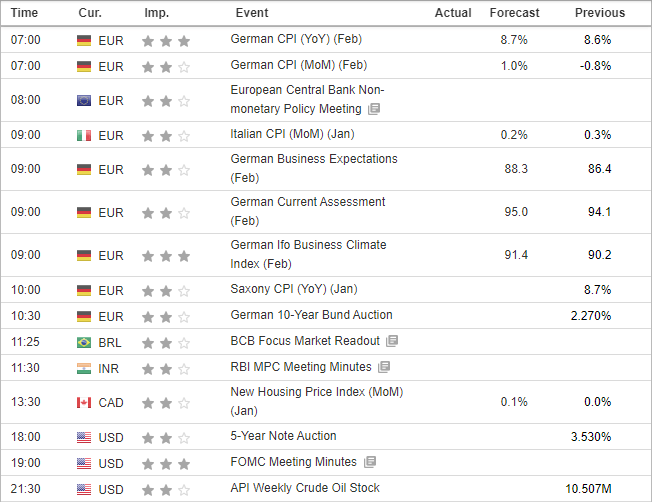

Economic events up next (Times in GMT)