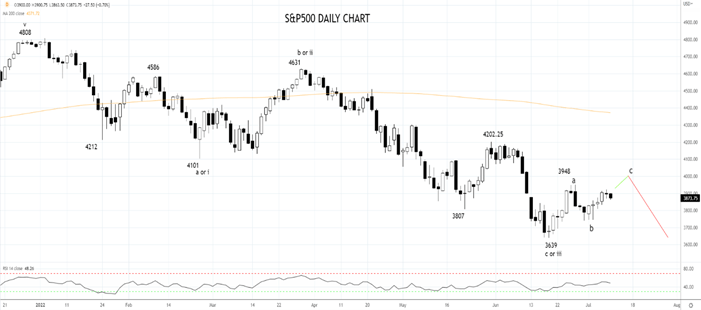

Last week, U.S stock markets extended their recovery after a punishing first half of the year. The S&P500 finished the week 2% higher while the tech-heavy Nasdaq added almost 5%.

The key as to whether U.S equity markets can extend their rebound this week will be the release of June CPI data which is expected to see headline inflation accelerate to 8.8% YoY from 8.6% in May.

However, since mid-June, energy and food prices have since eased considerably. Furthermore, core CPI inflation is expected to ease to 5.8% YoY, its lowest level in five months. A combination that may again spark talk of peak inflation and a Fed pivot before year-end.

Elsewhere, Q2 earnings reports from the big banks, including JP Morgan, Wells Fargo, Morgan Stanley, and Citigroup, will likely mark the beginning of a more sombre earnings season.

According to FactSet, the S&P 500 is expected to report (YoY) earnings growth of 4.3% for the second quarter, which would be the slowest rate of growth since the fourth quarter of 2020 and mark a significant slowdown from the 9% seen in the first quarter.

Throwing added uncertainty into the mix for the S&P500, reports that Shanghai recorded its first case of the highly infectious BA.5 omicron sub-variant over the weekend, forcing 30 million citizens into a new round of lockdowns.

Based on the points outlined above, allow the countertrend rally in the S&P500 from the June 3639 low to extend towards the 4000/4100 resistance zone, where the rally will likely run out of steam.

As such, look to scale into shorts within the 4000/4100 sell zone with a stop loss placed above resistance at 4200/20 coming from the late May and early June highs. The profit target is a retest of the 3639 low.

Source Tradingview. The figures stated are as of July 11th 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade