Asian Indices:

- Australia's ASX 200 index rose by 15.4 points (0.21%) and currently trades at 7,433.20

- Japan's Nikkei 225 index has fallen by 243.66 points (-0.88%) and currently trades at 27,427.32

- Hong Kong's Hang Seng index has risen by 46.77 points (0.22%) and currently trades at 21,211.19

- China's A50 Index has fallen by -52.21 points (-0.38%) and currently trades at 13,685.07

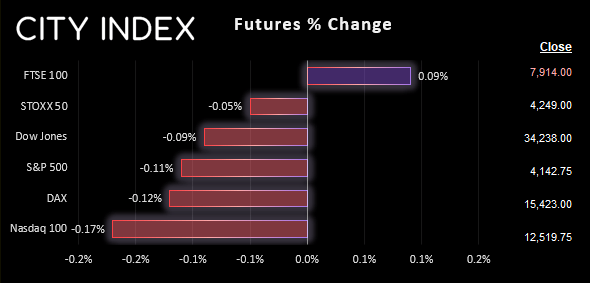

UK and Europe:

- UK's FTSE 100 futures are currently up 7 points (0.09%), the cash market is currently estimated to open at 7,954.60

- Euro STOXX 50 futures are currently down -2 points (-0.05%), the cash market is currently estimated to open at 4,239.36

- Germany's DAX futures are currently down -18 points (-0.12%), the cash market is currently estimated to open at 15,379.34

US Futures:

- DJI futures are currently down -31 points (-0.09%)

- S&P 500 futures are currently down -22 points (-0.18%)

- Nasdaq 100 futures are currently down -4.75 points (-0.11%)

- Japan’s government has officially nominated academic Kazuo Ueda as their choice for Governing the BOJ, when Kuroda leaves in April

- There are expectations growing that this could lead to the end of YCC (yield curve control), but if I’ve learned anything from the BOJ it is to not expect them to fulfil market expectations

- Japan’s economy bypassed a technical recession of two negative quarters, but only just with Q4 GDP rising just 0.2% below the 0.5% expected

- Mixed data from Australia saw household spending slow, a consumer survey flag unemployment expectations rising nearly 11% and print fourth lowest intentions to purchase big items, yet business confidence and conditions moved higher

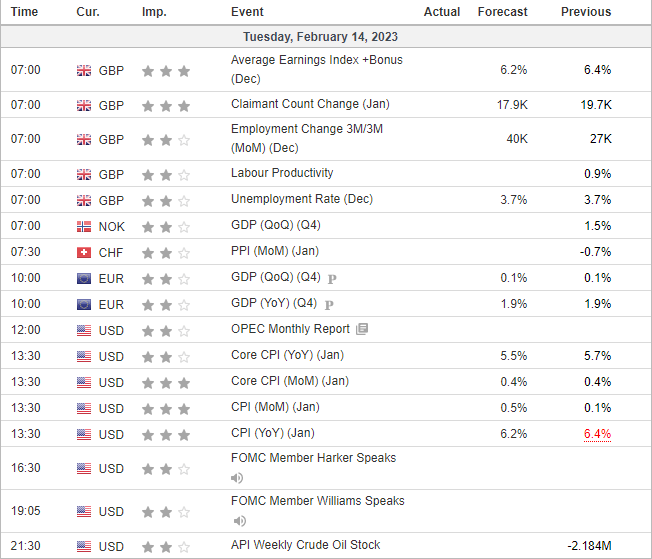

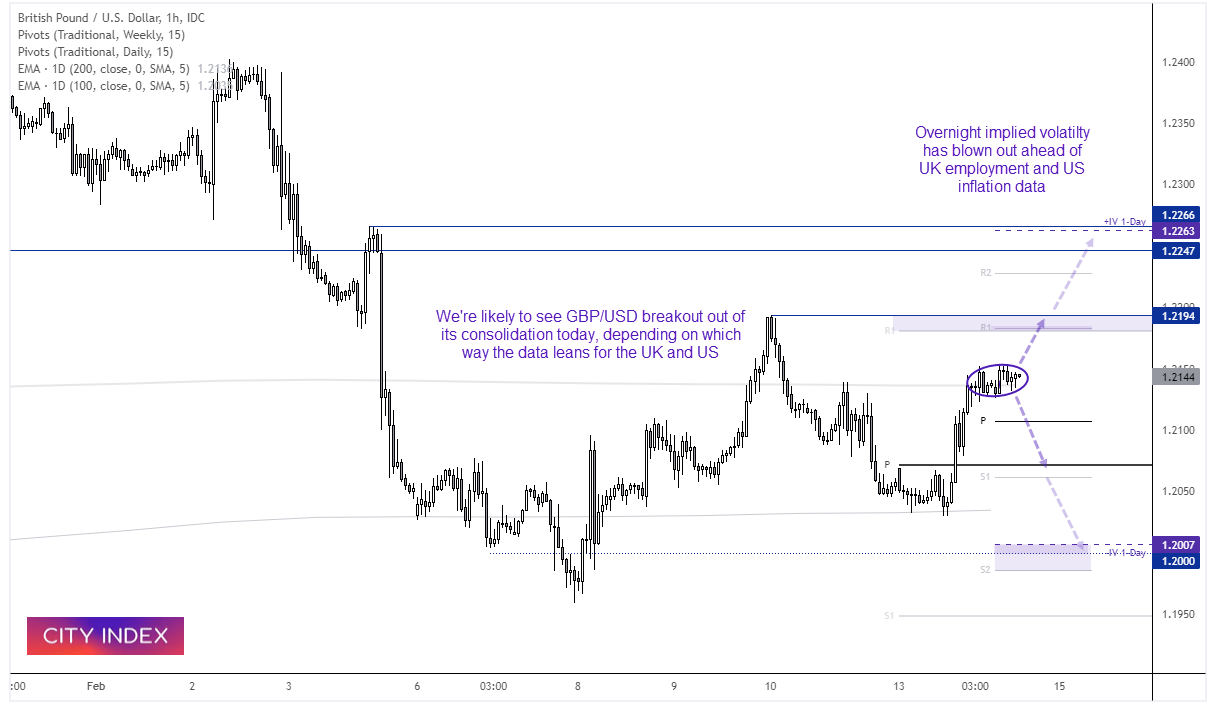

- UK wage data and US inflation are key economic data points today and likely to drive sentiment

- Implied volatility for GBP/USD has spiked to ~130 pips ahead of the data

- FOMC members Harker and Williams also speak at 16:30 GMT and 19:05 respectively

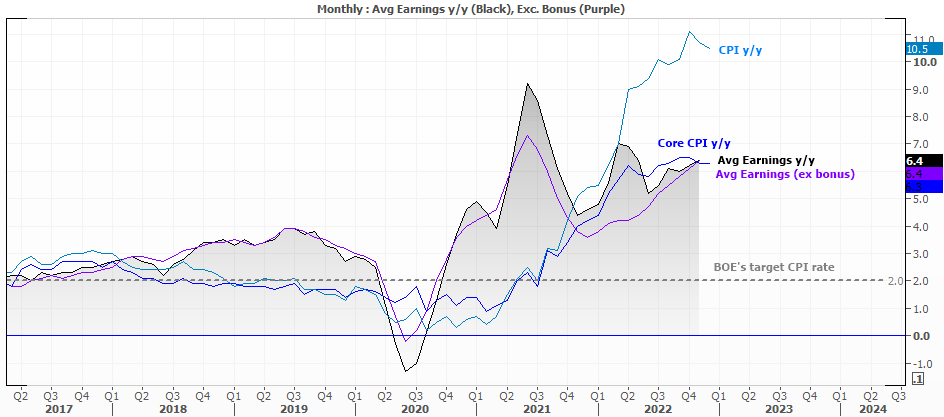

UK employment and wage data in focus before the open

The BOE (Bank of England) hiked rates by 50bp to 4.5%, and it could have been their last hike of such a magnitude. Whilst they had hinted of a pause in December, subsequent data pushed expectations back towards another 50bp hike, and whether they’ll slow down to a 25bp increment in March could be dictated by data over the next couple of days.

Average earnings – a key input for inflation – is part of the employment report scheduled for 07:00 GMT today. At 6.4% y/y it clearly remains too high for the BOE’s liking, but a tick lower in wages would be welcomed and could weigh on GBP, as traders assume less chance of a chunky 50bp hike in March. But we also have inflation data released tomorrow which sits at an eye-watering 10.5% y/y, over 5x their 2% target. Presumably what the BOE (and GBP bears) would like to see is a softer-than-expected data set from wages and inflation.

US inflation data could be the event of the week

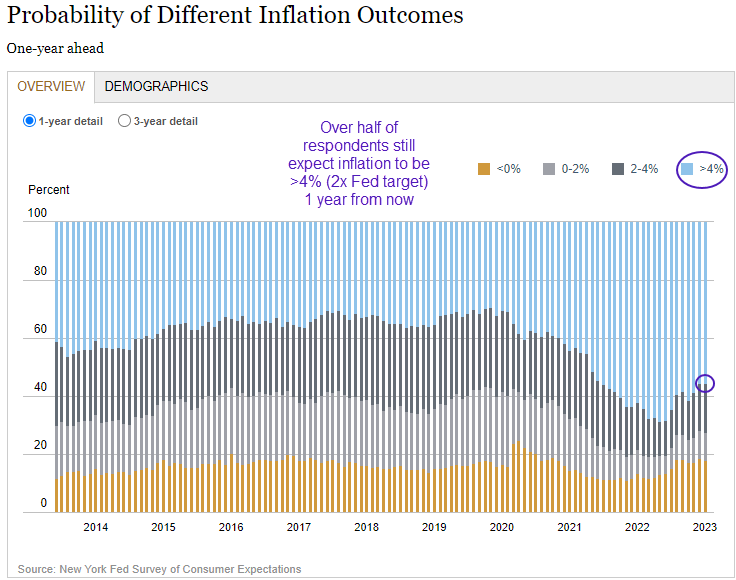

Of course, the real show in town is US inflation data at 13:30, as traders continue their obsession with the Fed’s terminal rate and likelihood of a cut (despite the fact the Fed are still hiking). It seems equity trader are taking it within their stride and pricing in a soft inflation report overall, which would likely be a weak US dollar event if it proves true. But I remain sceptical that the Fed are even thinking about cutting with inflation expectations remaining so high.

According to the NY Fed, 55.6% of respondents expect inflation to be over 4% 1-year from now (twice the Fed’s target). Moreover, 39.9% expect it to be over 4% three years from now. Even if it is not correct, expectations of inflation can drive inflation, and the Fed will want to see these drop further before even thinking of a cut.

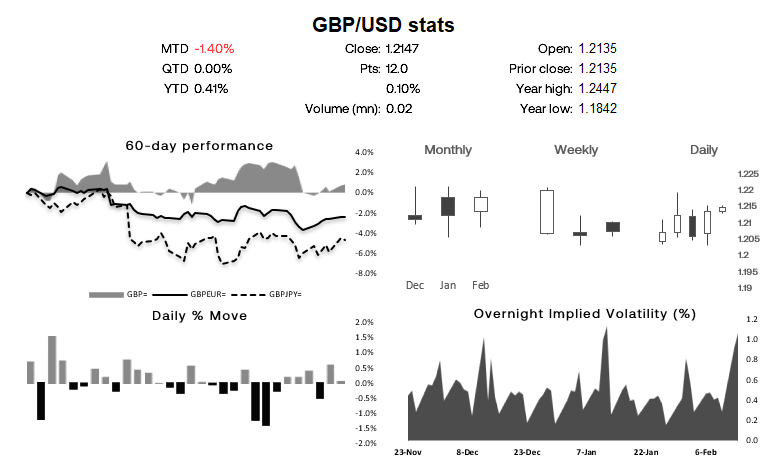

GBP1-hour chart and dashboard:

- Overnight implied volatility has risen to +/- 1.06% (128.28 pips)

- A bullish outside day formed yesterday

- GBP has outperformed USD, EUR and JPY over the past 60 days

- We’re looking for a divergent theme between UK wages and US inflation to dictate the direction of a strength of a clean breakout from GBP/USD’s current consolidation

GBP/USD is within a consolidation on the 1-hour chart after posting a strong rally earlier in the day. Yesterday’s low found support at the 100-day EMA before closing on the 200-day EMA – a level it is meandering around now.

But a slightly firmer wage report and soft US inflation could send it to a new cycle high, with strong UK inflation tomorrow potentially seeing it head for the highs around 1.2200. Conversely, we might see a clean bearish breakout from consolidation should wages and dip, and US inflation come in hotter than expected.

Economic events up next (Times in GMT)