However, in an unexpected twist this week, Fed Chairman Powell, in a Congressional testimony, made a hawkish pivot alluding to the potential for accelerated tapering of the Feds bond-buying program and said it was no longer appropriate to include the word “transitory” when talking about inflation.

The pivot coming after iron ore and lumber prices have fallen by 50%, steel prices by 25%, and crude oil by 20% has left many scratching their heads. If the pivot had come the week before Omicron's arrival, the likelihood is the market would have accepted it willingly as the Fed was moving towards the market's pricing of three interest rate hikes in 2022.

However, coming just days after the arrival of the Omicron that brings with it uncertainty around growth, it has sparked memories of December 2018 and a 15% sell-off in stock markets. The result of a hawkish Fed into slowing growth courtesy of the U.S. - China trade war.

Raising further concerns about the growth outlook, news today that Apple has told its component suppliers that demand for the iPhone13 has weakened.

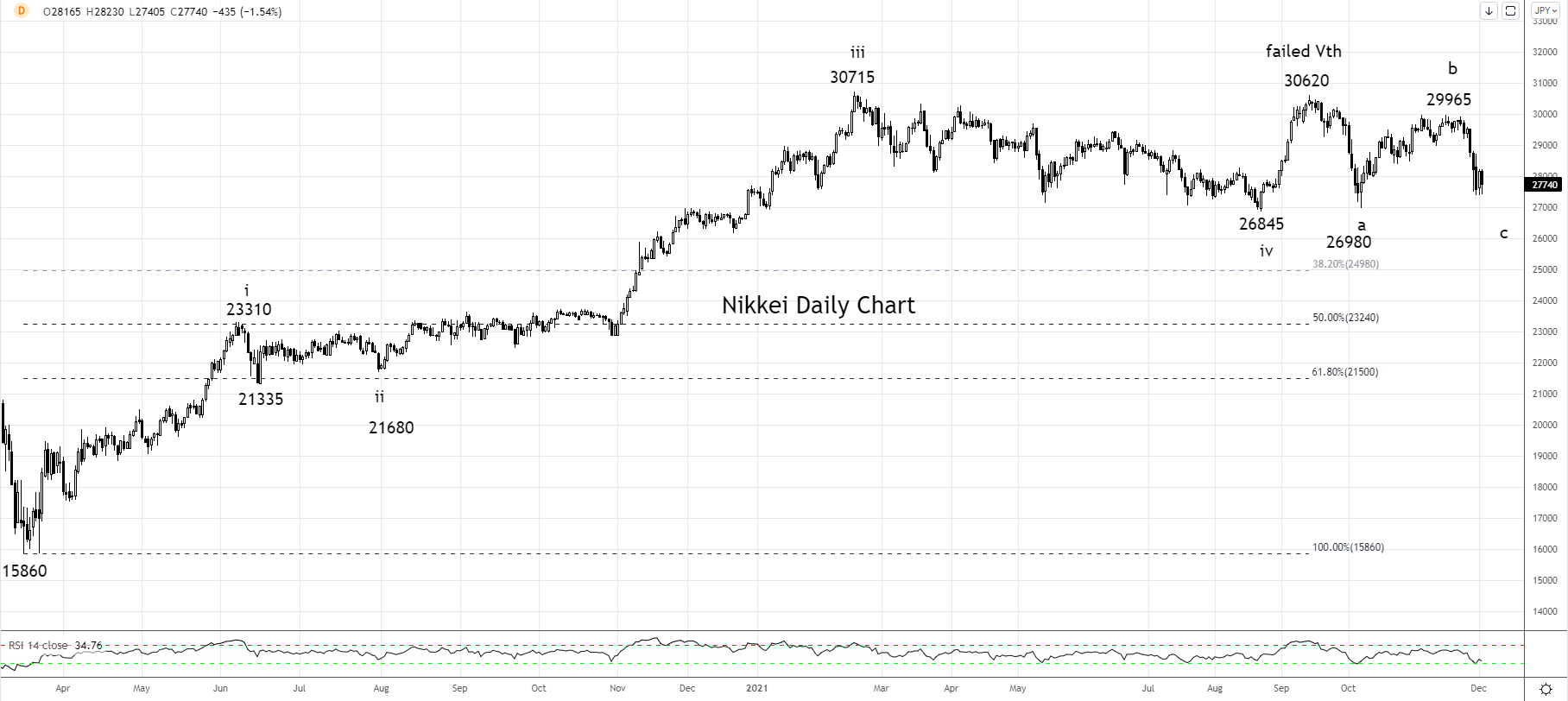

Over the past two weeks, the Nikkei has corrected by almost 8%, significantly underperforming its global peers, partly courtesy of yen strength, after completing a five-wave advance from the 15,680 March 2020 Covid low at the September 30,620 high.

The correction appears to be missing a competed third leg lower, which targets wave equality at 26,325, reinforced by the 38.2% Fibonacci retracement at 25,000.

Within the band of support, between 26,325 and 25,000 watch for basing as an initial sign to consider opening longs in anticipation of the uptrend resuming towards 33,000.

Source Tradingview. The figures stated areas of December 1st, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade