It is by no means a big week for Australian economic data. With that said, if we’re to see notable weakness in the home lending or business activity indicators, then that could excite AUD bears who will take any scrap of data to price in a rate cut. But unless that happens, these data sets are likely to be on the back burner.

Tension in the Middle East are rising once more, with rising concerns that the conflict could spread. That saw US indices extend their losses from record highs, and the S&P 500 form a bearish engulfing week during its worst week since October. And that means traders need to factor in headline risk and the potential for a further knock for sentiment, which in turn could weigh on AUD/USD given its close relationship with risk.

Earlier this week, the RBA’s minutes acknowledged slower growth an inflation, although reminded us that CPI remains “too high”. Until we see them drop those two words from their statement, a cut seems unlikely over the foreseeable future. With that said, the SNB (Swiss National Bank) cut rates ahead of expectations, the BOE could be on track for a June cut – so there is some speculation that central banks are nearing a phase of easing. Yet what muddies the water for the RBA is that Fed members continue to push back on imminent rate cuts.

Of course, we’ll need to keep an eye on the RBNZ interest rate decision. It is unlikely they will cut rates since their February statement said that their cash rate needs to “remain at a restrictive level for a sustained period of time”, but with the economy since confirming a technical recession with two quarters of contracting growth, they may tip their hat towards easing sooner.

Overseas, US inflation, producer prices and the ECB meeting are the main events. What markets want to see if softer CPI figures from the US to further bolster bets of a June rate cut by the Fed. If that happens, it alleviates some pressure from the RBA – although as things stand I do not yet see the RBA cutting rates ahead of the Fed. But if we’re to see softer PPI and PPI figures next week from their US, it could weigh dearly on the US dollar and send AUD/USD higher.

As for the ECB, they too are unlikely to alter policy. But we’re keen to hear what they may say given the latest round of softer inflation figures. Again, this is not likely to directly impact the RBA’s monetary policy decision, but the more central banks that consider cuts, the greater the odds of the RBA have of cutting sooner than September or October.

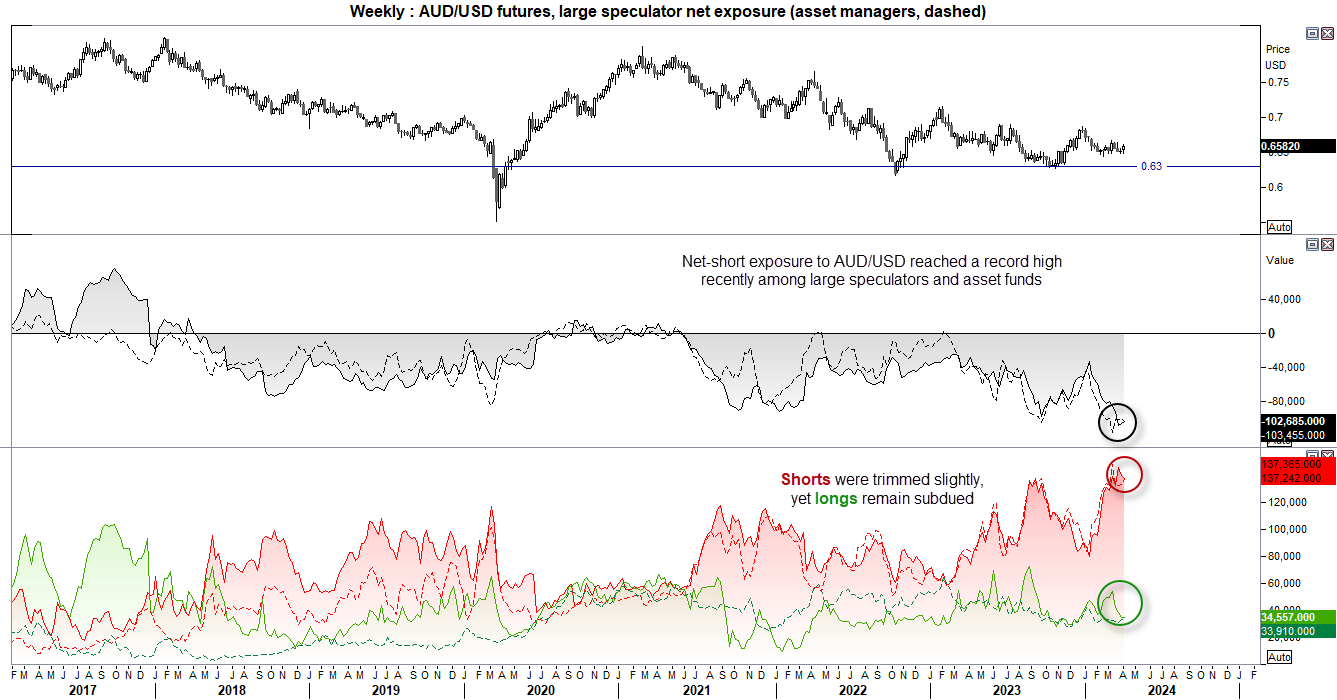

AUD/USD futures – market positioning from the COT report:

Net-short exposure to AUD/USD futures reached a record high recently, which is why I rang the alarm bell for a potential sentiment extreme. Last week we saw large specs slightly trim their short exposure, although asset managers increased theirs. Long remain subdued among both sets of traders, which suggests any upside could be limited. However, given the extremely bearish positioning, I remain sceptical of extended losses unless we get some sort of a black swan event.

A bullish outside week formed on the weekly chart, which could be part of a 3-week bullish reversal pattern called a morning star formation. Should AUD/USD decide to follow its seasonal pattern this week (which could be helped by a softer set of inflation figures from the US) then perhaps AUD/USD could rise again this week.

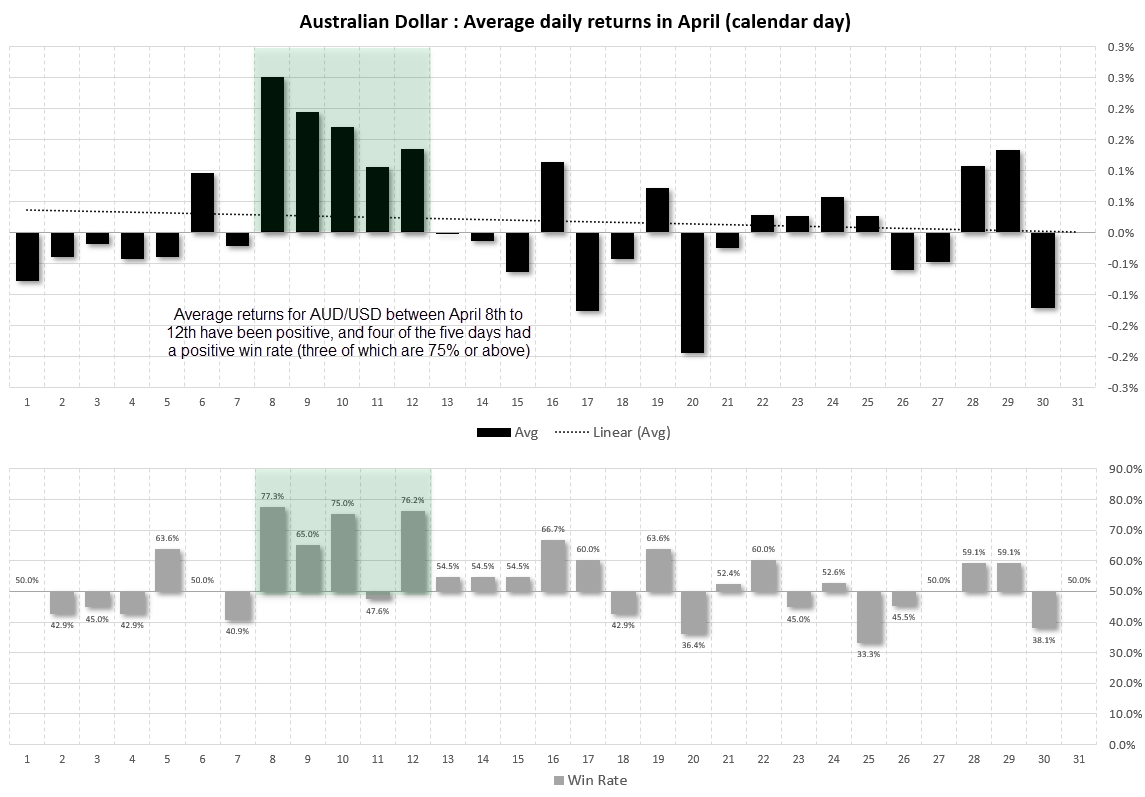

AUD/USD seasonality (April)

The average return in April for AUD/USD since 1976 has been 0.48%, the median has been 0.82% and its win rate is 55.8%. Taking a closer look, I’ve calculated average daily returns for AUD/USD in April, and it shows that April 8th to 12th has averaged positive returns each day, four of which have positive iwn rate (three of which at 75% or higher). This ties in with US analysis, which shows a negative average and mean return in April, particularly between April 8th to 19th.

Of course, seasonality patters are no silver bullet and current themes can easily ignore them. But if conditions allow, we could be in for a bullish week on AUD/USD if it is to follow its seasonal pattern again this year.

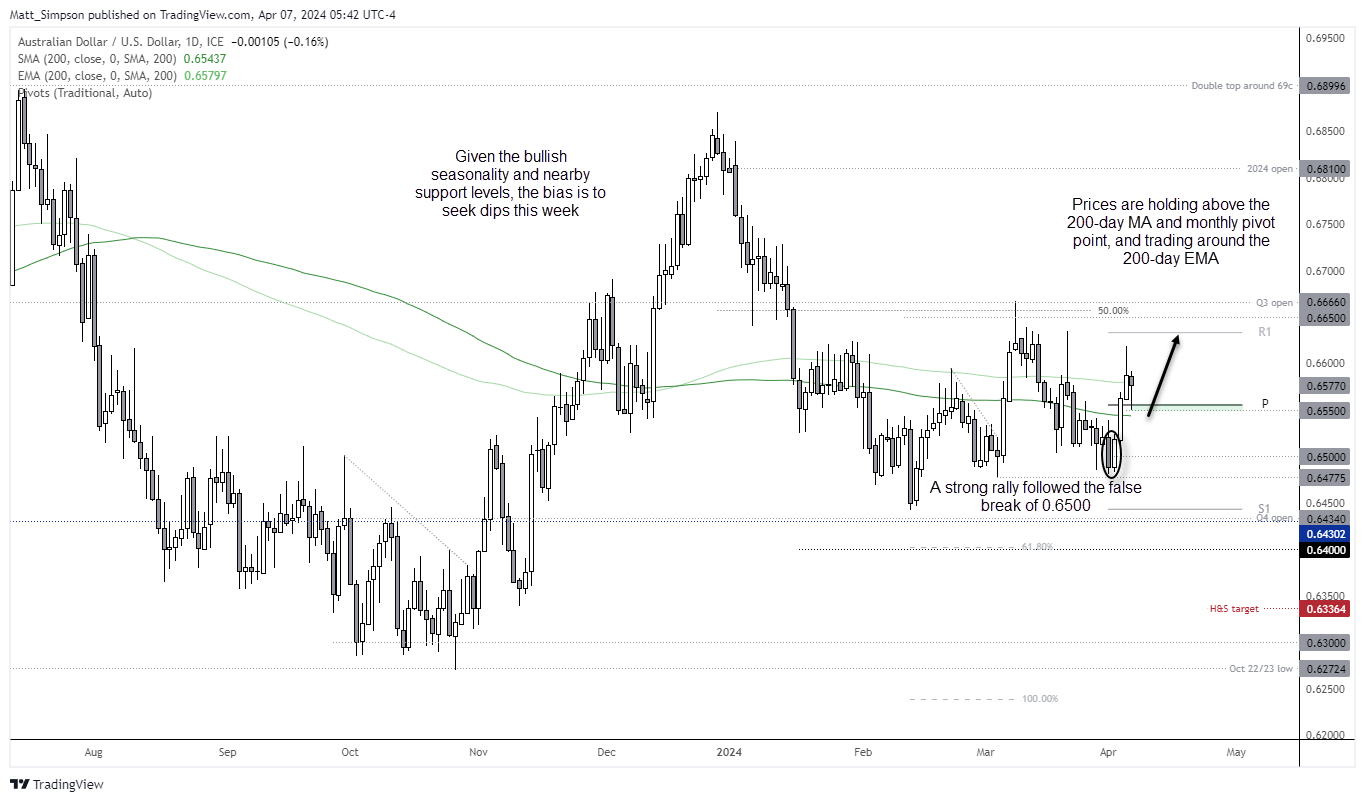

AUD/USD technical analysis

The Australian dollar did indeed bounce following a false break of 75c, in line with last week’s bias. It rose for three days before Friday’s hanging man candle broke the sequence, and it brings the potential for some choppy trade at the beginning of the week.

Yet the fact it is trading around its 200-day EMA and holding above its 200-day average suggests any downside move could be limited. And that places it on a bullish watchlist for the week and a market to consider dips, given its tendency to rise at this time of the year.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade