Market Summary:

- US retail sales was stronger than expectations, to underscore a resilient US consumer at a festive time of the year. This plays in with Fed Waller’s comments to push back on imminent Fed rate cuts, which weighed on Wall Street and further boosted the US dollar and US yields.

- A happy consumer boosted expectations of oil demand, helping WTI crude oil form a bullish outside / engulfing day formed with a long lower wick and its ability to remain above $70 is apparent.

- The S&P 500 led the Nasdaq 100 and Dow Jones lower as it seems Wall Street are finally getting the message that multiple Fed rate cuts are likely not happening soon unless we see the wheels all off of the economy (which would likely be bearish for Wall Street anyway, at least initially)

- UK inflation became the latest to report above-expected levels of CPI and core CPI which made GBP the strongest FX major as traders reduced bets of multiple BOE rate cuts. US and Canada also saw similar results for December, as did an unofficial report for Australia.

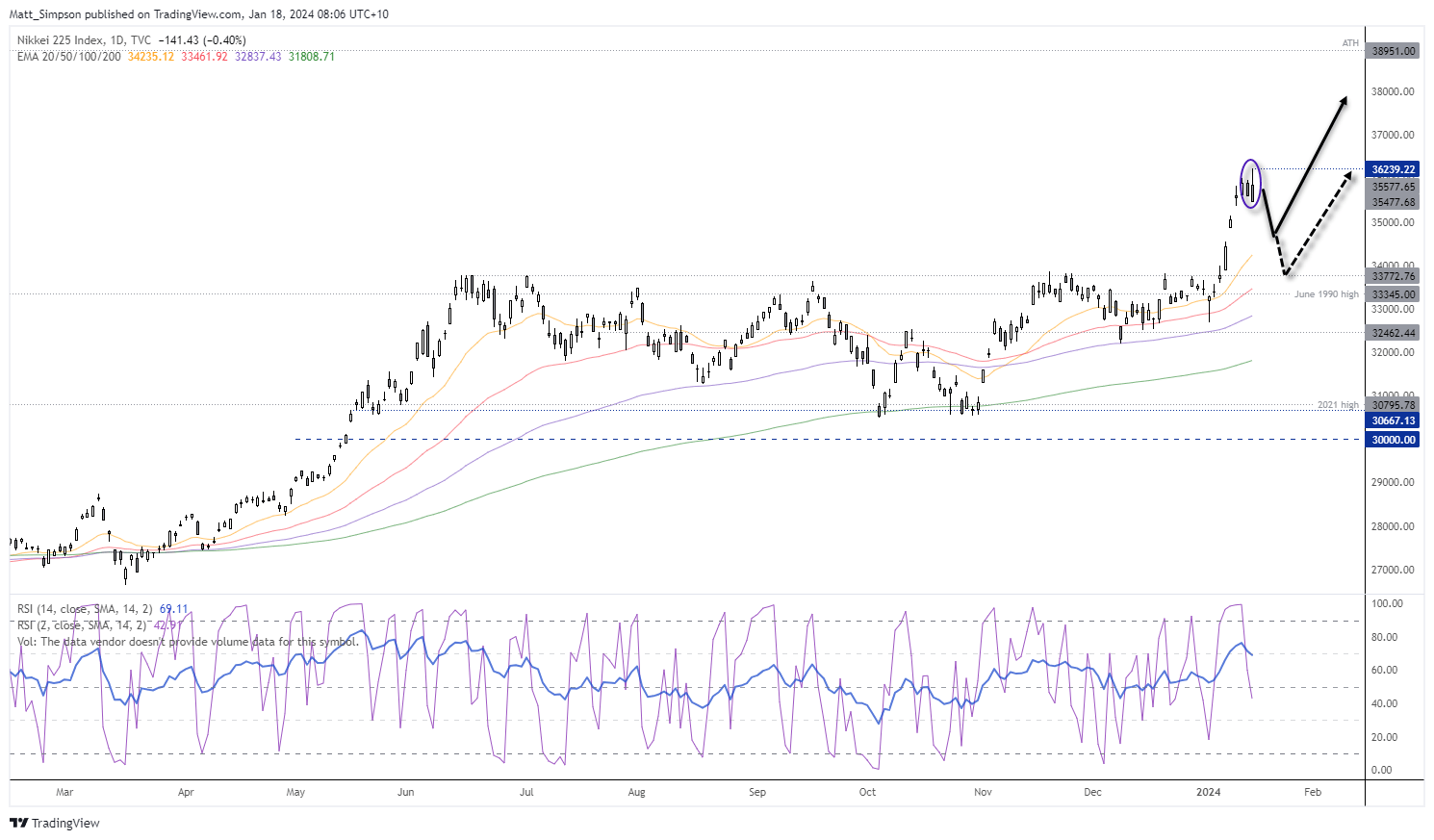

- The Nikkei pushed to a fresh 33-year high at the open before promptly reversing lower, for the day to close with an ominous bearish outside day.

- Stronger yields and US dollar saw gold prices continued lower for a second day to notch its worst 2-day run since March. Take note that $2000 support is nearby and could prompt at least a minor bounce before its next anticipated leg lower.

Events in focus (AEDT):

- TBC – China’s Foreign direct investment

- 09:00 – Australian

- 10:50 – Japan’s machinery orders, foreigner bond/stock investment

- 11:30 – Australian employment report

- 15:30 – Japan’s capacity utilisation

- 11:30 – Fed Bostic speaks

- 12:30 – US housing starts, building permits, jobless claims

- 13:30 – Fed Bostic speaks

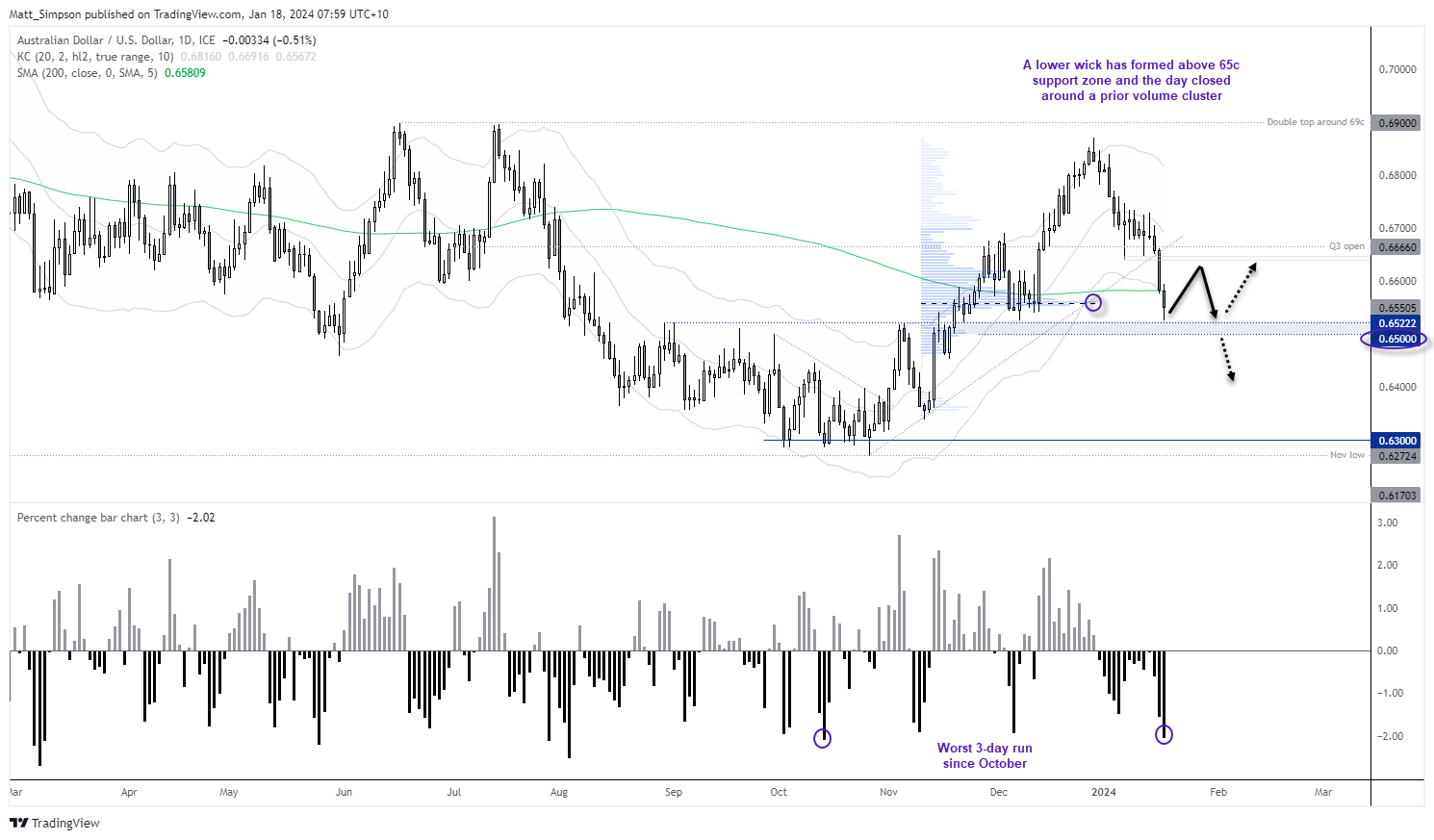

AUD/USD technical analysis (daily chart):

Appetite for risk remained sour, and that has been a clear drag on AUD/USD ahead of today’s employment report. It would likely take a very strong employment report for lift any expectations of an RBA hike, with cash rate futures implying a 97% chance of a hold in February. But it could see some traders at least short cover given AUD/USD is trying to find stability above 65c. Beyond any sort of bounce, I remain bullish on the US dollar over the coming weeks which leaves the potential for a move below 65c, although I remain sceptical it will simply crash beneath 63c given the strong support levels seen around Q4 last year.

For today, a retest and potential break above the 200-day average seems feasible given the Aussie’s false break of the lower keltner band. I’m not expecting a rally back above 66c, so bears could seek to fade into moves below 66c after the anticipated bounce. Whether it can break below 65c is likely down to how much juice is left in the US dollar’s tank.

Nikkei 225 technical analysis (daily chart):

The Nikkei tapped a fresh 33-year high, but as soon as yen strength arrived the index was sent swiftly lower. A bearish outside day formed with after RSI 14 had spent several days in the overbought zone. This is a strong trend for bears to consider fading against, so the analysis may be best served to warn of a pullback for bulls to tighten stops or step aside and seek bullish reversal clues at lower levels. If countertrend bears must, they could seek minor rallies within yesterday’s range with a stop above the cycle high, keeping in mind that 35k may provide support unless we see the yen strengthen notably.

And if the yen strengthens across the board and global stocks are falling due to risk-off trade, then bears could be looking at a move to 34k.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade