- Interest rate hikes may have ended

- Low- and zero-yielding assets continue to outperform on falling rates expectations

- Nasdaq in ‘Cup and Handle’ breakout potential

The major US indices have all bounced back strongly after dropping the day before as the Fed’s dovish rate hike triggered profit-taking. We are also seeing precious and base metals moving higher, along with Bitcoin and other cryptos. The US dollar has continued to weaken as the short-end of the yield curve remains under pressure, with US 2-year yields dropping below 3.90% today.

The market is thus betting that we have reached a peak in terms of rate hikes and that from here looser monetary policy should follow.

The Fed, SNB and BoE all hikes interest rates this week, but the message from these banks was the same: more increases may be required, not will be, if inflationary pressures persist.

With investors starting to price in interest rate cuts for later in the year or start of next year, this should help to relief pressure on technology stocks, and underpin non-interest-bearing assets like gold and silver.

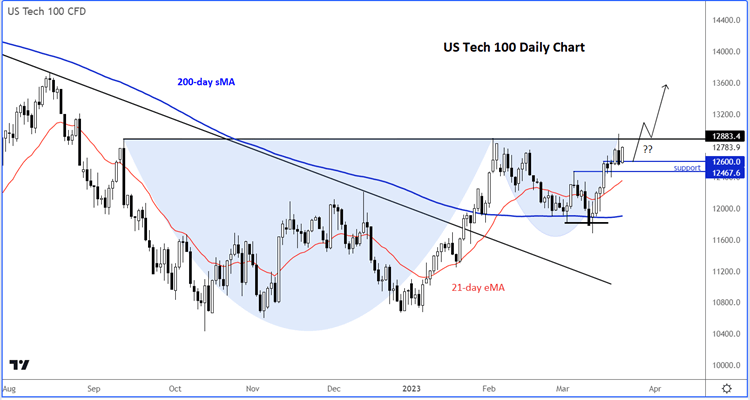

Nasdaq 100 Technical Analysis

The Nasdaq may be about to stage a more decisive rally, as it continues to find support on the dips.

While Wednesday’s large bearish-looking daily candle formed around former resistance area of 12850/900 appears quite bearish, the fact that we haven’t had any downside follow-through suggests the market is not willing to go lower.

Therefore, the larger “cup and handle” formation observed on the larger time frame still remains valid. The cup & handle formation is a bullish continuation pattern. The fact the handle has a shallower dip than the cup part of price action means the pressure is building for a bullish breakout.

The fact that the Nasdaq has managed to reclaim its 21-day exponential average and held above the 200-day average earlier this month is another sign of bullish strength.

So, a bullish breakout may still be on the cards above 12885-12900 resistance area, for as long key support around 12600 to 12450 is defended by the bulls. If that happens, look out for follow-up technical buying above that zone.

Only if the abovementioned 12450-12600 support area gives way, do we turn bearish on the Nasdaq again, or if we observe a key reversal pattern at higher levels, whichever comes first.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade