Yesterday, the US released Housing Starts for January, which were down -4.1% MoM vs -0.5% MoM expected and 0.3% MoM in December. This was the first drop since September 2021 and the largest drop since the -5.7% MoM print in July. Today the US released Existing Home Sales at 6.7% MoM vs an estimate of -1% MoM and December’s print of -3.8% MoM. Earlier in the week, the MBA 30-Year Mortgage Rate for the week of February 11th was 4.05%. This was the highest level in over 2 years. Are home buyers rushing to buy ahead of a rise in interest rates? Do builders see the writing on the wall and are beginning to build less houses? If so, we may see housing purchases come down, as well as housing prices. The S&P/Case Schiller Home Prices (DEC) for December will be released next week. An increase of 0.8% is expected, however note that this data is for December house prices, as opposed to housing data which was for January.

How do interest rates affect financial markets?

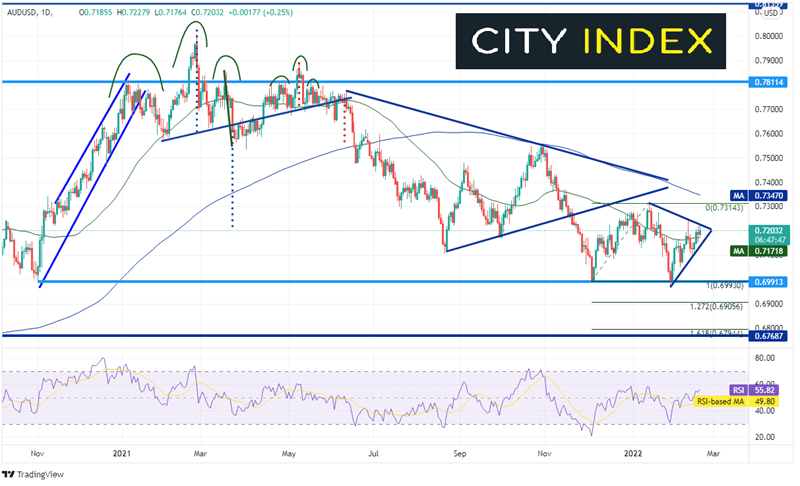

If US rates continue to rise, the US Dollar is likely to rise with it. AUD/USD has been moving lower for nearly a year, after putting in highs at 0.8000 on February 25th, 2021. The pair consolidated in a symmetrical triangle between June and November of 2021, eventually breaking lower on November 19th, 2021 near 0.7275. Price then moved down to horizontal support dating to November 3rd, 2020 near 0.6990 and held. That level was retested on January 31st, as the pair bounced and is presently near the apex of another symmetrical triangle, near 0.7200.

Source: Tradingview, Stone X

Trade AUD/USD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

On a 240-minute timeframe, if the US Dollar does move higher, AUD/USD could move lower. First support is at the 50 Day Moving Average near 0.7172 (see daily) and then the upward sloping trendline of the triangle near 0.7150. Below there is the 61.8% Fibonacci retracement level from the January 28th lows to the February 10th highs near 0.7075 and then the January 28th lows at 0.6975. If AUD/USD moves higher, first resistance is at today’s higher of 0.7228, which is also the top, downward sloping trendline of the channel. Above there, is the February 10th highs at 0.7249 and the January 13th highs at 0.7313.

Source: Tradingview, Stone X

Could January’s surge in existing home sales be the peak of home purchases as buyers rushed to get ahead of higher interest rates? Home builders may seem to think so as they slowed housing starts in January. If interest rates do continue higher, watch the US Dollar as it may follow with it. That could send AUD/USD to new near-term lows.

Learn more about forex trading opportunities.