- Crude oil analysis: Why haven’t prices stopped falling?

- Will the OPEC do more to support prices?

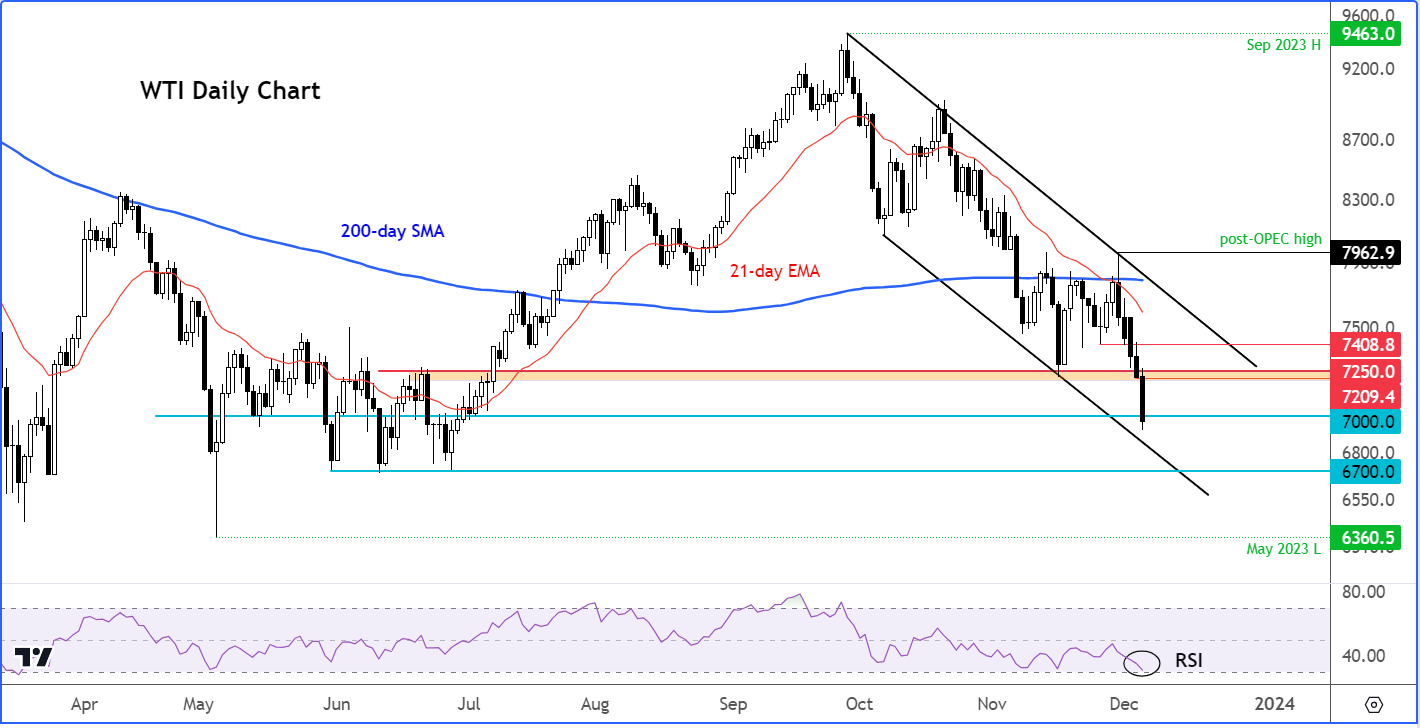

- Technical levels to watch on WTI

Crude prices remain on a slippery slope after the OPEC+ failed to impressive with their voluntary output cuts last week. From Thursday’s high point, oil prices have now fallen about 12% so far. On Wednesday, Brent dropped below $75 and WTI took out $70, with both contracts falling in excessive 3.5% each on the day. The selling has gathered pace as more and more support levels gave way. So far, there was no end in sight in the sharp drop. But prices do look severely oversold. A bounce should not come as major surprise now.

Crude oil analysis: Why haven’t prices stopped falling?

There are various reasons for this, both fundamental and technical.

The market is doubtful about the efficacy of the OPEC’s latest output cuts, just as the US exports of crude are continuing to grow. So, investors have become more worried about excessive non-OPEC supply recently, while fears about demand have also intensified.

The global economy is at a standstill because of high interest rates and the impact of past inflation spike is continuing to hurt consumers and businesses alike, not least because the disinflationary process has been so slow. But I don’t think the global economy is doing so bad that prices should fall massively further from these levels. Oil prices are demand-inelastic anyway, which means the supply-side of the equation has a much larger impact.

The trouble is this: the market is doubtful about the efficacy of the OPEC’s latest output cuts. It also doesn’t help when you hear headlines like Saudi Arabia are lowering their prices for crude destined for the Asian market. The fact that US is exporting near 6 million barrels of the black stuff per day also makes the job of oil producers in the OPEC+ group difficult, as they have to give up more market share as part of their agreement to withhold supplies. Some can’t afford to lose market share to the US, so they are not comfortable to cut further.

Will the OPEC do more to support prices?

The OPEC+ last week agreed on voluntary output cuts of about 2.2 million barrels per day for the first quarter of 2024. We have since heard from officials in Saudi and Russia that their cuts could be extended and/or deepened beyond Q1. Let’s see if the visit of Russian president Vladimir Putin, who travelled to the UAE and Saudi Arabia to meet with the UAE's President Sheikh Mohammed Bin Zayed Al Nahyan and Saudi Crown Prince Mohammed bin Salman, will yield into anything significant.

Crude oil analysis: technical levels to watch

From a technical point of view, the fact that more and more support levels are giving way, this is further fuelling the momentum selling. Today we saw WTI take out $70 and Brent plunged below $75. A lot of trading usually takes place around these round and psychological levels. Given that prices have now fallen a huge 12% from their respective highs made on Thursday, we could well see an oversold bounce soon.

So, a potential rebound could be triggered by short covering, even if the bulls are nowhere to be seen. But just because there is the potential for such bounces, this doesn’t necessarily mean oil prices will bottom out. We will need to see a confirmed reversal signal before we even discuss the upside potential.

Anyway, WTI is looking quite overstretched here as it tests liquidity below the $70.00 handle. Let’s see if the bulls will step in or allow prices to drift further lower towards the next key support at $67.00 from here.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade