Economic data points for the Australian dollar

|

Date |

AEDT (GMT +11) |

Event |

|

Monday, March 4 |

11:00 |

AU Inflation gauge (Melbourne Institute) |

|

|

11:30 |

AU Job advertisements (ANZ), building approvals, gross company profits, business inventories (ABS |

|

Tuesday, March 5 |

09:00 |

AU Services PMI |

|

|

11:30 |

AU current account, net exports contribution |

|

|

12:45 |

CN services PMI (Caixin) |

|

Wednesday, March 6 |

01:45 |

US composite PMI (final, S&P Global) |

|

|

02:00 |

US ISM non-manufacturing PMI |

|

|

- |

Jerome Powell testifies to the House Committee |

|

|

09:00 |

AU construction, manufacturing indices (AIG) |

|

|

11:00 |

AU Q4 GDP, retail sales (final) |

|

Thursday, March 7 |

00:15 |

US ADP employment change |

|

|

11:30 |

AU trade balance, home loans |

|

|

14:00 |

CN trade balance |

|

Friday, March 8 |

00:30 |

US jobless claims |

|

Saturday, March 9 |

00:30 |

US nonfarm payroll |

|

|

12:30 |

CN CPI, PPI |

Looking through the calendar flags several data points that might be of interest, but in all likelihood won’t be much of a mover for the Australian dollar directly. For example, one should not exactly ignore data coming out of China such as PMIs and inflation figures, but these days it’s more about what central powers do (or not) that sets the tone for China and therefore if AUD/USD reacts to it.

We have plenty of domestic second-tier data on the menu such as job ads, building approvals, current account and final PMIs. But I just cannot see them being market movers for the Aussie. And that means Q4 GDP data is the highlight for the domestic calendar, with potential moves coming from the US due to ISM services, Jerome Powell’s testimony and Nonfarm payrolls.

With US events more likely to impact AUD/USD, it really comes down as to whether the data is hawkish for the Fed (high-for-longer rates = higher USD and lower AUD/USD) or dovish for the Fed (potential cut/s = lower USD, higher AUD/USD0.

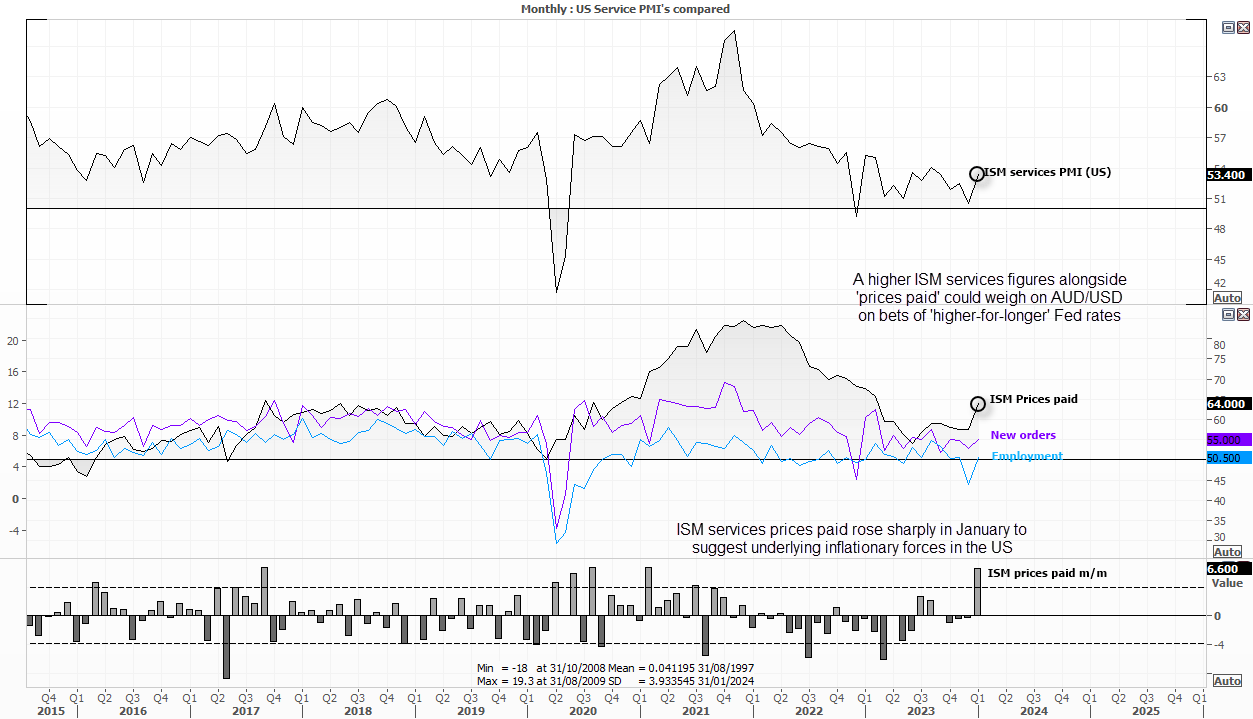

Keep an eye on ISM services, prices paid

Of course, US data points such as the ISM services and nonfarm payroll report can have an indirect on AUD/USD through the lens of their impact on Fed policy. But there is not a huge amount in the calendar that might prompt a change intact from the RBA.

- If ISM services expands further (and particularly if ‘prices paid’ continues to shoot higher) then AUD/USD could falter on the stronger US dollar / higher for longer Fed rates

- If Nonfarm payroll data remains robust, again this feeds back into the higher-for-longer Fed rates and could weigh on AUD/USD

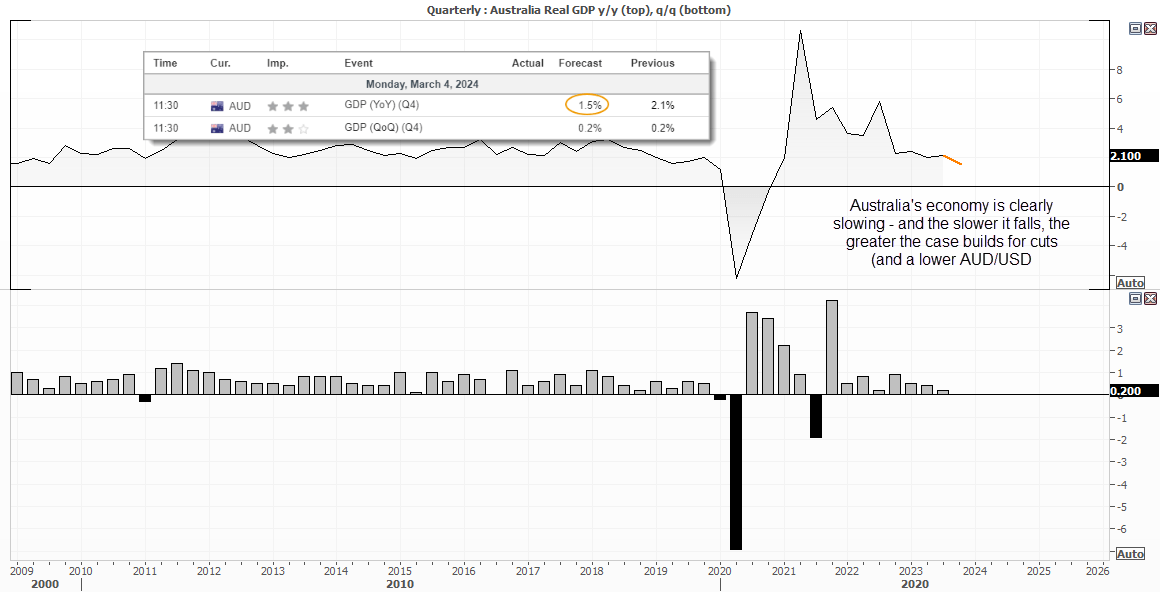

Australian GDP could be the highlight for domestic data and RBA watchers

Of course, the RBA will be particularly keen on the GDP figures to see how they sit with their own economic forecasts. Their recent outlook pencilled in GDP y/y to be 1.8%, yet the market consensus is for it to fall faster at 1.5% y/y. And should it come in softer than expected, it could be assumed that Q1 data is also set to deteriorate given weak retail sales and inflation data seen so far this year. And that could even ring the bells for a recession and weigh on AUD/USD accordingly.

But let’s not get ahead of ourselves. We can see the economy is clearly softening, and there’s no real indication that it is falling hard and fast. Either way, it is very hard to justify the RBA’s tightening bias in their recent statement, other than the fact that it is to cover themselves if their forecasts are wrong.

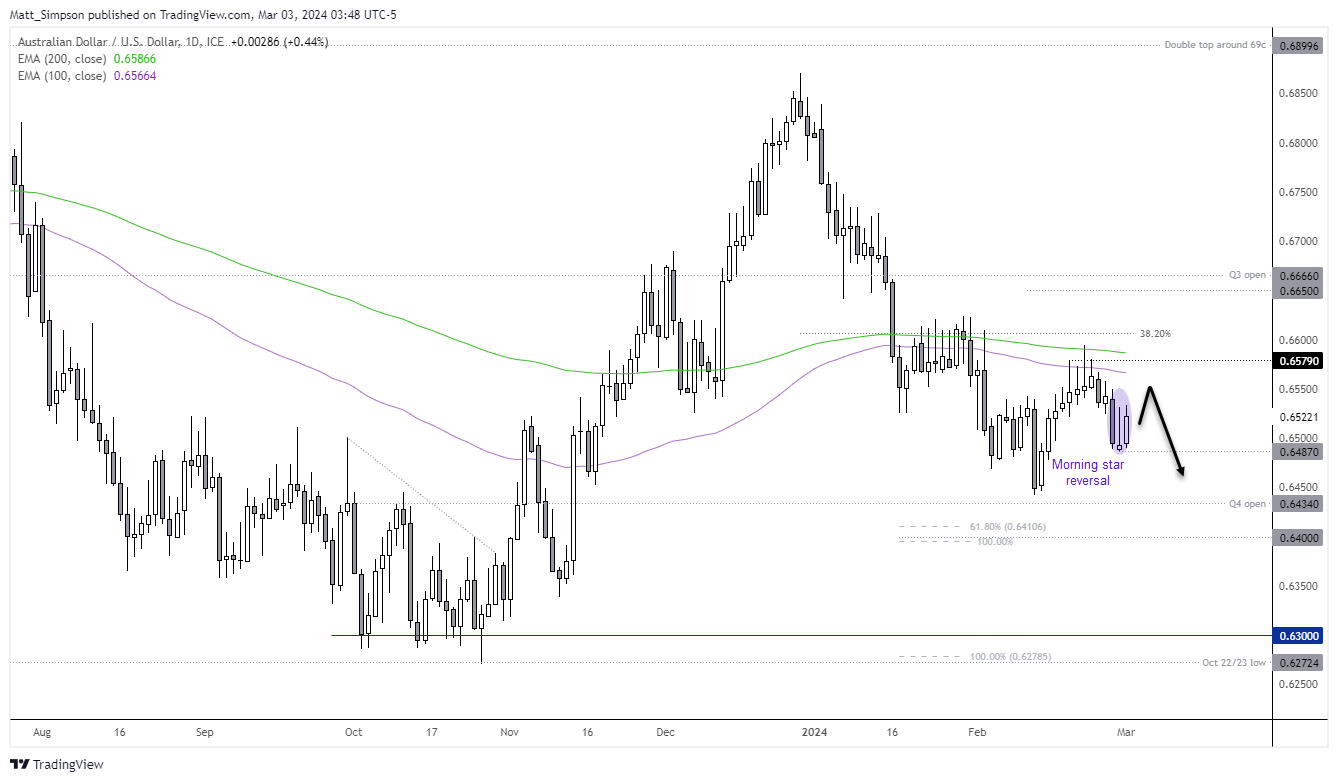

AUD/USD technical analysis:

If we needed a reminder that expectations of Fed policy via bonds and the US dollar remains a key driver for AUD/USD, it is clearly visible on the daily chart. AUD/USD recouped most of Wednesday’s losses as a slew of weaker US economic data drove the US dollar lower, the benefit of AUD/USD.

Friday’s bullish close confirms a 3-bar bullish reversal pattern called a morning star formation. At the beginning of the week, my preferred option is to seek bullish reversal patterns on intraday timeframes if prices retrace within Friday’s range. Yet I do not yet see this as a significant low, and doubt this will rally to 66c. So if this does indeed bounce, I will then be on the lookout evidence of a swing high and for momentum to then turn lower.

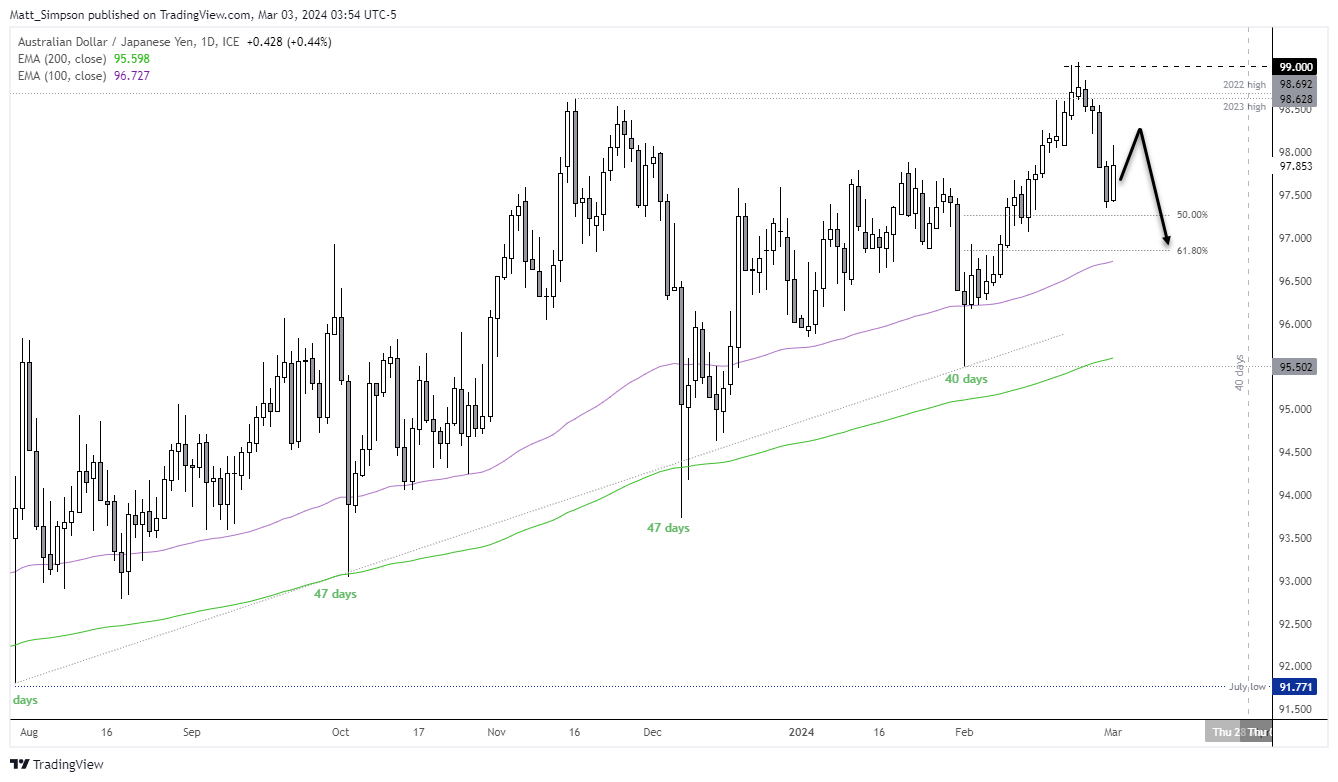

AUD/JPY technical analysis:

I strongly suspect we have seen the top of the 40-47 day cycle on AUD/JPY. The cross fell -1.7% over four days since its failed attempt to break above 99, and Friday saw it produce a near bullish engulfing candle which suggest a swing low ha formed. Like AUD/USD, I suspect a bounce is due and that the supposed rebound will fail to take out the previous cycle high. At which, I’ll then be on guard for evidence of a swing high for the anticipated move lower.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade