Wall Street opened higher after futures rose in the first half of Tuesday’s session, finding good support from firmer Chinese and European equity markets, and positive risk appetite across the financial markets with the likes of Bitcoin and AUD/USD also higher. But at the time of writing, the major indices had all turned negative on the day, most likely due to profit-taking ahead even more earnings. Therefore, the bullish S&P 500 forecast is still valid until the charts tell us otherwise.

- Chinese data fuels rally in risk assets

- Mixed bank earnings reports

- Netflix kicks off tech earnings

Strong Chinese GDP underpins miners, luxury names

Earlier in the day, stronger-than-expected Chinese GDP and consumer spending data had helped to fuel a rally in European luxury names, while miners were leading the charge in London. Investors were also digesting US earnings, as Goldman Sachs and Bank of American produced contrasting results with the former dropping more than 3% and the latter rising 2.8% in premarket. These come after strong results from JP Morgan, Citi and Wells Fargo on Friday, soothing investor concerns surrounding banks’ profitability.

US housing data highlights impact of higher rates

Meanwhile, the latest US housing market data hinted to a drop in future construction, underscoring the impact of high interest rates. Housing starts for March were 1.42 million annualised units compared to 1.40 million expected and 1.43m last. Housing permits fell to 1.41m from 1.55m previously, disappointing expectations of 1.45m. So, not great numbers – especially the near-9% decline in permits, which is a leading indicator of future housing construction.

Despite the housing market slowdown, the labour market is still holding its own rather well, an inflation is falling somewhat rapidly now. All told, the US is still likely heading for an economic slowdown, but it may be less severe than expected. Which is why investors’ have pared their Fed rate-cut predictions from extreme levels, and why we have seen US equity markets perform rather well in recent weeks.

Focus turns to Netflix and other big techs

Investors’ focus will turn to technology sector earnings, with Netflix set to report its results after the close tonight and Tesla the day after. Microsoft, Alphabet, Amazon, and Meta are scheduled to post their numbers next week, followed by Apple in early May. These results will have an impact on our S&P 500 forecast, as well as the other major indices.

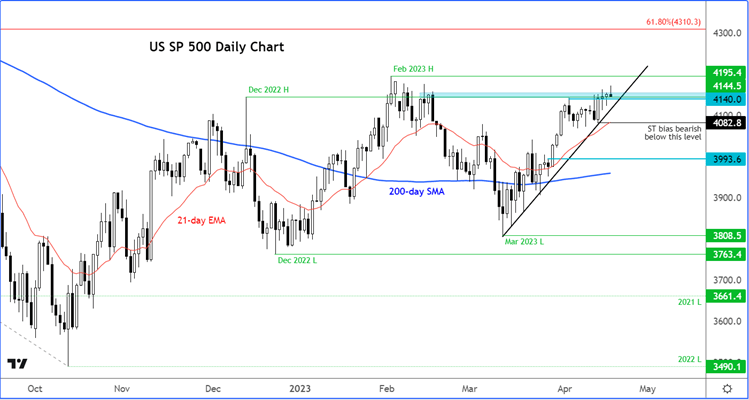

S&P 500 Forecast: Technical Analysis

While the current shape of the candle looks bearish, the day is still young, and dip-buyers might step back in to save the day. Regardless of how the market closes today, the S&P 500 forecast remains bullish until we see a break down in the market structure of higher highs and higher lows.

The most recent low comes in around 4082, which is now the line in the sand as far the short-term outlook is concerned. For as long as the S&P holds above this level, the path of least resistance would remain to the upside.

Source: TradingView.com

The bulls will want to defend the shaded blue area that was being tested at the time of writing. Previously resistance, it needs to serve as support to keep the short-term bullish momentum intact. If support holds here, then the next stop could be above 4195, the high that was hit back in February.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade