When will Peloton report Q3 2022 earnings?

Peloton is scheduled to publish results covering the third quarter of its financial year before US markets open on Tuesday May 10.

Peloton Q3 earnings preview

Peloton was one of the big winners during the pandemic as demand for its in-home exercise equipment soared during lockdown. But things quickly unravelled when demand started to slow and the pandemic eased, leaving Peloton with a burdensome cost base that squeezed profitability after rapidly expanding and spending millions on inventory and production.

The severe problems were revealed last November, when Peloton slashed its outlook and warned demand was much softer than anticipated as people started leaving the house and returning to traditional gyms. That prompted the biggest single-day fall in its share price ever and the stock has plunged over 78% since then. Having boasted a valuation of over $46 billion at its peak in early 2021, the company is worth closer to $6 billion today.

Peloton has taken drastic action to turn the company around. Founder John Foley bowed to pressure from investors and relinquished the role of chief executive, paving the way for Barry McCarthy, who has previously held senior roles at both Netflix and Spotify, to take over at the helm and introduce a number of other fresh faces to the board. However, Foley remains a major player as executive chairman and still owns around 40% of all voting rights in the company.

The management changes coincided with a new plan to revive Peloton’s fortunes and get the company generating both profits and cashflow again. Its operations burnt through over $1 billion more cash than they generated in the last six months of 2021. With that in mind, Peloton had around $1.7 billion worth of cash and equivalents on its books at the end of December.

Peloton has already cut around 2,800 jobs – equal to about 20% of its workforce – in order to save money and has also slashed the number of warehouses it owns and operates after deciding it is more cost-effective to rely on third-party providers of storage and delivery services. It also slashed its capital expenditure budget in half for 2022 to around $150 million.

This is part of its ambition to deliver $800 million worth of annual cost savings, although it will cost around $130 million in cash charges and $80 million in non-cash charges to achieve – and the majority of this will be booked in the current financial year.

Markets will be predominantly focused on how much cash Peloton is burning through and the progress being made as it tries to right-size the business. Wall Street believes its actions will start delivering results immediately with the consensus suggesting it will burn through just $37 million in operating cashflow in the third quarter and $78 million in the fourth – markedly less than what was burnt through in the preceding six months. We may also see McCarthy unveil new ideas to revive the company, with some reports suggesting a subscription model could be introduced to attract customers that balk at the high upfront costs, which could significantly shake-up Peloton’s sales mix.

Still, they will also be hoping that Peloton can continue to grow its user base and sales as a further slowdown in demand is the last thing Peloton needs right now.

Wall Street is looking for 2.93 million Connected Fitness Subscribers at the end of the third quarter, up from the 2.77 million reported three months earlier and up 40% from the year before.

Revenue is forecast to plunge 23% year-on-year to $971.5 million as it comes up against tough comparatives from the year before, when sales more than doubled. The adjusted Ebitda loss – Peloton’s headline earnings measure – is forecast to amount to $132.5 million in the third quarter. That will turn from a $63.2 million profit the year before.

Where next for PTON stock?

Peloton languishes near all-time lows at just $17 after its last set of results tanked its share price, with the stock having been stuck in a downtrend over the past six months. For context, the stock opened at $27 on its first day of trading back in 2019 and once traded over $171 during the height of the pandemic in early 2021.

Shares have hit as a low as $16.67 this week, which needs to hold as a floor to prevent the door being opened to unknown territory and fresh all-time lows.

However, there are signs that Peloton could experience a reversal in the near future. The RSI is technically in the bearish ballpark but on the cusp of entering oversold territory. That is reinforced by the fact trading volumes have risen over the last 10-days, although this remains below the 100-day average. Meanwhile, we have seen the share price diverge from the RSI over the last six months as the indicator has risen while the stock has sank to new lows, suggesting the selloff could ease and see the stock rebound.

The stock needs to recapture the 50-day moving average at $24 in order to break out of the current downtrend, although this has proven to be a firm ceiling for the stock over the last six months that has only be captured for brief moments. From there it can target the peak seen in late March of $30 and then the February-high of $40. Notably, the 33 brokers that cover the stock believe the selloff has been overdone this year with an average target price of $43.

How to trade Peloton stock

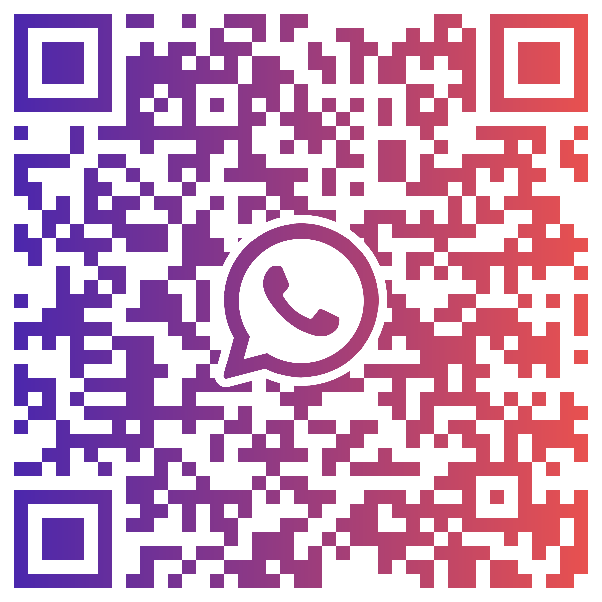

You can trade Peloton shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘DBS Group’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can try out your trading strategy risk-free by signing up for our Demo Trading Account.