- S&P 500 analysis: How much further will Magnificent Seven do the heavy lifting?

- US 30-year debt auction in focus today

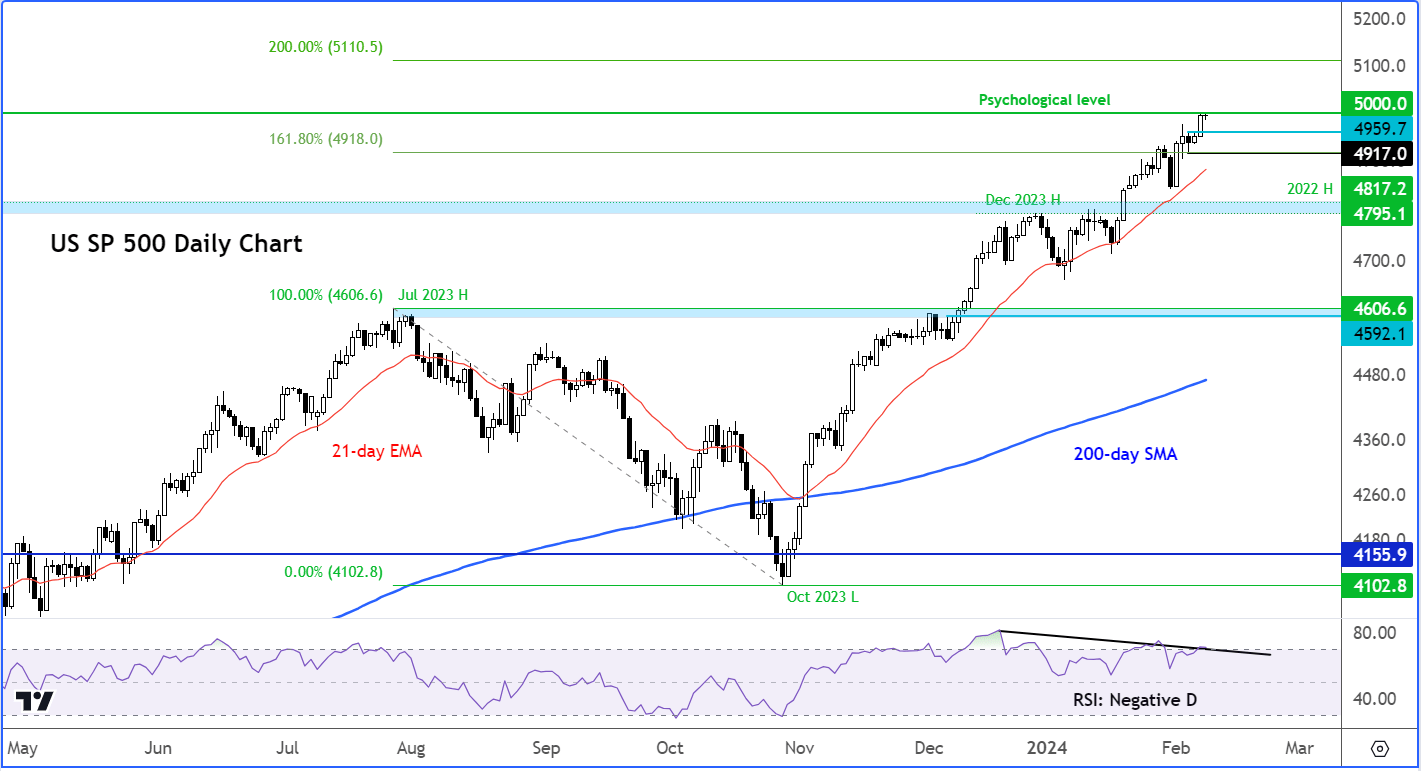

- S&P 500 technical analysis point to overbought conditions

Another day, another record high for the Nasdaq. The S&P 500 was trading near its own record high it hit the day before, but the Dow was a touch lower at the time of writing. Investors insatiable appetite for mostly tech stocks has helped to lift the S&P 500 near the next psychological barrier of 5,000. This is despite the fact the Fed has pushed back on expectations of an early rate cut. Mostly stronger earnings and the AI optimism has been behind the rally. But with most of the earnings from the Magnificent 7 out of the way now, the upside may be limited without a correction of some sort to remove some froth.

Video: S&P 500 analysis and insights on FTSE, DAX, China A50 and FX majors

US 30-year debt auction in focus

Today, on a macro level, there isn’t a lot on the agenda to excite investors. Tonight, a sale of 30-year US government debt will be watched following the successful auction of the 10-year debt the day before. There is a risk that the US Treasury’s latest auction of debt with much longer-maturity could prove a tougher test of investor appetite. There are also some fears about the health of the US commercial real estate sector amid high interest rates, after the Fed warned that monetary policy will not be loosened in a hurry. Let’s see what the Federal Reserve’ Thomas Barkin have to say about interest rates when he speaks shortly.

S&P 500 analysis: How much further will Magnificent Seven do the heavy lifting?

The group of technology stocks known as the "Magnificent Seven," including Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta Platforms, and Tesla, currently make up about 30% of the S&P 500 index. They were accountable for over 3/5 of the total return of the S&P 500 last year. While many analysts predicted a diversification of the market rally in 2024, the opposite has occurred, with market leadership becoming even more concentrated. These particular stocks have been responsible for driving over 80% of the index's increase this year. Logically one would think investors might be keen to take some profit on these stocks. Rotation into other sectors might also be a factor behind a potentially correction of the tech sector, and thereby the Nasdaq and to a lesser degree the S&P 500.

S&P 500 analysis: Technical levels and factors to watch

Source: TradingView.com

The magnificent tech rally saw the S&P 500 nearly hit the 5K mark on Wednesday. Will this act as a barrier now that most of the earnings are out of the way and the dollar is rebounding? And if we do see a pullback, will just be a case of a small decline and consolidation, or will it lead to a more significant correction? These are million-dollar questions, but as traders we must be prepared for all scenarios. One thing is clear, the market is quite overbought now, as indicated by the Relative Strength Index, which is actually in a state of negative divergence (lower high vs. the higher high on the underlying S&P 500 index). Markets can remain overbought longer… (you know the rest).

I guess we will have to let the charts guide us.

Short-term support is now seen around 4960, which needs to hold on a closing basis to keep this bullish trend alive. However, if we go back below Monday’s low at 4917, then this will put the bulls in a spot of bother, and potentially lead to a correction of some sort.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade