The USD/CAD outlook is going to be influenced by jobs reports from both the US and Canada due out later today.

Most traders will be watching the US jobs report on Friday, as the market refocuses on Fed policy after the Fitch downgrade of US credit rating caused a risk off response in the markets, which sent the dollar and long-dated bond yields surging higher this week. Once the jobs report is out of the way, the focus will turn to inflation data next week. Together, these macro events could move the markets sharply as they have the potential to influence the Fed’s decision whether to hike or not next month.

But for USD/CAD traders, there is also the small matter of the Canadian jobs data being released at the same time as the US non-farm payrolls report. Canadian employment is expected to show a gain of 25K vs. 60K in the previous month, with the unemployment rate seen rising to 5.5% from 5.4% last.

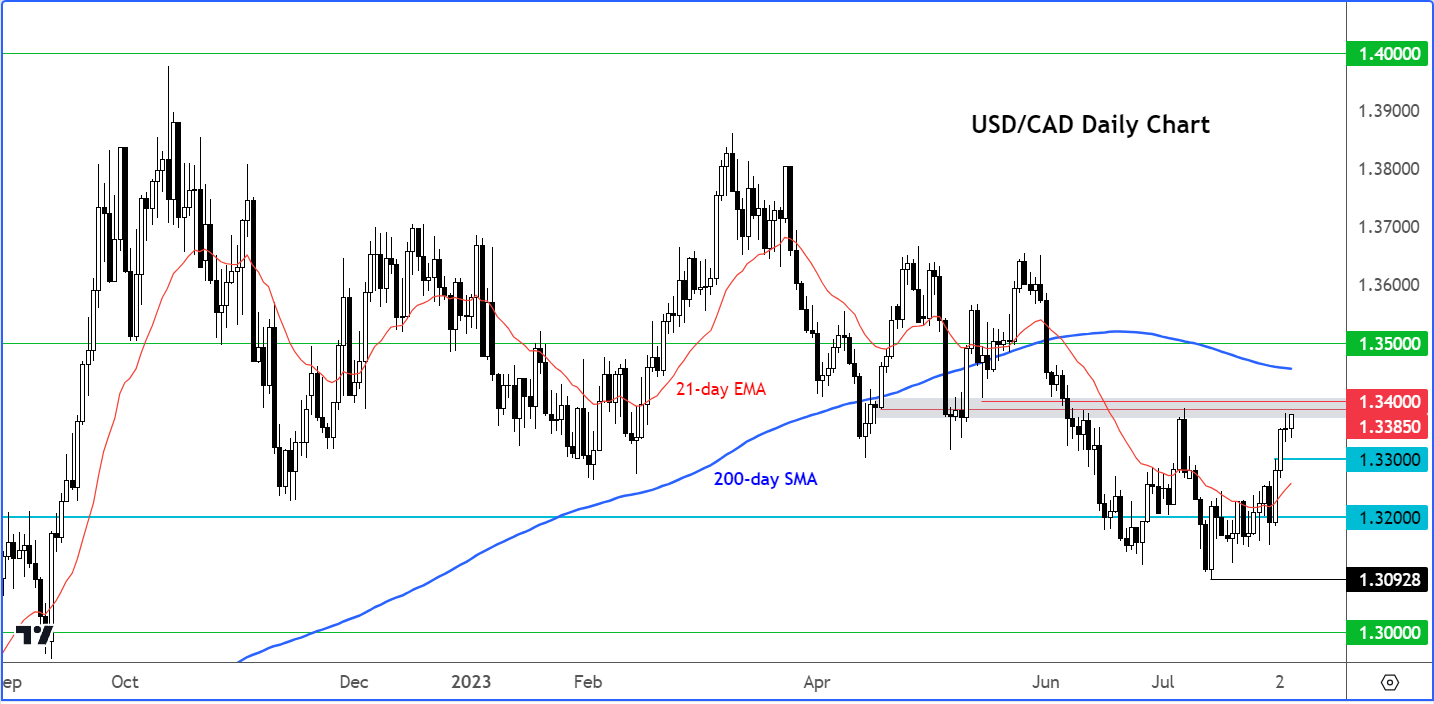

Before discussing the US macro data, let’s take a quick look at the USD/CAD chart.

USD/CAD outlook: Bulls still in search of higher high

Source: TradingView.com

The USD/CAD was approaching key resistance around 1.3385 to 1.3400 area, where it had previously sold off from. Depending on the outcome of the jobs reports from both North American nations, the USD/CAD could move sharply today. The bulls will want to see a convincing break above this area, while the bears would be eying the emergence of a key bearish reversal pattern here. Short-term support is seen at 1.3300.

NFP report could influence Fed policy next month

Employment reports are almost always important anyway, but this one is going to be even more so. Coming in a week before the CPI report, Friday’s jobs data is going to influence Fed’s policy, as Powell has made it quite clear that US monetary policy is now restrictive enough and that the next decision in September would be entirely data dependent. Until then, we will have two more inflation and a couple of jobs reports to consider, including this one. While the focus is clearly on inflation as employment is still very strong, any potential weakness in jobs data could cement expectations of a policy hold. But another surprisingly strong employment report would keep the threat of further Fed hikes alive.

A headline jobs growth of 200,000 is expected compared to 209,000 in June, with the unemployment rate seen steady at 3.6%. Meanwhile, Average Hourly Earnings are seen printing +4.2% y/y vs. +4.4% previously

The leading employment indicators we have had this week have been quite mixed. While the ADP private sector payrolls report was strong at 324K, the employment components of both the ISM Services (50.7) and Manufacturing (44.4) PMIs weakened from the previous reading in June. Overall, these pre-NFP leading indicators point to a jobs report roughly in line with expectations.

But the jobs report has a tendency to deviate sharply from expectations, which means the dollar could move sharply. It is also important to consider the whole picture and take into account average hourly earnings when it comes to trading the NFP. On the latter front, we have seen earnings increase by 4.4% year-on-year in April, May and June 2023. This shows that wage inflation is still going strong, and it is a concern for the Fed. This is especially the case for the services sector – which was also highlighted by the rise in prices paid index of the ISM services PMI. Another strong showing in wages data would be considered a dollar-bullish jobs report, even if we see a small miss in headline employment.

US CPI next area of focus next week

Once the jobs report is out of the way, investors will turn their attention towards more inflation data, due in the following week. As mentioned, we will have already had the wages data from the employment report, but CPI is going to be important next Thursday. US inflation has fallen sharply in recent times, printing below-forecast readings in each of the past 4 months. Annual CPI fell to just 3.0% in June from around 6.5% at the start of the year, increasing the likelihood that interest rates have now peaked.

The Fed’s policy decision in September will be entirely data dependent. Until then, we will have one more inflation and jobs report after this. Any further weakening of CPI could cement expectations of a policy hold.

Don’t forget the bond market sell-off

The further strengthening of the US dollar so far this week has nothing to do with the Fed’s expected policy decision. It has a lot to do with the sell-off in US bond market, especially at the long end of the curve. This has been triggered by that rating downgrade by Fitch, causing investors to demand more for the increased risks associated with holding Treasurys. While a US debt default is unthinkable, it could happen at some future point in time. So, we wouldn’t rule out the possibility of further increases in US bond yields in the near-term. It will be interesting to watch next week’s $103 billion bond auction. This will tell us a lot about investors’ willingness to hold government debt. That said, the correction potential for the dollar is now high, and investors may soon start selling USD once the dust settles down – and especially if Friday’s jobs report comes in weaker, or inflation data were to surprise to the downside next week.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade