Another day, another record high for gold. There's clearly something else supporting gold at these highs other than reduced rate-cuts bets and geopolitical tensions from the Middle East. But if US economic data remains hot and investors are concerned that the Fed may ease rates, even if only to a degree, then perhaps gold is being used as an inflationary hedge once more.

Dips remain shallow and gold bugs are seemingly laughing their way to the gold vault. The market looks like it wants to test $2400, and with no major signs of a market top forming - it just might make it. But at some point I expect to see some bearish volatility shake out some bulls from these highs, as the higher it goes the more tempting it becomes for some larger pockets to book a profit.

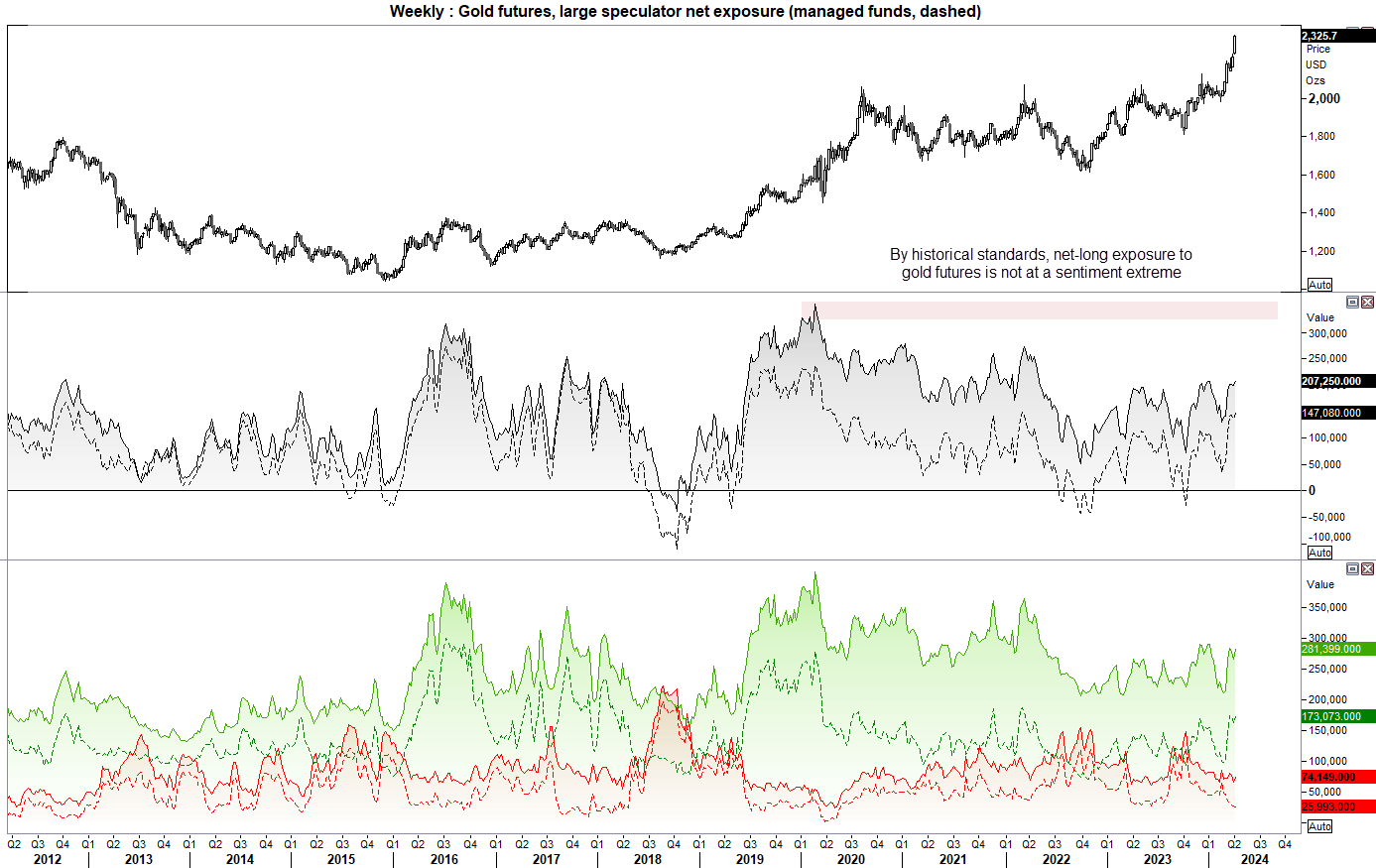

I whilst we may be nearing a correction, timing it is difficult with such bullish momentum behind it. And apart from a daily doji during a low-new day, there is little evidence of a top forming on price action. And besides, the retracement could be limited looking at market positioning.

What is really interesting is that net-long expose to gold futures is not at a sentiment extreme among asset managers and large speculators, despite the surge to record highs. $2500 is not out of the question over the coming weeks, but it remains debatable as to whether it can reach that milestone in a straight line. Any dips towards $2200 or even $2250 are likely to be snapped up by bulls stuck on the sideline, who remain hesitant to jump onto the trade at record highs.

View related analysis:

US dollar, EUR/USD, gold, crude oil analysis: COT report

AUD/USD weekly outlook: Seasonals hint at a bullish week for AUD/USD

Market Summary:

In recent articles I have noted the tendency for the US dollar to provide negative returns in April, and for GBP/USD to outperform. And more specifically, GBP/USD tends to perform quite well between April 8th to the 19th while the US dollar underperforms over this period. So it is interesting to see that forex markets followed these patterns on Monday – and I remain curious to see whether the US dollar will suffer over the next couple of weeks to support the other FX majors.

This allowed AUD/USD to also trade higher despite a low -news day and follow its own seasonal pattern around this time of the year.

- Fed fund futures have trimmed their rate-cut bets to their lowest level since October in light of stronger-than-expected economic data (a June cut is now priced at a 51.2% probability)

- WTI crude oil fell to a 2-day low following Friday’s small-ranged doji at the cycle highs, although the bias remains for bulls to buy dips given the rising long exposure among speculators and fund managers – with $84 making a likely support level

- AUD/JPY closed above 100 for the first time since December 2014

- USD/JPY continues to flirt with the idea of a test of 152, but bulls lack the conviction to even test that level before prices pull back (which might make sell-limit orders around such levels likely tempting to bears)

- New Zealand’s business confidence

- ASX 200 formed a small bullish inside day to show bearish momentum is waning, after we successfully picked the swing high last week. I suspect we may be nearing another inflection point, hence the feeling to look for a swing low over the near-term (although 7700 is the next major support level).

Events in focus (AEDT):

- 09:00 – FOMC member Kashkari speaks

- 09:01 – UK retail sales (BRC)

- 10:30 – Australian consumer sentiment (Westpac)

- 11:30 – Australian business sentiment (NAB)

- 15:00 – Japan’s household confidence

- 18:00 – China’s loan growth, M2 money supply, social financing

- 18:00 – ECB bank lending survey

- 20:00 – US small business optimism (NFIB)

- 02:30 – SNB vice chairman Schlegel speaks

AUD/USD technical analysis:

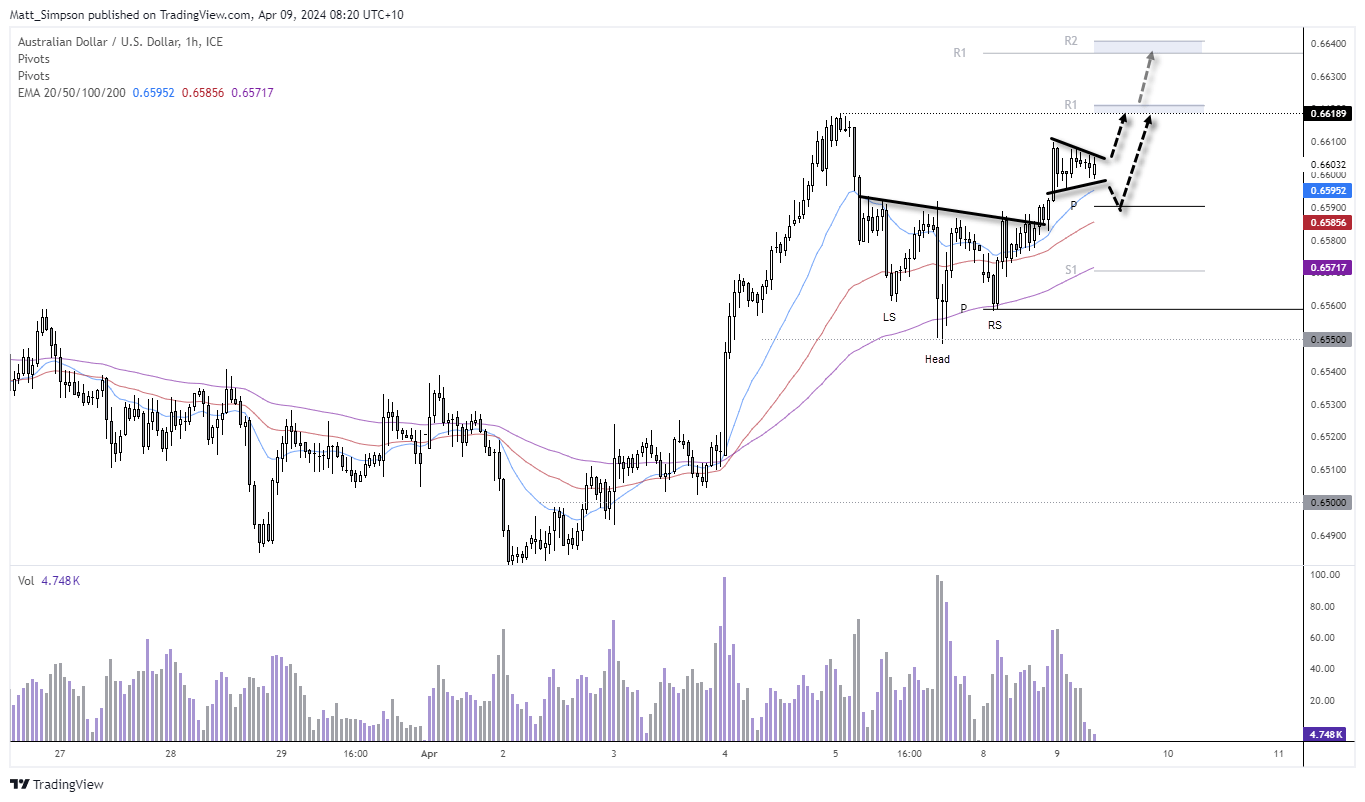

The Australian dollar formed its daily low around 11am on Monday and didn’t look back, closing to a 17-day high in line with this week’s bias (see the weekly outlook report). The 1-hour chart shows a higher low formed perfectly at the monthly pivot point before breaking back above 66c in one single move. And that confirmed an inverted head and shoulders pattern, which projects an upside target around 0.6630 is successful.

Prices are now consolidating within a potential flag/pennant pattern and, given the bullish seasonality this time of year for AUD (and bearish for USD), today’s bias remains bullish.

Bulls could enter a breakout from the consolidation pattern or seek evidence of a swing low should prices initially break lower from the consolidation.

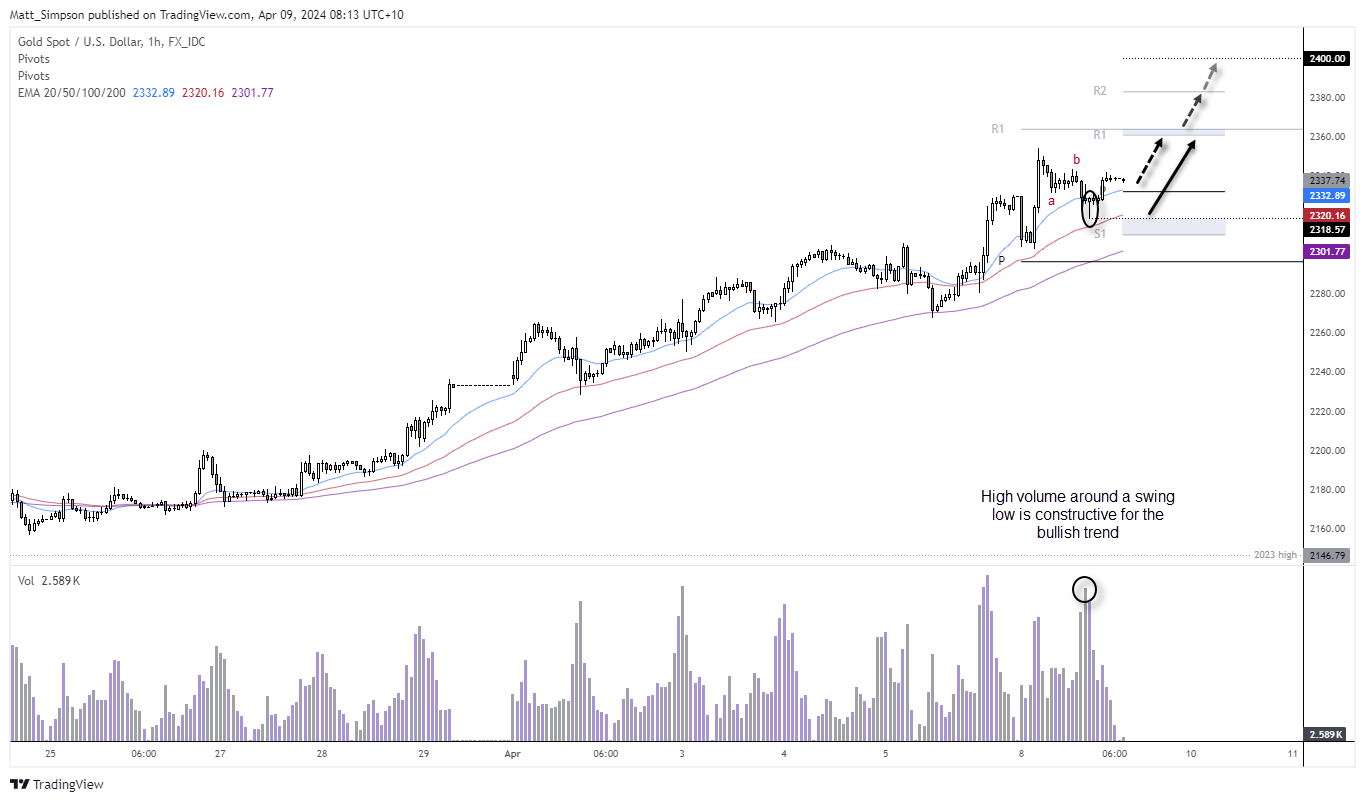

Gold technical analysis:

Unsurprisingly, the 1-hour gold chart shows a strong uptrend. It formed a doji at the record high on Monday, but one candle is not enough to break a trend – even if it brings the prospects of a minor pullback. Yet the trend structure is decisively bullish and high levels of volumes are appearing at the right places (around the swing lows).

A 3-wave correction formed on Monday and momentum is trying to turn higher once more. But given the very low levels of volume in recent hours, bulls may want to consider dips within the lower bounds of yesterday's range.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade