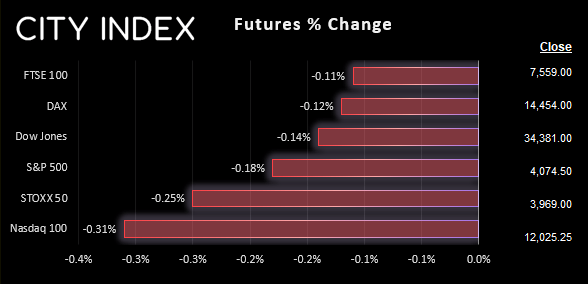

Asian Indices:

- Australia's ASX 200 index fell by -52.9 points (-0.72%) and currently trades at 7,301.50

- Japan's Nikkei 225 index has fallen by -474.72 points (-1.68%) and currently trades at 27,751.36

- Hong Kong's Hang Seng index has fallen by -132.44 points (-0.71%) and currently trades at 18,604.00

- China's A50 Index has fallen by -69.56 points (-0.54%) and currently trades at 12,708.63

UK and Europe:

- UK's FTSE 100 futures are currently down -7 points (-0.09%), the cash market is currently estimated to open at 7,551.49

- Euro STOXX 50 futures are currently down -10 points (-0.25%), the cash market is currently estimated to open at 3,974.50

- Germany's DAX futures are currently down -17 points (-0.12%), the cash market is currently estimated to open at 14,473.30

US Futures:

- DJI futures are currently down -46 points (-0.13%)

- S&P 500 futures are currently down -36.5 points (-0.3%)

- Nasdaq 100 futures are currently down -7.25 points (-0.18%)

Asian equity markets were lower as they absorbed weak manufacturing PMI data from the US, and likely booked profits after a few strong days ahead of today’s NFP report.

Currency markets were their usual quiet selves ahead of today’s nonfarm employment report, which is released alongside Canadian employment data which leaves USD/CAD vulnerable to extra levels of volatility.

Today’s NFP report is the main event for traders, and the consensus forecasts is for headline job growth to soften to 200k (261k previously), and the unemployment rate remain at 3.7%. A poor employment report only adds to the reasons for the Fed to stop hiking and could send the dollar lower, whilst a hot employment report suggests the economy can handle higher rates and could send the US dollar higher.

As things currently stand, markets are pricing in ~80% of the Fed hiking by 50bp – which is as good as a done deal as it is widely believed the Fed will act when they’ve convinced 70% of the market to price in.

OPEC+ meet (virtually) on Sunday, although expectations of a sharp supply cut appear to have fizzled out as this week has worn on. Perhaps dovish Fed comments and subsequently weaker US dollar have helped lower analyst expectations, but it would be prudent to manage risk accordingly over the weekend to avoid any unnecessary gaps at the Monday open.

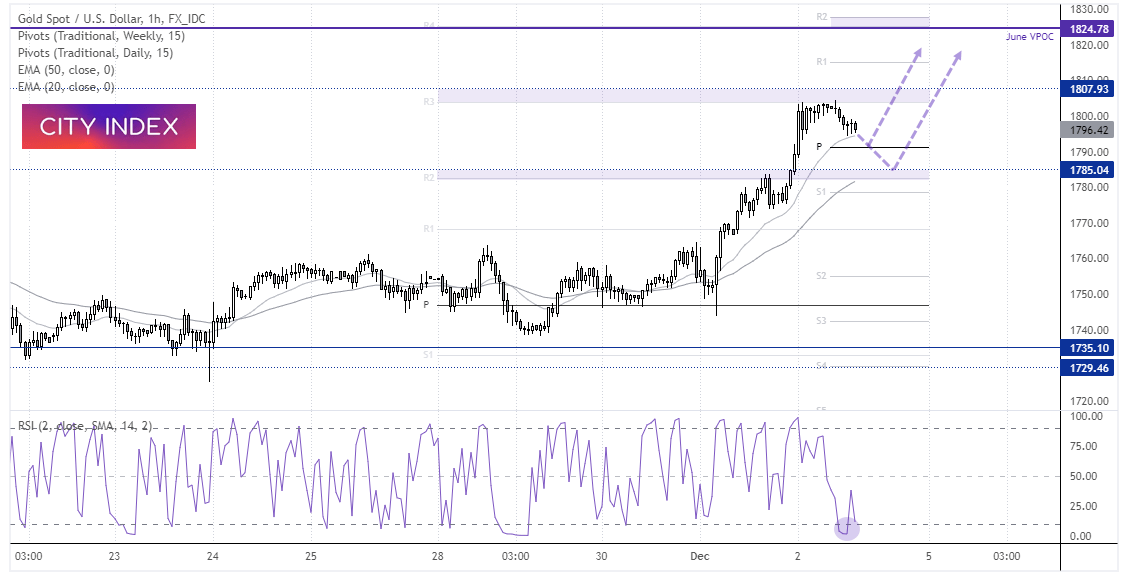

Gold 1-hour chart:

Gold closed above 1800, to a 3-month high during its best day in three weeks. However, the strong rally on the 1-hour chart met resistance at the weekly R3 pivot point and remains below the August high. A bearish divergence has formed on the RSI (2) ahead of a retracement, although it has now reached a very oversold level to suggest a low could be fast approaching.

Perhaps it can hold above the daily pivot point and form a swing low, with its next line of defence being 1785 highs. However, a weak or OK employment report will likely weaken the US dollar and send gold above 1808.

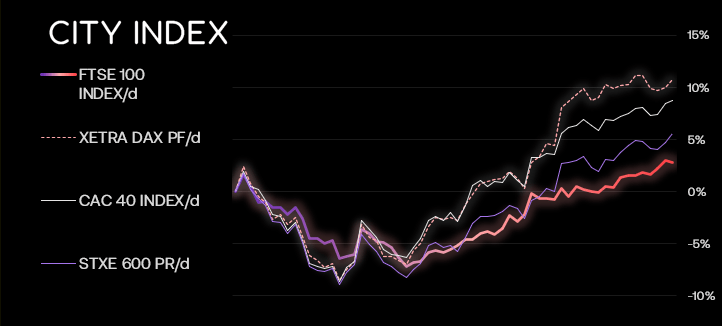

FTSE 350 market internals:

FTSE 350: 4181.79 (0.66%) 01 December 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 12 stocks rose to a new 52-week high, 1 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 8.19% - Bridgepoint Group PLC (BPTB.L)

- + 8.00% - Molten Ventures PLC (GROW.L)

- + 6.78% - Ocado Group PLC (OCDO.L)

Underperformers:

- -9.38% - Investec PLC (INVP.L)

- -8.05% - Auction Technology Group PLC (RBDR.L)

- -5.19% - Pearson PLC (PSON.L)

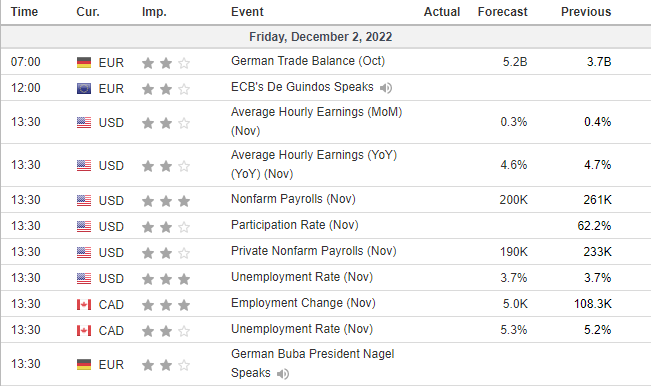

Economic events up next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade