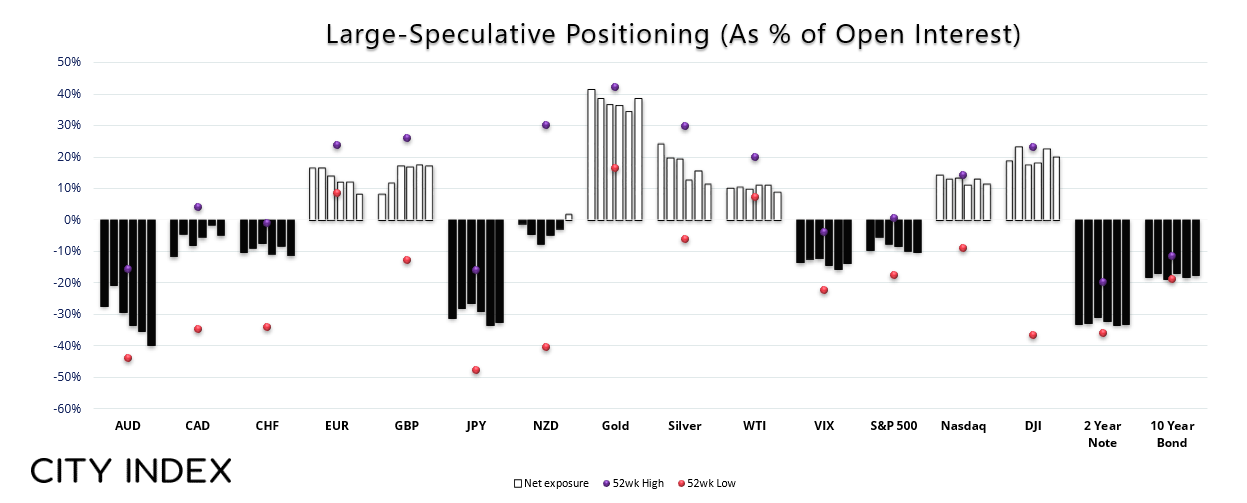

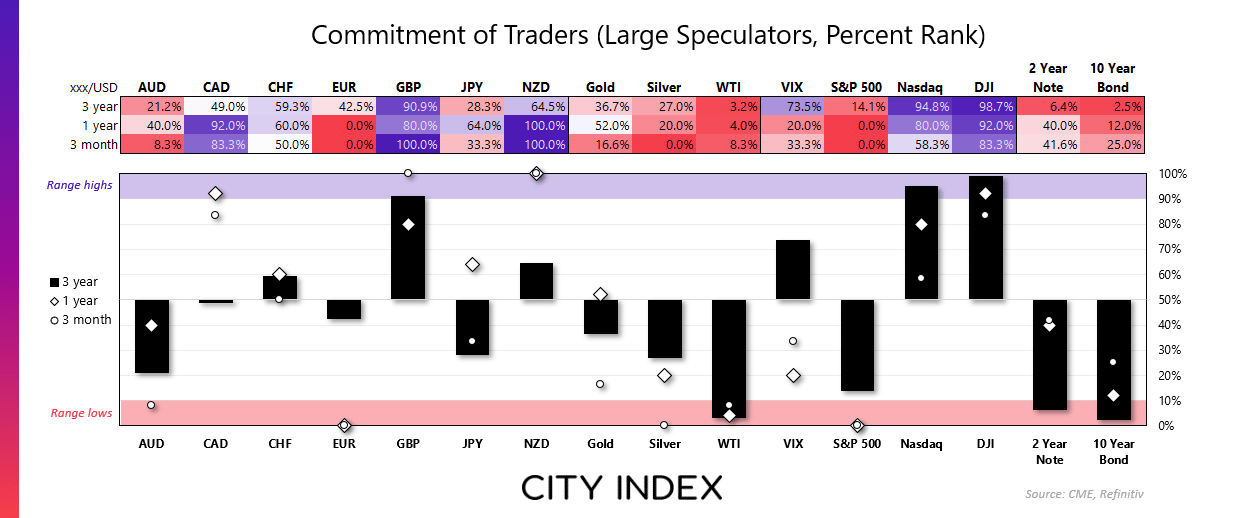

Market positioning from the COT report - as of Tuesday Feb 6, 2024:

- Gross-short exposure to EUR/USD futures rose at its most aggressive pace in 20 months, sending net-long exposure to a 68-week low

- Large speculators increased their net-short exposure to AUD/USD futures to an 11-week high

- Net-long exposure to gold futures rose for the first week in five

- Net-long exposure to GBP/USD futures rose to a 21-week high

- Large speculators flipped to net-long exposure to NZD/USD futures

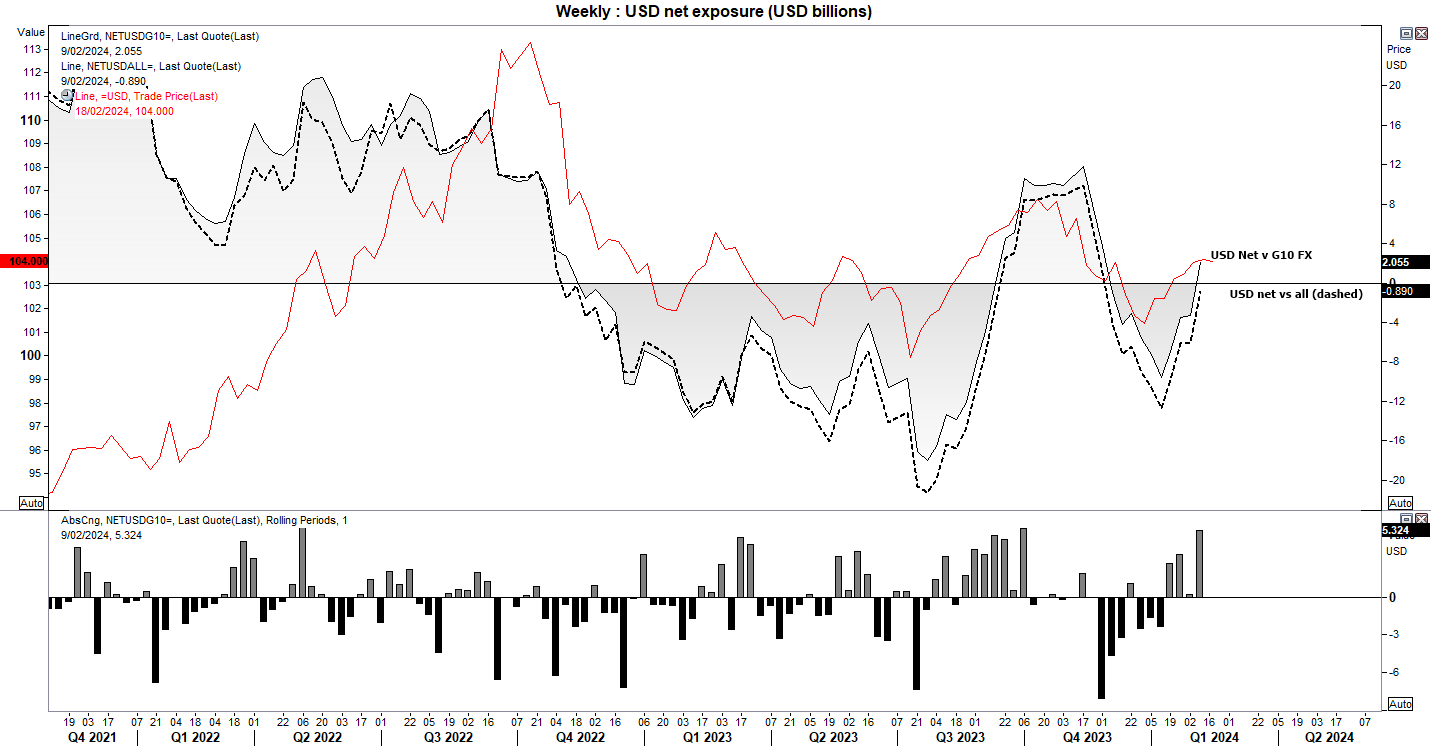

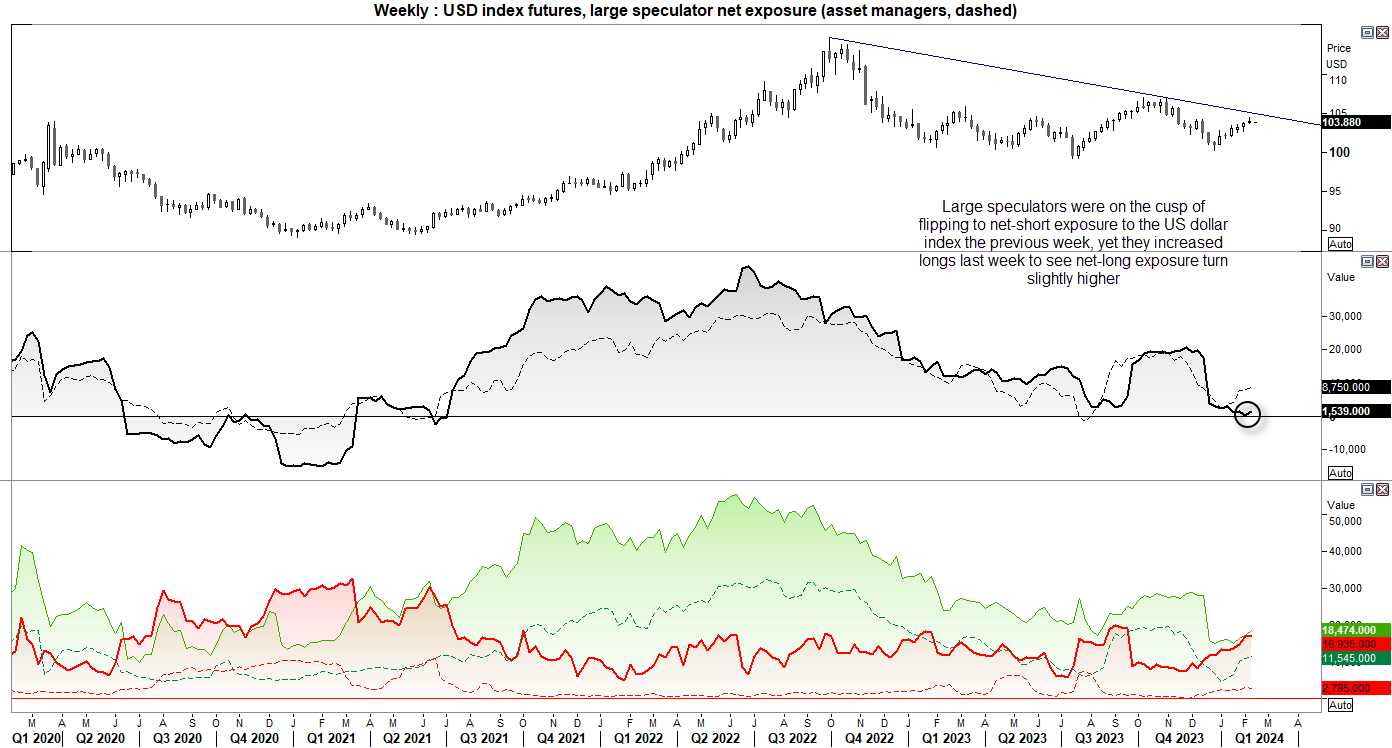

US dollar positioning (IMM data) – COT report:

Traders flipped to net-long exposure to the US dollar against G10 currencies according to data complied by IMM, which took positioning to its most bullish level in 10 weeks. And despite being on the cusp of flipping to net-short exposure the week prior, large speculators actually increased their net-log exposure to the US dollar index last week.

We can see on the weekly US dollar index chart that a small shooting star formed to warn of weakness around the highs, and that trend resistance resides around 104.50 – 105. I therefore suspect that the upside for the US dollar could be limited from here, which may provide a level of support for EUR/USD.

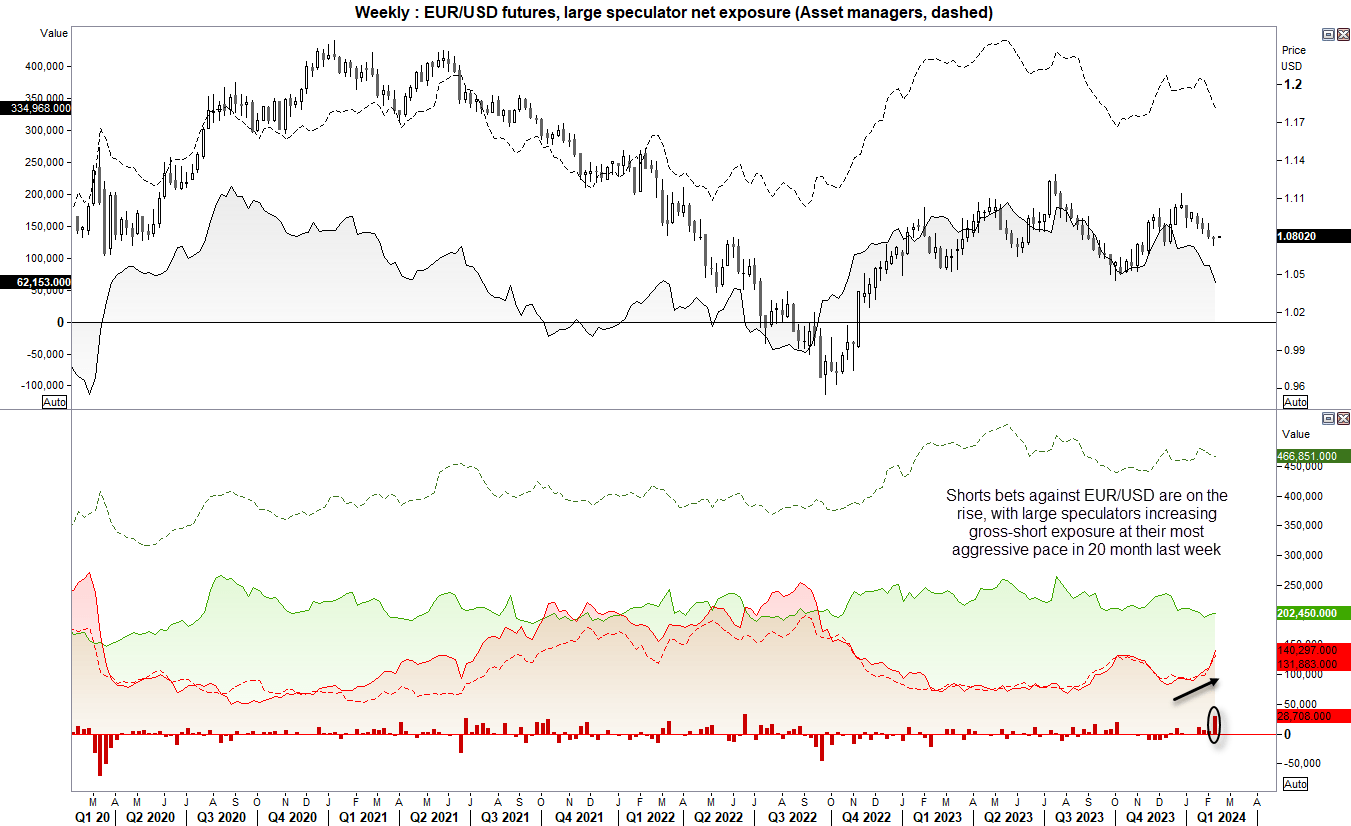

EUR/USD (Euro dollar futures) positioning – COT report:

Short bets against EUR/USD are on the rise, with large speculators increasing their gross-short exposure at their most aggressive pace in 20 months lasty week. Net-long exposure has now dipped to a 68-week low among large speculators, and a 13-week low among asset managers.

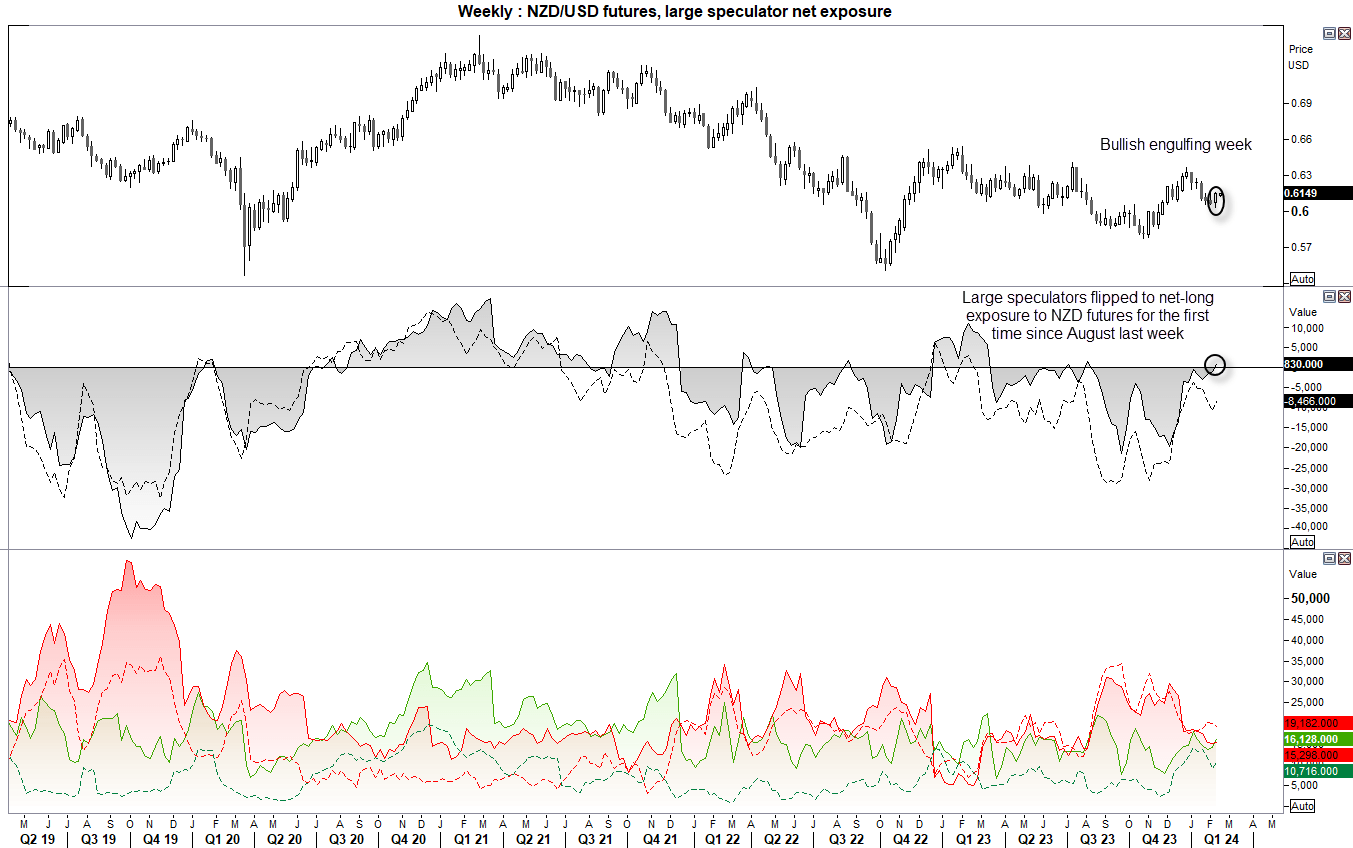

NZD/USD (New Zealand dollar futures) positioning – COT report:

It is interesting to see that large speculators flipped to net-long exposure to NZD/USD futures ahead of ANZ’s call for two more 25bp hikes from the RBNZ. Asset managers remain net short NZD/USD futures, although gross longs rose for both groups of traders whilst gross-shorts were rimmed. Take note of the bullish engulfing week on NZD/USD to suggest the Kiwi dollar may be the best bet to express a bearish view against the US dollar compared with its peers.

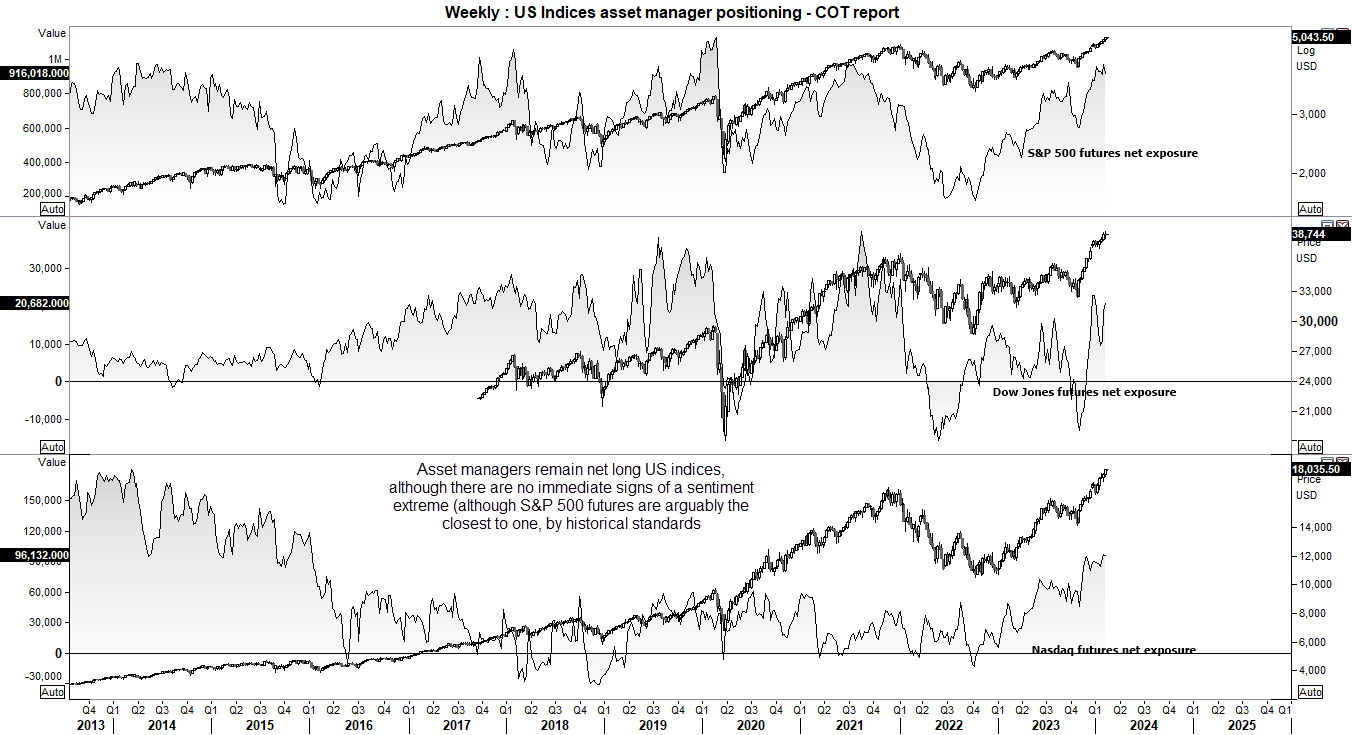

Nasdaq, S&P 500, Dow Jones futures (DJ) positioning – COT report:

Asset managers trimmed gross-long exposure to S&P 500 futures and increased their shorts at the fastest weekly pace in 15 weeks. They also trimmed long and short exposure to Nasdaq 100 futures, but not at an alarming rate. Besides, futures continued to print record highs after the report was compiled and have also gaped higher at this week’s open.

Ultimately, asset managers remain net-long against the Dow Jones, Nasdaq 100 and S&P 500 futures markets yet none are showing immediate signs of a sentiment extreme.

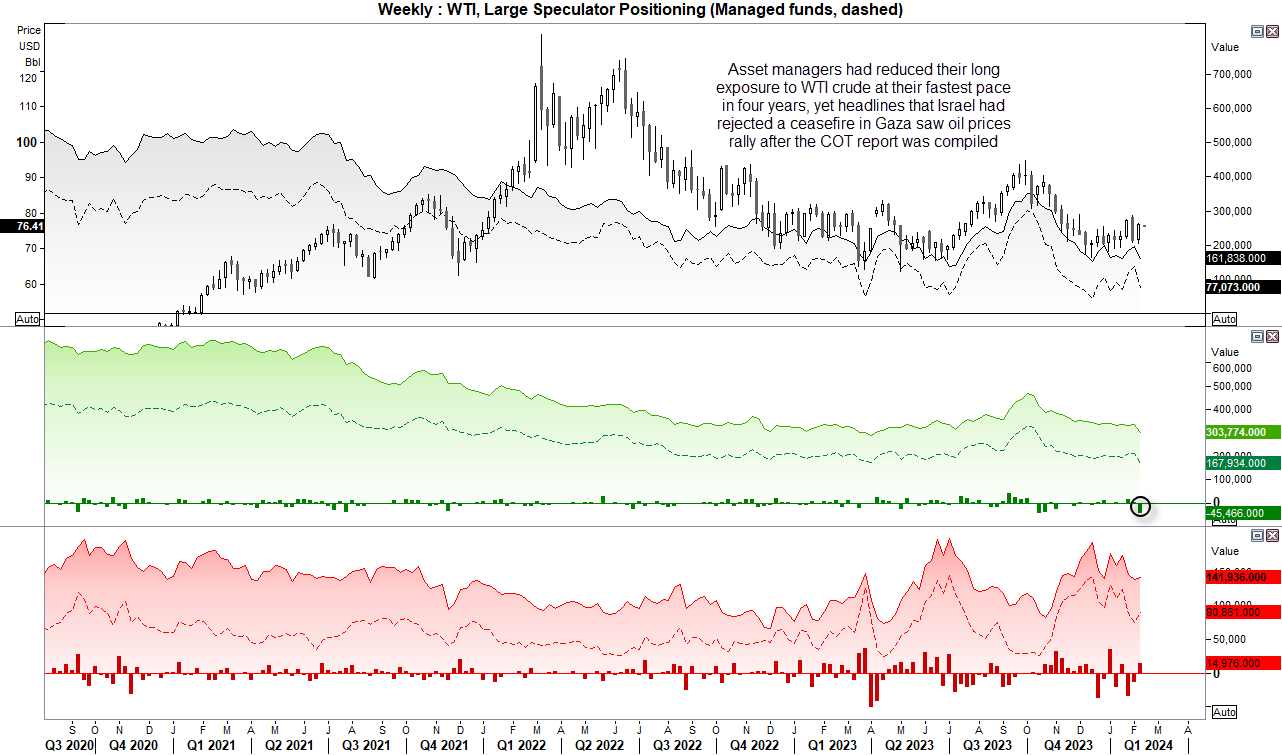

WTI crude oil (CL) positioning – COT report:

Market positioning suggests traders were taking a more bearish view on WTI crude oil, yet headline risks remain a key driver for oil markets and that saw oil post strong gains after the report was compiled on Tuesday. Managed funds had reduced their gross longs by the largest weekly amount in over four years, and large speculators had trimmed longs at their fastest pace in 17 weeks. Both sets if traders had also increased their short exposure, but the meat of the movements were in the culling of longs. Yet headlines that Israel had rejected a ceasefire lit a match under crude oil prices, so we can only assume many shorts have been covered and freshly-dumped longs reinitiated.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade