Asian Indices:

- Australia's ASX 200 index rose by 42.5 points (0.64%) and currently trades at 6,637.00

- Japan's Nikkei 225 index has risen by 381.43 points (1.46%) and currently trades at 26,489.08

- Hong Kong's Hang Seng index has risen by 15.21 points (0.07%) and currently trades at 21,601.87

- China's A50 Index has risen by 82.08 points (0.56%) and currently trades at 14,782.03

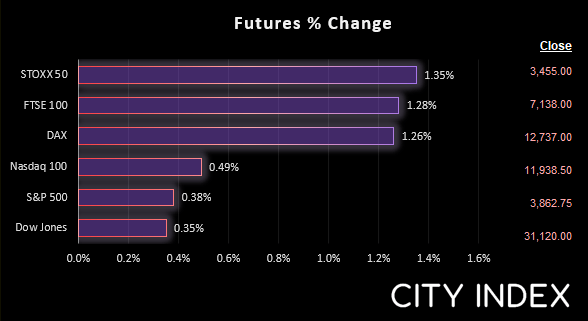

UK and Europe:

- UK's FTSE 100 futures are currently up 90.5 points (1.28%), the cash market is currently estimated to open at 7,198.27

- Euro STOXX 50 futures are currently up 46 points (1.35%), the cash market is currently estimated to open at 3,467.84

- Germany's DAX futures are currently up 158 points (1.26%), the cash market is currently estimated to open at 12,752.52

US Futures:

- DJI futures are currently up 110 points (0.35%)

- S&P 500 futures are currently up 59 points (0.5%)

- Nasdaq 100 futures are currently up 14.75 points (0.38%)

Boris clings on despite 44 resignations

Despite growing excitement from his foes, Boris Johnson will not face a new confidence vote this week. Instead, the Conservative Party Committee decided to elect a new executive before considering such a move, and the election for said member is on Monday. Therefore, a new vote of confidence would be next week at the earliest assuming there is one at all.

- 44 members of government have now resigned from the government in protest of Boris Johnson not stepping down as PM.

- Johnson maintains his defiance and vow not to design despite growing

- Johnson has fired Michael Gove, after Gove threatened to quit of Johnson did not resign.

AUD and NZD rally in Asia

AUD and NZD are the strongest currency after Australia reported a record trade surplus, thanks to the energy boom. Strong domestic demand coupled with rising coal and LNG exports saw the trade balance rise to $15.9 million and exports rise 9% in May.

The US dollar index has pulled back from its 1-year high, allowing commodity FX pairs to lift further from their lows. At some point the dollar’s rally will falter, but there are no obvious immediate signs. The closest clue we have to a loss in momentum on DXY (dollar index) is that yesterday’s bullish range was around half compared to Tuesday’s.

Gold 4-hour chart:

Clearly, a strong US dollar has been a key driver for the selloff seen on gold. But it is not the only reason, as capitulation appears to be a driver for gold right now. It cut through 1800 and 1750 like a hot knife through butter – but I’d usually expect some sort of support at such big levels. And as gold spent an extended period in choppy trading conditions above 1800, a break beneath it was a game-changer for many and likely triggered large stops and a rush for the exit.

Whilst prices remain below 1850 then the 1821 support level / September low could appeal to bears.

FTSE 350 – Market Internals:

FTSE 350: 3943.39 (1.17%) 06 July 2022

- 293 (83.48%) stocks advanced and 55 (15.67%) declined

- 4 stocks rose to a new 52-week high, 27 fell to new lows

- 16.24% of stocks closed above their 200-day average

- 28.49% of stocks closed above their 50-day average

- 5.98% of stocks closed above their 20-day average

Outperformers:

- +9.43% - Trainline PLC (TRNT.L)

- +3.96% - Scottish Mortgage Investment Trust PLC (SMT.L)

- +3.05% - Chrysalis Investments Ltd (CHRY.L)

Underperformers:

- ·-15.04% - Fresnillo PLC (FRES.L)

- ·-8.64% - Harbour Energy PLC (HBR.L)

- ·-5.62% - Energean PLC (ENOG.L)

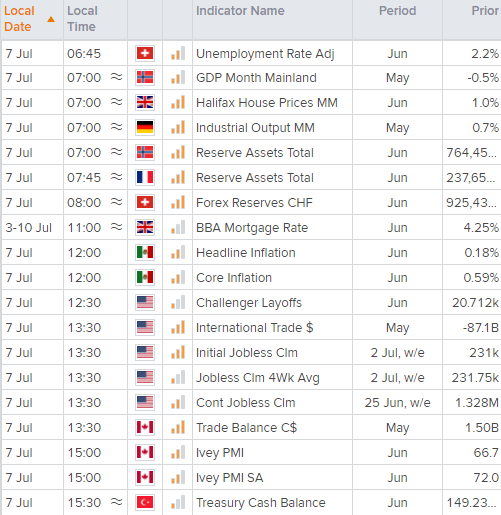

Economic events up next (Times in BST)

- BOE MPC member Catherine Mann speaks at 09:00 on “the rise of inflation and global monetary policy issues.

- BOE Chief Economist Huw Pill speaks at 17:05 on the economy.

- Canada release trade data at 13:30 and they’re going in from a position of strength, with exports having risen 28.4% y/y in April and a trade surplus of CA$1.5 billion.

- The Fed’s Waller and James Bullard speak at 18:00 speaks on the economy and monetary policy.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade