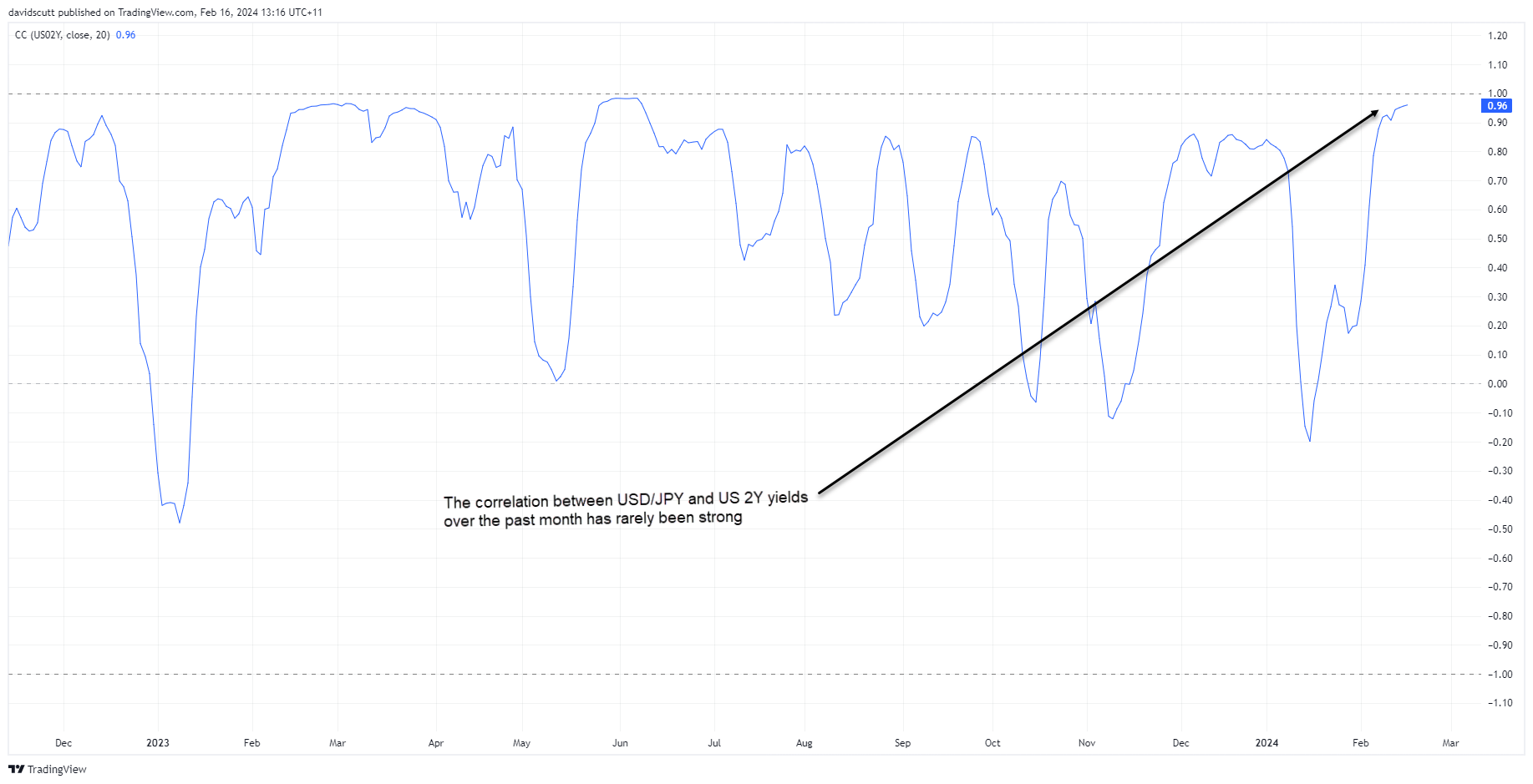

- USD/JPY and US 2-year yields have been highly correlated over the past month

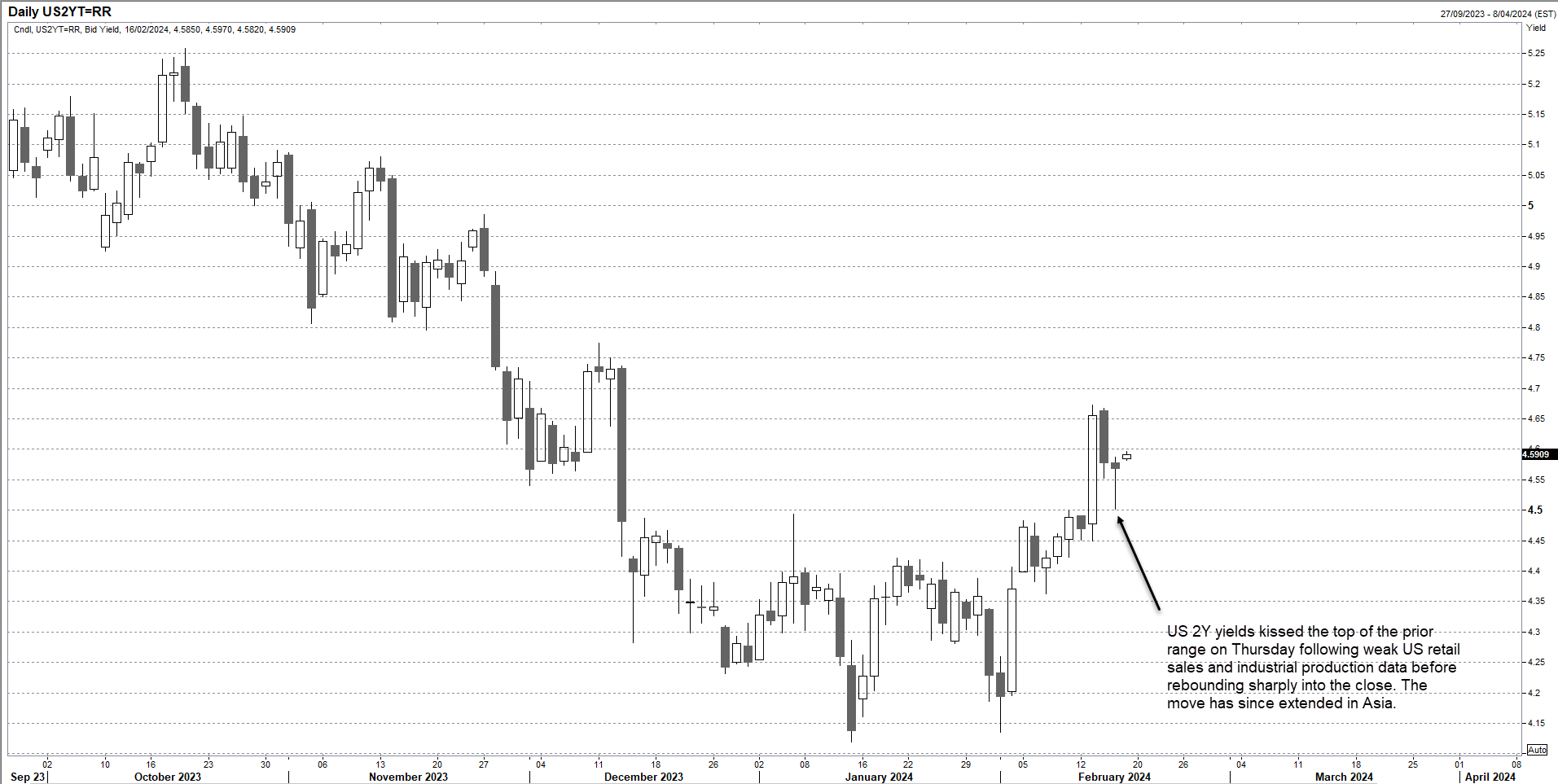

- US short-end yields rebounded on Thursday, with USD/JPY following suit

- US producer price inflation and consumer inflation expectations are the key reports to watch later in the session after Tuesday’s upside surprise for US CPI

Look no further than relative central bank interest rate expectations if you’re wondering what’s driving USD/JPY right now. The pair is moving in lockstep with US two-year Treasury note yields, running with a positive correlation of 0.96 on the daily over the past month. And in this instance, correlation does mean causation.

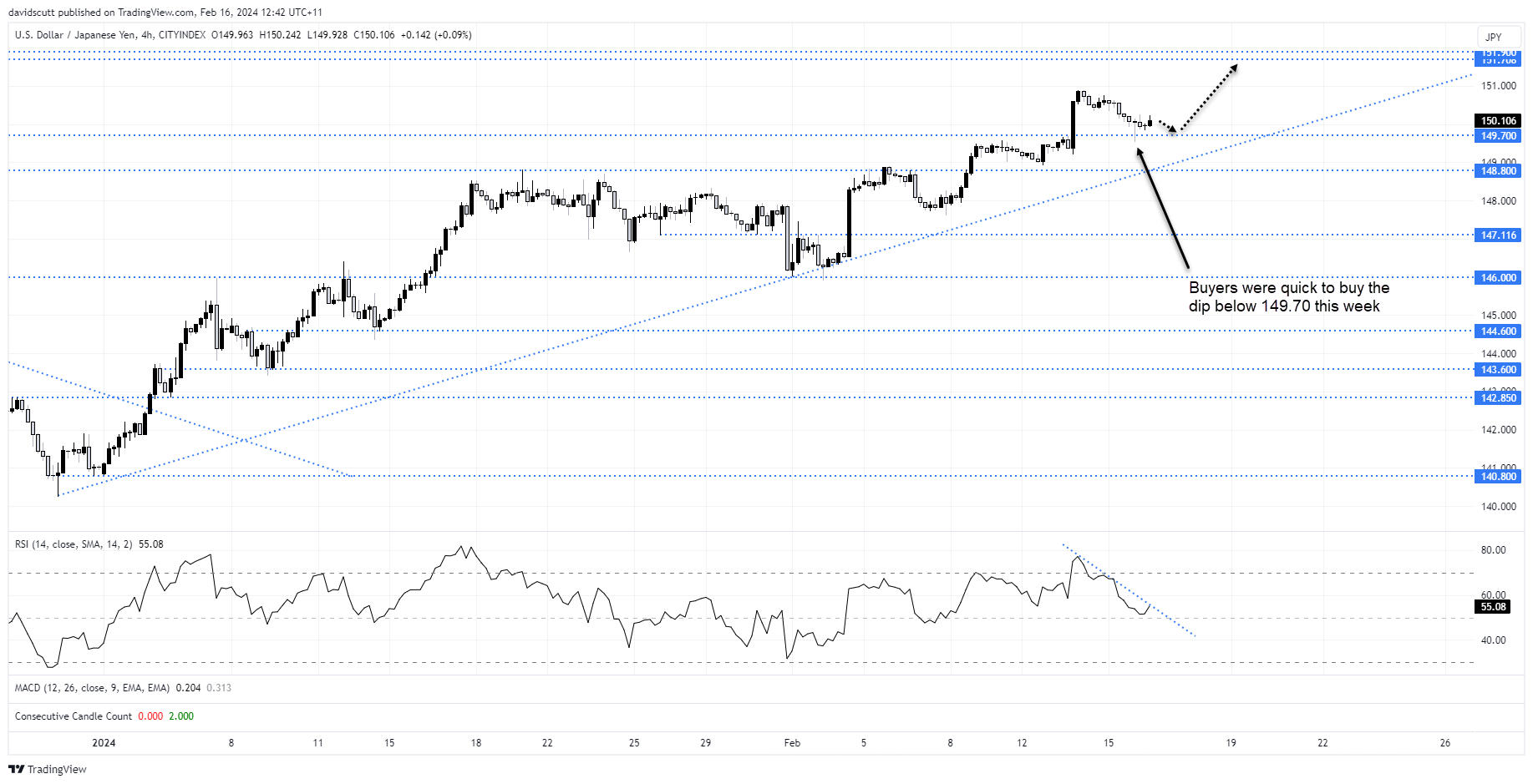

USD/JPY back above 150 as US yields rebound

Unsurprisingly, USD/JPY reacted to a bounce in US shorter-date yields in Thursday trade, seeing the pair break back above 150 ahead of the release of US producer price inflation data from the States.

The reversal in two-year yields was noteworthy, briefly falling to the top of the prior range they were trading in throughout the early part of the year before rebounding strongly into the close. The inability to maintain the decline despite sot US economic data warns of the potential for further upside in yields ahead.

Source: Refinitiv

Important inflation reports loom

The producer price inflation report, along with University of Michigan consumer inflation expectations, have helped fuel the immaculate disinflation narrative over recent months, with traders piling into Fed rate cut bets every time they showed another deceleration in inflationary pressures. However, if we see an upside surprise – such as that seen in the CPI report this week – it will likely add to the case for the Fed waiting longer to begin lowering rates, placing upside pressure on yields.

If higher yields eventuate, it’s likely USD/JPY will push higher despite the ongoing threat of intervention from the Bank of Japan on behalf of the Japanese government.

USD/JPY buyers lurking below 150

Looking at USD/JPY on the four-hourly, having pulled back from just shy of 151 following the upside surprise in the US inflation report, the pair sank below 150, briefly testing former horizontal support at 149.70 before rebounding back above the figure. The bullish pin candle printed on failed probe lower suggests buyers are waiting in the wings below that level. From a momentum perspective, RSI appears like it may also break the downtrend running from the highs hit earlier in the week.

For those considering longs, pullbacks towards 150 offer a decent entry level to enter trades, allowing for stops to be placed below 149.70 for protection. Above the high of around 150.90 set on Tuesday, there’s not a lot of visible resistance evident until you get back towards the multi-decade high below 152 hit last year.

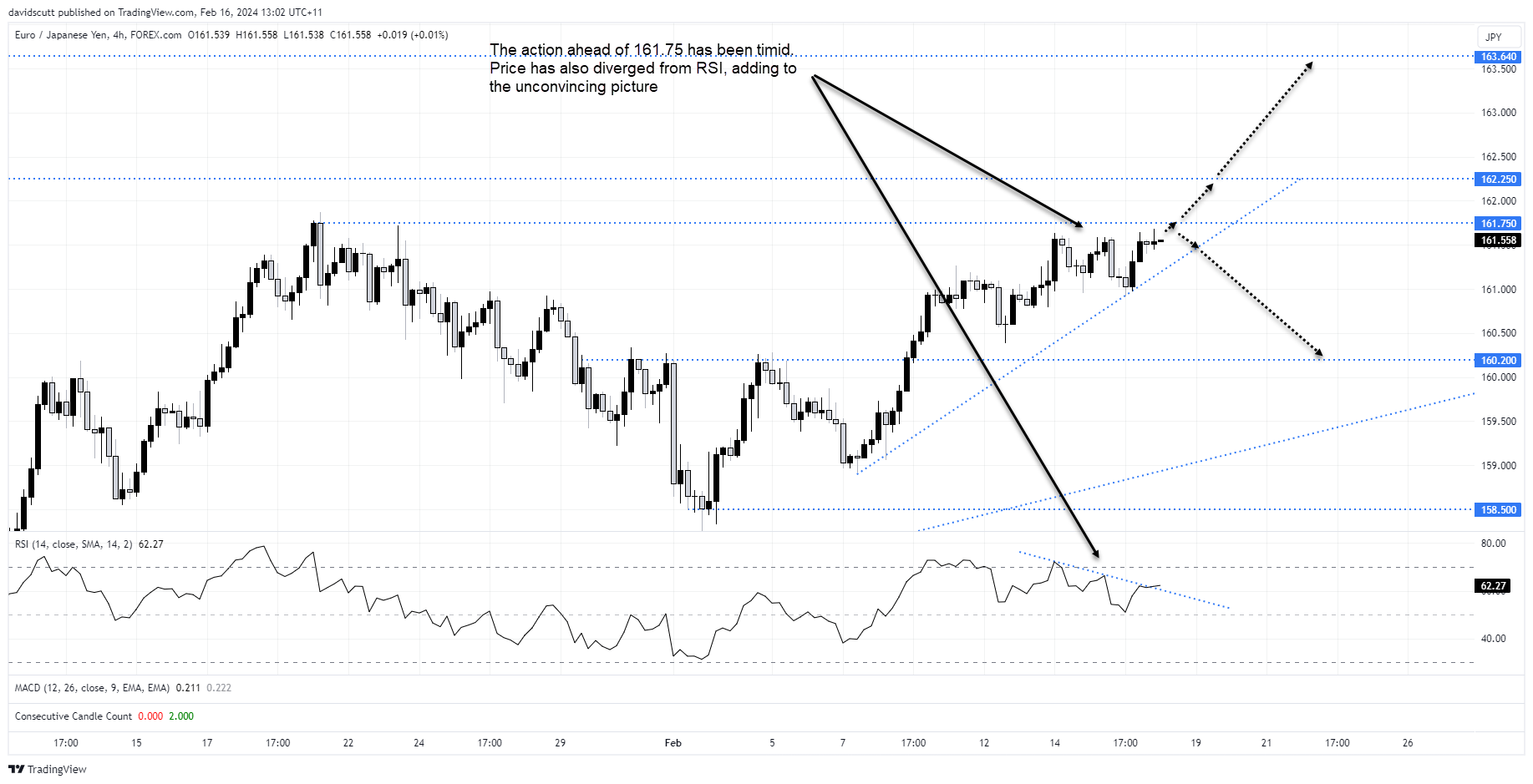

EUR/JPY nears range break but looks unconvincing

Even though the euro is not immune to shifts in relative interest rate expectations against the dollar, EUR/JPY is not in a too dissimilar position to USD/JPY right now, threatening to break to a new higher range.

You can see on the four-hourly that traders have been reluctant to test highs set in January, coming close on several occasions without having a proper crack. RSI may provide a reasoning, diverging from price over the past week. While the price action isn’t convincing, we know that if US yields push higher, it’s likely JPY will weaken against not only the dollar but also other crosses. Therefore, there’s a risk we may see upside if yields push higher.

A break and hold of 161.75 brings the January highs above 162.25 into play. If they go, 163.64 may be the next potential port of call. On the downside, a failed break of 161.75 or break of minor uptrend support may see the pair push back towards 160.20.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade