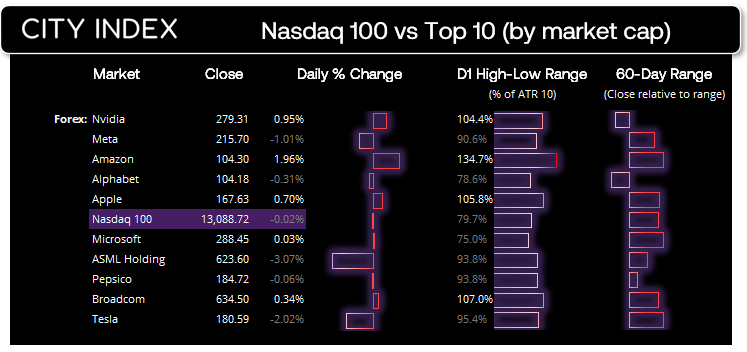

It’s been an impressive year so far for Nvidia, having not only outperformed the Nasdaq 100 but also being its top performer with its 91% rally YTD. A weaker US dollar has certainly played some part of its success, with the 2022 top in the US dollar coinciding with the 2022 low of Nvidia’s stock price. And that makes sense given roughly half of its profits come from overseas, helping to boost returns once they’re repatriated to the US.

But it has also enjoyed the tailwind of improved sentiment for the stock market in general as investors began to anticipate the end of the Fed’s tightening cycle and (rightly or wrongly) pricing in a Fed pivot. But that doesn’t fully explain why the stock has rallied nearly 160% since its 2022 low.

Nvidia is very much at the centre of the rise of ChatGPT, having recently announced with Microsoft that thousands of their GPUs were used to train the very AI tool itself. And with the rise of AI likely here to stay, demand for such GPU’s could continue to further support companies such as Nvidia. In fact, the they recently launched a new range of new GPUs in response to increased demand for AI such as the H100 NVL, which is specifically designed to deploy large language models such as ChatGPT.

I think it is safe to say that AI is not a fad and demand for it will only increase, which likely provides Nvidia further support for its really. Admittedly, we recently provided a bullish case for the US dollar over the near-term which could weigh on the stock to a degree, but we suspect the tailwind of AI more than outstrips the negative effects of a stronger US dollar. Besides, the rally from the 2022 low appears to be impulsive, which assumes more highs could follow in due course.

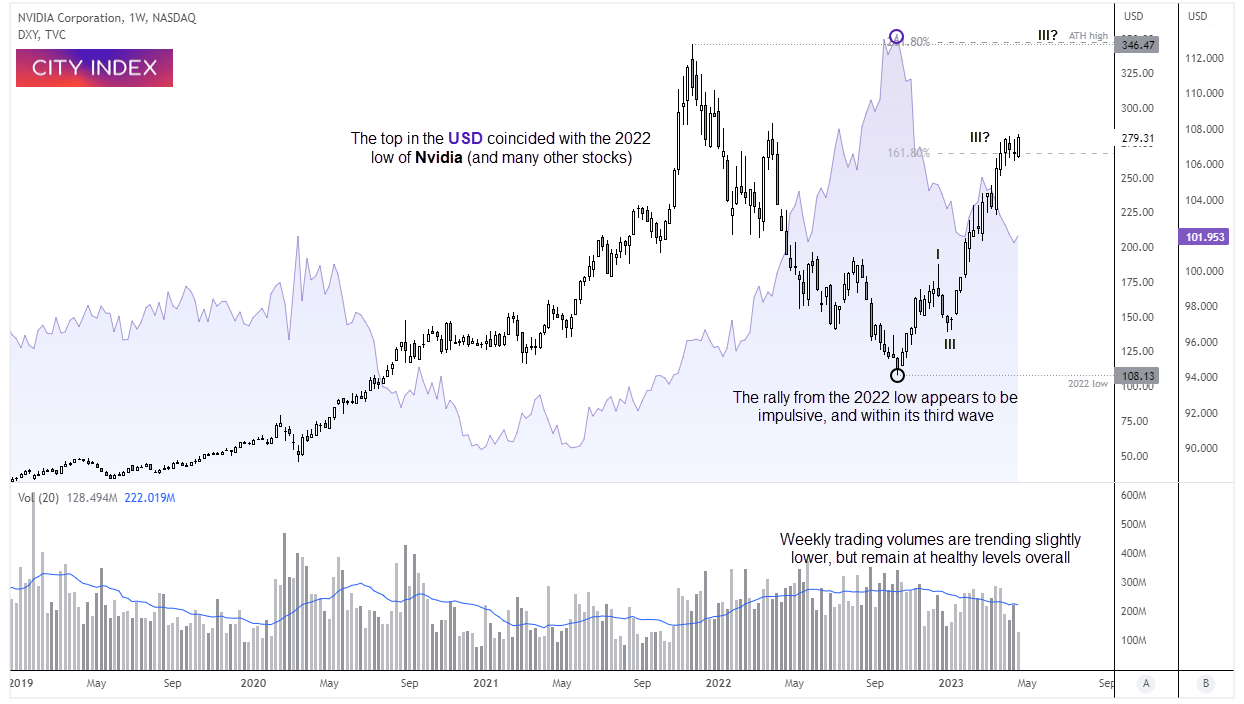

Nvidia weekly chart:

The price action from the ATH high appears to be corrective due the overlapping swings during the stock’s decline. And if we compare it to price action seen since the 2022 low, it further suggests the current rally to be impulsive which suggest momentum on the weekly chart has reverted to its long-term uptrend. It also appears we’re in wave three (of five), so the job now is to see how much further it can go before it embarks upon a wave four pullback ahead of its wave-five rally.

Whilst weekly trading volumes are trending slightly lower (which is to be expected as a trend matures), the absolute levels remain healthy overall so we think there is some more upside potential for the stock over the near-term. Also note that prices are above the 161.8% projection from wave two which tends to be the minimum of a wave-three rally. And given the strength of the trend, we cannot discount its potential for a wave three to extend back to the all-time highs (assuming stocks in general do not enter an ‘Armageddon’ phase).

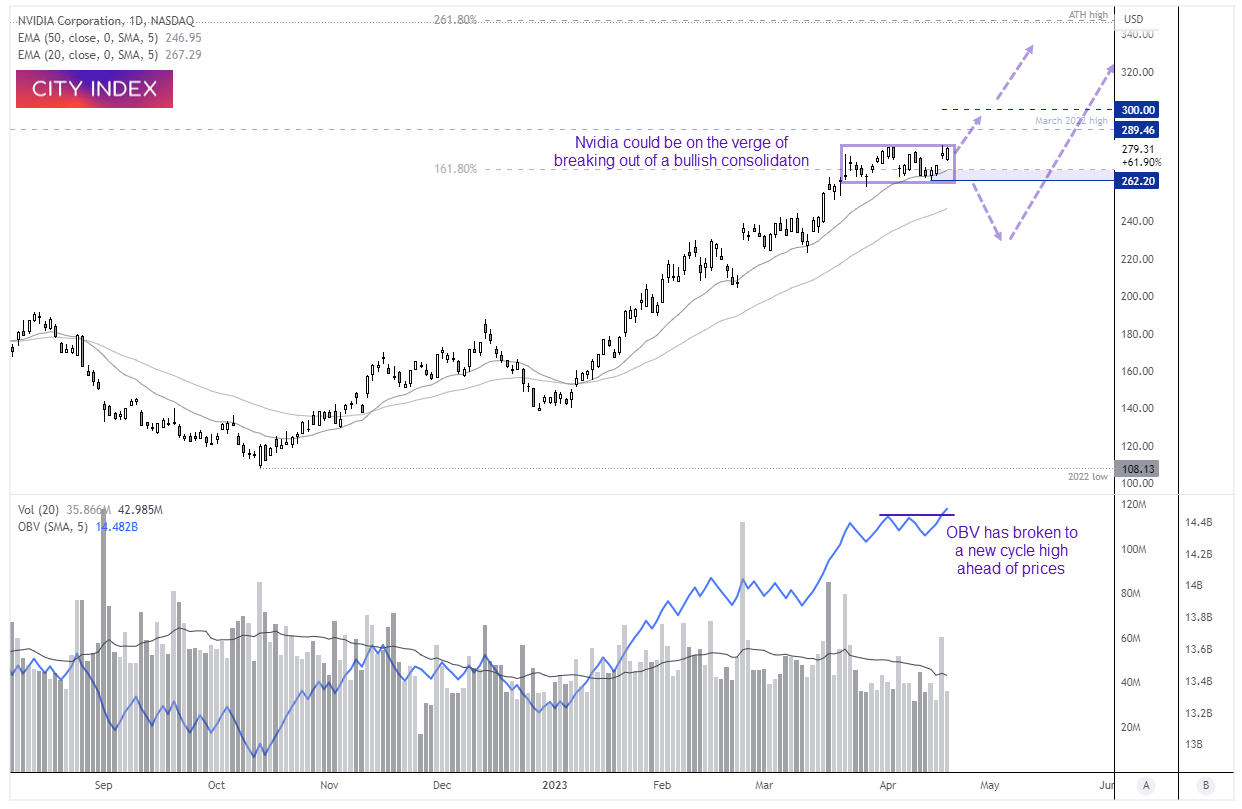

Nvidia daily chart:

Nvidia is clearly within an established and strong uptrend on the daily chart and could be set to break out of a bullish consolidation zone. The OBV (on balance volume) has broken to a new cycle high ahead of prices to suggest underlying bullish pressure. A slight concern is the March 2022 high and 300 handle nearby which could prompt a pause in trend or pullback. But whilst prices hold above $260, our bias remains for a breakout towards and beyond $300.

Should we see a break below $260 then we may have entered a wave-four correction. Yet due to the strength of the trend and fundamentals, we’d then look for evidence of a swing low and for signs that momentum has once again reverted to its long-term bullish trend.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade