When is the September US CPI report?

The US Bureau of Labor Statistics (BLS) will release the September Consumer Price Index (CPI) report Thursday, October 13 at 8:30 ET.

What are economists expecting for September CPI?

Consensus expectations are for headline CPI to come in at 0.2% m/m, 8.1% y/y, with the Core (ex-food and -energy) CPI report expected to print at 0.4% m/m, 6.5% y/y.

CPI preview

When it comes to markets, change is the only constant.

Back in the early 1980s, the US trade balance was THE monthly economic release to watch for traders. For the 2010s, THE top-tier monthly release was the Non-Farm Payrolls (NFP) report. And now, while traders still keep an eye on trade balance readings and employment, THE release to watch each month is the US CPI report.

With the Fed clearly satisfied with the level of employment, the other half of its dual mandate, price stability, is the sole factor driving monetary policy decisions at the world’s most important financial institution. Though the central bank reportedly favors the more arcane Core Personal Consumption Expenditures (PCE) measure of price pressures, the general US populace (and by extension, politicians heading into a key mid-term election cycle) is more focused on the CPI reading.

As we noted above, traders are expecting the headline CPI reading to moderate to 8.1% y/y from 8.3% y/y last month. Notably, an as-expected print would also bring the 3-month annualized rate of consumer inflation to just 1.2% from above 10% in both Q1 and Q2 of this year. However, the core inflation rate is likely to be stickier, with the year-over-year core CPI reading expected to rise to 6.5% from 6.3% last month; this potential for a continued rise in “core” inflation is what the Fed is worried about, and it is the component of the CPI report that could cement another 75bps interest rate hike from the Fed early next month.

According to the CME’s FedWatch tool, Fed Funds futures traders are already pricing in about an 80% chance of such a move in November. Perhaps more importantly, after a solid jobs report last week, traders have started to open the door for yet another 75bps hike in the FOMC’s December meeting, and therefore a hotter-than-expected inflation reading on Thursday could still lead to another leg higher in the greenback and a continuation lower in risk assets.

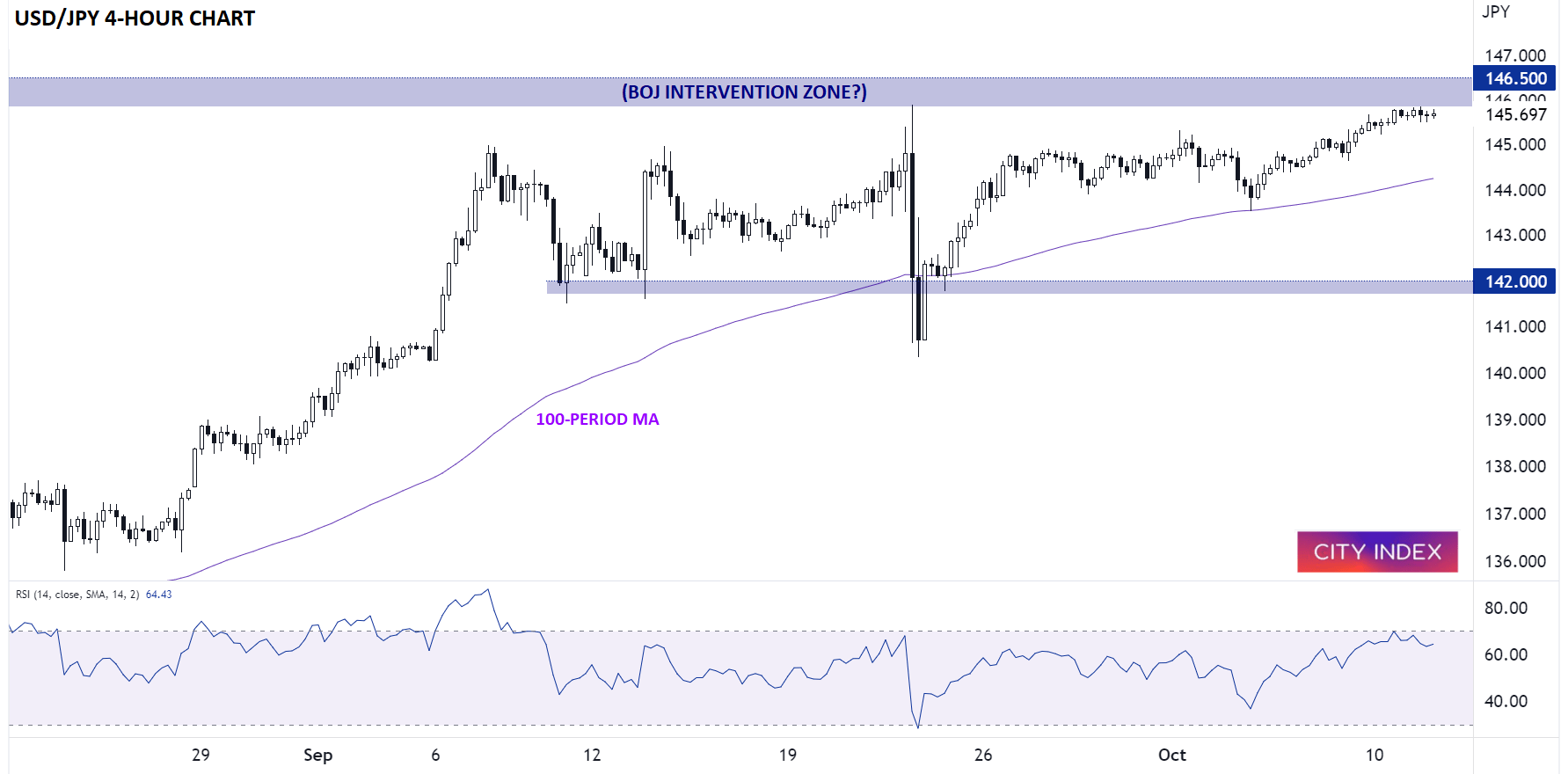

Technical view: USD/JPY

As the chart below shows, USD/JPY is once again probing 30+ year highs above 145.00. Traders are understandably wary of pushing rates higher as the pair is within a couple dozen pips of where the BOJ intervened to support the yen last month, but an elevated inflation reading may give them the confidence to push the pair above 146.00 and prompt the BOJ to push back its Maginot Line toward 150.00 as the gap in relative economic performance on either side of the Pacific widens.

Alternatively, a sharp slowdown in US price pressures could lead to a quick drop in USD/JPY, with room down to test the bottom of the range over the last month in the 142.00 area.

Source: TradingView, StoneX

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade