US futures

Dow futures +0.04% at 38860

S&P futures +0.28% at 5084

Nasdaq futures +0.4% at 17988

In Europe

FTSE +0.3% at 7621

Dax 0.58% at 17580

- Core PCE cools to 2.8% from 2.9%

- On a monthly basis, Core PCE rises to 0.4%

- C3.ai rallies after upbeat earnings

The market reacts to cooling inflation

U.S. stocks point higher as investors digest the latest reading of the Fed's preferred inflation gauge -core PCE.

Core PCE came in as expected, easing to 2.8% annually in January, down from 2.9%, while on a monthly basis, core PCE increased by 0.4% after rising by 0.2% in the previous month.

This monthly increase was the fastest pace of inflation acceleration in almost a year, supporting the Fed's view that a patient approach to cutting interest rates is needed.

Meanwhile, personal spending slowed to 0.2% in January, down from 0.7% in December, marking the first drop in five months.

The market reaction of a falling U.S. dollar and rising stocks suggests that investors interpret the data as dovish, focusing on the steady annual decline in inflation and the slowing spending.

The data comes as Federal officials have repeatedly said they need more evidence that the inflation rate is falling towards the 2% target before they start cutting interest rates, insisting it's too soon to begin loosening monetary policy just yet.

This is the final core CPE report that the Fed will have before the March FOMC meeting. However, the market has priced out expectations of a rate cut. Instead, the market is leaning towards a June rate cut which is 63% priced in.

Corporate news

C3.aI rises 15% premarket after a better-than-expected Q3 report. The AI tech company posted a loss per share of $0.13 in Q3, ahead of the forecasted loss per share of $0.28. Revenues rose to $78.4 million, well ahead of estimates of $76.14 million.

Best Buy is set to rise over 2% on the open after the electronics retailer posted a smaller-than-expected fall in quarterly sales and holiday promotions prompted shoppers to buy goods.

Snowflake falls premarket after the cloud data analytics company disappointed with its full-year 2025 guidance. The stock fell 21% in premarket trading, with the company guiding full current quarter product revenue between $745 million and $750 million, below average estimates of $765 million.

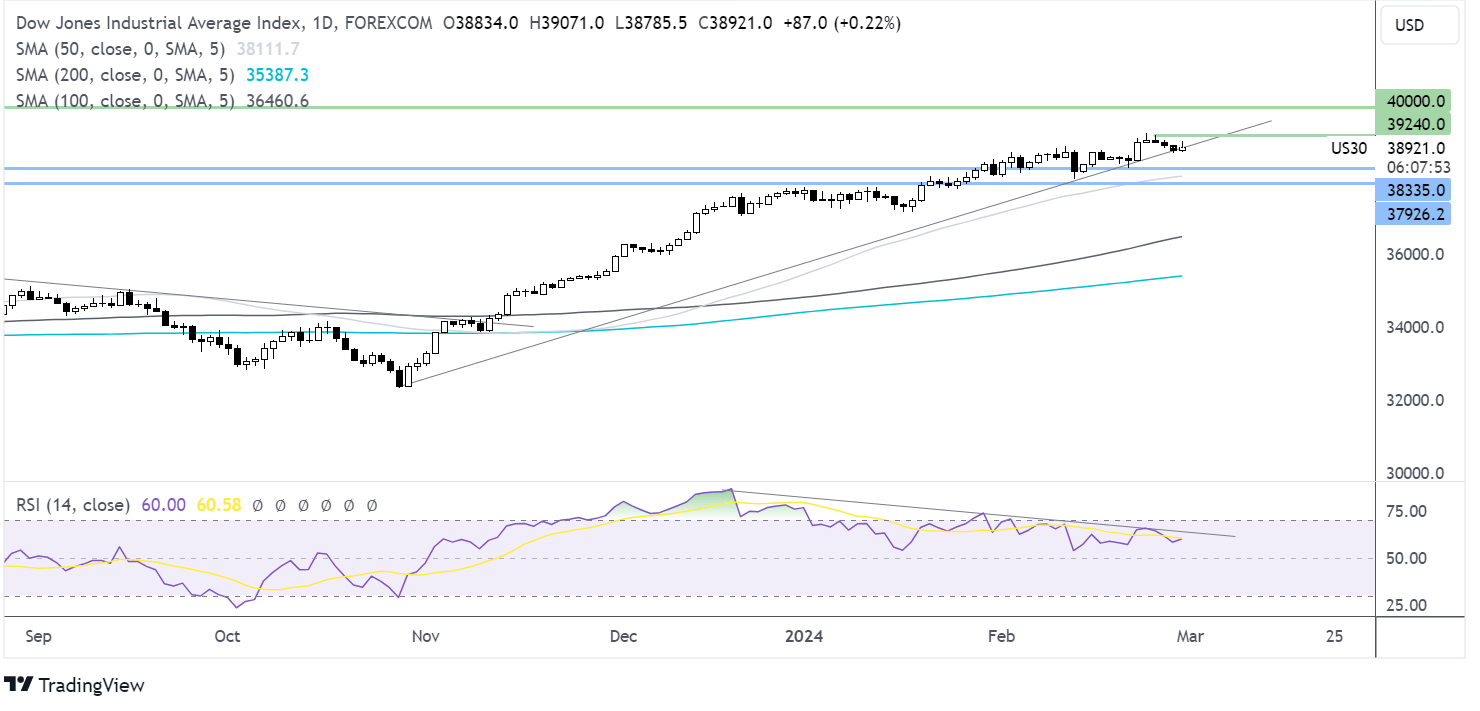

Dow Jones forecast – technical analysis

After running into resistance at 39240, a record high at the start, the price has eased lower and is testing the multi-month rising trendline support. The RSI bearish divergence suggests buyers could struggle from here. A break below here could open the door to 38335, last week’s low, and 38000, the February low. Meanwhile, should the trendline support hold, buyers could look for a rise of 39240 for fresh all-time highs.

FX markets – USD falls, USD/JPY drops

The U.S. dollar is inching lower following the inflation report as inflation cooled in line with forecasts, inching slowly toward the Fed's 2% target.

EUR/USD is falling after German inflation came in cooler than expected, falling by 2.6%, down from 2.9% in January. German retail sales were also weaker, unexpectedly falling 0.4% after dropping zero points at 1.6% in the previous month. The data supports the view that the ECB could move sooner to start cutting interest rates, although attention is on tomorrow's eurozone inflation data for further clues.

USD/JPY fell sharply in European trade after hawkish comments from Bank of Japan policymakers fueled bets that the central bank could move away from negative interest rates sooner rather than later.

Oil holds steady

Oil prices are holding steady with US inflation data in focus but are on track to book gains across the month of February, marking the second straight monthly gain. Oil prices are set to rise 3.6% this month after increasing 5% in the previous month.

According to a report and Reuters, expectations are for oil prices to fall over the coming months as disruption in the Red Sea has less impact than initially expected, and the geopolitical risk premium remains modest.