Asian Indices:

- Australia's ASX 200 index rose by 113.4 points (1.65%) and currently trades at 6,976.90

- Japan's Nikkei 225 index has risen by 73.88 points (0.27%) and currently trades at 27,661.34

- Hong Kong's Hang Seng index has risen by 603.04 points (4.11%) and currently trades at 15,290.06

- China's A50 Index has risen by 280.12 points (2.5%) and currently trades at 11,505.41

UK and Europe:

- UK's FTSE 100 futures are currently up 43.5 points (0.61%), the cash market is currently estimated to open at 7,138.03

- Euro STOXX 50 futures are currently up 26 points (0.72%), the cash market is currently estimated to open at 3,643.54

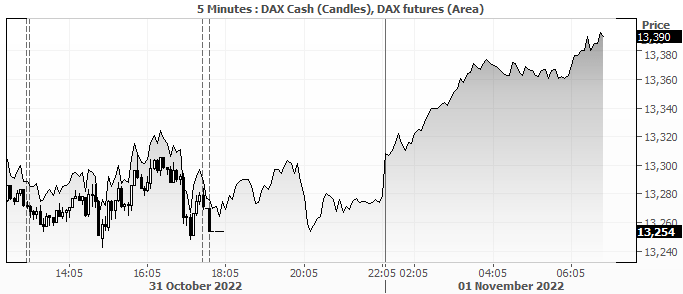

- Germany's DAX futures are currently up 98 points (0.74%), the cash market is currently estimated to open at 13,351.74

US Futures:

- DJI futures are currently up 147 points (0.45%)

- S&P 500 futures are currently up 72.25 points (0.63%)

- Nasdaq 100 futures are currently up 21 points (0.54%)

China’s manufacturing PMI contracted for a third month, although not as fast as feared. But with China still handing out lockdowns like free samples, it is difficult to construct a bullish case for the sector (and services is likely to have contracted as well). But the less-than-feared print allowed the Aussie to rally ahead of today’s RBA meeting.

The PBOC’s yuan fixing was lower than expected, sending USD/CNY to a 14-year low which left us wondering whether USD/CNH would break to a record high. For now, it seems it was not meant to be as the pair has pulled back from the October high. But it clearly looks supported ahead of tomorrow’s FOMC meeting. And Beijing appear happy to let their currency slide.

The RBA hiked interest rate by 25bp to 2.85%. This is their highest rate since 2013, there’ll be more to follow – although they seem happy with 25dp increments.

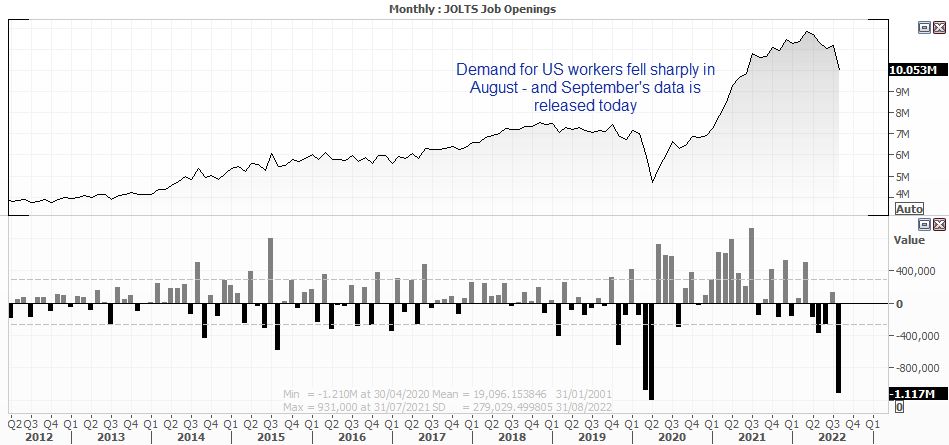

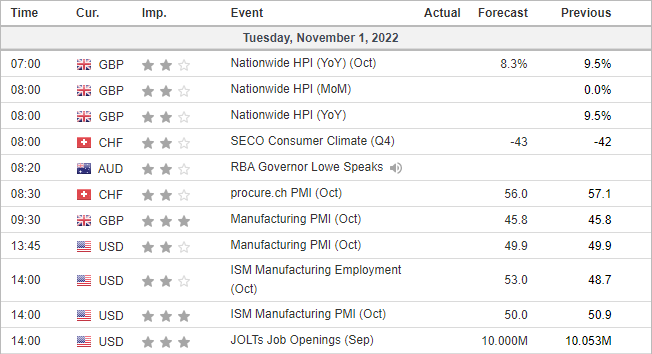

ISM manufacturing and JOLTS job openings in focus

ISM manufacturing is expected to contract for the first time since May 2020. This is a scenario I have mentioned since the beginning of the year, and the reality is it feels a little underwhelming because this global recession has been well advertised. New orders have also contracted 3 of the past 4 months, although ‘prices paid’ are at post-pandemic lows.

What may provide the more volatile reaction is if the JOLTS job openings report. Last month it fell -1.2 million (around -11%) which was its fastest monthly decline since the pandemic. It points to slower demand for employers, which are early warnings signs of a broken employment market. And if we see another dire print today, it could weigh on the dollar and support equities as traders continue to get over excited over a Fed pivot.

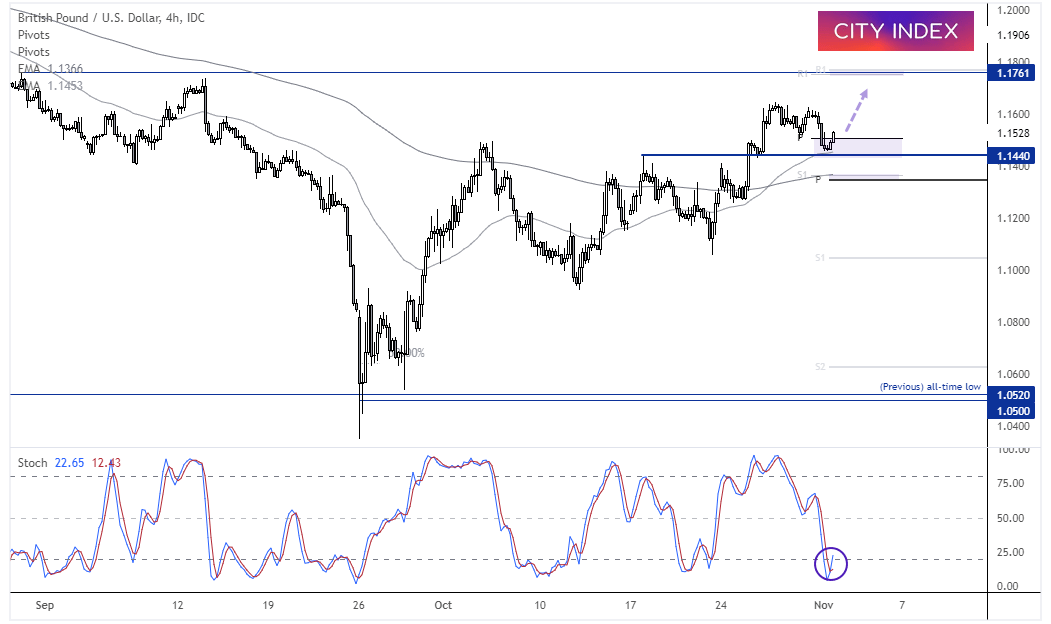

GBP/USD 4-hour chart:

The pound was lower yesterday following reports that tax hikes are indeed to come for the UK, over a course of years. But I think many would agree that is inevitable, and not a move limited to the UK.

GBP/USD is trending higher on the 4-hour chart and may have completed a 3-wave correction. It is holding above the 50-bar EMA, 1.1440 support level and is now back above the weekly pivot point. A stochastic buy signal has also formed. The weekly R1 pivot coincides with the monthly R1 and 1.1761 high, making it a potential target for bulls. Altough the interim level to focus on is of course yesterday’s high. A break below 1.1140 brings the weekly S1, monthly pivot point and 200-bar EMA into focus for bears.

FTSE 350 – Market Internals:

FTSE 350: 3914.69 (0.66%) 31 November 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 1 stocks rose to a new 52-week high, 5 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 9.90% - Helios Towers PLC (HTWS.L)

- + 6.46% - Wizz Air Holdings PLC (WIZZ.L)

- + 6.06% - Easyjet PLC (EZJ.L)

Underperformers:

- -6.27% - Petrofac Ltd (PFC.L)

- -4.64% - Bridgepoint Group PLC (BPTB.L)

- -4.54% - Oxford Instruments PLC (OXIG.L)

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade