The pound was higher across the board this morning, finding support from stronger-than-expected UK data. This means that our pound analysis has not changed much. Our view remains bullish on the GBP/USD outlook, especially as the cable has now extended its rally above the 1.30 handle, until the charts tell us otherwise. The GBP/JPY outlook will also remain positive if it can break 181.00 resistance. Traders in this pair have so far responded positively to news the UK’s economy shrank by only 0.1% in May despite high inflation and rising interest rates, with traders also questioning the narrative that the Bank of Japan could soon pivot away from its ultra-loose monetary policy. The EUR/GBP remained on track to potentially drop to 0.85 handle.

GBP/USD outlook improves as UK economy shrinks less than expected

Already finding support from weakening US dollar, the GBP/USD advanced beyond 1.3050 on the back of stronger UK data. The fact that the UK economy shrunk in May surprised no one, given how high inflation has been and interest rates are still climbing. But the fact that output fell only by 0.1% instead of 0.3% expected by economists, this is what has helped to fuel the latest pound rally.

The smaller fall in output means the economy is now more likely to avoid contracting in the second quarter. A small growth of 0.1% for the three-month period between April to June is now to be expected.

The UK economy may now grow modestly in the coming months, finding support from the improving real wages and given that energy bulls are slightly lower. Higher mortgage rates will hold growth back, which is something that could impact the long-term GBP/USD outlook and weigh on other pound crosses. For now, the path of least resistance is to the upside for the cable and other pound crosses.

Pound traders’ focus will turn to inflation data next Wednesday after we had higher-than-expected rise in wages this week. The Bank of England will mostly likely hike rates further at its next meeting on August 3.

GBP/JPY outlook: Bulls back in town but BOJ meeting is key

The Japanese yen has so far enjoyed its best month of the year against the US dollar, rising 4%, as the greenback fell against all major currencies. The yen has also found mild support against other currencies, with some speculation doing the rounds that the Bank of Japan might tweak its policy at its next meeting on July 28.

Last week, BoJ deputy governor Shinichi Uchida said the central bank was seeking “a balanced decision” on the yield curve control (YCC) policy, “with an eye on monetary interventions and market functions.”

The BoJ intervenes by holding down yields on benchmark 10-year Japanese government bonds within a very low band i.e., 0.5% above or below zero, in an effort to sustainably achieve 2% inflation.

Those remarks aided speculation the BoJ would adjust its yield curve controls settings after introducing the policy 7 years ago and amending it twice since March 2021.

In March 2021, it widened the band to 0.25% either side of zero, before doubling it in December 2022 to 0.5% as other global central banks tightened their policies aggressively.

But the policy has come under heavy criticism and the pressure is growing on the central bank to widen this band even further or abolish it all together.

Given the yen’s strength so far this month on just speculation, the bulls will find it difficult to justify buying the currency further without any actual adjustments to YCC. Until July 28, we have a couple of weeks to go, which means there’s plenty of time for the yen to weaken again.

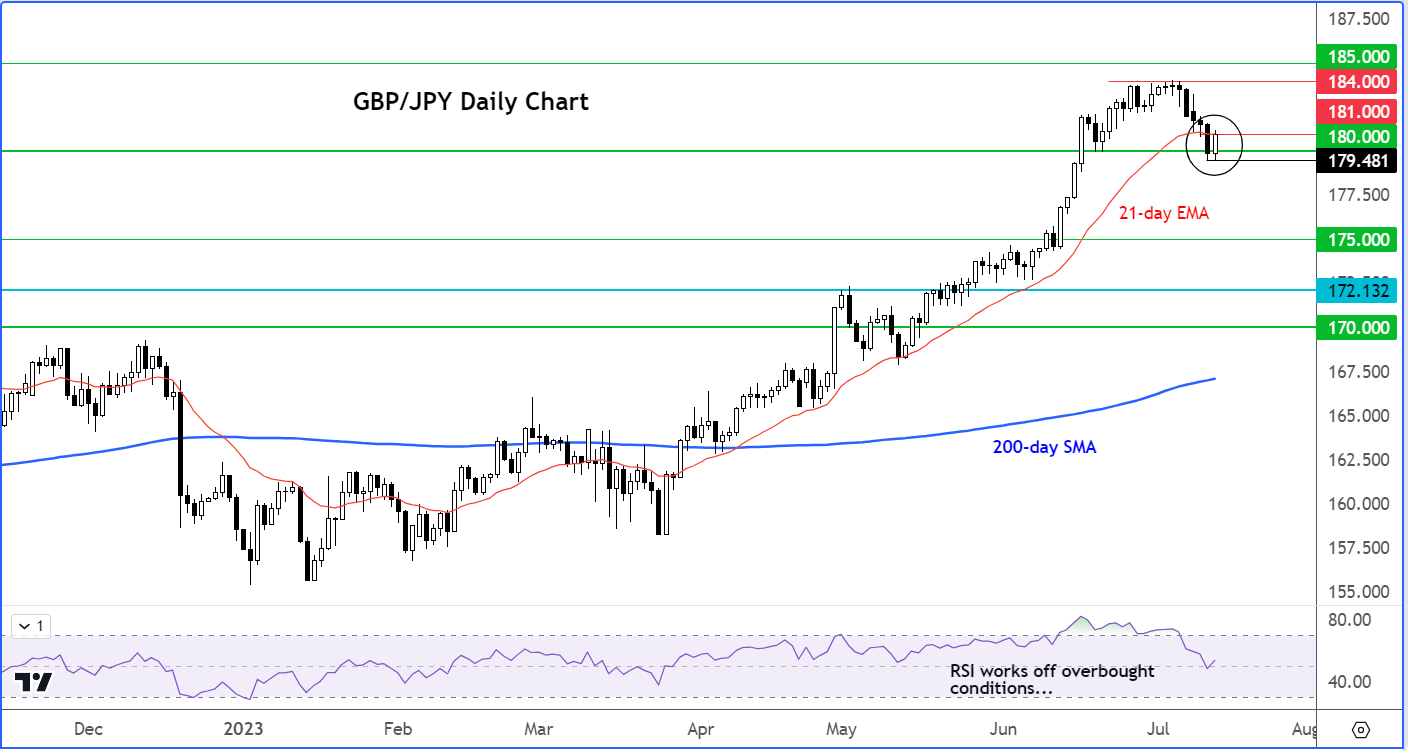

Pound analysis: Technical outlook on GBP/JPY

The GBP/JPY outlook remains positive from a technical point of view as rates have held above key support circa 180. However, the technical outlook will turn bearish if the Guppy closes below this level at some point this week, for then we will have a confirmed lower low in place. Our pound analysis would turn negative against the yen in that case, but for now we remain on the bullish camp. The bulls meanwhile will be eyeing a close above 181.00 resistance, which would also put the GBP/JPY back above the 21-day exponential moving average.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade